Affordable Professional Liability Insurance

Professional liability insurance, often referred to as errors and omissions (E&O) insurance, is a critical safeguard for businesses and professionals across various industries. It protects against financial losses stemming from claims of negligence, errors, or omissions in the services provided. However, the cost of this essential coverage can be a significant concern for many businesses, especially startups and small enterprises with limited financial resources.

In this comprehensive guide, we will delve into the world of affordable professional liability insurance, exploring the factors that influence its cost, the best practices for obtaining competitive rates, and the strategies to ensure your business remains protected without breaking the bank. By the end of this article, you will have a clear understanding of how to navigate the insurance market, assess your unique risks, and secure the coverage you need at a price you can afford.

Understanding the Factors That Impact Professional Liability Insurance Costs

The cost of professional liability insurance is influenced by a myriad of factors, each playing a crucial role in determining the premium you pay. These factors are often specific to your industry, the nature of your business operations, and the level of risk associated with your services.

Industry and Professional Classification

The first and most significant factor is your industry. Insurance providers categorize businesses into various classes based on the level of risk associated with their operations. For instance, professions like healthcare, law, and financial services typically face higher premiums due to the intricate nature of their work and the potential for substantial claims. On the other hand, industries like consulting or graphic design may enjoy more affordable rates, as the risks associated with their services are generally considered lower.

Here's a table illustrating the average annual premiums for professional liability insurance across different industries:

| Industry | Average Annual Premium |

|---|---|

| Healthcare (Physicians) | $15,000 - $25,000 |

| Lawyers (General Practice) | $3,000 - $10,000 |

| Financial Advisors | $1,500 - $5,000 |

| Consultants (IT, Management) | $500 - $2,000 |

| Graphic Designers | $200 - $1,000 |

These figures are approximate and can vary significantly based on the specific nature of your business and the insurance provider. It's essential to understand that while your industry plays a pivotal role, other factors also contribute to the overall cost of your professional liability insurance.

Business Size and Revenue

The size and revenue of your business are additional key considerations for insurance providers. Larger businesses with higher revenues are often seen as more attractive risks, as they typically have more resources to manage and mitigate potential claims. As a result, they may enjoy more favorable insurance rates.

Conversely, smaller businesses, especially startups, can face higher premiums due to their perceived higher risk. Insurance providers often view smaller businesses as more vulnerable to financial strains in the event of a claim, which can impact their ability to pay premiums or meet the financial obligations of a settlement.

Claims History and Risk Management Practices

Your business's claims history is another critical factor in determining your professional liability insurance rates. Insurance providers closely examine your track record, including the number and severity of past claims. A history of frequent or substantial claims can significantly impact your premiums, as it suggests a higher risk of future incidents.

However, implementing robust risk management practices can help mitigate these concerns. Insurance providers often reward businesses that demonstrate a commitment to minimizing risks through comprehensive training programs, regular safety audits, and the implementation of industry-best practices. By showcasing your proactive approach to risk management, you can potentially secure more favorable insurance rates.

Location and Coverage Limits

The location of your business and the coverage limits you choose can also impact your professional liability insurance costs. Certain geographic areas may be more prone to specific types of claims, such as regions with a higher risk of natural disasters or those with a reputation for more litigious clients. As a result, insurance providers may adjust their premiums accordingly.

Additionally, the coverage limits you select play a crucial role. Higher coverage limits provide more financial protection in the event of a claim but also result in higher premiums. It's essential to find the right balance between the level of protection you need and the cost of that protection.

Strategies for Securing Affordable Professional Liability Insurance

Now that we've explored the factors influencing the cost of professional liability insurance, let's delve into some practical strategies to help you secure the coverage you need at a more affordable price.

Shop Around and Compare Quotes

One of the most effective ways to find affordable professional liability insurance is to shop around and compare quotes from multiple providers. The insurance market is highly competitive, and rates can vary significantly between companies, even for the same level of coverage. By obtaining quotes from several insurers, you can identify the most competitive options and potentially negotiate better rates.

When comparing quotes, pay close attention to the coverage details, exclusions, and any additional benefits or services offered. Ensure that the policies you're comparing are truly comparable, as slight variations in coverage can significantly impact the value you receive.

