What Is The Point Of Life Insurance

Life insurance is a financial tool that provides a sense of security and peace of mind to individuals and their loved ones. It serves as a safety net, ensuring that your financial responsibilities and legacies are taken care of even in the unfortunate event of your passing. With life insurance, you can protect your family's future, pay off debts, and maintain their standard of living. In this comprehensive guide, we will delve into the various aspects of life insurance, exploring its purpose, benefits, and how it can be tailored to meet your specific needs.

Understanding the Purpose of Life Insurance

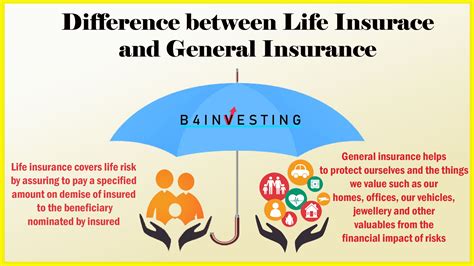

Life insurance is designed to offer financial protection and support to your beneficiaries, which can include your spouse, children, parents, or anyone else you designate. It provides a lump-sum payment, known as the death benefit, to your beneficiaries upon your death. This benefit serves multiple purposes, addressing various financial concerns and helping your loved ones navigate through the difficult times that follow the loss of a loved one.

The primary purpose of life insurance is to mitigate the financial impact of your passing. It ensures that your family can maintain their current lifestyle, cover essential expenses, and fulfill their financial commitments without added stress. Life insurance can also be used to pay off debts, such as mortgages, loans, or credit card balances, ensuring that your loved ones are not burdened with these financial obligations.

Key Benefits of Life Insurance

Life insurance offers a range of benefits that make it an essential financial tool for many individuals and families:

- Financial Security: Life insurance provides a safety net for your beneficiaries, ensuring they have the financial means to cover immediate and long-term expenses. This security can be particularly crucial during times of emotional distress, helping to alleviate financial worries.

- Debt Repayment: The death benefit can be used to pay off any outstanding debts, including mortgages, car loans, or personal loans. This prevents your loved ones from inheriting these financial burdens and ensures your estate is not encumbered by debt.

- Education Funding: Many parents use life insurance to fund their children's education. The death benefit can be earmarked for college or university fees, providing a solid foundation for their academic pursuits.

- Business Continuity: Life insurance is vital for business owners. It can ensure the smooth transition of ownership or provide funds to buy out a deceased partner's share, preventing disruptions to the business.

- Estate Planning: Life insurance can be a valuable component of your estate plan. It can help cover estate taxes, probate costs, and other expenses associated with settling your estate, ensuring a smoother and more efficient process.

