Cheap And Best Car Insurance

When it comes to finding affordable and reliable car insurance, many drivers seek a balance between cost-effectiveness and comprehensive coverage. In this comprehensive guide, we will delve into the world of car insurance, exploring the factors that influence prices, strategies to secure the best deals, and the key aspects to consider when choosing a policy that suits your needs without breaking the bank. So, buckle up as we embark on a journey to uncover the secrets of cheap and best car insurance.

Understanding Car Insurance: A Comprehensive Overview

Car insurance is a contractual agreement between a policyholder and an insurance company, designed to provide financial protection in the event of an accident, theft, or other covered incidents. It plays a crucial role in ensuring the safety and security of drivers and their vehicles, offering peace of mind on the road. However, with a myriad of options and varying price points, finding the best car insurance that fits your budget can be a daunting task. Let's unravel the complexities and shed light on how to navigate the car insurance landscape successfully.

Factors Influencing Car Insurance Premiums

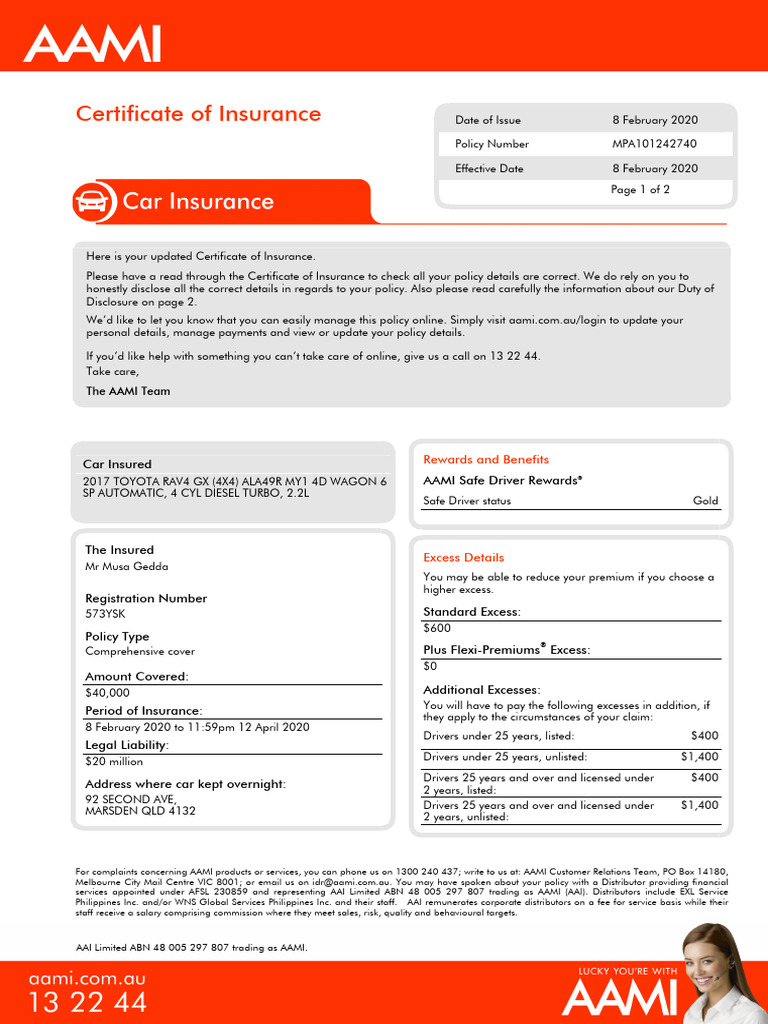

Several factors contribute to the calculation of car insurance premiums. Understanding these elements is essential for negotiating lower rates and securing the best deal. Here are some key factors that insurance providers consider when determining your premium:

- Vehicle Type and Usage: The make, model, and age of your vehicle impact insurance costs. High-performance cars or luxury vehicles often attract higher premiums due to their repair costs. Additionally, the purpose of your vehicle's usage, whether for personal, commercial, or pleasure, can influence the price.

