Whole Life Insurance Plans

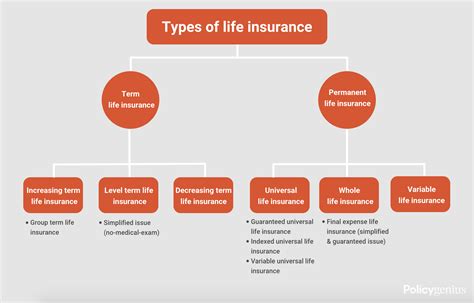

Whole life insurance, often referred to as permanent life insurance, is a financial tool that offers a comprehensive approach to protecting your loved ones and securing your legacy. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong protection and accumulates cash value over time. This type of insurance policy has gained significant popularity due to its unique features and long-term benefits. In this comprehensive guide, we will delve into the intricacies of whole life insurance plans, exploring their advantages, how they work, and why they might be the right choice for your financial future.

Understanding Whole Life Insurance Plans

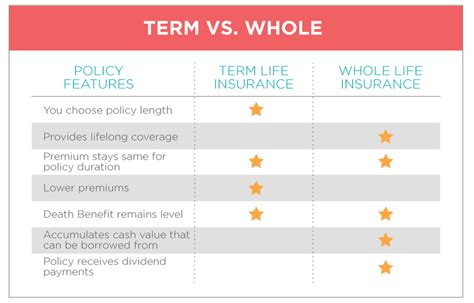

Whole life insurance plans are designed to offer a combination of death benefit protection and cash value accumulation. Unlike term life insurance, which is temporary and typically offers a lower premium, whole life insurance provides coverage for your entire life, ensuring your beneficiaries receive a guaranteed payout upon your passing. But the benefits of whole life insurance go beyond just a death benefit.

One of the key features of whole life insurance is its cash value component. With each premium payment, a portion goes towards building cash value within the policy. This cash value acts as a savings account, growing on a tax-deferred basis. Over time, this accumulated cash value can be accessed through policy loans, withdrawals, or even used to pay future premiums, providing a source of financial flexibility.

Whole life insurance plans are often seen as a long-term investment strategy, offering stability and guaranteed returns. The premiums for these policies remain level throughout the policyholder's life, providing predictability and ease of planning. Additionally, whole life insurance policies are customizable, allowing policyholders to choose from various riders and add-ons to enhance their coverage and meet their specific needs.

Key Benefits of Whole Life Insurance

Lifetime Protection

Whole life insurance provides peace of mind, knowing that your loved ones are financially secured throughout your entire life. Regardless of age or health status, a whole life policy ensures a guaranteed death benefit, protecting your family from unexpected financial burdens.

Cash Value Accumulation

The cash value component of whole life insurance is a significant advantage. Over time, this cash value can grow substantially, providing a financial cushion for various needs. Policyholders can access this cash value through loans, withdrawals, or by using it to pay premiums, offering flexibility in managing their financial goals.

Tax Advantages

Whole life insurance policies offer tax benefits, as the cash value grows on a tax-deferred basis. Any policy loans or withdrawals are tax-free as long as they do not exceed the policy’s basis. Additionally, the death benefit received by beneficiaries is typically tax-free, providing a substantial financial advantage.

Guaranteed Returns

Whole life insurance policies offer guaranteed returns on the cash value component. Unlike other investment options, the policy’s cash value is protected and guaranteed to grow, providing a stable and reliable financial tool for long-term planning.

Flexibility and Customization

Whole life insurance plans allow policyholders to customize their coverage to meet their unique needs. Riders and add-ons can be added to enhance the policy, such as long-term care benefits, accelerated death benefits for critical illnesses, or even waiver of premium options. This flexibility ensures that whole life insurance can adapt to changing life circumstances.

How Whole Life Insurance Works

Whole life insurance policies are structured with a basic formula: a portion of the premium goes towards the cost of insurance (COI), while the remaining amount contributes to the cash value accumulation. The COI is determined by factors such as age, gender, health status, and lifestyle choices. As the policyholder ages, the COI typically increases, but the premium remains level due to the growth of the cash value.

The cash value within the policy is invested by the insurance company in a conservative manner, often in fixed-income securities or other low-risk assets. This ensures a stable and predictable growth rate for the cash value. Policyholders can choose from different investment options offered by the insurance company, allowing for some level of control over the growth of their cash value.

Whole life insurance policies also offer policy dividends, which are based on the insurance company's financial performance. These dividends can be used to reduce future premiums, increase the policy's cash value, or even provide a cash payout to the policyholder. The availability and amount of dividends depend on the insurance company's performance and are not guaranteed.

