What Does Liability Insurance Cover If You're Not At Fault

In the realm of insurance, liability coverage is an essential component of any comprehensive insurance plan, especially for individuals and businesses. While it is designed to protect policyholders against claims arising from their own negligence or fault, many wonder what happens when they are not at fault in an incident. Does liability insurance still provide coverage in such scenarios? In this article, we delve into the intricacies of liability insurance, exploring its scope, benefits, and how it can protect individuals even when they are not responsible for an accident.

Understanding Liability Insurance: A Comprehensive Overview

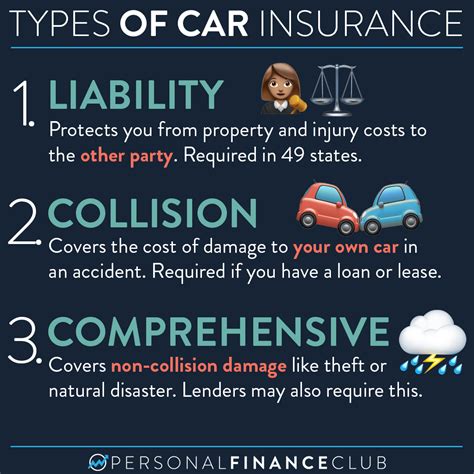

Liability insurance is a critical aspect of risk management, offering protection against financial losses that may arise from claims of negligence, bodily injury, or property damage caused by the policyholder or their designated representatives. This type of insurance is especially crucial for businesses and individuals who engage in activities that could potentially expose them to liability risks. Here’s a deeper look at what liability insurance entails and how it functions.

The Scope of Liability Insurance

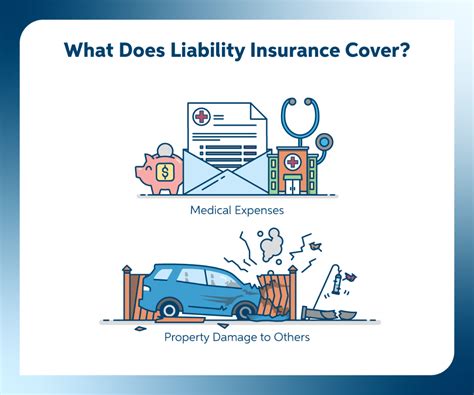

Liability insurance typically covers a wide range of scenarios, including:

- Personal Injury: This covers bodily harm caused to others as a result of the policyholder’s actions or negligence. For instance, if a customer slips and falls due to a wet floor in a store, liability insurance can help cover the medical expenses and potential compensation for the injured party.

- Property Damage: If the policyholder’s actions or products cause damage to someone else’s property, liability insurance steps in to provide financial protection. This could include damage to a client’s building during construction or a defective product that causes harm to a consumer’s property.

- Advertising Injury: Certain types of liability insurance also cover claims arising from advertising practices. This could involve defamation, copyright infringement, or other forms of harm caused through marketing or advertising.

- Legal Defense Costs: In the event of a lawsuit, liability insurance often includes coverage for legal defense fees and court costs, even if the policyholder is ultimately found not at fault.

The scope of coverage can vary widely depending on the specific policy and the insurance provider. Some policies may offer broader coverage, while others may have more restrictive terms.

The Benefits of Liability Insurance

Liability insurance provides several key benefits to policyholders:

- Financial Protection: Perhaps the most significant benefit is the financial safeguard it offers. Liability claims can result in substantial costs, and liability insurance ensures that policyholders are not personally responsible for paying these expenses out of pocket.

- Peace of Mind: Knowing that you are protected against potential liability claims can provide a significant sense of security and peace of mind, especially for businesses and individuals in high-risk industries.

- Legal Defense: As mentioned earlier, liability insurance often includes coverage for legal defense costs, which can be a crucial aspect of managing a liability claim effectively.

- Damage Control: In addition to financial protection, liability insurance can help mitigate the potential damage to a business’s or individual’s reputation. By handling claims promptly and professionally, it can help maintain a positive public image.

Liability Insurance and Claims of No Fault

So, what happens when a policyholder finds themselves in a situation where they are not at fault for an incident but are still named in a liability claim? Does their liability insurance still offer protection in such scenarios?

The answer is, it depends on the specific circumstances and the terms of the policy. While liability insurance primarily covers claims arising from the policyholder's negligence or fault, it can also provide some level of protection in no-fault situations.

When Liability Insurance Covers No-Fault Claims

In certain cases, liability insurance may cover incidents where the policyholder is not at fault. Here are some common scenarios where this could occur:

- Defective Products: If a policyholder’s product causes harm to a consumer, even if the product was defective or malfunctioned due to a manufacturing error, liability insurance may still apply. This is because the policyholder is still responsible for the product, regardless of the fault.

- Strict Liability Claims: In some jurisdictions, certain types of accidents or incidents are considered “strict liability” offenses. This means that the person or entity responsible for the accident may be held liable, even if they took all reasonable precautions. In such cases, liability insurance can provide coverage.

