Vehicle Insurance Price

Vehicle insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers around the world. The cost of this coverage, however, can vary significantly based on numerous factors, making it a topic of great interest and concern for vehicle owners. In this comprehensive guide, we will delve into the intricacies of vehicle insurance prices, exploring the key factors that influence them, providing real-world examples, and offering valuable insights to help you navigate the complex world of automotive insurance.

The Landscape of Vehicle Insurance Costs

Vehicle insurance prices are a complex tapestry woven from various threads, each contributing to the overall cost. These threads include individual driver characteristics, the type of vehicle insured, geographical location, and the coverage options chosen. Understanding how these factors interplay is crucial to grasping the dynamics of insurance pricing.

Individual Factors: A Unique Fingerprint

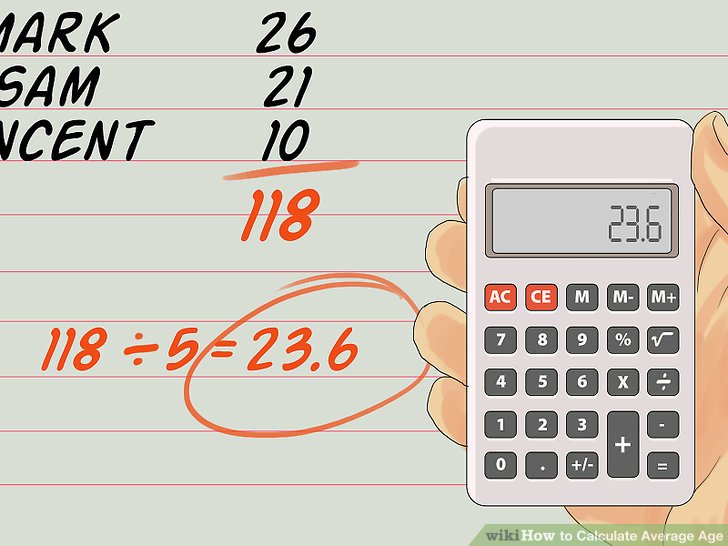

Insurance companies assess a multitude of individual characteristics to determine insurance rates. These include age, gender, driving history, and credit score. For instance, younger drivers, particularly those under 25, often face higher premiums due to their perceived higher risk on the road. Gender can also play a role, with some insurers charging slightly different rates for male and female drivers.

Driving history is a significant factor. A clean record with no accidents or traffic violations can lead to more favorable insurance rates. Conversely, a history of accidents or moving violations may result in higher premiums. Credit score is another important consideration; many insurers believe that individuals with higher credit scores are more responsible and therefore pose a lower risk.

| Factor | Impact on Premium |

|---|---|

| Age | Younger drivers often pay more. |

| Gender | Males and females may have different rates. |

| Driving History | Clean record leads to lower premiums. |

| Credit Score | Higher scores can result in lower rates. |

Vehicle Type: The Cost of Wheels

The type of vehicle you drive significantly influences your insurance premium. Generally, sports cars, luxury vehicles, and SUVs carry higher insurance costs due to their expensive repair and replacement costs. On the other hand, compact cars and sedans often have more affordable insurance rates.

The safety features and theft statistics associated with your vehicle also play a role. Vehicles with advanced safety features like collision avoidance systems and anti-theft devices may qualify for insurance discounts. Conversely, vehicles with a high likelihood of being stolen or involved in accidents can drive up insurance costs.

Location, Location, Location

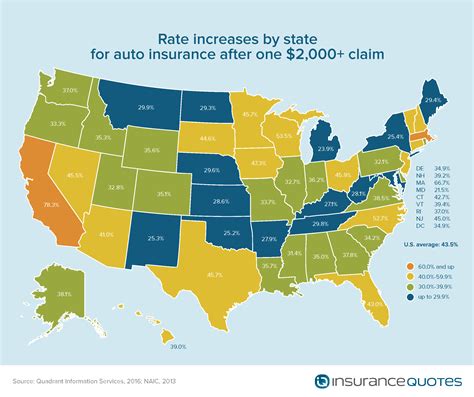

Your geographical location is a critical factor in determining insurance rates. Insurance companies consider the number of claims and accidents in your area, as well as local crime rates and traffic conditions. Urban areas with higher traffic volumes and more accidents often result in higher insurance premiums.

The specific address where your vehicle is garaged also matters. Some neighborhoods or cities may have higher rates of vehicle-related crimes, which can increase insurance costs. Additionally, local laws and regulations can influence insurance rates, with certain states or municipalities requiring higher minimum coverage limits.

