What Does Pip Insurance Cover

Personal Injury Protection (PIP) insurance is an essential component of many automobile insurance policies, offering crucial financial protection to policyholders in the event of an accident. This type of insurance is designed to cover a range of expenses and damages resulting from a car crash, providing a safety net for drivers and their passengers. Understanding what PIP insurance covers is vital for anyone looking to ensure they have adequate protection on the road.

In this comprehensive guide, we will delve into the specifics of PIP insurance coverage, exploring its key benefits and limitations. By examining real-world examples and industry data, we aim to provide a clear picture of how PIP insurance operates and the critical role it plays in automobile accident scenarios.

Understanding Personal Injury Protection (PIP) Insurance

PIP insurance, often referred to as no-fault insurance, is a mandatory coverage in many states across the United States. It is a vital component of an auto insurance policy, as it provides financial protection to the policyholder and their passengers, regardless of who is at fault in an accident. The primary purpose of PIP is to ensure that those involved in a crash receive the necessary medical attention and compensation for their injuries without having to engage in lengthy legal battles.

The coverage offered by PIP insurance can vary slightly depending on the state and the specific policy. However, there are some common benefits that most PIP policies include. These benefits are designed to address the immediate and long-term needs of those injured in a car accident, providing a comprehensive safety net.

Medical Expenses Covered by PIP Insurance

One of the primary functions of PIP insurance is to cover medical expenses resulting from an automobile accident. This coverage is extensive and can include a wide range of medical treatments and services. Here’s a breakdown of the medical expenses typically covered by PIP:

Emergency Medical Treatment

In the immediate aftermath of an accident, PIP insurance covers the cost of emergency medical services. This includes ambulance transportation, emergency room visits, and any urgent medical care required to stabilize the patient.

Doctor and Specialist Visits

PIP insurance also covers the cost of follow-up appointments with doctors and specialists. Whether it’s a general practitioner or a specialist in orthopedics or neurology, PIP will typically reimburse these expenses.

Hospitalization

If an accident victim requires hospitalization, PIP insurance steps in to cover the cost. This includes room and board, nursing care, and any necessary medical procedures during the hospital stay.

Medical Procedures and Surgeries

PIP insurance covers a wide range of medical procedures, including surgeries, physical therapy, and even rehabilitation services. This ensures that accident victims can access the medical care they need to recover fully.

Pharmaceuticals

Prescription medications are often a crucial part of the recovery process. PIP insurance covers the cost of these pharmaceuticals, ensuring that accident victims can afford the medications prescribed by their healthcare providers.

Medical Equipment

In some cases, accident victims may require medical equipment such as wheelchairs, crutches, or even specialized braces. PIP insurance typically covers the rental or purchase of these necessary items.

| Medical Expense | Coverage Details |

|---|---|

| Emergency Treatment | Ambulance, ER visits, urgent care |

| Doctor Visits | General practitioners and specialists |

| Hospitalization | Room, board, nursing care, procedures |

| Medical Procedures | Surgeries, therapy, rehabilitation |

| Pharmaceuticals | Prescription medications |

| Medical Equipment | Wheelchairs, braces, rental/purchase |

By covering these medical expenses, PIP insurance ensures that accident victims can focus on their recovery without the added stress of financial burden.

Lost Income and Other Economic Losses

In addition to medical expenses, PIP insurance also provides coverage for economic losses resulting from an automobile accident. This is particularly important for those who are unable to work due to their injuries.

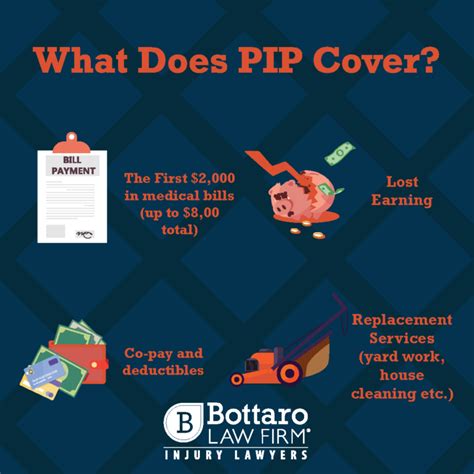

Lost Wages

PIP insurance covers a portion of an accident victim’s lost wages if they are unable to work due to their injuries. This compensation helps to maintain financial stability during the recovery period.

