Homeowners House Insurance

Securing your home and its contents is an essential aspect of responsible homeownership. House insurance, or home insurance as it is often called, provides financial protection against a variety of risks and potential disasters that could leave homeowners financially vulnerable. In this comprehensive guide, we will delve into the world of homeowners' insurance, exploring its importance, the coverage it offers, and how to navigate the process of choosing the right policy for your home.

Understanding the Basics of Homeowners’ Insurance

Homeowners’ insurance is a form of property insurance designed to protect individuals who own homes. It serves as a safety net, providing coverage for the structure of your home, your personal belongings, and even offering liability protection. The primary purpose of this insurance is to ensure that you are financially prepared to handle unexpected events that could result in significant expenses.

The coverage provided by homeowners' insurance typically includes the following:

- Dwelling Coverage: This covers the physical structure of your home, including walls, roofs, and permanent fixtures. It ensures that in the event of a covered peril, such as a fire or storm damage, the cost of repairing or rebuilding your home is covered.

- Personal Property Coverage: Your insurance policy will also protect the belongings inside your home. This includes furniture, electronics, clothing, and other personal items. If these items are damaged or stolen, you can file a claim to receive compensation.

- Liability Protection: Homeowners' insurance provides liability coverage, which is crucial for protecting you against potential lawsuits. If someone is injured on your property or if your actions off your property cause damage or injury, this coverage can help cover legal fees and any settlements or judgments.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered incident, this coverage helps cover the costs of temporary housing and additional expenses while you make repairs or rebuild.

The Importance of Choosing the Right Coverage

Selecting the appropriate homeowners’ insurance policy is crucial to ensure that you have adequate protection. Different policies offer varying levels of coverage, and understanding your specific needs is essential. Here are some key factors to consider when choosing a policy:

Assessing Your Home’s Value

The first step is to accurately assess the value of your home. This includes not only the market value but also the cost of rebuilding your home if it were to be completely destroyed. An accurate valuation ensures that you have sufficient coverage to rebuild or repair your home without incurring additional expenses.

Understanding Your Belongings

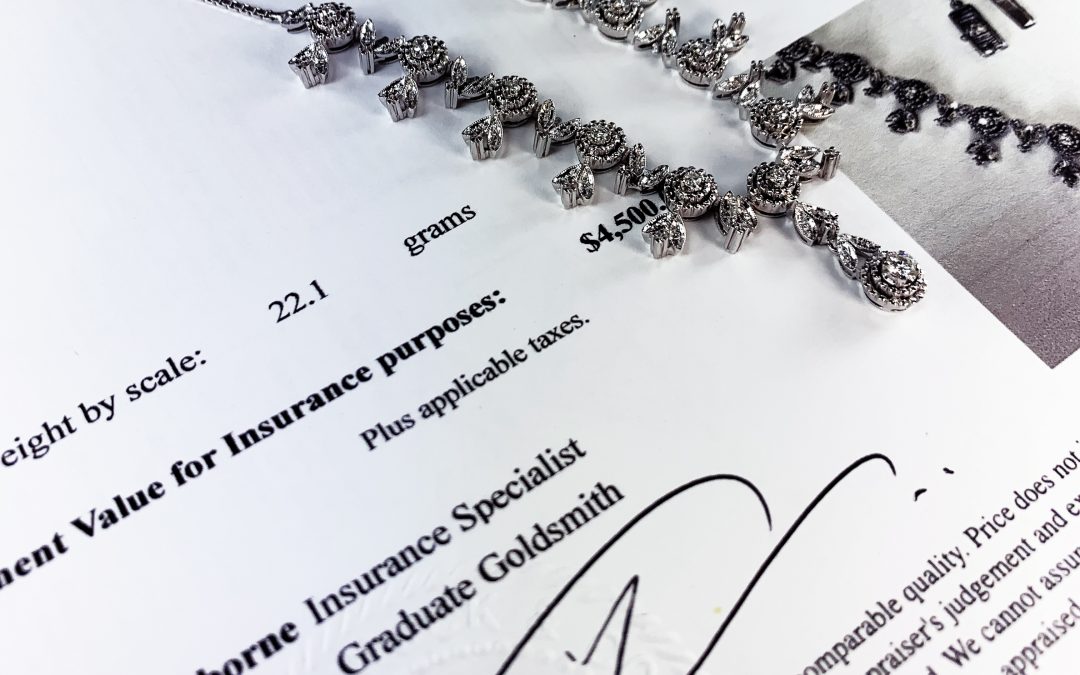

Take inventory of your personal belongings and their value. Some items, such as jewelry, art, or collectibles, may require additional coverage or specific riders to ensure they are adequately insured. Understanding the value of your possessions will help you choose a policy with the right limits.

