Which Auto Insurance Is The Cheapest

Finding the cheapest auto insurance can be a daunting task, as insurance rates vary greatly depending on numerous factors, including your location, driving history, vehicle type, and the coverage options you choose. However, understanding these variables and knowing the best practices for securing affordable coverage can help you make informed decisions and potentially save a significant amount on your auto insurance premiums.

Understanding the Factors that Influence Auto Insurance Rates

Auto insurance rates are determined by a complex algorithm that considers various factors. Here’s a breakdown of some key elements that influence the cost of your auto insurance policy:

Your Location

Insurance rates can vary significantly from one state to another and even between different zip codes within the same city. This variation is due to factors such as the local cost of living, the frequency of accidents and claims in the area, and the prevalence of car theft. For instance, urban areas with higher populations and congestion often have higher insurance rates compared to rural areas.

Your Driving History

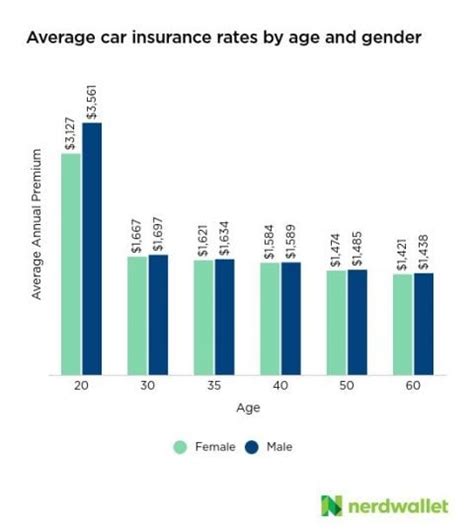

Your driving record is a critical factor in determining your insurance rates. Insurers consider your history of accidents, traffic violations, and claims. A clean driving record with no recent accidents or moving violations can lead to lower insurance rates. Conversely, if you have a history of accidents or moving violations, you may be considered a higher risk, resulting in higher insurance premiums.

Your Vehicle

The make, model, and year of your vehicle play a significant role in determining your insurance rates. Factors such as the cost of repairs, the frequency of theft or damage, and the safety features of your vehicle can all impact your insurance costs. For instance, sports cars and luxury vehicles often have higher insurance rates due to their higher repair costs and increased likelihood of theft.

Your Coverage Options

The level of coverage you choose will directly impact your insurance premiums. Comprehensive and collision coverage, which cover damages to your vehicle in accidents or from natural disasters, typically cost more than liability-only coverage, which only covers damages to other vehicles or persons in an accident you cause. Additionally, optional add-ons like rental car reimbursement or roadside assistance can further increase your premiums.

Tips for Securing Affordable Auto Insurance

While it’s impossible to control all the factors that influence your insurance rates, there are several strategies you can employ to potentially reduce your auto insurance costs:

Shop Around

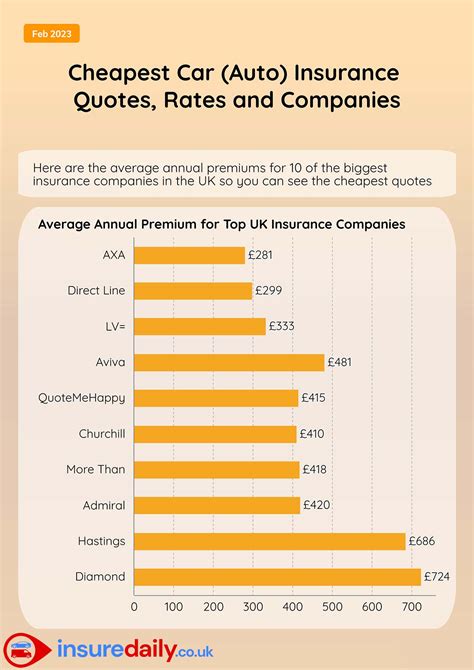

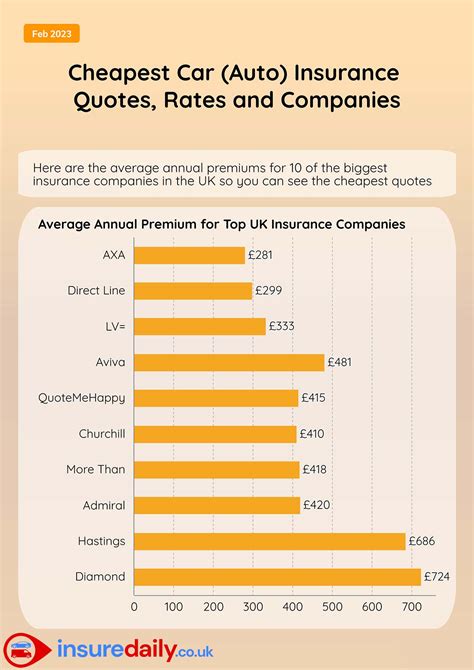

Insurance rates can vary significantly between providers, so it’s essential to compare quotes from multiple insurers. Online quote comparison tools can be a convenient way to get an overview of different insurers’ rates. Additionally, consider speaking to an independent insurance agent who can provide quotes from multiple companies.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto insurance with home or renters insurance. Bundling your policies can lead to significant savings, especially if you have multiple vehicles or other insurance needs.

Consider Higher Deductibles

Choosing a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your insurance premiums. However, this strategy requires careful consideration, as you’ll need to have the financial means to cover a higher deductible in the event of an accident or claim.

Review Your Coverage Regularly

Your insurance needs can change over time. Regularly reviewing your coverage and making necessary adjustments can help ensure you’re not overpaying for coverage you don’t need. For instance, if your vehicle is older and less valuable, you may be able to save by switching from comprehensive and collision coverage to liability-only coverage.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance rates low. Avoid accidents and moving violations, and if you do have a violation on your record, work on improving your driving habits to avoid future incidents.

Take Advantage of Discounts

Many insurers offer discounts for a variety of reasons. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing a defensive driving course. Ask your insurer about the discounts they offer and consider how you might qualify for additional savings.

The Role of Insurer Reputation and Financial Stability

When choosing an auto insurance provider, it’s not just about finding the cheapest rates. The reputation and financial stability of the insurer are crucial factors to consider. A reputable insurer with a strong financial standing is more likely to provide reliable coverage and timely claim processing. On the other hand, choosing an insurer solely based on low rates without considering their reputation could lead to potential issues down the line, such as slow claim processing or inadequate coverage.

The Future of Auto Insurance: Technological Innovations and Their Impact

The auto insurance industry is undergoing significant changes due to technological advancements. The rise of usage-based insurance (UBI), also known as pay-as-you-drive or pay-how-you-drive insurance, is one notable innovation. UBI policies use telematics devices or smartphone apps to track driving behavior, such as miles driven, time of day, and driving style. These policies can offer significant discounts to safe drivers and provide a more personalized insurance experience.

Additionally, the integration of advanced driver-assistance systems (ADAS) and autonomous vehicle technologies is expected to have a significant impact on auto insurance in the future. As these technologies become more prevalent, they could lead to a reduction in accidents and claims, potentially resulting in lower insurance rates for drivers. However, the full implications of these technologies on insurance rates are still uncertain and will depend on various factors, including the pace of adoption and the effectiveness of these technologies in reducing accidents.

Conclusion

Finding the cheapest auto insurance involves a careful consideration of various factors and a strategic approach to shopping for coverage. By understanding the variables that influence insurance rates and employing the tips outlined above, you can make informed decisions and potentially save significantly on your auto insurance premiums. Remember, the cheapest policy may not always be the best option, so consider the reputation and financial stability of insurers alongside the cost of premiums.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies greatly depending on numerous factors, including your location, driving history, and the type of coverage you choose. According to recent data, the national average cost of car insurance is approximately 1,674 per year. However, this figure can range significantly, with some states having average premiums as low as 500 while others can exceed $2,500.

Can I get auto insurance if I have a poor credit score?

+Yes, it is possible to get auto insurance even with a poor credit score. However, insurers often use credit-based insurance scores to determine your insurance rates, and a poor credit score may lead to higher premiums. Some states, like California, Hawaii, and Massachusetts, have banned the use of credit scores in determining insurance rates. In these states, your credit score won’t affect your insurance premiums.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever you experience a significant life change such as buying a new car, getting married, or moving to a new location. These changes can impact your insurance needs and potentially lead to savings if you adjust your coverage accordingly.