Replacement Services

In some cases, accident victims may require assistance with daily tasks or household chores. PIP insurance can cover the cost of hiring someone to perform these tasks, ensuring that the policyholder’s life continues as smoothly as possible.

Funeral Expenses

Tragically, some accidents result in fatalities. In such cases, PIP insurance can cover the cost of funeral expenses, providing a measure of financial relief to the bereaved family.

Other Economic Losses

PIP insurance may also cover other economic losses, such as the cost of repairing or replacing personal property damaged in the accident. This can include items like clothing, cell phones, or other personal belongings.

| Economic Loss | Coverage Details |

|---|---|

| Lost Wages | Compensation for inability to work |

| Replacement Services | Cost of hiring help for daily tasks |

| Funeral Expenses | Coverage for funeral-related costs |

| Personal Property | Repair or replacement of damaged items |

These economic loss coverages are a vital part of PIP insurance, ensuring that accident victims and their families can maintain their financial stability during a challenging time.

Non-Economic Damages: Pain and Suffering

While PIP insurance primarily focuses on economic losses and medical expenses, it also provides coverage for non-economic damages, such as pain and suffering. This aspect of PIP coverage acknowledges the physical and emotional toll that an accident can take on an individual.

Pain and Suffering

PIP insurance can provide compensation for the physical pain and emotional distress caused by an automobile accident. This coverage recognizes that accidents can have long-lasting effects on an individual’s well-being, and it aims to provide financial support to help cope with these challenges.

Scarring and Disfigurement

In cases where an accident results in permanent scarring or disfigurement, PIP insurance can offer compensation for the associated emotional and psychological impact. This coverage acknowledges the lifelong impact of such injuries.

Loss of Consortium

PIP insurance may also cover loss of consortium, which refers to the loss of companionship, support, and intimacy in a personal relationship due to an accident. This aspect of PIP coverage recognizes the impact an accident can have on the policyholder’s personal life.

| Non-Economic Damage | Coverage Details |

|---|---|

| Pain and Suffering | Compensation for physical and emotional distress |

| Scarring/Disfigurement | Emotional and psychological impact of permanent injuries |

| Loss of Consortium | Loss of companionship and support in personal relationships |

By covering these non-economic damages, PIP insurance ensures that accident victims receive the full range of support they need to cope with the aftermath of a crash.

Limitations and Exclusions of PIP Insurance

While PIP insurance offers extensive coverage, it’s important to understand its limitations and exclusions. These restrictions are in place to prevent abuse of the system and to ensure that the insurance remains financially sustainable.

Policy Limits

PIP insurance policies typically have a maximum payout limit. This means that while PIP will cover a wide range of expenses, there is a cap on the total amount that can be reimbursed. Policyholders should be aware of this limit and ensure that their coverage is adequate for their needs.

Pre-Existing Conditions

PIP insurance may not cover injuries or medical conditions that existed prior to the accident. This exclusion aims to prevent individuals from using an accident as an opportunity to seek treatment for pre-existing issues.

Fraud and Misrepresentation

PIP insurance providers have measures in place to detect and prevent fraud. Any attempt to misrepresent the extent of injuries or expenses can result in the denial of claims and potential legal consequences.

Other Limitations

PIP insurance may have specific exclusions or limitations based on the state and the policy. For example, some policies may exclude coverage for certain types of accidents or injuries. It’s crucial to review the policy details to understand these limitations.

| Limitation | Explanation |

|---|---|

| Policy Limits | Maximum payout amount |

| Pre-Existing Conditions | Injuries or conditions prior to the accident |

| Fraud and Misrepresentation | Strict measures to prevent abuse |

| Specific Exclusions | State-specific or policy-specific exclusions |

Understanding these limitations is crucial for policyholders to manage their expectations and ensure they have additional coverage if needed.

The Importance of PIP Insurance in Real-World Scenarios

To illustrate the significance of PIP insurance, let’s consider a real-world example. Imagine a driver involved in a severe automobile accident resulting in multiple injuries, including a broken leg, concussive symptoms, and soft tissue damage. The accident leaves the driver unable to work for several months during their recovery.

