What Is Mortgage Protection Insurance

Mortgage protection insurance (MPI) is a specialized form of life insurance designed to safeguard one of the most significant financial commitments an individual or family may undertake: the mortgage on their home. This type of insurance acts as a safety net, ensuring that in the event of an unexpected life change or tragedy, the policyholder's loved ones are protected from the financial burden of mortgage payments.

Understanding Mortgage Protection Insurance

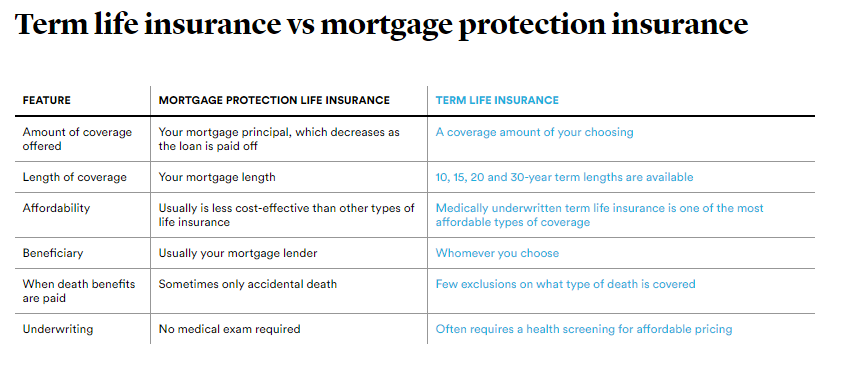

MPI is a type of term life insurance that is specifically tailored to cover the outstanding balance on a mortgage. The primary purpose is to provide peace of mind to homeowners, knowing that their families will not face the risk of losing their homes due to mortgage defaults if the primary earner or borrower passes away or becomes disabled.

This insurance policy covers the homeowner for a specific term, typically aligned with the mortgage repayment period. During this term, the policyholder makes regular premium payments to the insurance company. If a covered event occurs, such as the death or disability of the policyholder, the insurance company will pay out a benefit to cover the outstanding mortgage balance.

Key Benefits of Mortgage Protection Insurance

- Financial Security: MPI ensures that the homeowner’s family can maintain their standard of living and keep their home, even in the face of tragedy.

- Affordability: Policies are often more affordable than traditional life insurance, as they are designed to cover a specific, time-bound financial commitment.

- Customizable Coverage: Policyholders can tailor their coverage to match their mortgage repayment schedule, providing flexibility and peace of mind.

- Ease of Application: The application process is generally straightforward, making it accessible to a wide range of homeowners.

Additionally, MPI can be particularly beneficial for individuals who may not qualify for traditional life insurance due to health conditions or age. It offers a simple and effective way to secure their family's financial future.

How MPI Works

The operation of MPI is relatively straightforward. The policyholder selects a coverage amount that aligns with their mortgage balance. This coverage amount remains fixed throughout the term of the policy, even if the mortgage balance decreases due to regular payments. The policyholder then makes premium payments, which are typically fixed and affordable.

In the event of a covered incident, such as the policyholder's death or disability, the insurance company will pay out a benefit equal to the outstanding mortgage balance. This benefit is typically paid directly to the mortgage lender, ensuring that the mortgage is settled in full. The remaining benefit, if any, can then be used by the policyholder's family for other financial needs.

Real-World Examples

Consider a family with a 300,000 mortgage on their home. They opt for MPI with a coverage amount of 300,000, and they pay a monthly premium of 50. If the primary earner in the family passes away, the insurance company will pay out 300,000 to cover the mortgage balance. This ensures that the family can remain in their home and continue their lives without the added stress of mortgage payments.

In another scenario, a homeowner with a disability policy rider on their MPI becomes unable to work due to a severe injury. The insurance company pays out a benefit to cover the outstanding mortgage balance, providing the homeowner with financial stability during their recovery.

Technical Specifications and Performance

| Coverage Type | Term Life Insurance |

|---|---|

| Policy Duration | Customizable, typically aligned with mortgage term |

| Coverage Amount | Fixed, equal to the mortgage balance |

| Premium Payment | Regular, fixed payments based on coverage amount and term |

| Benefit Payout | Full mortgage balance in the event of death or disability |

Future Implications

As the housing market continues to evolve, MPI is likely to become an increasingly popular financial tool for homeowners. With rising property values and longer mortgage terms, the financial risks associated with homeownership are also increasing. MPI provides a simple and effective solution to mitigate these risks, offering a safety net for homeowners and their families.

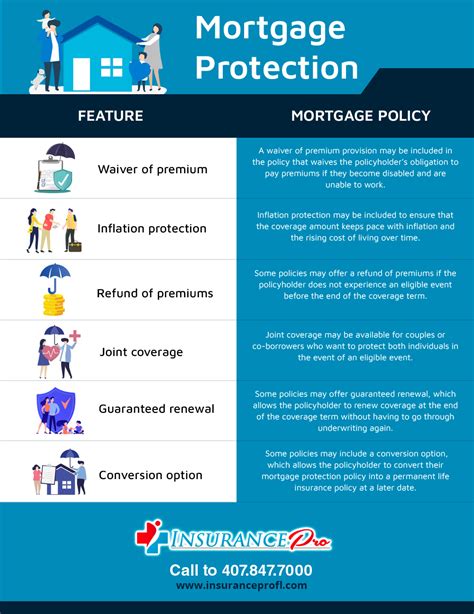

Moreover, as awareness of MPI grows, insurance companies are likely to innovate and offer more tailored and flexible policies. This could include options for renewable or convertible policies, allowing homeowners to adjust their coverage as their financial needs change over time. Additionally, the integration of technology and data analytics may lead to more precise risk assessment and personalized pricing, making MPI even more accessible and affordable.

Conclusion

Mortgage protection insurance is a valuable financial instrument that empowers homeowners to protect their most significant investment - their home. By providing a safety net against unexpected events, MPI ensures that families can maintain their financial stability and continue to build their lives with peace of mind.

Frequently Asked Questions

How much does MPI typically cost?

+The cost of MPI varies based on factors such as the coverage amount, policy term, and the age and health of the policyholder. On average, premiums can range from a few dollars to several hundred dollars per month. It’s essential to shop around and compare quotes from different insurance providers to find the most affordable option that suits your needs.

Can MPI be canceled or modified once it’s in place?

+Yes, MPI policies can be canceled or modified. If you wish to cancel your policy, you can typically do so by providing written notice to your insurance company. Keep in mind that you may not receive a refund for any premiums already paid. To modify your policy, you’ll need to contact your insurance provider to discuss your options. Changes may include adjusting the coverage amount or term, adding or removing riders, or switching to a different type of insurance.

Are there any tax benefits associated with MPI?

+MPI premiums are generally not tax-deductible as they are considered a personal expense. However, the death benefit payout from an MPI policy is typically received tax-free, providing a significant financial benefit to the policyholder’s beneficiaries. It’s important to consult with a tax professional to understand the specific tax implications of MPI in your situation.