Animal Insurance Coverage

Animal Insurance Coverage: A Comprehensive Guide for Pet Owners

In today's world, pet ownership has become an integral part of many people's lives. Our furry companions bring us joy, companionship, and a sense of responsibility. As pet owners, we want to ensure that our beloved animals receive the best care possible, especially when unexpected health issues arise. This is where animal insurance coverage steps in, offering a safety net for both pets and their owners.

Animal insurance, often referred to as pet insurance, is a type of health coverage designed specifically for our four-legged friends. It provides financial protection and peace of mind, ensuring that pet owners can access quality veterinary care without worrying about the associated costs. With the rising costs of veterinary treatments and the increasing complexity of medical procedures available for animals, having insurance coverage has become an essential aspect of responsible pet ownership.

In this comprehensive guide, we will delve into the world of animal insurance coverage, exploring its various aspects, benefits, and considerations. Whether you are a new pet owner or have had furry friends for years, understanding the intricacies of pet insurance is crucial to making informed decisions about your pet's healthcare.

Understanding Animal Insurance Coverage

Animal insurance coverage operates similarly to human health insurance, offering financial support for various veterinary expenses. It provides a safety net that covers a range of medical treatments, procedures, and even preventive care. By paying a monthly or annual premium, pet owners can access this coverage, which can significantly reduce the financial burden of unexpected veterinary bills.

Types of Animal Insurance Plans

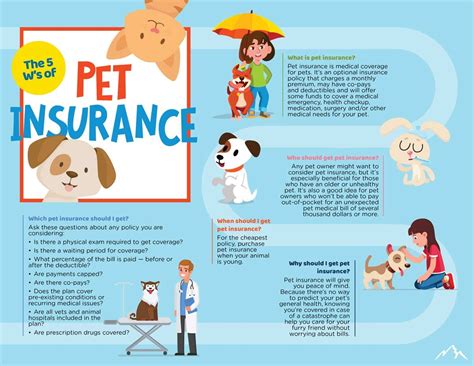

There are several types of animal insurance plans available, each offering different levels of coverage and benefits. The most common types include:

- Accident-Only Coverage: As the name suggests, this plan covers accidents such as broken bones, lacerations, or injuries resulting from car accidents. It typically provides comprehensive coverage for these unexpected events.

- Illness Coverage: This plan focuses on covering illnesses, including chronic conditions, infections, and diseases. It offers financial assistance for treatments, medications, and ongoing care.

- Accident and Illness Coverage: A combination of the above, this plan provides the most comprehensive coverage, offering protection for both accidental injuries and illnesses.

- Wellness Plans: These plans cover routine care, vaccinations, and preventive treatments. They are ideal for maintaining your pet's overall health and can include benefits such as annual check-ups, flea and tick treatments, and dental care.

Factors Influencing Coverage

Several factors can influence the coverage provided by animal insurance plans. These include:

- Pet's Age and Breed: Older pets and certain breeds with known health issues may face higher premiums or exclusions from specific coverage.

- Pre-Existing Conditions: Most insurance providers exclude coverage for pre-existing conditions, which are health issues present before the policy was purchased.

- Policy Limits and Deductibles: Policy limits refer to the maximum amount an insurer will pay for a claim, while deductibles are the amount the pet owner must pay out of pocket before the insurance coverage kicks in.

- Waiting Periods: Some policies have waiting periods before certain conditions or treatments are covered. This can range from a few days to several weeks.

Benefits of Animal Insurance Coverage

Animal insurance coverage offers a multitude of benefits to pet owners, providing both financial security and improved access to veterinary care. Here are some key advantages:

Financial Protection

Perhaps the most significant benefit of animal insurance is the financial protection it provides. Veterinary costs can quickly escalate, especially for specialized treatments or surgeries. With insurance coverage, pet owners can access the necessary care without worrying about the financial strain. This peace of mind allows owners to make decisions based on their pet's well-being rather than financial constraints.

Enhanced Veterinary Care

Insurance coverage encourages pet owners to seek regular veterinary check-ups and preventive care. This proactive approach to pet health can lead to early detection of potential issues, allowing for more effective and less costly treatments. Additionally, with insurance, owners are more likely to explore advanced diagnostic tests and specialized treatments, ensuring their pets receive the best possible care.

Peace of Mind

Knowing that your pet is covered by insurance provides immense peace of mind. Whether it's a minor accident or a serious illness, pet owners can rest assured that they have the means to provide the necessary medical attention. This sense of security allows owners to fully enjoy their time with their furry companions, free from the worry of unexpected expenses.

Flexibility and Customization

Many animal insurance providers offer customizable plans, allowing pet owners to choose coverage that suits their needs and budget. Owners can select the level of coverage, deductibles, and even add-on options such as coverage for alternative therapies or travel expenses. This flexibility ensures that pet owners can find a plan that aligns with their specific requirements.

Choosing the Right Animal Insurance Provider

With numerous animal insurance providers in the market, selecting the right one can be a daunting task. Here are some key considerations to guide your decision-making process:

Reputation and Experience

Research the reputation and track record of potential insurance providers. Look for companies with a solid history of paying claims promptly and providing excellent customer service. Online reviews and testimonials can offer valuable insights into the provider's reliability.

