California Car Insurance Quotes

In the Golden State of California, the road to securing the best car insurance coverage is paved with a unique set of considerations. From the bustling streets of Los Angeles to the serene coastal drives, understanding the nuances of California's auto insurance landscape is crucial for both residents and visitors alike. This comprehensive guide will navigate you through the key aspects, regulations, and strategies to find the most suitable and affordable car insurance quotes in California.

Understanding California’s Auto Insurance Requirements

California stands as one of the most populous states in the nation, which translates to a diverse and dynamic driving environment. As such, the state’s auto insurance regulations are designed to ensure adequate protection for all motorists. Here’s a breakdown of the essential coverage requirements:

- Liability Coverage: The bedrock of California's auto insurance mandate is liability coverage. This ensures that if you're at fault in an accident, your policy will cover the resulting damages to the other party. The minimum liability limits in California are $15,000 for bodily injury per person, $30,000 for bodily injury per accident, and $5,000 for property damage.

- Uninsured Motorist Coverage: Given the state's diverse population and varied driving behaviors, California requires uninsured motorist coverage. This safeguards you if you're involved in an accident with a driver who lacks insurance. The minimum limits mirror those for liability coverage.

- Additional Coverage Options: While not mandatory, other coverage types like collision, comprehensive, medical payments, and personal injury protection are highly recommended to ensure comprehensive protection. These additional coverages can significantly reduce out-of-pocket expenses in the event of an accident or other vehicle-related incidents.

California’s Insurance Landscape: A Snapshot

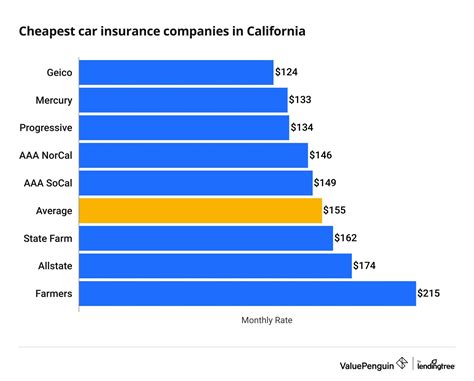

California’s auto insurance market is highly competitive, with a wide array of insurers offering diverse policies to cater to the state’s diverse driving population. Here’s a glimpse into the key metrics and trends:

| Metric | Data |

|---|---|

| Average Annual Premium | $1,643 (as of 2023) |

| Premium Growth Rate | 3.4% (2022-2023) |

| Most Common Coverage Type | Liability Only (28% of drivers) |

| Average Liability Limits | $100,000 / $300,000 (Bodily Injury) and $50,000 (Property Damage) |

Securing the Best California Car Insurance Quotes

Obtaining competitive car insurance quotes in California involves a strategic approach that considers your unique driving profile and coverage needs. Here are some essential steps to guide you through the process:

Assess Your Coverage Needs

Begin by evaluating your specific driving habits and risks. Consider factors such as your daily commute, the age and value of your vehicle, and any personal injury or property damage concerns. This self-assessment will help determine the appropriate coverage limits and types to ensure you’re adequately protected without overpaying.

Compare Multiple Quotes

California’s insurance market is teeming with options, so it’s crucial to compare quotes from various insurers. Online quote comparison tools can provide a quick snapshot of different policies and premiums. However, for a more personalized assessment, consider working with an independent insurance agent who can shop around on your behalf and offer tailored recommendations.

Understand Discounts and Savings Opportunities

Insurers in California offer a plethora of discounts to incentivize safe driving and policy loyalty. Common discounts include:

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record and avoiding accidents or traffic violations can qualify you for reduced premiums.

- Low-Mileage Discounts: If you drive fewer miles annually, some insurers offer discounted rates.

- Loyalty Discounts: Staying with the same insurer for an extended period can result in loyalty bonuses.

- Vehicle Safety Features: Having advanced safety features like anti-lock brakes, air bags, or collision avoidance systems can lower your premiums.

Consider Usage-Based Insurance (UBI)

California is home to several insurers offering Usage-Based Insurance programs. These innovative plans use telematics devices or smartphone apps to monitor your driving behavior, offering discounts for safe driving habits. While UBI may not be suitable for all drivers, it can be a cost-effective option for those who prioritize safety and are confident in their driving skills.

Explore Alternative Insurance Options

If you’re a low-mileage driver or primarily use your vehicle for pleasure rather than commuting, consider alternative insurance options like pay-per-mile or mileage-based insurance. These plans charge premiums based on actual miles driven, which can lead to substantial savings for drivers who don’t log many miles annually.