Medical Expenses

In this scenario, PIP insurance would step in to cover the cost of emergency treatment, including ambulance transportation and emergency room care. It would also cover the cost of follow-up appointments with specialists, such as an orthopedic surgeon for the broken leg and a neurologist for the concussive symptoms.

Lost Income

The driver’s inability to work due to their injuries would result in a loss of income. PIP insurance would provide compensation for a portion of this lost income, helping to maintain financial stability during the recovery period.

Other Economic Losses

In addition, the driver’s personal property, such as their cell phone, may have been damaged in the accident. PIP insurance would cover the cost of repairing or replacing these items, ensuring that the driver’s daily life is not disrupted further.

Non-Economic Damages

The physical and emotional impact of the accident would also be acknowledged by PIP insurance. The driver’s pain and suffering, as well as any potential scarring or disfigurement, would be considered in the compensation provided by the policy.

This example highlights how PIP insurance provides a comprehensive safety net, ensuring that accident victims receive the necessary medical care, financial support, and compensation for their injuries and losses.

Future Implications and Advancements in PIP Insurance

As the landscape of automobile insurance evolves, PIP insurance is likely to adapt and change to meet the needs of policyholders. Here are some potential future implications and advancements to consider:

Technological Integration

The increasing use of technology in the automobile industry, such as telematics and connected cars, may lead to more accurate and efficient PIP insurance claims processing. This could result in faster payouts and improved customer satisfaction.

Enhanced Medical Coverage

As medical technology advances, PIP insurance may expand its coverage to include new treatments and therapies. This could provide accident victims with access to cutting-edge medical care, improving their chances of full recovery.

Mental Health Support

The recognition of the importance of mental health is growing, and PIP insurance may begin to include coverage for mental health services related to accident-related trauma. This could include counseling and therapy to help victims cope with the emotional impact of an accident.

Injury Prevention Initiatives

PIP insurance providers may invest in initiatives to prevent accidents and injuries. This could involve supporting driver education programs, promoting road safety campaigns, or even providing incentives for the use of safety features in vehicles.

Expanded Coverage for Vulnerable Populations

As society becomes more aware of the unique challenges faced by certain populations, PIP insurance may be expanded to better protect vulnerable groups. This could include coverage for pedestrians, cyclists, and other road users who are not typically covered by traditional auto insurance policies.

| Future Implication | Potential Impact |

|---|---|

| Technological Integration | Faster claims processing, improved efficiency |

| Enhanced Medical Coverage | Access to advanced medical treatments |

| Mental Health Support | Coverage for counseling and therapy |

| Injury Prevention Initiatives | Reduced accidents and improved safety |

| Expanded Coverage | Protection for vulnerable road users |

These future implications highlight the potential for PIP insurance to become even more comprehensive and responsive to the needs of policyholders. By staying informed about these advancements, individuals can ensure they have the best possible protection on the road.

Frequently Asked Questions (FAQ)

How much PIP coverage do I need?

+

The amount of PIP coverage you need depends on your personal circumstances and the laws in your state. As a general guideline, experts recommend having at least $25,000 in PIP coverage, but some states may require higher limits. It’s important to review your policy and consult with your insurance provider to ensure you have adequate coverage.

Does PIP insurance cover my passengers?

+

Yes, PIP insurance typically covers not only the policyholder but also any passengers involved in an accident. This ensures that everyone in the vehicle receives the necessary medical attention and financial support in the event of an accident.

Can I use my PIP insurance for non-accident-related medical issues?

+

No, PIP insurance is specifically designed to cover medical expenses and losses resulting from an automobile accident. It does not cover general medical issues unrelated to an accident.

How long does it take to receive PIP benefits?

+

The time it takes to receive PIP benefits can vary depending on the circumstances and the insurance provider. In most cases, the process begins as soon as the accident occurs, and benefits are typically paid out within a few weeks. However, complex cases may take longer to process.

Understanding what PIP insurance covers is crucial for anyone who wants to ensure they have adequate protection on the road. By covering a wide range of expenses and damages, PIP insurance provides a vital safety net for policyholders and their passengers. From medical expenses to lost income and non-economic damages, PIP insurance offers comprehensive coverage to help accident victims cope with the financial and physical impacts of a crash.

As the future of automobile insurance continues to evolve, PIP insurance is likely to adapt and expand its coverage to meet the changing needs of policyholders. By