- Driver Profile: Your driving history and personal details play a significant role. Young drivers or those with a history of accidents or traffic violations may face higher premiums. Conversely, safe drivers with clean records often enjoy lower rates.

- Location and Geographical Factors: The area where you reside and drive affects insurance costs. Urban areas with higher population densities and traffic congestion tend to have elevated premiums due to increased accident risks. Climate and weather conditions in your region can also impact insurance rates.

- Coverage Options and Limits: The extent of coverage you choose impacts your premium. Comprehensive and collision coverage, which provide protection for a wide range of incidents, typically cost more. On the other hand, liability-only coverage is more affordable but offers limited protection.

- Insurance Company and Discounts: Different insurance companies offer varying rates and discounts. It's essential to shop around and compare quotes from multiple providers. Additionally, insurers often provide discounts for safety features, good driving records, or loyalty programs, which can significantly reduce your premium.

| Factor | Impact on Premium |

|---|---|

| Vehicle Type and Usage | High-performance or luxury vehicles, commercial use, and urban locations may increase premiums. |

| Driver Profile | Young drivers, history of accidents or violations, and high-risk demographics can lead to higher rates. |

| Location and Geographical Factors | Urban areas, high-traffic regions, and regions with extreme weather conditions may result in higher premiums. |

| Coverage Options and Limits | Comprehensive and collision coverage offer broader protection but cost more, while liability-only coverage is more affordable. |

| Insurance Company and Discounts | Shopping around and comparing quotes can lead to significant savings. Look for discounts based on safety features, driving records, and loyalty programs. |

Strategies for Securing Cheap Car Insurance

Now that we have a grasp of the factors influencing car insurance premiums, let's explore some effective strategies to obtain the best deals and reduce your insurance costs:

- Compare Quotes from Multiple Insurers: Shopping around is crucial. Obtain quotes from various insurance companies to identify the most competitive rates. Online comparison tools and insurance brokers can streamline this process, making it easier to find the best deals.

- Bundling Policies: Consider bundling your car insurance with other policies, such as home or renters insurance. Many insurers offer discounts when you combine multiple policies, resulting in significant savings.

- Increase Deductibles: Opting for a higher deductible can reduce your premium. While this means you'll pay more out of pocket in the event of a claim, it can lead to substantial savings on your monthly insurance payments.

- Explore Discounts: Insurance companies often provide a range of discounts. These may include discounts for safe driving, loyalty, good academic performance (for young drivers), safety features in your vehicle, and even membership in certain organizations. Inquire about available discounts and ensure you're taking advantage of all applicable options.

- Maintain a Good Driving Record: A clean driving record is essential for securing affordable insurance. Avoid traffic violations and accidents, as they can significantly impact your premium. Additionally, complete defensive driving courses, as some insurers offer discounts for completing such programs.

- Consider Usage-Based Insurance: Usage-based insurance, also known as pay-as-you-drive or telematics insurance, uses tracking devices or smartphone apps to monitor your driving habits. This data is used to calculate your premium based on your actual driving behavior. If you drive safely and responsibly, this type of insurance can result in lower rates.

- Shop Around Regularly: Insurance rates can fluctuate, and new insurers may enter the market with competitive offers. Regularly review your insurance options and compare quotes to ensure you're still getting the best deal. Don't hesitate to switch insurers if you find a more affordable policy.

Evaluating Car Insurance Policies: Key Considerations

While cost is a significant factor when choosing car insurance, it's crucial not to compromise on essential coverage. Here are some key considerations to keep in mind when evaluating car insurance policies:

- Liability Coverage: Ensure you have adequate liability coverage to protect yourself financially in the event of an accident you cause. This coverage pays for the damages and injuries sustained by others involved in the accident.

- Collision and Comprehensive Coverage: Consider including collision and comprehensive coverage in your policy. Collision coverage covers repairs or replacements for your vehicle after an accident, while comprehensive coverage protects against non-accident-related incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you're involved in an accident with a driver who doesn't have sufficient insurance. It ensures you're not left with the financial burden of medical bills or vehicle repairs in such situations.