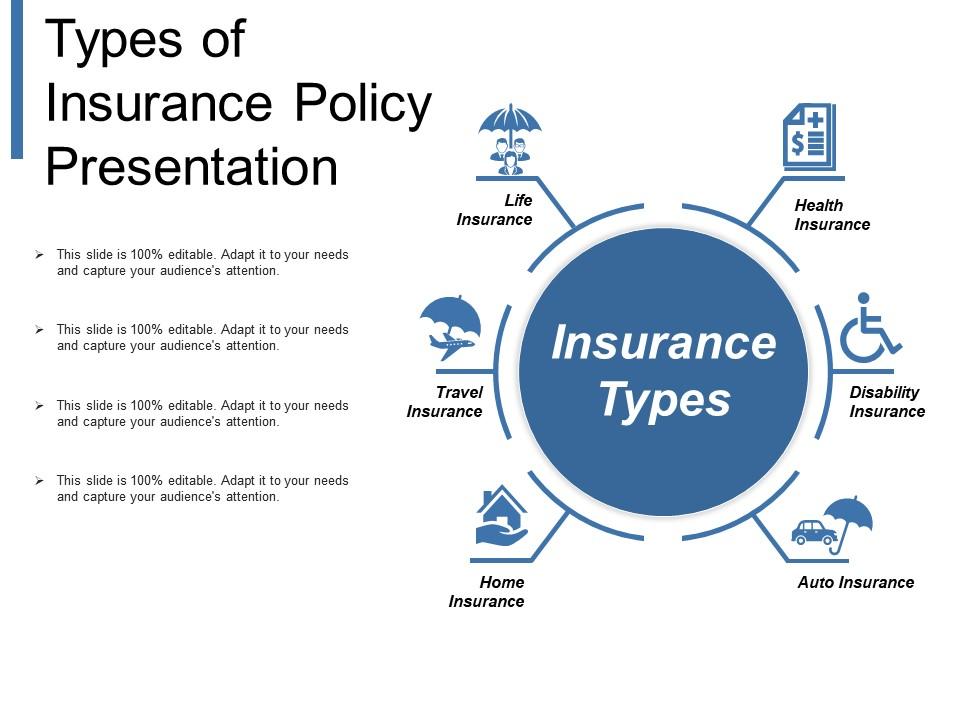

Types of Life Insurance Policies

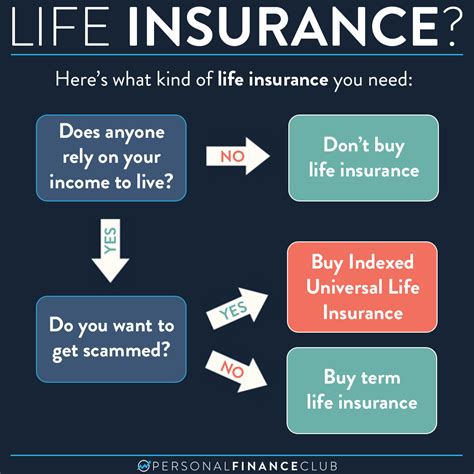

Life insurance policies come in various forms, each designed to meet different needs and preferences. The two main categories are term life insurance and permanent life insurance, and within these categories, there are several specific types to consider.

Term Life Insurance

Term life insurance is a straightforward and affordable option that provides coverage for a specific period, known as the "term." It is ideal for individuals seeking coverage for a defined period, such as until their children become financially independent or until they retire. Term life insurance offers high coverage amounts at relatively low premiums, making it an attractive choice for those on a budget.

Here are some key features of term life insurance:

- Coverage Period: The term can range from 10 to 30 years, and at the end of the term, the coverage expires. If you outlive the term, you will need to either renew the policy or purchase a new one.

- Renewal: Many term policies allow for renewal, but the premiums typically increase with age. It's important to review your policy terms and consider your long-term needs.

- Convertible Option: Some term policies offer the flexibility to convert to a permanent life insurance policy without a medical exam. This can be beneficial if your needs change over time.

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides coverage for your entire life, as long as you continue to pay the premiums. It offers a combination of insurance coverage and a cash value component, which grows over time. Permanent life insurance is more expensive than term life insurance, but it provides lifelong protection and can be a valuable asset for estate planning and wealth transfer.

Here are the main types of permanent life insurance:

- Whole Life Insurance: This is the most common type of permanent life insurance. It offers a fixed premium and a guaranteed death benefit. The cash value component grows at a guaranteed rate, and you can borrow against it or withdraw funds if needed.

- Universal Life Insurance: Universal life insurance offers more flexibility than whole life. It allows you to adjust your premium payments and death benefit amounts within certain limits. The cash value component can be invested, providing potential for higher returns.

- Variable Life Insurance: With variable life insurance, the cash value component is invested in separate accounts, such as mutual funds. The potential for higher returns exists, but there is also more risk involved. You have more control over investment decisions.

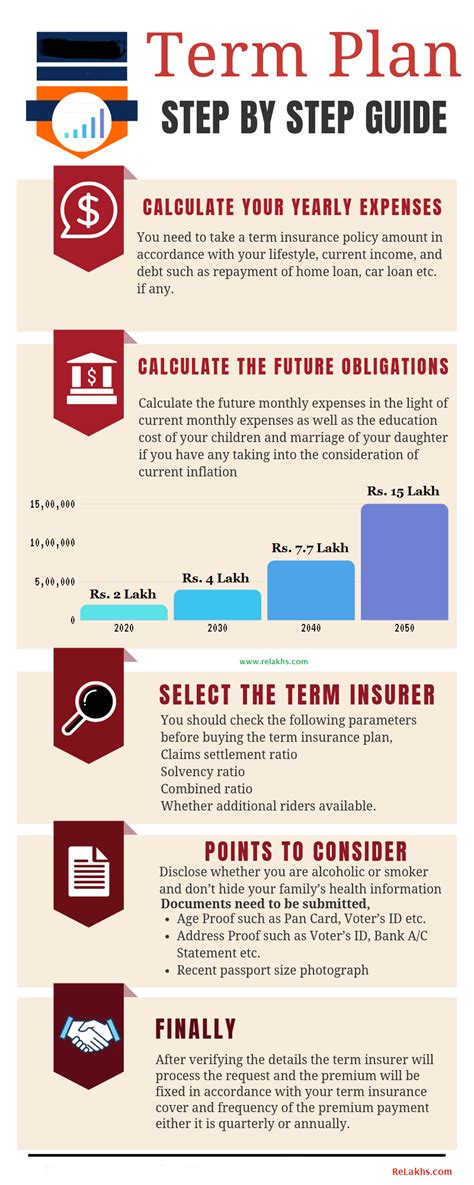

How to Choose the Right Life Insurance Policy

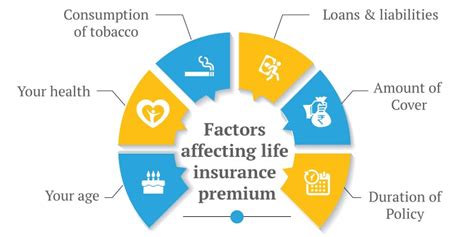

Selecting the right life insurance policy involves careful consideration of your unique circumstances and financial goals. Here are some factors to keep in mind:

- Coverage Amount: Determine how much coverage you need by considering your financial obligations, such as mortgage, loans, and living expenses. You may also want to factor in future goals like your children's education.