- Shared Fault: In some incidents, liability may be shared between multiple parties. If a policyholder is found to be partially at fault, their liability insurance may still offer some coverage, though the extent of coverage will depend on the specific policy and the degree of fault attributed to the policyholder.

It's important to note that the specific coverage and limitations for no-fault claims can vary significantly between insurance providers and policies. Policyholders should carefully review their policy documents and understand the nuances of their coverage to ensure they are adequately protected.

Limitations and Exclusions

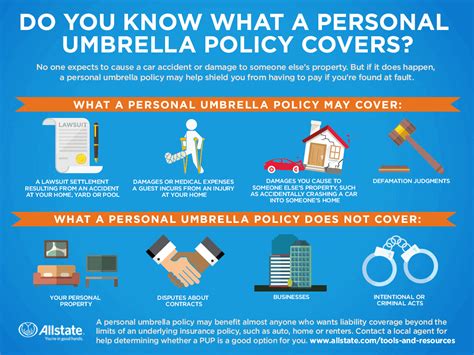

While liability insurance can provide coverage in certain no-fault scenarios, it’s not a blanket protection. There are limitations and exclusions that policyholders should be aware of:

- Willful Acts: Most liability insurance policies exclude coverage for willful or intentional acts of harm. If a policyholder intentionally causes harm to another person or their property, liability insurance will likely not provide coverage.

- Contractual Liability: Some policies may exclude coverage for liability assumed through a contract or agreement. Policyholders should carefully review their contracts and consult with their insurance provider to ensure they understand the extent of their coverage.

- Certain Types of Damage: Policies may also exclude coverage for specific types of damage, such as pollution or environmental damage. These exclusions are typically listed in the policy’s exclusions section.

Real-World Examples of Liability Insurance in Action

To better understand how liability insurance functions in practice, let’s explore a few real-world examples:

Example 1: Product Liability

Consider a small business that manufactures kitchen appliances. If one of their products, a blender, malfunctions and causes injury to a consumer, the business could be held liable for the harm caused. In this scenario, the business’s liability insurance would likely cover the costs associated with the injury, including medical expenses and potential compensation.

Example 2: Professional Liability

A lawyer provides legal advice to a client, but the advice turns out to be incorrect, leading to financial loss for the client. The client sues the lawyer for professional negligence. In this case, the lawyer’s professional liability insurance (also known as errors and omissions insurance) would provide coverage for the legal defense costs and any potential compensation awarded to the client.

Example 3: General Liability

A restaurant owner slips on a wet floor in their establishment and suffers an injury. Even though the owner is not at fault, a customer could still potentially sue the restaurant for negligence. In this scenario, the restaurant’s general liability insurance would cover the costs associated with the claim, including medical expenses and legal fees.

Best Practices for Maximizing Liability Insurance Coverage

To ensure that liability insurance provides the best possible protection, policyholders should consider the following best practices:

Choose the Right Policy

Work with an insurance broker or agent to select a policy that aligns with your specific needs and risks. Different businesses and individuals will have varying levels of liability exposure, so it’s crucial to tailor your insurance coverage accordingly.

Understand Your Policy

Take the time to thoroughly read and understand your policy documents. Pay close attention to the coverage limits, exclusions, and any endorsements or riders that may have been added to the policy. This knowledge will help you make informed decisions and manage your risks effectively.

Review and Update Regularly

As your business or personal circumstances change, so too may your liability risks. Regularly review your insurance coverage to ensure it remains adequate and aligned with your current needs. Consider updating your policy if your risk profile has changed significantly.

Maintain Open Communication

Keep an open line of communication with your insurance provider. If you have questions or concerns about your coverage, don’t hesitate to reach out to your agent or broker. They can provide valuable insights and guidance to help you make the most of your liability insurance.

Conclusion: The Value of Liability Insurance

Liability insurance is a critical component of any comprehensive risk management strategy. While it primarily covers claims arising from the policyholder’s fault, it can also provide valuable protection in certain no-fault scenarios. By understanding the scope and limitations of liability insurance, policyholders can make informed decisions to protect themselves and their businesses from potential financial losses and legal liabilities.

Can liability insurance cover me if I’m sued for something I didn’t do?

+In certain cases, yes. Liability insurance can provide coverage for claims where the policyholder is not at fault, especially in situations involving defective products or strict liability laws. However, the extent of coverage will depend on the specific policy and the circumstances of the claim.

Are there any situations where liability insurance won’t cover me even if I’m not at fault?

+Yes, there are exclusions and limitations to liability insurance coverage. For instance, most policies won’t cover willful acts of harm or liability assumed through contracts. It’s important to review your policy carefully to understand the exclusions that may apply.

What should I do if I’m involved in an incident where I’m not at fault but someone is claiming liability against me?

+First, stay calm and gather as much information about the incident as possible. Contact your insurance provider promptly to report the claim and discuss the next steps. They will guide you through the process and help determine the extent of your coverage.

How can I choose the right liability insurance policy for my needs?

+Working with an experienced insurance broker or agent is crucial. They can assess your specific risks and recommend policies that offer adequate coverage. Be sure to review the policy documents carefully and don’t hesitate to ask questions to ensure you fully understand the coverage you’re purchasing.