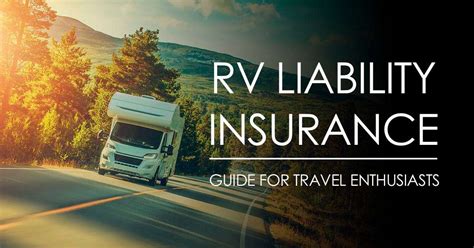

Insurance On Motorhome

When it comes to motorhome ownership, one of the essential considerations is securing the right insurance coverage. A motorhome, often referred to as a recreational vehicle (RV), is a significant investment, and protecting it with adequate insurance is crucial. This comprehensive guide aims to explore the world of motorhome insurance, providing you with the insights and knowledge to make informed decisions about insuring your mobile home.

Understanding Motorhome Insurance

Motorhome insurance is a specialized form of insurance designed to cover the unique risks and needs associated with owning and operating a motorhome. It offers a range of benefits and protection, ensuring that you can enjoy your adventures with peace of mind. Here’s an in-depth look at what motorhome insurance entails.

Coverage Options

Motorhome insurance policies typically offer a variety of coverage options to cater to different needs and preferences. Some of the key coverages include:

- Liability Coverage: This protects you in the event of an accident where you are at fault. It covers the costs of injuries and property damage sustained by others.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by events other than collisions, such as theft, vandalism, fire, or natural disasters.

- Collision Coverage: Collision insurance covers the cost of repairing or replacing your motorhome if it’s involved in an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you if you’re involved in an accident with a driver who doesn’t have adequate insurance.

- Personal Property Coverage: It ensures that your personal belongings inside the motorhome are protected against loss or damage.

- Emergency Roadside Assistance: Many motorhome insurance policies include roadside assistance, offering help with towing, flat tires, battery issues, and more.

Factors Influencing Motorhome Insurance Rates

The cost of motorhome insurance can vary significantly depending on several factors. Understanding these factors can help you make informed choices and potentially save on your insurance premiums.

- Motorhome Value: The value of your motorhome is a significant determinant of your insurance rates. Higher-value motorhomes generally require more extensive coverage and thus cost more to insure.

- Location: The area where you primarily park or store your motorhome can impact your insurance rates. Regions with higher crime rates or a history of natural disasters may result in increased premiums.

- Usage: How often you use your motorhome can affect your insurance costs. Frequent travelers may require additional coverage and thus pay higher premiums.

- Driver Profile: Your driving history and the number of drivers using the motorhome play a role in determining rates. A clean driving record and responsible driving behavior can lead to lower premiums.

- Coverage Limits: The extent of coverage you choose will impact your insurance costs. Higher coverage limits typically result in higher premiums.

- Deductibles: Opting for a higher deductible can reduce your insurance premiums. However, it’s essential to consider your financial situation and ensure you can afford the deductible in the event of a claim.

Customizing Your Motorhome Insurance Policy

One of the advantages of motorhome insurance is the ability to tailor your policy to your specific needs. Here are some additional coverage options you may consider:

- Full-Timer Coverage: If you live in your motorhome full-time, this coverage provides the necessary protection for your home and personal belongings.

- Vacation Liability Coverage: This coverage extends liability protection to situations where you rent out your motorhome to others during your vacations.

- Pet Coverage: Many motorhome owners travel with their pets. Pet coverage can ensure that any injuries or damages caused by your pet are covered.

- Content Replacement Coverage: This option provides replacement cost coverage for your personal belongings, ensuring you receive the full value of your items in the event of a loss.

Choosing the Right Motorhome Insurance Provider

Selecting the right insurance provider is crucial to ensure you receive the best coverage and service. Here are some key considerations when choosing a motorhome insurance company:

- Reputation and Financial Stability: Opt for insurance companies with a solid reputation and financial strength. Check ratings from independent agencies like AM Best or Standard & Poor’s to ensure the insurer is stable and reliable.

- Policy Customization: Look for providers that offer flexible policies, allowing you to tailor coverage to your specific needs and budget.

- Claims Handling: Research the insurer’s claims process and reputation for prompt and fair claim settlements. Read reviews and testimonials from other motorhome owners to gauge their satisfaction with the claims experience.

- Customer Service: Excellent customer service is essential. Choose an insurer with a dedicated and knowledgeable team that can provide support and guidance throughout the insurance process.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as multiple policy bundles (combining motorhome insurance with other insurance types), safe driving records, or loyalty programs. Take advantage of these opportunities to save on your premiums.

