What Is Workers Comp Insurance

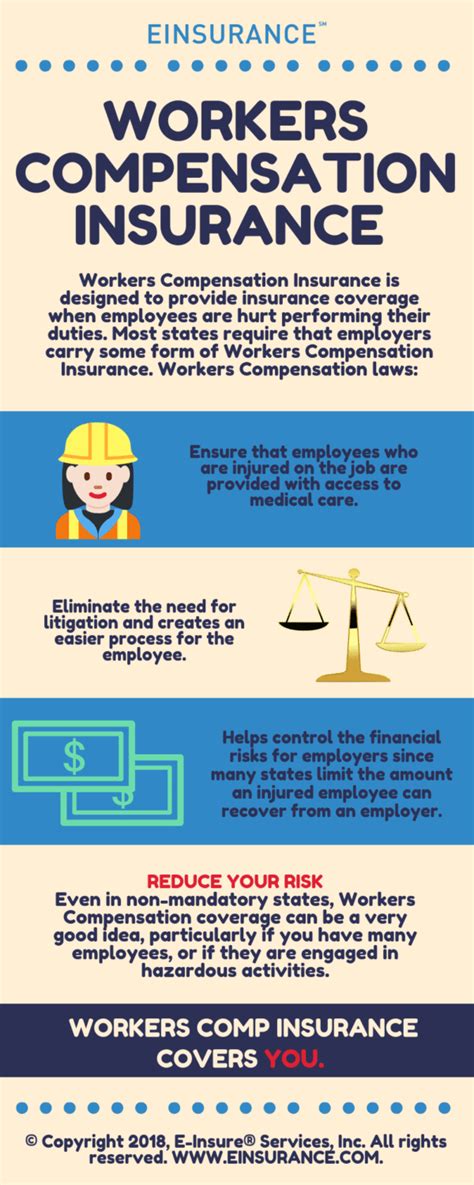

Workers' compensation insurance, often simply referred to as workers' comp, is a vital aspect of business operations, designed to provide financial protection and support for employees who suffer work-related injuries or illnesses. This comprehensive insurance coverage ensures that employees receive the necessary medical care and compensation for their losses, while also protecting employers from potential liability claims. With a rich history dating back to ancient times, workers' compensation has evolved into a sophisticated system that varies across jurisdictions, reflecting the unique needs and regulations of each region.

Understanding Workers’ Compensation

At its core, workers’ compensation is a form of social insurance that aims to safeguard the well-being of employees and their families in the event of workplace accidents or health issues. This insurance coverage operates as a no-fault system, meaning that an employee’s entitlement to benefits does not hinge on proving employer negligence or fault. Instead, it recognizes that certain risks are inherent in various occupations and provides a safety net for those affected.

Key Components of Workers’ Comp

Workers’ compensation insurance encompasses several critical components, each playing a unique role in the overall protection it offers:

- Medical Benefits: This aspect covers the cost of medical treatment, including doctor visits, hospital stays, medications, and rehabilitation, ensuring employees receive prompt and comprehensive care.

- Wage Replacement: Workers’ comp provides a portion of an employee’s lost wages, offering financial support during their recovery period, which can be crucial for maintaining their standard of living.

- Disability Benefits: In cases where an injury or illness results in temporary or permanent disability, workers’ compensation offers benefits to compensate for the loss of earning capacity.

- Vocational Rehabilitation: For those unable to return to their previous jobs, this coverage includes vocational training and support to help employees transition into new, suitable occupations.

- Death Benefits: Tragically, workplace accidents can sometimes result in fatalities. In such cases, workers’ compensation provides financial support to the employee’s dependents, covering funeral expenses and offering ongoing financial assistance.

These components collectively form a robust system of protection, ensuring that employees and their families are supported during challenging times. However, the specific benefits and coverage limits can vary significantly depending on the jurisdiction and the nature of the employment.

The Importance of Workers’ Compensation Insurance

Workers’ compensation insurance is not just a legal requirement; it is an essential pillar of a fair and just workplace. By providing a safety net for employees, it fosters a culture of care and responsibility within organizations. Here are some key reasons why workers’ comp insurance is of utmost importance:

Protection for Employees

The primary purpose of workers’ compensation is to protect employees from the financial burden of workplace injuries or illnesses. It ensures that they receive the necessary medical treatment and financial support to recover, without worrying about mounting medical bills or lost income. This protection is especially critical for low-wage earners, who may not have the financial resources to cope with such unexpected events.

Legal Compliance and Risk Mitigation

For employers, workers’ compensation insurance is a legal requirement in most jurisdictions. Failure to comply with these regulations can result in significant penalties, including fines and legal actions. Additionally, this insurance provides a crucial layer of protection against potential lawsuits from injured employees, shielding employers from the financial risks associated with workplace accidents.

Promoting Workplace Safety

Workers’ compensation insurance acts as an incentive for employers to prioritize workplace safety. By implementing comprehensive safety measures and training programs, employers can reduce the frequency and severity of workplace injuries, thereby lowering their insurance premiums. This creates a positive feedback loop, encouraging a culture of safety and continuous improvement.

Support for Rehabilitation and Return to Work

Workers’ compensation insurance goes beyond providing immediate financial support. It also plays a vital role in facilitating the rehabilitation and return to work for injured employees. Through vocational rehabilitation programs, employees can acquire new skills and adapt to their changing circumstances, ensuring a smoother transition back into the workforce.

