What Is A Ppo In Insurance

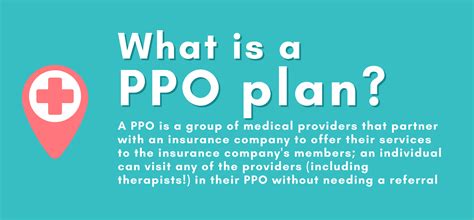

In the realm of insurance, a Preferred Provider Organization (PPO) is a prominent type of health plan that offers policyholders a comprehensive and flexible approach to healthcare. Unlike other insurance models, PPOs provide an extensive network of healthcare providers, including doctors, specialists, and hospitals, with whom they have negotiated discounted rates for their members. This unique arrangement allows individuals to choose their preferred healthcare professionals while still benefiting from cost-effective services.

The concept of a PPO is designed to strike a balance between the freedom to select personal healthcare providers and the cost-efficiency that comes with pre-negotiated rates. This model has gained significant popularity due to its ability to cater to a wide range of healthcare needs while maintaining a level of affordability. Policyholders with a PPO plan can rest assured that they have access to a broad spectrum of medical services without compromising on financial considerations.

Understanding the PPO Model

At the core of a PPO insurance plan is the concept of provider networks. These networks are carefully curated by the insurance company, comprising a diverse range of healthcare professionals and facilities. Policyholders are encouraged to utilize these network providers, as doing so ensures they receive the agreed-upon discounted rates. This system not only benefits the policyholders but also the providers, who gain a steady stream of patients while maintaining a profitable business model.

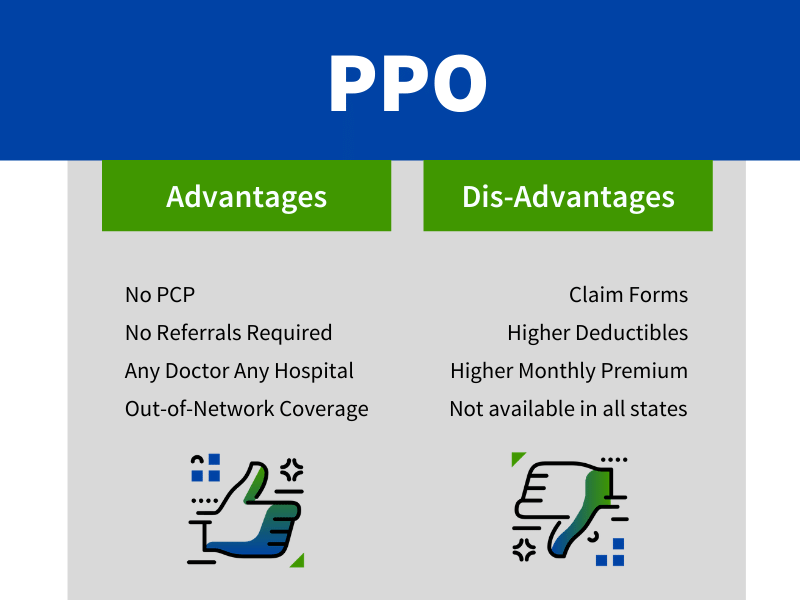

One of the standout features of PPO plans is the freedom of choice they offer. Unlike Health Maintenance Organizations (HMOs) which often require referrals and limit provider options, PPOs allow members to visit any healthcare professional, whether in-network or out-of-network. This flexibility is particularly beneficial for individuals who have established relationships with specific doctors or prefer a certain medical facility. While out-of-network services may come at a higher cost, the PPO model still provides coverage, ensuring that policyholders have a broad range of healthcare options available to them.

Key Benefits of PPO Insurance

- Wide Network of Providers: PPOs boast an extensive network, ensuring policyholders have access to a diverse range of healthcare professionals, from primary care physicians to specialists, across multiple facilities.

- No Referrals Required: Unlike HMOs, PPOs do not mandate referrals for specialist visits, giving members direct access to the healthcare services they need.

- Freedom of Choice: Policyholders are free to choose any healthcare provider, whether in-network or out-of-network, providing a high level of flexibility and convenience.

- Cost Savings: The negotiated rates with in-network providers can result in significant cost savings for policyholders, making healthcare more affordable.

- Prevention and Wellness Focus: Many PPO plans emphasize preventive care, encouraging members to take proactive steps towards their health through regular check-ups and screenings.

