Auto Insurance For Mexico

Ensuring your vehicle is properly insured is crucial, especially when traveling across international borders. When it comes to driving in Mexico, obtaining the right auto insurance coverage is essential to protect yourself, your vehicle, and your finances. Mexico has its own unique set of regulations and requirements for auto insurance, which differ significantly from those in the United States and Canada. This comprehensive guide will provide you with the necessary information to understand and navigate the world of auto insurance for Mexico, ensuring a smooth and secure journey south of the border.

Understanding the Importance of Mexican Auto Insurance

When venturing into Mexico, it's imperative to recognize the distinct legal and cultural landscape, which includes a different set of rules and expectations for drivers. One of the key differences is the mandatory nature of Mexican auto insurance. Unlike some U.S. states where minimum liability insurance is required by law, in Mexico, it is compulsory to have valid auto insurance coverage to legally operate a vehicle on Mexican roads.

The primary reason for this mandatory insurance is to protect Mexican citizens and their property from potential harm caused by foreign drivers. In the event of an accident, Mexican authorities hold the foreign driver responsible, and without valid insurance, you could face severe financial penalties, including vehicle impoundment and even personal imprisonment. This insurance not only safeguards your interests but also ensures you're in compliance with Mexican law.

Furthermore, Mexican auto insurance provides coverage for a range of scenarios that may not be included in your domestic policy. For instance, many U.S. and Canadian policies exclude coverage for driving in Mexico, leaving you vulnerable to unforeseen expenses such as medical bills, vehicle repairs, or legal fees in the event of an accident.

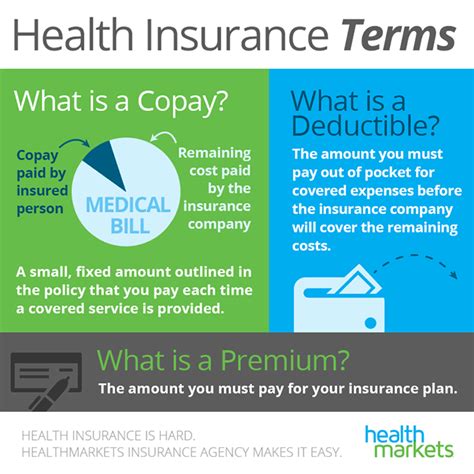

Key Components of Mexican Auto Insurance Policies

Understanding the various components of a Mexican auto insurance policy is crucial to ensure you receive the coverage that best suits your needs. Here's a breakdown of the key elements you'll encounter:

Liability Coverage

This is the cornerstone of any Mexican auto insurance policy. Liability coverage protects you against claims arising from bodily injury or property damage caused to others in an accident for which you are deemed responsible. It's important to note that Mexican liability limits are higher than those in the U.S. and Canada, and purchasing adequate coverage is essential to avoid personal financial liability.

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle if you're involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, provides protection for non-collision incidents such as theft, vandalism, natural disasters, or damage caused by animals. These coverages are particularly important when driving in Mexico, where the risk of theft and vandalism is higher than in many U.S. states.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, covers the cost of medical treatment for you and your passengers in the event of an accident, regardless of fault. This coverage is crucial as medical expenses in Mexico can be substantial, and without insurance, you'd be personally responsible for these costs.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with a driver who either has no insurance or has insufficient insurance to cover the damages. It's an important addition to your policy, as a significant portion of drivers in Mexico may be uninsured, which could leave you vulnerable to financial loss in the event of an accident.

Legal Assistance Coverage

Given the potential severity of legal consequences in Mexico, legal assistance coverage is a valuable addition to your policy. This coverage provides access to legal representation in the event of an accident, ensuring you have the necessary support to navigate the Mexican legal system.

Choosing the Right Mexican Auto Insurance Provider

Selecting the right Mexican auto insurance provider is a critical decision that can impact your coverage and overall experience. Here are some factors to consider when making your choice:

Reputation and Financial Stability

It's essential to choose an insurance provider with a solid reputation and strong financial stability. Look for companies that have been in business for a significant period and have a proven track record of paying claims promptly and fairly. You can research customer reviews and ratings to gauge the provider's reliability.

Policy Options and Coverage Limits

Different providers offer a range of policy options and coverage limits. Ensure that the provider you choose offers the specific coverages you require, such as liability, collision, comprehensive, medical payments, and legal assistance. Additionally, verify that the coverage limits meet or exceed your personal needs and the legal requirements in Mexico.

Claims Handling and Customer Service

The efficiency and responsiveness of an insurance provider's claims handling and customer service departments can make a significant difference in your overall experience. Look for providers that offer 24/7 emergency assistance and a dedicated claims team with experience in Mexican auto insurance. Positive customer service ratings and reviews are also a good indicator of a provider's commitment to customer satisfaction.

Pricing and Payment Options

While cost is an important consideration, it should not be the sole factor in your decision-making process. Compare quotes from multiple providers to ensure you're getting a competitive rate, but also evaluate the value of the coverage you're receiving. Additionally, consider the provider's payment options and flexibility. Some providers offer convenient online payment options, while others may require payment in advance or at the border.