Coverage Options: Tailoring Your Protection

Vehicle insurance isn’t a one-size-fits-all proposition. Insurance providers offer a variety of coverage options to cater to individual needs and budgets. These options include liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Liability Coverage: A Legal Necessity

Liability coverage is a fundamental component of vehicle insurance, protecting you from financial liability if you’re at fault in an accident. This coverage pays for bodily injury and property damage caused to others. Most states mandate a minimum level of liability coverage, but higher limits can provide greater protection.

For instance, a liability limit of $50,000 may not be sufficient if you're involved in an accident with multiple injured parties or significant property damage. Increasing your liability limits can provide added peace of mind and protect your financial assets.

Collision and Comprehensive Coverage: For Total Protection

Collision coverage and comprehensive coverage are two additional key components of vehicle insurance. Collision coverage pays for damage to your vehicle in the event of an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage from non-collision events such as theft, vandalism, fire, or natural disasters.

The cost of these coverages depends on various factors, including the value of your vehicle, your driving history, and your location. For older vehicles, it may not be cost-effective to carry comprehensive or collision coverage, as the premiums can outweigh the potential payout.

Personal Injury Protection (PIP) and Uninsured/Underinsured Motorist Coverage

Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. This coverage is mandatory in some states and can be an essential safety net in the event of an accident. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage to pay for the damages.

While these coverages can add to your insurance premium, they provide valuable protection and can be worth the investment, especially in states with high rates of uninsured drivers.

Discounts and Savings: Optimizing Your Insurance Costs

Vehicle insurance companies offer a range of discounts and incentives to attract and retain customers. These discounts can significantly reduce your insurance premium and make coverage more affordable. Here are some common discounts to look out for:

- Multi-Policy Discounts: Insuring multiple vehicles or combining vehicle insurance with other policies, such as home or renters insurance, can lead to substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period can qualify you for safe driver discounts. These discounts reward responsible driving and can significantly reduce your premium.

- Loyalty Discounts: Many insurance companies offer loyalty discounts to long-term customers, rewarding their continued business.

- Defensive Driving Course Discounts: Completing a defensive driving course can demonstrate your commitment to safe driving and may result in a premium reduction.

- Vehicle Safety Discounts: Vehicles equipped with advanced safety features or anti-theft devices may qualify for insurance discounts, as these features can reduce the risk of accidents and theft.

It's worth exploring these discounts and discussing them with your insurance provider. By taking advantage of these opportunities, you can optimize your insurance costs and ensure you're getting the best value for your money.

The Future of Vehicle Insurance: Technological Innovations

The landscape of vehicle insurance is evolving rapidly, driven by technological advancements and changing consumer expectations. One of the most significant trends is the rise of usage-based insurance (UBI), which uses telematics technology to track and analyze driving behavior.

UBI offers a more personalized approach to insurance, as premiums are based on actual driving behavior rather than generalized risk profiles. This technology can reward safe driving habits and provide real-time feedback to improve driving skills. For example, a driver who consistently maintains a safe speed and avoids harsh braking or acceleration may qualify for lower insurance rates.

Additionally, the integration of autonomous vehicle technologies is set to revolutionize the insurance industry. As self-driving cars become more prevalent, the risk landscape will shift, potentially leading to a reduction in certain types of accidents and, consequently, insurance claims. This could result in more affordable insurance rates for autonomous vehicle owners.

Conclusion: Navigating the Complex World of Vehicle Insurance

Vehicle insurance is a complex and dynamic field, influenced by a myriad of factors. From individual characteristics and vehicle type to geographical location and coverage options, each element plays a role in determining insurance premiums. Understanding these factors can empower vehicle owners to make informed decisions about their insurance coverage and find the best value for their unique circumstances.

By exploring the various coverage options, understanding the potential discounts available, and keeping abreast of technological innovations, vehicle owners can navigate the complex world of insurance with confidence. Remember, vehicle insurance is a vital component of responsible vehicle ownership, providing financial protection and peace of mind in the event of an accident or other unforeseen event.

How can I reduce my vehicle insurance premium?

+There are several strategies to reduce your insurance premium. These include maintaining a clean driving record, increasing your deductible, exploring multi-policy discounts, and taking advantage of safe driver discounts. Additionally, shopping around and comparing quotes from different insurers can help you find the most competitive rates.

What factors do insurance companies consider when determining rates?

+Insurance companies consider a wide range of factors, including age, gender, driving history, credit score, vehicle type, location, and coverage options. Each of these factors can influence your insurance premium, and understanding how they interplay can help you make informed decisions about your coverage.

Is it worth adding comprehensive and collision coverage to my policy?

+Whether or not to add comprehensive and collision coverage depends on several factors, including the value of your vehicle, your driving history, and your personal financial situation. For older vehicles with low resale value, these coverages may not be cost-effective. However, for newer or high-value vehicles, these coverages can provide valuable protection in the event of an accident or other covered event.