Online insurance marketplaces and brokerages can be excellent resources for obtaining multiple quotes quickly and efficiently. These platforms aggregate insurance policies from various providers, allowing you to compare options side by side and make more informed decisions.

Bundle Your Insurance Policies

Bundling your insurance policies can often lead to significant cost savings. Many insurance providers offer discounts when you purchase multiple policies from them. By combining your professional liability insurance with other coverages, such as general liability, property insurance, or cyber liability insurance, you may be eligible for substantial discounts.

Bundling your policies can also simplify your insurance management. Instead of dealing with multiple insurers and policies, you can have a single point of contact and a more streamlined process for making changes, filing claims, or updating your coverage.

Explore Alternative Risk Transfer (ART) Options

Alternative Risk Transfer (ART) refers to a range of insurance and risk financing techniques that can provide more flexible and potentially more affordable coverage options. These include captive insurance companies, risk retention groups, and parametric insurance.

Captive insurance companies are insurer-owned entities that provide coverage to the owner or a group of affiliated businesses. By establishing a captive, businesses can gain more control over their insurance coverage, potentially reducing costs and tailoring policies to their specific needs. However, captive insurance requires significant upfront capital and a thorough understanding of insurance and risk management.

Risk retention groups are another form of ART, where businesses with similar risks pool their resources to provide insurance coverage to each other. By joining a risk retention group, businesses can often access more affordable coverage and have a greater say in the management and direction of their insurance program.

Parametric insurance is a relatively new form of ART that provides coverage based on predefined parameters, such as weather events or natural disasters. While parametric insurance may not provide traditional indemnification coverage, it can offer more affordable and efficient protection against specific risks.

Leverage Risk Management Strategies

As mentioned earlier, implementing robust risk management strategies can significantly impact your professional liability insurance costs. Insurance providers view businesses that actively manage their risks as more attractive prospects, often resulting in more favorable rates.

Here are some risk management strategies to consider:

- Employee Training: Invest in comprehensive training programs for your employees to ensure they understand their roles, the potential risks associated with their work, and the best practices for mitigating those risks.

- Safety Audits: Conduct regular safety audits to identify potential hazards and implement measures to reduce or eliminate them. This can include everything from physical safety improvements to enhanced cybersecurity protocols.

- Incident Reporting and Management: Establish clear protocols for reporting and managing incidents, whether they are customer complaints, near misses, or actual claims. Prompt and effective incident management can help prevent small issues from escalating into costly claims.

- Contractual Risk Transfer: Review your contracts and consider including indemnification clauses or requiring your clients or partners to carry their own professional liability insurance. This can help shift some of the risk away from your business.

Consider Excess and Umbrella Policies

Excess and umbrella liability policies can provide additional coverage beyond your primary professional liability insurance policy. These policies can be particularly valuable if you face higher-than-average risks or if you want to ensure comprehensive protection in the event of a catastrophic claim.

Excess liability policies, also known as excess liability coverage or excess liability insurance, kick in when the limits of your primary professional liability policy have been exhausted. They provide an additional layer of protection, ensuring you have adequate coverage even in the event of a large or complex claim.

Umbrella liability policies, on the other hand, provide broad coverage that extends across multiple types of insurance, including professional liability, general liability, and other liability coverages. Umbrella policies can be particularly beneficial for businesses that face a wide range of risks or those that want to ensure they have sufficient coverage for catastrophic events.

The Role of Insurance Brokers and Agents

Insurance brokers and agents can be invaluable resources when navigating the complex world of professional liability insurance. These professionals have deep expertise in the insurance market and can provide personalized guidance based on your unique business needs and risk profile.

Insurance Brokers

Insurance brokers are independent professionals who represent their clients, not insurance companies. They work on your behalf to find the best coverage options from a wide range of insurers, ensuring you receive the most competitive rates and comprehensive coverage.

Brokers can provide several key benefits:

- Expertise and Knowledge: Brokers have extensive experience in the insurance industry and can offer valuable insights and advice based on their understanding of the market and your specific needs.

- Market Access: They have relationships with multiple insurance providers, giving them access to a wider range of policies and potentially more competitive rates.

- Negotiation Power: Brokers can negotiate with insurers on your behalf, potentially securing better terms and conditions for your coverage.