Tips for Negotiating and Finalizing Your Policy

Once you’ve narrowed down your options and identified the most competitive quotes, it’s time to finalize your policy. Here are some tips to ensure you’re getting the best value:

Negotiate Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Negotiating a higher deductible can lower your premium, but it’s important to ensure the deductible amount is manageable in the event of a claim. Find a balance that aligns with your financial comfort and risk appetite.

Review Coverage Limits

Ensure that your policy’s coverage limits adequately protect you in the event of a serious accident. While California’s minimum liability limits are a starting point, it’s often recommended to opt for higher limits to provide more robust protection.

Understand Policy Exclusions

Carefully review your policy’s fine print to understand any exclusions or limitations. This ensures you’re aware of any scenarios where your coverage might not apply, allowing you to make informed decisions about additional coverage types or limits.

Consider Payment Options

Insurers often provide flexibility in payment terms, including monthly, quarterly, or annual payments. Evaluate your financial situation and choose a payment schedule that aligns with your cash flow and budget.

Read Reviews and Seek Recommendations

Before finalizing your policy, research the insurer’s reputation and customer satisfaction. Online reviews and recommendations from friends or family can provide valuable insights into the insurer’s claims process, customer service, and overall reliability.

The Future of California Car Insurance

The landscape of car insurance in California is evolving, driven by technological advancements and changing consumer expectations. Here are some trends to watch:

Telematics and Connected Cars

The integration of telematics and connected car technologies is set to revolutionize the insurance industry. Insurers are increasingly leveraging these tools to offer more precise and personalized premiums based on real-time driving data. This shift is expected to incentivize safer driving behaviors and lead to more accurate risk assessments.

Automated Claims Processing

The rise of artificial intelligence and machine learning is streamlining the claims process. Insurers are investing in technologies that automate claim assessments, reducing processing times and improving overall efficiency. This shift is expected to benefit consumers by simplifying the claims process and accelerating payouts.

Usage-Based Insurance (UBI) Expansion

As more drivers embrace UBI programs, insurers are expected to expand their offerings and tailor plans to cater to a wider range of driving behaviors and preferences. This evolution is likely to result in more diverse and competitive UBI options, making it an increasingly viable choice for cost-conscious drivers.

In-Vehicle Safety Features

The automotive industry’s rapid innovation in safety technology is set to influence insurance premiums. As more vehicles come equipped with advanced safety features like automatic emergency braking, lane departure warnings, and adaptive cruise control, insurers are likely to offer more substantial discounts for these vehicles. This trend will incentivize the adoption of safer vehicles and reward drivers for choosing advanced safety options.

Conclusion: Navigating California’s Car Insurance Journey

Securing the right car insurance coverage in California is a strategic endeavor that requires a thoughtful approach. By understanding the state’s insurance requirements, exploring the competitive landscape, and leveraging discounts and innovative insurance options, you can find a policy that provides robust protection at a competitive price. As the insurance industry evolves, staying informed about emerging trends and technologies will empower you to make the most of your car insurance journey in California.

What are the consequences of driving without insurance in California?

+Driving without insurance in California is a serious offense. If caught, you may face fines ranging from 100 to 2,000, and your registration may be suspended. Additionally, you could be required to file an SR-22 certificate, which is a proof of financial responsibility, for a period of three years.

How can I save money on my car insurance in California?

+There are several ways to save on car insurance in California. These include comparing quotes from multiple insurers, exploring discounts for safe driving, vehicle safety features, and loyalty, opting for higher deductibles, and considering usage-based insurance if you’re a low-mileage driver.

What factors influence car insurance premiums in California?

+Car insurance premiums in California are influenced by a variety of factors, including your driving record, the age and value of your vehicle, your location, and the coverage limits and types you select. Additionally, personal factors like your age, gender, and marital status can also impact your premium.

Can I get car insurance if I have a poor driving record in California?

+Yes, you can still obtain car insurance with a poor driving record in California. However, insurers may view you as a higher risk, leading to increased premiums. It’s important to shop around and compare quotes to find an insurer who offers competitive rates for drivers with similar records. Improving your driving habits and avoiding further violations can also help reduce premiums over time.

How often should I review and update my car insurance policy in California?

+It’s recommended to review your car insurance policy annually or whenever there’s a significant change in your life or driving circumstances. This could include moving to a new location, purchasing a new vehicle, getting married, or adding a young driver to your policy. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying for unnecessary coverage.