Apt Rental Insurance

Renting an apartment often comes with the challenge of ensuring your belongings are adequately protected. In the event of unforeseen circumstances like theft, fire, or natural disasters, having apt rental insurance can provide the necessary coverage and peace of mind. This comprehensive guide will delve into the world of apt rental insurance, exploring its benefits, coverage options, and how it can safeguard your possessions and personal liability.

Understanding Apt Rental Insurance

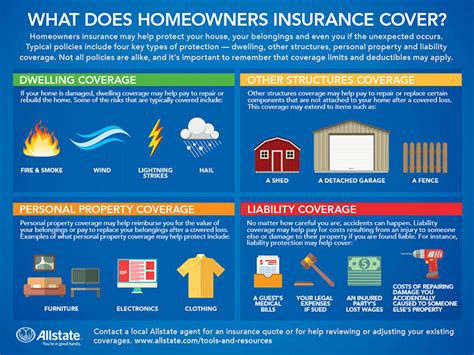

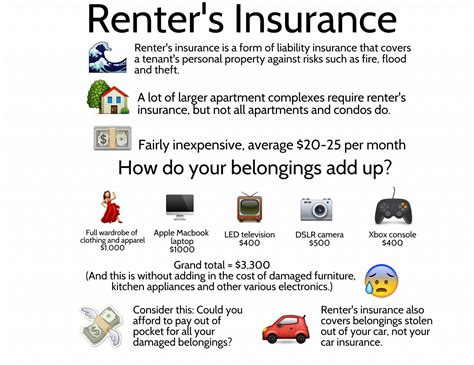

Apt rental insurance, also known as renters insurance, is a specialized type of insurance policy designed to protect renters and their belongings. Unlike homeowners insurance, which typically covers the structure and its contents, apt rental insurance focuses on the personal property and liability of tenants. It serves as a vital safety net, offering financial protection in various scenarios that could otherwise lead to significant financial burdens.

Key Benefits of Apt Rental Insurance

The benefits of apt rental insurance extend beyond the obvious protection of personal belongings. Here's a detailed breakdown of the advantages it provides:

- Property Coverage: This is the primary function of apt rental insurance. It covers the cost of replacing or repairing your personal property, such as furniture, electronics, clothing, and other valuables, in the event of a covered loss. Whether it's a fire, theft, or a burst pipe, apt rental insurance ensures you can quickly recover and replace your possessions.

- Liability Protection: One of the often-overlooked aspects of apt rental insurance is its liability coverage. If someone is injured in your rental unit or on your property, this insurance can provide financial protection against potential lawsuits and medical expenses. It offers a vital layer of protection, safeguarding your personal assets.

- Additional Living Expenses: In the unfortunate event that your rental unit becomes uninhabitable due to a covered loss, apt rental insurance can cover the additional costs of temporary housing and other related expenses until you can return to your home. This provision ensures you have a place to stay and prevents added financial strain during a challenging time.

- Personal Injury Protection: Some apt rental insurance policies also offer personal injury protection, which covers legal expenses if you are sued for defamation, libel, or slander. This added layer of protection provides further peace of mind and can help you navigate potential legal complexities.

- Valuable Item Coverage: Standard apt rental insurance policies typically have coverage limits for certain high-value items like jewelry, artwork, or collectibles. However, you can often add riders or endorsements to your policy to increase the coverage limits for these valuable possessions, ensuring they are adequately protected.

Coverage Options and Customization

Apt rental insurance policies can be tailored to meet the unique needs of renters. Here's an in-depth look at the various coverage options and how they can be customized:

Personal Property Coverage

This is the cornerstone of apt rental insurance. It covers the cost of repairing or replacing your personal belongings in the event of a covered loss. The coverage limits can vary depending on the policy and your chosen coverage amount. It's essential to accurately assess the value of your possessions to ensure adequate coverage.

Liability Coverage

Liability coverage is a vital component of apt rental insurance. It protects you against lawsuits and claims for bodily injury or property damage that occur on your rental property. This coverage typically includes defense costs and any settlements or judgments up to the policy limits. It's crucial to choose liability limits that align with your specific needs and the potential risks you face.