How Workers’ Compensation Works

The process of workers’ compensation can vary depending on the jurisdiction and the specific circumstances of the claim. However, the general steps are relatively consistent across different regions. Here’s a simplified breakdown of how workers’ compensation typically works:

Reporting an Injury or Illness

When an employee sustains a work-related injury or develops an occupational illness, they must report it to their employer as soon as possible. Timely reporting is crucial to ensure that the incident is documented accurately and that the employee’s rights are protected.

Filing a Claim

After reporting the incident, the employee must file a formal claim with the relevant workers’ compensation board or agency. This claim outlines the details of the injury or illness, including the date, location, and circumstances of the incident. The employee will typically need to provide supporting documentation, such as medical reports and witness statements.

Evaluation and Approval

Once the claim is filed, it undergoes a thorough evaluation process. The workers’ compensation board or insurer will assess the validity of the claim, considering factors such as the nature of the injury, the employee’s medical history, and the circumstances of the incident. If the claim is approved, the employee will receive the appropriate benefits as outlined by their jurisdiction’s regulations.

Benefits and Support

Upon approval, the injured employee will receive the designated benefits, which may include medical treatment, wage replacement, and disability support. The specific benefits and their duration will depend on the nature and severity of the injury or illness, as well as the applicable regulations.

Return to Work and Rehabilitation

As part of the workers’ compensation process, injured employees are encouraged to actively participate in their recovery and rehabilitation. This may involve working with healthcare professionals and vocational counselors to develop a plan for returning to work, whether it’s through modified duties or a new career path. The goal is to help employees regain their independence and return to a fulfilling work life.

Types of Workers’ Compensation Coverage

Workers’ compensation insurance is not a one-size-fits-all solution. Depending on the nature of the business and the specific risks involved, different types of coverage may be required. Here are some common types of workers’ compensation coverage:

Standard Workers’ Compensation

This is the most common type of coverage, providing the basic benefits outlined earlier, such as medical treatment, wage replacement, and disability support. It is typically required for most employers, ensuring that their employees are protected in the event of workplace injuries or illnesses.

Employer’s Liability Insurance

While workers’ compensation insurance provides coverage for most workplace accidents, it does not protect employers from claims made by employees who are not covered under the policy. Employer’s liability insurance fills this gap, providing coverage for lawsuits arising from workplace injuries or illnesses that are not covered by workers’ compensation.

Voluntary Compensation

In some jurisdictions, certain types of workers, such as domestic workers or agricultural workers, may not be automatically covered by workers’ compensation insurance. Voluntary compensation coverage extends the benefits of workers’ compensation to these employees, ensuring they receive the same protection as other workers.

Occupational Disease Coverage

Occupational diseases, such as those caused by exposure to hazardous materials or repetitive strain injuries, can take years to develop. Occupational disease coverage provides benefits for employees who develop such illnesses as a direct result of their work. This coverage is particularly important for industries with high exposure risks, such as mining or manufacturing.

The Future of Workers’ Compensation

As the world of work continues to evolve, so too must workers’ compensation insurance. With advancements in technology and changing workplace dynamics, the landscape of workers’ compensation is poised for significant transformations. Here are some key trends and considerations for the future of workers’ comp:

Telemedicine and Virtual Care

The rise of telemedicine and virtual healthcare services has the potential to revolutionize workers’ compensation. By leveraging digital technologies, injured employees can access medical care and support remotely, reducing the need for in-person visits and expediting the claims process. This not only improves accessibility but also enhances the overall efficiency of the system.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are increasingly being used to streamline various aspects of workers’ compensation, from claim processing to fraud detection. These technologies can analyze vast amounts of data, identify patterns, and make more accurate predictions, leading to faster claim resolutions and improved overall efficiency.

The Gig Economy and Independent Contractors

The growing prevalence of the gig economy and the rise of independent contractors present unique challenges for workers’ compensation. As more individuals work on a freelance or contract basis, traditional employment relationships are being disrupted, and the lines between employee and contractor are becoming increasingly blurred. This raises questions about who should be covered by workers’ compensation and how these arrangements should be classified.

Mental Health and Well-Being

The recognition of mental health as a legitimate workplace concern is gaining traction. As such, workers’ compensation systems are beginning to expand their coverage to include mental health conditions, such as anxiety, depression, and post-traumatic stress disorder (PTSD), which can arise from workplace incidents or prolonged stress.

Data-Driven Risk Management

With the increasing availability of data and advanced analytics, employers can now identify potential risks and hazards in the workplace more effectively. By leveraging data-driven insights, employers can implement targeted safety measures and interventions, reducing the likelihood of workplace accidents and illnesses. This proactive approach not only protects employees but also helps mitigate the financial risks associated with workers’ compensation claims.

| Key Statistic | Value |

|---|---|

| Average Cost of a Workplace Injury | $30,000 |

| Percentage of Small Businesses with Workers' Comp Insurance | 85% |

| Average Time for a Claim to be Resolved | 45 days |

What are the key benefits of workers’ compensation insurance for employers?

+Workers’ compensation insurance offers several advantages for employers, including legal compliance, risk mitigation, and a reduction in potential liability claims. It also helps foster a positive work environment by demonstrating a commitment to employee well-being.

How does workers’ compensation insurance affect small businesses?

+While the cost of workers’ compensation insurance can be a significant expense for small businesses, it is often a necessary investment to protect their employees and the business itself. Many small businesses find that the peace of mind and legal compliance provided by workers’ comp outweigh the financial burden.

Can employees choose to opt out of workers’ compensation insurance?

+No, employees cannot opt out of workers’ compensation insurance. It is a legal requirement in most jurisdictions, and employers are responsible for ensuring their employees are covered. Attempting to opt out could result in significant legal consequences for both the employer and the employee.