How to Purchase Mexican Auto Insurance

The process of purchasing Mexican auto insurance can vary depending on the provider you choose and your specific needs. Here's a step-by-step guide to help you through the process:

Determine Your Coverage Needs

Before purchasing any policy, take the time to assess your specific coverage needs. Consider factors such as the value of your vehicle, the length of your trip, and the level of risk you're comfortable assuming. For example, if you're driving an older vehicle with low resale value, you may opt for a policy with lower coverage limits to keep costs down. On the other hand, if you're driving a newer, more expensive vehicle, you'll want to ensure you have adequate coverage to protect your investment.

Compare Quotes from Multiple Providers

Obtain quotes from at least three reputable Mexican auto insurance providers. This will give you a good sense of the market rates and the various coverage options available. When comparing quotes, pay attention to the specific coverages included, the limits of those coverages, and any additional perks or benefits offered by the provider.

Review Policy Terms and Conditions

Once you've narrowed down your options, carefully review the policy terms and conditions of each provider. Look for any exclusions or limitations that may impact your coverage. It's also important to understand the claims process, including any requirements for reporting accidents or seeking medical treatment.

Purchase Your Policy

After selecting the provider that best meets your needs, it's time to purchase your policy. Many providers offer the option to purchase online, providing immediate coverage. You'll typically receive a confirmation email and a copy of your policy, which you should keep with you during your trip to Mexico. If you prefer, you can also purchase your policy at the border, although this may result in longer wait times and potentially higher costs.

Understand Your Policy Exclusions

Familiarize yourself with the exclusions and limitations of your policy. For example, some policies may exclude coverage for off-roading or for driving under the influence. Understanding these exclusions is crucial to ensure you're not unknowingly engaging in activities that could void your coverage.

Navigating the Mexican Auto Insurance Claims Process

In the unfortunate event of an accident while driving in Mexico, it's crucial to understand the claims process to ensure a smooth and timely resolution. Here's a step-by-step guide to help you through this process:

Report the Accident

As soon as it's safe to do so, report the accident to your Mexican auto insurance provider. Most providers offer a 24/7 emergency assistance hotline, which you can call from anywhere in Mexico. Provide the provider with as much detail as possible about the accident, including the location, the circumstances leading up to the accident, and any injuries or property damage involved.

Cooperate with Local Authorities

If the accident results in injuries or significant property damage, Mexican law requires you to file a police report. Cooperate fully with local authorities and provide any requested documentation or information. This report is crucial for your insurance claim, as it provides an official record of the accident.

Seek Medical Treatment

If you or your passengers are injured in the accident, seek medical treatment immediately. Even if your injuries seem minor, it's important to have them assessed by a medical professional. Keep records of all medical treatment received, including receipts and documentation of any prescriptions or ongoing care.

Document the Scene

Take photos of the accident scene, including all vehicles involved, any damage, and the surrounding area. If possible, obtain contact information from witnesses and take notes about what they saw. This documentation can be crucial in supporting your insurance claim.

File Your Insurance Claim

Once you've gathered all the necessary information and documentation, file your insurance claim with your provider. Provide them with a detailed account of the accident, including any police reports, medical records, and photos. The claims process can vary depending on the provider and the complexity of the claim, but your provider will guide you through the necessary steps.

Follow Up on Your Claim

After filing your claim, stay in regular contact with your insurance provider to ensure the process is moving forward smoothly. If you have any questions or concerns, don't hesitate to reach out to your provider's claims team. They're there to assist you and ensure you receive the coverage you're entitled to under your policy.

Frequently Asked Questions

Can I use my U.S. or Canadian auto insurance policy when driving in Mexico?

+No, your U.S. or Canadian auto insurance policy does not provide coverage for driving in Mexico. Mexican law requires all vehicles operating on Mexican roads to have valid Mexican auto insurance. Failure to have this coverage can result in significant fines, vehicle impoundment, and even personal imprisonment.

What happens if I get into an accident in Mexico without Mexican auto insurance?

+If you're involved in an accident in Mexico without valid Mexican auto insurance, you'll be personally liable for all damages and injuries caused. This could result in substantial financial penalties, including the cost of medical treatment, vehicle repairs, and legal fees. In some cases, your vehicle may be impounded, and you may even face personal imprisonment until the matter is resolved.

How much does Mexican auto insurance cost?

+The cost of Mexican auto insurance varies depending on several factors, including the coverage limits you select, the length of your trip, and the make and model of your vehicle. Generally, a basic liability-only policy for a week-long trip can start at around $50, while more comprehensive coverage with higher limits can cost upwards of $200.

Can I purchase Mexican auto insurance at the border?

+Yes, you can purchase Mexican auto insurance at the border, but it's generally more convenient and often less expensive to purchase it online beforehand. However, if you prefer to purchase it at the border, there are typically insurance agents or booths available at major border crossings.

Do I need to speak Spanish to purchase Mexican auto insurance or to navigate the claims process?

+While it's helpful to have some basic Spanish language skills, most Mexican auto insurance providers have English-speaking representatives who can assist you with the purchase process and claims handling. Additionally, many policies come with a toll-free number that provides English-language support 24/7.

By understanding the importance of Mexican auto insurance, selecting the right provider, and navigating the claims process, you can ensure a safe and enjoyable journey through Mexico. Remember, proper insurance coverage is not just a legal requirement, but it’s also a crucial safeguard to protect your finances and well-being while exploring this beautiful country.