Additional Living Expenses

If a covered loss makes your rental unit uninhabitable, this coverage kicks in. It reimburses you for the additional costs of temporary housing, meals, and other related expenses until you can return to your home. The coverage limits and duration can vary, so it's important to review these details and ensure they align with your potential needs.

Medical Payments Coverage

This coverage provides for the medical expenses of guests who are injured on your rental property, regardless of fault. It covers reasonable and necessary medical costs up to the policy limit, helping to ensure that your guests receive the necessary care without the added financial burden.

Personal Injury Protection

Personal injury protection covers legal expenses if you are sued for personal injury claims such as libel, slander, or wrongful eviction. It provides a vital layer of protection against these less common but potentially costly legal situations.

Customizing Your Policy

Apt rental insurance policies can be customized to meet your specific needs. You can adjust coverage limits, choose additional endorsements or riders, and even bundle your policy with other insurance products to maximize savings and convenience. Working with an insurance agent or broker can help you tailor your policy to your unique circumstances.

| Coverage Type | Description |

|---|---|

| Personal Property | Covers the cost of repairing or replacing your belongings. |

| Liability | Protects against lawsuits and claims for bodily injury or property damage. |

| Additional Living Expenses | Reimburses costs for temporary housing if your rental unit is uninhabitable. |

| Medical Payments | Covers medical expenses for guests injured on your property. |

| Personal Injury | Provides legal protection for personal injury claims. |

How Apt Rental Insurance Works

Understanding the process of apt rental insurance is key to ensuring you receive the full benefits when needed. Here's an overview of how it works:

The Claims Process

When a covered loss occurs, you'll need to file a claim with your insurance provider. This typically involves providing documentation of the loss, such as photographs, receipts, or police reports, depending on the nature of the claim. The insurance company will then assess the claim and determine the amount of coverage applicable to your situation.

Policy Limits and Deductibles

Apt rental insurance policies have specific coverage limits, which are the maximum amounts the insurer will pay for a covered loss. It's essential to choose coverage limits that align with the value of your possessions. Additionally, policies typically have deductibles, which are the amounts you must pay out of pocket before the insurance coverage kicks in. Choosing an appropriate deductible can help balance your premium costs and coverage needs.

Exclusions and Limitations

Like all insurance policies, apt rental insurance has exclusions and limitations. It's crucial to review these carefully to understand what is not covered. Common exclusions include flood damage, earthquake damage, intentional damage, and certain types of high-risk activities. Understanding these exclusions can help you assess if additional coverage is necessary.

Bundling with Other Insurance Policies

Many renters choose to bundle their apt rental insurance with other insurance policies, such as auto insurance or homeowners insurance (if they own a home). Bundling can often lead to significant savings and simplify the insurance process. It's worth exploring the potential benefits of bundling with your insurance provider.

Choosing the Right Apt Rental Insurance

Selecting the right apt rental insurance policy involves careful consideration of your unique needs and circumstances. Here are some key factors to keep in mind when making your choice:

Assessing Your Needs

Take time to evaluate your personal belongings and their value. Consider the cost of replacing or repairing them in the event of a loss. Additionally, assess your liability risks and the potential costs associated with lawsuits or medical expenses. Understanding your needs will help you choose the right coverage limits and policy features.

Comparing Providers and Policies

Research and compare different insurance providers and their apt rental insurance policies. Look for providers with a strong reputation, financial stability, and positive customer reviews. Compare coverage options, policy limits, deductibles, and any additional perks or discounts offered. It's beneficial to obtain quotes from multiple providers to ensure you're getting the best value.

Reading the Fine Print

Don't overlook the importance of carefully reading the policy documents. Understand the coverage limits, exclusions, and any special conditions that may apply. This ensures you're fully aware of what is and isn't covered by the policy. If you have any questions or concerns, don't hesitate to reach out to the insurance provider for clarification.

Considering Additional Coverage

Evaluate whether you need additional coverage for specific items or situations. For instance, if you have valuable jewelry or artwork, you may need to add a rider to your policy to ensure adequate coverage. Additionally, consider whether you require coverage for specific risks like flood or earthquake, especially if you live in an area prone to such natural disasters.