However, it is important to note that while PPOs offer numerous benefits, they may also come with higher premium costs compared to other insurance plans. Additionally, out-of-network services can be more expensive, and policyholders may need to pay a portion of these costs upfront.

| Key PPO Features | Description |

|---|---|

| Provider Networks | A diverse network of healthcare professionals and facilities with negotiated rates. |

| Flexibility | Policyholders can choose any healthcare provider, promoting personal choice and convenience. |

| Cost-Effectiveness | In-network services are offered at discounted rates, making healthcare more affordable. |

| Preventive Care | Many PPO plans emphasize preventive measures, encouraging regular health check-ups and screenings. |

PPO Plans: A Comprehensive Overview

When considering a PPO plan, it's essential to delve deeper into the specific features and benefits that these insurance models offer. From the breadth of coverage to the intricacies of out-of-pocket expenses, understanding these details can greatly impact an individual's healthcare journey.

Coverage and Benefits

PPO plans typically offer a wide range of coverage, including essential health benefits such as outpatient care, emergency services, hospitalization, maternity and newborn care, mental health services, and more. Additionally, many PPO plans provide coverage for prescription drugs, offering policyholders access to a preferred pharmacy network where they can obtain medications at discounted rates.

Beyond the standard benefits, PPO plans often come with added perks. Some plans may include coverage for alternative therapies, such as acupuncture or chiropractic care, while others might offer wellness programs aimed at promoting healthy lifestyles. These additional benefits can make a significant difference in an individual's overall healthcare experience and well-being.

Out-of-Pocket Costs and Deductibles

Like any insurance plan, PPOs involve out-of-pocket costs, which are the expenses that policyholders must pay directly. These costs typically include deductibles, copayments, and coinsurance. The deductible is the amount an individual must pay out of pocket before the insurance coverage kicks in. Copayments, on the other hand, are fixed amounts paid for specific services, such as a $20 copay for a doctor's visit. Coinsurance refers to the percentage of the total cost that the policyholder must pay, for instance, 20% coinsurance for a hospital stay.

It's important to note that out-of-pocket costs can vary greatly depending on whether a policyholder utilizes in-network or out-of-network providers. Services received from in-network providers often have lower out-of-pocket expenses due to the negotiated rates. In contrast, out-of-network services may be more expensive, as they are not part of the PPO's preferred network.

Network Size and Accessibility

The size and accessibility of a PPO's network are crucial factors to consider. A larger network means more options for policyholders when choosing healthcare providers, which can be especially beneficial for those with specific healthcare needs or preferences. Conversely, a smaller network might limit choices but can also result in more focused and personalized care.

The geographic reach of the network is another important consideration. A PPO plan with a broad geographic scope ensures that policyholders can access healthcare services regardless of their location, which is particularly relevant for individuals who travel frequently or live in rural areas. On the other hand, a more localized network might be ideal for those who prefer to stay close to home for their healthcare needs.

Comparing PPOs to Other Insurance Plans

While PPOs offer a balance between provider flexibility and cost-effectiveness, it's beneficial to compare them to other insurance models. For instance, Health Maintenance Organizations (HMOs) often have more restrictive provider networks and require referrals for specialist visits. On the other hand, Exclusive Provider Organizations (EPOs) offer a similar provider network structure to PPOs but typically do not cover out-of-network services.

Understanding the differences between these insurance models can help individuals choose the plan that best aligns with their healthcare needs and preferences. Whether it's the freedom to choose providers, the emphasis on preventive care, or the cost savings associated with in-network services, each insurance model has unique features that can impact an individual's healthcare journey.

How do PPO plans compare to other insurance models in terms of flexibility and cost?

+

PPO plans offer a unique blend of flexibility and cost-effectiveness. Compared to HMOs, PPOs provide greater freedom in choosing healthcare providers without requiring referrals for specialist visits. While EPOs share similarities in provider network structure with PPOs, they often lack coverage for out-of-network services. In terms of cost, PPOs generally provide cost savings through negotiated rates with in-network providers, but policyholders may face higher out-of-pocket expenses for out-of-network services.

What are the key benefits of choosing a PPO plan over other insurance options?

+

PPO plans offer a wide range of benefits, including an extensive network of healthcare providers, no referral requirements for specialists, and the flexibility to choose any healthcare professional. Additionally, PPOs often emphasize preventive care, encouraging regular health check-ups and screenings. While they may come with higher premiums, the cost savings through in-network services and the focus on wellness can make PPO plans an attractive choice for many individuals.

How can policyholders maximize the benefits of their PPO insurance plan?

+

To make the most of a PPO plan, policyholders should thoroughly understand their coverage and out-of-pocket expenses. They should utilize the extensive provider network, especially in-network providers, to take advantage of negotiated rates. Staying up-to-date with preventive care and wellness programs can also help individuals maintain their health and potentially reduce future healthcare costs. Additionally, being aware of any changes or updates to the PPO plan’s network or benefits can ensure policyholders are prepared for any adjustments.