Auto Insurance Uk

Welcome to this comprehensive guide on auto insurance in the United Kingdom. Understanding the nuances of car insurance is essential for every driver, as it provides financial protection and peace of mind in case of accidents or vehicle-related incidents. This article aims to delve deep into the world of UK auto insurance, covering everything from the types of coverage available to the factors that influence premiums and the claims process.

Understanding Auto Insurance in the UK

Auto insurance, also known as motor insurance, is a legal requirement for all vehicle owners in the UK. It protects drivers against financial loss in the event of an accident, theft, or other types of vehicle-related incidents. The UK’s insurance market offers a range of policies to suit different needs and budgets, making it crucial for drivers to understand their options and choose the coverage that best fits their circumstances.

Types of Auto Insurance Coverage

In the UK, there are primarily three types of auto insurance coverage:

- Third-Party Only (TPO) Insurance: This is the minimum legal requirement for driving in the UK. TPO insurance covers the policyholder against claims made by third parties for injuries or damage to their vehicles or property caused by the policyholder. However, it does not provide any coverage for the policyholder’s vehicle or injuries sustained by the driver or passengers.

- Third-Party, Fire, and Theft (TPFT) Insurance: TPFT insurance offers a more comprehensive coverage than TPO. In addition to third-party liability, it also covers the policyholder’s vehicle in case of fire or theft. This type of insurance provides a good balance between cost and coverage for many drivers.

- Comprehensive Insurance: Comprehensive insurance is the most extensive type of auto insurance available in the UK. It provides coverage for third-party liability, fire, and theft, as well as for damage to the policyholder’s vehicle caused by accidents, vandalism, or natural disasters. Comprehensive insurance often includes additional benefits such as legal assistance, replacement vehicle cover, and personal accident cover.

Each type of insurance comes with its own set of advantages and limitations, and the choice depends on the driver's individual needs and budget. It's important to carefully assess these options to ensure adequate protection without paying for unnecessary coverage.

Factors Influencing Auto Insurance Premiums

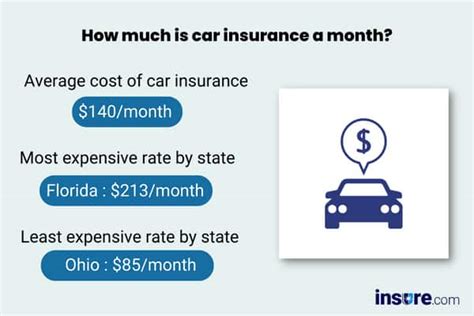

Auto insurance premiums in the UK can vary significantly depending on several factors. Understanding these factors can help drivers make informed decisions and potentially reduce their insurance costs.

Vehicle and Driver Information

The make, model, and age of the vehicle are key factors in determining insurance premiums. Vehicles that are more expensive to repair or are statistically more likely to be involved in accidents may attract higher insurance costs. Additionally, the driver’s age, gender, driving experience, and claims history play a significant role. Younger drivers and those with a history of accidents or claims are often considered higher risk and may face higher premiums.

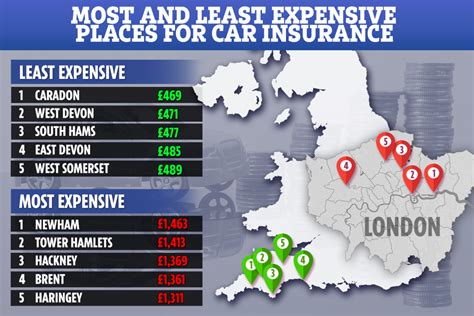

Location and Usage

The area where the vehicle is kept overnight and the distance traveled annually can impact insurance costs. Areas with higher crime rates or a history of frequent accidents may result in higher premiums. Similarly, vehicles used for business purposes or those driven frequently may be subject to higher insurance rates.

Excess and No-Claims Discount

Excess, also known as a deductible, is the amount the policyholder agrees to pay towards a claim. Choosing a higher excess can reduce insurance premiums. Additionally, building a no-claims discount, which rewards policyholders for each year they avoid making a claim, can lead to significant savings over time. However, it’s important to note that making a claim, even if it’s not the policyholder’s fault, may result in the loss of this discount.

Additional Factors

Other factors that can influence insurance premiums include the level of coverage chosen, any additional drivers or vehicles on the policy, and the inclusion of optional add-ons such as breakdown cover or legal assistance.

| Factor | Impact on Premiums |

|---|---|

| Vehicle Type | High-performance or expensive vehicles often cost more to insure. |

| Driver's Age and Experience | Younger or less experienced drivers may face higher premiums. |

| Claims History | A history of accidents or claims can lead to increased premiums. |

| Location | Areas with higher crime rates or accident statistics may have higher insurance costs. |

| Usage | Vehicles used for business or those driven frequently may attract higher premiums. |

The Claims Process

Understanding the claims process is essential for any auto insurance policyholder. In the event of an accident or vehicle-related incident, knowing the steps to take and the information to provide can streamline the process and ensure a smoother experience.