- Term Length: If you opt for term life insurance, choose a term that aligns with your needs. For example, if you want coverage until your children are adults, select a term that ends when they turn 18 or 21.

- Budget: Evaluate your financial situation and set a realistic budget for premiums. Term life insurance is generally more affordable, but permanent life insurance offers long-term benefits.

- Health and Lifestyle: Your health and lifestyle can impact the cost and availability of life insurance. Be prepared to disclose your medical history and undergo a medical exam, especially for permanent life insurance.

- Estate Planning: If you have complex estate planning needs, permanent life insurance with its cash value component can be a valuable tool for minimizing estate taxes and providing liquidity for your heirs.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Affordable, coverage for a defined period, high coverage amounts, renewal options, convertible to permanent life insurance. |

| Whole Life Insurance | Permanent coverage, fixed premiums, guaranteed death benefit, cash value grows at a guaranteed rate. |

| Universal Life Insurance | Permanent coverage, flexible premiums and death benefit, cash value can be invested for potential higher returns. |

| Variable Life Insurance | Permanent coverage, cash value invested in separate accounts, potential for higher returns but with more risk, control over investment decisions. |

The Impact of Life Insurance on Your Beneficiaries

Life insurance has a profound impact on your beneficiaries, providing them with the financial resources to navigate the challenges that arise after your passing. The death benefit can be used in numerous ways to ensure their well-being and security:

- Immediate Expenses: Your beneficiaries can use the death benefit to cover immediate expenses, such as funeral and burial costs, outstanding medical bills, or any urgent financial needs.

- Day-to-Day Living Expenses: The death benefit can help your loved ones maintain their current standard of living. It can cover rent or mortgage payments, utilities, groceries, and other everyday expenses.

- Childcare and Education: If you have young children, the death benefit can be allocated to cover childcare expenses or fund their education. This ensures they have the necessary support to thrive academically.

- Debt Repayment: Life insurance proceeds can be used to pay off any debts you may have left behind, such as credit card balances, personal loans, or even business debts. This relieves your beneficiaries of the burden of managing these obligations.

- Business Continuity: For business owners, life insurance can be crucial in ensuring the continuity of their business. It can provide funds to buy out a deceased partner's share or cover the costs of hiring new staff, allowing the business to operate smoothly.

Maximizing the Benefits of Life Insurance

To make the most of your life insurance policy, consider these strategies:

- Review and Update Regularly: Life circumstances change, so it's essential to review your policy periodically. Ensure that your coverage amount and beneficiaries are up-to-date to reflect your current needs and relationships.

- Consider Riders and Add-Ons: Many life insurance policies offer additional riders or add-ons that can enhance your coverage. For example, you might consider a waiver of premium rider, which waives your premium payments if you become disabled.

- Explore Tax Benefits: Life insurance proceeds are generally tax-free, but there may be other tax benefits associated with certain policies. Consult a tax advisor to understand the potential advantages.

- Estate Planning Integration: Work with an estate planning attorney to integrate your life insurance policy into your overall estate plan. This ensures that your assets are distributed according to your wishes and that your beneficiaries receive the maximum benefit.

Frequently Asked Questions

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your financial obligations and goals. Calculate your outstanding debts, estimate future expenses, and consider your desired legacy. As a general rule, aim for coverage that is 10-15 times your annual income.

Can I change my beneficiaries at any time?

+Yes, you can typically change your beneficiaries at any time. It's a good idea to review your beneficiary designations periodically, especially after significant life events like marriage, divorce, or the birth of a child.

What happens if I miss a premium payment?

+Missed premium payments can have different consequences depending on your policy. Some policies have a grace period, while others may lapse or enter a reduced paid-up status. It's important to understand your policy's terms and contact your insurer if you anticipate missing a payment.

Can I access the cash value of my permanent life insurance policy?

+Yes, you can access the cash value of your permanent life insurance policy through loans or withdrawals. However, be aware that borrowing against your policy may reduce the death benefit and impact the overall value of your policy.

Are life insurance proceeds taxable?

+In most cases, life insurance proceeds are not taxable to your beneficiaries. However, there may be tax implications for the cash value of permanent life insurance policies, so consult a tax professional for guidance.

Life insurance is a powerful tool that offers financial protection and peace of mind. By understanding the different types of policies and their benefits, you can make an informed decision to ensure your loved ones are taken care of in the event of your passing. Remember, life insurance is not just about covering immediate expenses; it’s about securing your family’s future and fulfilling your legacy.