The Importance of Adequate Coverage

Having adequate coverage with your apt rental insurance is essential to ensure you're fully protected. Here's why it matters:

Avoiding Financial Strain

In the event of a covered loss, adequate coverage ensures you can quickly and fully recover from the financial impact. Whether it's replacing valuable possessions or dealing with legal expenses, having sufficient coverage prevents you from bearing the full financial burden yourself.

Peace of Mind

Knowing that you have adequate coverage provides a sense of security and peace of mind. You can rest assured that your belongings and personal liability are protected, allowing you to focus on other aspects of your life without worrying about potential financial setbacks.

Preventing Underinsurance

Underinsurance occurs when your coverage limits are too low to fully cover your losses. This can lead to significant financial gaps and added stress. By ensuring you have adequate coverage, you avoid the pitfalls of underinsurance and can fully rely on your insurance policy when needed.

Apt Rental Insurance and Landlord Policies

It's important to understand the relationship between apt rental insurance and landlord policies. While landlords typically have insurance to cover the structure and their own liability, it's essential to note that their policies do not cover the personal belongings or liability of tenants. Here's how apt rental insurance complements landlord policies:

Tenant Liability

Tenant liability is a key aspect of apt rental insurance. While landlords may have liability coverage for the property, it's crucial for tenants to have their own liability protection. This ensures that tenants are financially protected in the event of accidents or injuries that occur on the rental property, providing an added layer of security for both the tenant and the landlord.

Coverage for Personal Belongings

Landlord policies typically cover the structure and its fixtures, but not the personal belongings of tenants. Apt rental insurance fills this gap by providing coverage for tenants' possessions. This ensures that tenants can replace or repair their belongings if they are damaged or lost due to a covered event, offering peace of mind and financial security.

Reducing Legal Liability for Landlords

When tenants have their own apt rental insurance, it reduces the legal liability for landlords. If a tenant's guest is injured on the property, the tenant's insurance can cover the medical expenses and legal costs, preventing the landlord from being held responsible. This helps maintain a harmonious relationship between landlords and tenants and provides added protection for both parties.

Frequently Asked Questions

How much does apt rental insurance cost?

+The cost of apt rental insurance can vary depending on several factors, including the coverage limits, deductibles, and the location of the rental property. On average, renters insurance policies range from $15 to $30 per month. However, it's essential to obtain quotes from multiple providers to find the best value for your specific needs.

Does apt rental insurance cover theft?

+Yes, apt rental insurance typically covers theft of personal belongings. However, it's important to review the policy's coverage limits and any specific exclusions or conditions that may apply. Some policies may have limitations on coverage for high-value items, so it's crucial to understand the details of your policy.

Can I get apt rental insurance if I have a roommate?

+Yes, apt rental insurance can cover roommates and their belongings as well. Each roommate can have their own policy or be covered under a single policy, depending on the provider's requirements and the specific circumstances. It's essential to discuss coverage options with your insurance provider to ensure adequate protection for all roommates.

Does apt rental insurance cover natural disasters like floods or earthquakes?

+Standard apt rental insurance policies typically do not cover damage caused by natural disasters such as floods or earthquakes. However, you can often purchase separate endorsements or policies to cover these specific risks. It's important to assess your location and potential risks to determine if additional coverage is necessary.

How can I save money on apt rental insurance?

+There are several ways to save money on apt rental insurance. One effective strategy is to bundle your renters insurance with other policies, such as auto insurance or homeowners insurance. Additionally, increasing your deductible can lower your premium, but it's important to choose a deductible that you can afford if a claim arises. Finally, maintaining a good credit score and claim-free history can also lead to lower insurance rates.

In conclusion, apt rental insurance is an essential safeguard for renters, offering protection for their personal belongings and liability. By understanding the benefits, coverage options, and the claims process, renters can make informed decisions and ensure they have adequate coverage. With the right policy in place, renters can enjoy peace of mind and financial security, knowing they are prepared for any unforeseen circumstances that may arise during their tenancy.