Coverage Options

Evaluate the range of coverage options offered by different providers. Consider your pet's specific needs and choose a plan that aligns with those requirements. Ensure that the plan covers the conditions or treatments that are most relevant to your pet's health.

Cost and Value

Compare the premiums and deductibles of different plans. While cost is an important factor, it should not be the sole deciding factor. Assess the value of the coverage provided and choose a plan that offers the best balance between cost and benefits.

Customer Service and Claims Process

Inquire about the insurer's customer service and claims process. A responsive and efficient claims process can make a significant difference during times of need. Look for providers with a streamlined process, ensuring that your claims are processed promptly and without unnecessary hassle.

Real-Life Examples of Animal Insurance Claims

To illustrate the impact of animal insurance coverage, let's explore a few real-life scenarios where pet owners benefited from having insurance:

Emergency Surgery for a Dog

Mr. Johnson's Labrador Retriever, Max, ingested a foreign object, requiring emergency surgery. The surgery and associated treatments cost over $5,000. With his animal insurance coverage, Mr. Johnson only had to pay the deductible, saving him a significant amount and ensuring Max received the necessary care.

Ongoing Treatment for a Cat with Kidney Disease

Ms. Smith's cat, Whiskers, was diagnosed with chronic kidney disease. The condition required regular veterinary visits, medications, and specialized diets. With her illness coverage plan, Ms. Smith was able to manage Whiskers' condition effectively, and the insurance covered a significant portion of the ongoing treatment costs.

Wellness Plan for a Puppy

New pet owner, Ms. Taylor, invested in a wellness plan for her puppy, Luna. The plan covered all her routine vaccinations, deworming treatments, and annual check-ups. With the peace of mind that Luna's basic healthcare needs were covered, Ms. Taylor could focus on bonding with her new furry friend.

Performance Analysis and Industry Insights

The animal insurance industry has witnessed significant growth over the past decade, with an increasing number of pet owners recognizing the value of insurance coverage. Here are some key insights and performance metrics:

Market Trends

- The global pet insurance market is projected to reach $14.4 billion by 2026, with a CAGR of 16.3% from 2021 to 2026.

- North America and Europe lead the market, with a significant portion of pet owners already insured.

- The Asia-Pacific region is expected to witness the fastest growth, driven by increasing pet ownership and rising awareness of pet insurance.

Performance Metrics

| Metric | Value |

|---|---|

| Average Premium | $40-$60 per month (varies based on coverage and region) |

| Claim Settlement Time | Most insurers aim for a 14-day settlement period, with some offering even faster processing. |

| Policy Cancellation Rate | Around 10% of policies are cancelled annually, often due to changing circumstances or financial constraints. |

| Renewal Rate | The renewal rate for pet insurance policies is generally high, with many pet owners continuing their coverage year after year. |

Future Implications and Innovations

The animal insurance industry is continuously evolving, with insurers introducing innovative products and services to meet the changing needs of pet owners. Here's a glimpse into the future:

Telemedicine and Virtual Care

With the rise of telemedicine, animal insurance providers are exploring ways to incorporate virtual care into their offerings. This could include remote consultations, video calls with veterinarians, and even virtual diagnostic tools, making veterinary care more accessible and convenient.

Preventive Care Emphasis

There is a growing focus on preventive care within the industry. Insurers are recognizing the long-term benefits of proactive healthcare for pets. This shift may lead to enhanced wellness plans and incentives for pet owners to prioritize preventive measures.

Technology Integration

The use of technology in animal insurance is expected to increase. This includes the adoption of digital platforms for policy management, claims submission, and real-time policy updates. Additionally, the integration of IoT devices and wearables could provide insurers with valuable data for risk assessment and personalized coverage.

Conclusion

Animal insurance coverage has become an essential tool for pet owners, providing financial security and access to quality veterinary care. With a range of coverage options and the flexibility to customize plans, pet owners can find the right fit for their furry companions. As the industry continues to innovate, we can expect even more advanced and tailored insurance solutions for our beloved pets.

By understanding the benefits, considerations, and real-life impact of animal insurance, pet owners can make informed decisions to ensure the well-being of their four-legged family members. Remember, when it comes to our pets, there's no price too high for their health and happiness.

Can I get insurance for my pet if they have a pre-existing condition?

+Most insurance providers exclude coverage for pre-existing conditions. However, some insurers offer limited coverage for specific conditions if the policy is purchased before the condition is diagnosed. It’s important to disclose all known health issues when applying for insurance.

What happens if I need to switch insurance providers?

+Switching insurance providers may result in a new policy with different terms and conditions. It’s essential to review the new policy carefully and ensure there are no gaps in coverage. Some providers may offer transition plans to help ease the switch.

Are there any discounts or incentives for multiple pets?

+Yes, many insurance providers offer discounts for multiple pets insured under the same policy. Additionally, some providers have loyalty programs or incentives for long-term customers, providing further savings.