Comparing Motorhome Insurance Quotes

To ensure you’re getting the best value for your money, it’s crucial to compare quotes from multiple insurance providers. Here’s a step-by-step guide to comparing motorhome insurance quotes effectively:

- Identify Your Needs: Before requesting quotes, make a list of the coverage options and limits you require. This ensures you’re comparing apples to apples when evaluating different policies.

- Contact Insurance Providers: Reach out to several reputable motorhome insurance companies or brokers. Provide them with detailed information about your motorhome, driving history, and intended usage.

- Request Quotes: Ask for quotes that include a breakdown of coverage and premiums. Ensure the quotes cover the same set of coverage options and limits to facilitate an accurate comparison.

- Evaluate Coverage and Premiums: Carefully review each quote, considering not only the premium but also the level of coverage provided. Look for any exclusions or limitations that may impact your decision.

- Consider Additional Benefits: Besides coverage and premiums, evaluate other benefits offered by the insurance providers. These may include roadside assistance, rental car coverage, or discounts for safety features.

- Read the Fine Print : Pay close attention to the policy documents. Understand the terms and conditions, including any exclusions or limitations, to ensure you’re fully aware of what’s covered and what’s not.

The Benefits of Motorhome Insurance

Investing in motorhome insurance offers numerous advantages, providing peace of mind and financial protection during your adventures. Here’s a closer look at the benefits:

- Peace of Mind: Motorhome insurance ensures that you can enjoy your travels without worrying about unexpected expenses or liabilities. It provides security and confidence, knowing you’re protected against various risks.

- Financial Protection: In the event of an accident, theft, or other covered incidents, motorhome insurance covers the costs of repairs, replacement, or liability claims. This financial protection can be crucial in ensuring your motorhome remains in good condition and your personal assets are protected.

- Legal Compliance: Depending on your location, motorhome insurance may be a legal requirement. Even if it’s not mandatory, having adequate insurance demonstrates responsible ownership and can provide added protection in the event of an accident.

- Access to Specialized Coverage: Motorhome insurance offers specialized coverage options tailored to the unique needs of motorhome owners. This includes coverage for personal belongings, emergency roadside assistance, and liability protection while traveling.

- Discounts and Savings: Many insurance providers offer discounts for various reasons, such as safe driving records, loyalty programs, or bundling multiple insurance policies. Taking advantage of these discounts can help you save on your motorhome insurance premiums.

Tips for Maximizing Your Motorhome Insurance Coverage

To ensure you get the most out of your motorhome insurance policy, consider these expert tips:

- Maintain a Clean Driving Record: A clean driving history can lead to lower insurance premiums. Be a responsible driver, follow traffic rules, and avoid accidents to keep your insurance costs down.

- Bundle Policies: If you have other insurance needs, such as auto or home insurance, consider bundling your policies with the same insurer. This can result in significant discounts and simplify your insurance management.

- Review Your Coverage Regularly: Your insurance needs may change over time. Regularly review your policy to ensure it aligns with your current circumstances and usage. Update your coverage as needed to maintain adequate protection.

- Understand Your Deductibles: Choose deductibles that align with your financial situation. While higher deductibles can lower premiums, ensure you can afford the deductible in the event of a claim.

- Utilize Safety Features: Many insurance providers offer discounts for motorhomes equipped with safety features like backup cameras, collision avoidance systems, or theft-deterrent devices. Investing in these features can not only enhance your safety but also reduce your insurance costs.

Motorhome Insurance FAQs

Can I Insure My Motorhome if I Use It for Full-Time Living?

+Yes, you can insure your motorhome even if you use it as your primary residence. Many insurance providers offer specialized policies for full-time RVers, providing the necessary coverage for your home and belongings.

What Happens if My Motorhome is Damaged While in Storage?

+If your motorhome is damaged while in storage, your comprehensive coverage will typically apply. This coverage protects against various non-collision incidents, including damage caused by storms, vandalism, or theft.

Are There Discounts Available for Motorhome Insurance?

+Yes, several discounts may be available for motorhome insurance. These can include safe driver discounts, loyalty program discounts, discounts for bundling multiple policies, and discounts for installing safety features.

How Often Should I Review My Motorhome Insurance Policy?

+It’s recommended to review your motorhome insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains adequate and aligned with your needs.