Policy Loans and Withdrawals

One of the significant advantages of whole life insurance is the ability to access the policy’s cash value through loans or withdrawals. Policy loans allow policyholders to borrow against the cash value, with the loan accruing interest. This interest is typically added to the policy’s outstanding loan balance, and the loan can be repaid at any time without penalty. Withdrawals, on the other hand, allow policyholders to take out a portion of the cash value, reducing the policy’s death benefit and cash value accordingly.

It's important to note that policy loans and withdrawals can impact the policy's death benefit and cash value growth. Borrowing against the cash value reduces the policy's net cash value, which can impact the policy's overall performance and potential dividends. Additionally, withdrawals may trigger tax implications if they exceed the policy's basis.

Real-World Examples and Case Studies

Let’s explore a few real-world scenarios to better understand the impact and benefits of whole life insurance plans.

Case Study 1: Financial Security for Retirement

Meet John, a 40-year-old professional who wants to ensure financial security for his retirement. John purchases a whole life insurance policy with a 500,000 death benefit and a 100,000 cash value accumulation goal. Over the next 25 years, John consistently pays his premiums, and his cash value grows to $120,000. During his retirement years, John accesses this cash value through policy loans, providing him with a steady income stream without depleting his retirement savings.

John's whole life insurance policy not only ensures his family's financial security in the event of his passing but also provides a reliable source of income during retirement. The cash value accumulation allows him to maintain his lifestyle without relying solely on his retirement savings, offering a well-rounded financial plan.

Case Study 2: Business Protection

Sarah, a successful entrepreneur, owns a thriving business. She wants to ensure that her business is protected and can continue to operate smoothly even if she is unable to actively manage it. Sarah purchases a whole life insurance policy with a death benefit equal to the value of her business. This policy ensures that in the event of her untimely passing, the business can be purchased by a trusted partner or family member, maintaining its continuity.

Additionally, Sarah utilizes the cash value accumulation within her whole life insurance policy to secure business loans. By accessing the policy's cash value through loans, she can obtain financing for business expansion or other strategic initiatives without putting her personal assets at risk. This dual benefit of whole life insurance - providing business protection and access to capital - has been instrumental in Sarah's business growth.

Performance Analysis and Industry Insights

Whole life insurance plans have consistently proven their worth as a reliable financial tool. Over the past decade, whole life insurance policies have shown steady growth in popularity, with a significant increase in policy sales year over year. This growth can be attributed to the stability and long-term benefits these policies offer.

The performance of whole life insurance policies is measured by various factors, including the growth of cash value, policy dividends, and the overall return on investment. On average, whole life insurance policies have delivered consistent and guaranteed returns, outperforming many other investment options in terms of stability and predictability. The tax advantages and the ability to access cash value make whole life insurance an attractive choice for those seeking long-term financial security.

| Metric | Average Performance |

|---|---|

| Cash Value Growth | 5-7% annual increase |

| Policy Dividends | Varies by company, but typically 2-5% of face value |

| Overall Return on Investment | 4-6% annually, depending on policy duration and premiums |

Industry experts highlight the versatility of whole life insurance as a key advantage. From providing financial security for loved ones to offering a stable investment option and access to capital, whole life insurance plans cater to a wide range of financial needs. The ability to customize policies with riders and add-ons further enhances their appeal, making them a popular choice among those seeking comprehensive financial planning.

Frequently Asked Questions

Can I access the cash value in my whole life insurance policy at any time?

+Yes, you can access the cash value in your whole life insurance policy through policy loans or withdrawals. Policy loans allow you to borrow against the cash value, while withdrawals provide a partial surrender of the cash value. However, it’s important to note that accessing the cash value may impact the policy’s overall performance and potential dividends.

Are whole life insurance premiums fixed for the entire policy duration?

+Yes, one of the key advantages of whole life insurance is the fixed premiums. Unlike term life insurance, where premiums can increase over time, whole life insurance premiums remain level throughout the policy duration. This predictability allows for better financial planning and ensures the policy remains affordable.

What happens if I stop paying premiums on my whole life insurance policy?

+If you stop paying premiums on your whole life insurance policy, the policy will typically enter a grace period. During this grace period, the policy remains in force, and you have the opportunity to make the missed premium payment. If the grace period expires without payment, the policy may lapse, and all benefits, including the cash value, will be lost.

Can I convert my whole life insurance policy to another type of insurance later in life?

+Some whole life insurance policies offer the option to convert to another type of insurance, such as term life insurance, without undergoing a medical exam. The conversion option is typically available within a specific timeframe, allowing policyholders to adapt their coverage as their needs change. However, it’s important to review the policy’s terms and conditions to understand the conversion options available.