- Medical Payments Coverage: Medical payments coverage, also known as MedPay, helps cover the medical expenses of you and your passengers after an accident, regardless of fault. It provides quick access to funds for medical treatment, ensuring you receive the necessary care without delay.

- Personal Injury Protection (PIP): PIP coverage, available in some states, provides broader medical coverage and can also cover lost wages and funeral expenses. It's an essential consideration for comprehensive protection.

- Rental Car Reimbursement: If you frequently rent cars, this coverage can reimburse you for rental car expenses while your vehicle is being repaired after an insured accident.

The Future of Car Insurance: Technological Advancements and Industry Trends

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here's a glimpse into the future of car insurance and how it may impact your insurance journey:

- Telematics and Usage-Based Insurance: Telematics technology is becoming increasingly prevalent, allowing insurers to monitor driving behavior in real-time. This data-driven approach enables more accurate risk assessment and personalized insurance rates based on individual driving habits.

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are transforming the insurance industry. These technologies can analyze vast amounts of data, including driving patterns, accident statistics, and claims history, to identify trends and optimize insurance pricing and coverage recommendations.

- Connected Car Technology: With the rise of connected car technology, insurers can access real-time vehicle data, such as diagnostics and driving behavior. This information can be used to offer personalized insurance products and services, as well as provide insights for improving driving safety.

- Insurer Digital Transformation: Many insurance companies are embracing digital transformation to enhance customer experiences. This includes online quote comparisons, policy management, and claims processing, making it more convenient for policyholders to interact with their insurers.

- Pay-Per-Mile Insurance: Pay-per-mile insurance is gaining traction, especially for low-mileage drivers. This type of insurance charges a premium based on the number of miles driven, offering a more cost-effective option for those who don't drive frequently.

Frequently Asked Questions

How can I get cheap car insurance as a young driver?

+As a young driver, securing cheap car insurance can be challenging due to the higher risk associated with inexperience. Here are some strategies to help you find affordable coverage:

- Maintain a clean driving record: Avoid traffic violations and accidents, as they can significantly impact your premium.

- Consider adding a mature driver with a clean record to your policy. This can help lower your rates.

- Enroll in a defensive driving course. Many insurers offer discounts for completing such programs.

- Shop around and compare quotes from multiple insurers. Young driver rates can vary significantly between companies.

- Look for student discounts. Some insurers offer reduced rates for young drivers with good academic performance.

What is the average cost of car insurance per month?

+The average cost of car insurance per month can vary significantly based on several factors, including your location, driving history, vehicle type, and coverage limits. According to industry data, the average monthly car insurance premium in the United States ranges from $100 to $200. However, it's essential to note that this is just an average, and your specific rate may be higher or lower depending on your individual circumstances.

Can I get car insurance without a license?

+Obtaining car insurance without a valid driver's license can be challenging, as most insurance companies require proof of a valid license to provide coverage. However, there are a few scenarios where you might be able to get insurance without a license:

- If you own a vehicle but don't plan to drive it, you can purchase limited coverage, such as comprehensive and liability insurance, to protect your investment.

- In some cases, if you have a valid license from another country, certain insurers may offer coverage, but it's best to check with individual providers.

- If you're a teenager living with your parents, you can be added to their policy even without a license. However, this may impact their premium.

What factors can cause my car insurance rates to increase?

+Several factors can lead to an increase in your car insurance rates. Here are some common reasons:

- Traffic violations: Speeding tickets, DUIs, and other moving violations can result in higher premiums.

- Accidents: Being at fault in an accident can significantly impact your rates, especially if you have a history of accidents.

- Claims history: Filing multiple claims, even if they're not your fault, can cause your rates to rise.

- Change in personal circumstances: Moving to a new location with higher accident rates or a higher population density can lead to increased premiums.

- Vehicle changes: Upgrading to a more expensive or high-risk vehicle may result in higher insurance costs.

Remember, finding cheap and best car insurance requires a combination of research, comparison, and understanding of the factors that influence premiums. By implementing the strategies outlined in this guide and staying informed about industry trends, you can secure affordable coverage that meets your needs without compromising on essential protections.