Notifying the Insurer

The first step in making a claim is to notify the insurance provider as soon as possible after the incident. Most insurers have a dedicated claims helpline or online portal where policyholders can report their claim. It’s important to provide accurate and detailed information about the incident, including any injuries, the other parties involved, and the circumstances leading up to the event.

Gathering Evidence

Evidence plays a crucial role in the claims process. Taking photographs of the scene, including any damage to vehicles or property, can be invaluable. It’s also important to gather the contact details of any witnesses and to obtain a copy of the police report, if applicable. Preserving any damaged items or parts of the vehicle can provide additional evidence to support the claim.

Handling the Claim

Once the insurer has received the claim, they will assess the information provided and may request additional documentation or evidence. The insurer may appoint a claims handler or loss adjuster to manage the claim, who will guide the policyholder through the process. It’s important to keep records of all communications and to respond promptly to any requests for information.

Repair or Replacement

Depending on the nature and severity of the incident, the insurer may arrange for the vehicle to be repaired or, in some cases, replaced. The policyholder may have the option to choose their preferred repairer or to use the insurer’s approved network. In cases where the vehicle is written off, the insurer will assess the vehicle’s value and provide a settlement based on its pre-accident worth.

Claims Settlement

Once the insurer has all the necessary information and evidence, they will make a decision on the claim. If the claim is approved, the insurer will settle the claim either by arranging for the vehicle to be repaired or by providing a settlement amount. It’s important to note that the settlement amount may not always cover the full cost of repairs or the vehicle’s pre-accident value, particularly in cases where the policyholder has a higher excess or if the vehicle is an older model.

Future of Auto Insurance in the UK

The auto insurance landscape in the UK is continually evolving, driven by technological advancements and changing consumer expectations. Here are some key trends and developments to watch out for:

Telematics Insurance

Telematics insurance, also known as pay-as-you-drive or usage-based insurance, is gaining popularity in the UK. This type of insurance uses telematics devices to track a vehicle’s usage, including driving behavior, distance traveled, and even road conditions. The data collected is used to calculate insurance premiums, rewarding safe drivers with lower rates. This technology has the potential to revolutionize the insurance industry by offering a more personalized and fair pricing model.

Connected Cars and Data Sharing

The rise of connected cars, equipped with advanced sensors and communication technologies, is set to have a significant impact on auto insurance. These vehicles can collect and transmit real-time data, including information on driving behavior, vehicle health, and even road conditions. This data can be shared with insurance providers, allowing for more accurate risk assessment and potentially leading to more tailored insurance policies.

Insurtech Innovations

Insurtech, or insurance technology, is an emerging field that brings together insurance and technology to create innovative solutions. Insurtech startups and established insurers are developing new products and services that leverage technologies such as artificial intelligence, machine learning, and blockchain. These innovations have the potential to streamline the insurance process, improve risk assessment, and enhance customer experience.

Environmental Considerations

With growing environmental concerns and the shift towards electric and hybrid vehicles, auto insurance providers are adapting their policies to accommodate these changes. Some insurers are offering incentives for eco-friendly vehicles, such as lower premiums or additional benefits. Additionally, the introduction of Clean Air Zones in some UK cities may influence insurance premiums, as vehicles that meet certain emissions standards may be eligible for reduced rates.

Regulatory Changes

The UK insurance market is subject to ongoing regulatory changes and updates. For example, the introduction of the Financial Services Compensation Scheme (FSCS) provides protection for policyholders in the event of an insurer’s insolvency. Staying informed about these changes can help drivers make more informed choices and ensure they are adequately protected.

Conclusion

Auto insurance is a vital aspect of responsible driving in the UK, providing financial protection and peace of mind for drivers and their passengers. Understanding the different types of coverage, the factors influencing premiums, and the claims process empowers drivers to make informed choices and navigate the insurance landscape with confidence. With ongoing technological advancements and regulatory changes, the future of auto insurance in the UK looks set to offer even more personalized and innovative solutions.

How can I find the best auto insurance deal in the UK?

+To find the best auto insurance deal, it’s essential to shop around and compare quotes from multiple insurers. Consider using comparison websites or insurance brokers who can provide a range of options. Be sure to read the policy documents carefully to understand the level of coverage and any exclusions. Additionally, look for insurers who offer additional benefits or discounts that align with your specific needs.

What factors determine my insurance premium?

+Insurance premiums are influenced by various factors, including the make and model of your vehicle, your age and driving experience, your claims history, and the area where you live. Other factors such as the level of coverage chosen, excess amount, and any additional drivers or vehicles on the policy can also impact the premium.

How can I reduce my insurance costs?

+To reduce insurance costs, consider choosing a higher excess amount, as this can lower your premium. Building a no-claims discount by avoiding making claims for several years can also lead to significant savings. Additionally, compare quotes regularly and explore discounts or incentives offered by insurers, such as those for safe driving or eco-friendly vehicles.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, it’s important to remain calm and prioritize the safety of yourself and others involved. Exchange details with the other parties, including names, contact information, and insurance details. Take photographs of the scene and any damage to vehicles or property. Notify your insurer as soon as possible, providing them with all the relevant information. Follow their guidance on the claims process, and keep a record of all communications.