- Claims Support: Many brokers provide ongoing support throughout the claims process, helping to ensure your claims are handled efficiently and fairly.

Insurance Agents

Insurance agents, unlike brokers, represent specific insurance companies. They are employed by these companies and are trained to sell their products.

While agents may not have the same level of independence as brokers, they can still provide valuable services, including:

- Policy Expertise: Agents are knowledgeable about the policies they sell and can help you understand the coverage, exclusions, and benefits of their company's offerings.

- Personalized Service: Agents often provide more personalized service, building relationships with their clients and offering ongoing support and guidance.

- Claims Support: Like brokers, agents can assist with the claims process, helping to ensure your claims are handled promptly and efficiently.

Future Implications and Trends in Professional Liability Insurance

The landscape of professional liability insurance is constantly evolving, driven by changing regulatory environments, technological advancements, and shifting consumer expectations. Staying informed about these trends is essential for businesses to ensure they remain adequately protected and prepared for the future.

Regulatory Changes and Increased Litigation

Regulatory changes can significantly impact the professional liability insurance market. New laws and regulations may introduce additional compliance requirements, which can, in turn, affect the risks businesses face and the cost of insurance coverage. For instance, data privacy regulations like GDPR and CCPA have introduced new liabilities for businesses handling personal data, leading to an increased demand for cyber liability insurance.

Additionally, the rising trend of litigation in certain industries, particularly those with a high degree of public interaction, can drive up insurance costs. As businesses face a higher likelihood of claims, insurance providers may adjust their premiums accordingly.

The Impact of Technology and Digital Transformation

The rapid advancement of technology and the digital transformation of businesses have brought about new risks and opportunities. On the one hand, technology can help businesses improve their risk management practices, streamline operations, and enhance security. However, it also introduces new vulnerabilities, such as cyber attacks, data breaches, and system failures, which can lead to substantial financial losses and reputational damage.

As a result, the demand for cyber liability insurance and other technology-related coverages has grown significantly. Insurance providers are developing new products and services to address these emerging risks, and businesses must stay informed to ensure they have the appropriate coverage.

Consumer Expectations and Changing Business Models

Consumer expectations and preferences are constantly evolving, and businesses must adapt to stay competitive. This can lead to changes in business models, service offerings, and the very nature of professional services. For example, the rise of the gig economy and remote work arrangements has introduced new risks and challenges for businesses, particularly in terms of managing remote teams and ensuring data security.

As businesses adapt to these changes, they must also consider the potential impact on their insurance needs. New business models may introduce new risks or alter existing ones, requiring a reassessment of insurance coverage to ensure adequate protection.

Frequently Asked Questions (FAQ)

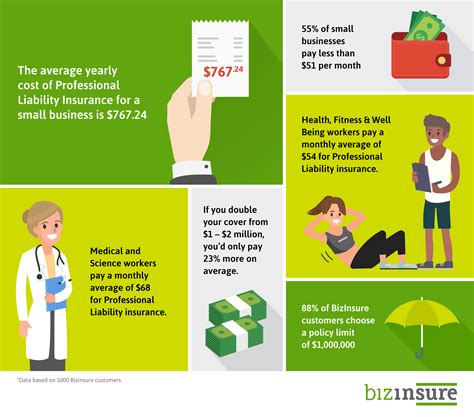

What is the average cost of professional liability insurance for small businesses?

+

The average cost of professional liability insurance for small businesses can vary significantly depending on the industry, business size, and other factors. However, as a general guideline, small businesses can expect to pay anywhere from a few hundred dollars to several thousand dollars per year for professional liability coverage.

How can I reduce my professional liability insurance premiums as a startup?

+

As a startup, you can explore several strategies to reduce your professional liability insurance premiums. These include implementing robust risk management practices, bundling your insurance policies, and shopping around for the most competitive rates. Additionally, consider seeking guidance from insurance brokers who can help you navigate the market and secure the best coverage at an affordable price.

What are the key differences between professional liability insurance and general liability insurance?

+

Professional liability insurance, or E&O insurance, is designed to protect professionals and businesses from claims arising from their services, such as negligence, errors, or omissions. On the other hand, general liability insurance provides coverage for bodily injury, property damage, and personal and advertising injury claims. While both types of insurance are crucial for businesses, they cover different types of risks and should be considered complementary.