Identifying Potential Risks

Consider the specific risks and hazards associated with your location. For example, if you live in an area prone to natural disasters like hurricanes or earthquakes, you may need to purchase additional coverage or endorsements to protect your home and belongings. Understanding these risks will help you choose a policy that provides comprehensive protection.

| Risk Factor | Coverage Considerations |

|---|---|

| Natural Disasters | Flood, earthquake, or windstorm coverage |

| Theft or Burglary | Increased personal property coverage or additional security measures |

| Liability Risks | Higher liability limits or specific endorsements |

Comparing Insurance Providers

Research and compare different insurance providers to find the best policy for your needs. Consider factors such as coverage options, customer service, claims handling, and of course, the cost of premiums. Seeking recommendations from friends, family, or trusted professionals can also be helpful.

Navigating the Claims Process

In the event of a covered loss, knowing how to navigate the claims process is crucial. Here’s a step-by-step guide to help you through the process:

- Report the Claim: Contact your insurance provider as soon as possible after the incident. Provide them with all relevant details, including any photos or videos of the damage.

- Document the Damage: Take thorough documentation of the damage to your home and belongings. This will help support your claim and provide evidence of the extent of the loss.

- Cooperate with Adjusters: Insurance adjusters will be assigned to assess the damage and determine the value of your claim. Cooperate fully with them and provide any additional information or documentation they request.

- Review the Estimate: Once the adjuster has completed their assessment, they will provide an estimate of the cost of repairs or replacements. Review this estimate carefully to ensure it accurately reflects the damage and your policy's coverage limits.

- Seek Additional Help if Needed: If you disagree with the adjuster's estimate or have concerns about the handling of your claim, you can seek the assistance of a public adjuster or an attorney who specializes in insurance claims. They can help advocate for your rights and ensure a fair settlement.

Future Trends and Innovations in Home Insurance

The world of homeowners’ insurance is evolving, and several trends and innovations are shaping the industry. Here’s a glimpse into the future of home insurance:

Data-Driven Personalization

Insurance providers are increasingly using advanced data analytics to personalize insurance policies. By analyzing factors such as your home’s construction, location, and even your lifestyle, insurers can offer more tailored coverage options, potentially reducing costs for homeowners.

Smart Home Integration

The rise of smart home technology is impacting the insurance industry. Some insurers now offer discounts or incentives for homeowners who install smart devices that can prevent or mitigate losses. These devices, such as smart water leak detectors or fire alarms, can help reduce the risk of damage and improve the overall safety of your home.

Sustainable and Green Initiatives

There is a growing focus on sustainability and environmental initiatives within the insurance industry. Some insurers are offering discounts or incentives for homeowners who adopt eco-friendly practices or make their homes more energy-efficient. This trend aligns with the increasing awareness of climate change and the need for more sustainable living.

Blockchain Technology

Blockchain technology is revolutionizing various industries, and insurance is no exception. Insurers are exploring the use of blockchain to streamline claims processes, improve data security, and enhance overall transparency. This technology has the potential to reduce administrative burdens and improve the efficiency of insurance operations.

Conclusion: Securing Your Home’s Future

Homeowners’ insurance is an essential investment for any homeowner. It provides peace of mind and financial protection against a wide range of potential risks. By understanding the basics of homeowners’ insurance, assessing your specific needs, and choosing the right policy, you can ensure that your home and belongings are adequately protected. Additionally, staying informed about the latest trends and innovations in the insurance industry can help you make more informed decisions and stay ahead of the curve.

What is the difference between homeowners’ insurance and renters’ insurance?

+Homeowners’ insurance covers the structure of your home and your personal belongings, while renters’ insurance covers only your personal belongings within a rental property. Renters’ insurance does not provide coverage for the actual dwelling or any improvements you make.

Is homeowners’ insurance mandatory?

+In many states and regions, homeowners’ insurance is not legally required. However, it is strongly recommended to protect your financial interests. Additionally, if you have a mortgage, your lender will typically require you to have homeowners’ insurance as a condition of the loan.

How often should I review my homeowners’ insurance policy?

+It is a good practice to review your homeowners’ insurance policy annually or whenever there are significant changes to your home, such as renovations or additions. Regular reviews ensure that your coverage remains up-to-date and aligns with your current needs.