Vehicle And Home Insurance

Insurance is a vital aspect of modern life, offering financial protection and peace of mind. Two of the most common types of insurance are vehicle insurance and home insurance, which provide coverage for some of our most valuable assets. In this comprehensive article, we delve into the world of vehicle and home insurance, exploring their importance, coverage options, and how they protect individuals and families.

Understanding Vehicle Insurance

Vehicle insurance, also known as auto insurance or car insurance, is a legal requirement in most countries and an essential financial safeguard for vehicle owners. It provides coverage for a range of scenarios, ensuring drivers are protected against potential financial losses and liabilities that can arise from operating a motor vehicle.

Comprehensive Coverage

A comprehensive vehicle insurance policy typically includes the following coverage options:

- Liability Coverage: This is the most fundamental aspect of vehicle insurance. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident for which the insured driver is at fault.

- Collision Coverage: This type of insurance pays for the repair or replacement of the insured vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to the insured vehicle that’s not caused by a collision, such as theft, vandalism, fire, or natural disasters.

- Medical Payments: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the insured driver and passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection in the event of an accident with a driver who either has no insurance or insufficient insurance to cover the damages.

Additionally, optional coverage options like rental car reimbursement, roadside assistance, and gap insurance can be added to provide more comprehensive protection.

Factors Affecting Vehicle Insurance Premiums

The cost of vehicle insurance, known as the premium, is influenced by several factors, including:

- Driver’s Age and Experience: Younger and less experienced drivers often pay higher premiums due to their higher risk profile.

- Vehicle Type and Usage: Sports cars and luxury vehicles generally have higher insurance rates due to their cost of repair and higher likelihood of theft. The purpose of the vehicle (e.g., personal use, business use, or pleasure) can also impact premiums.

- Location: The area where the vehicle is primarily garaged can affect insurance rates, with urban areas often having higher premiums due to increased risk of accidents and theft.

- Driving Record: A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or violations can significantly increase insurance costs.

- Credit Score: In many regions, insurance companies consider an individual’s credit score when calculating premiums, with higher credit scores often resulting in lower insurance rates.

Home Insurance: Protecting Your Sanctuary

Home insurance, or homeowners insurance, is designed to protect homeowners from financial losses related to their homes. It provides coverage for the structure of the home, its contents, and the additional costs that may arise from certain events, such as temporary living expenses if the home becomes uninhabitable due to a covered peril.

Coverage Options in Home Insurance

A standard home insurance policy typically includes:

- Dwelling Coverage: This covers the physical structure of the home, including the walls, roof, and permanent fixtures.

- Personal Property Coverage: This provides coverage for the contents of the home, such as furniture, clothing, and appliances.

- Liability Coverage: Similar to vehicle insurance, this protects the homeowner against lawsuits and medical claims from guests who are injured on the property.

- Additional Living Expenses: If a covered peril, such as a fire or severe storm, makes the home uninhabitable, this coverage pays for additional living expenses, like hotel stays and restaurant meals, until the home is repaired or rebuilt.

Additional coverage options can be added to a home insurance policy, including flood insurance, earthquake insurance, and personal articles coverage for high-value items like jewelry or artwork.

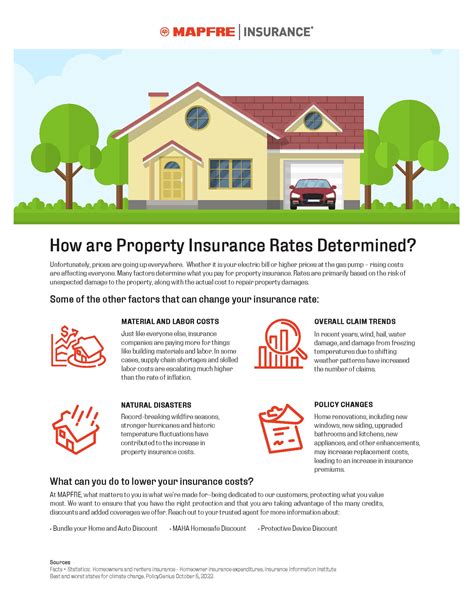

Factors Influencing Home Insurance Premiums

The cost of home insurance is influenced by various factors, including:

- Location: The geographical location of the home is a significant factor. Areas prone to natural disasters like hurricanes, tornadoes, or wildfires generally have higher insurance rates.

- Home Value and Construction: The value and type of construction of the home play a role in insurance costs. More valuable homes and those built with expensive materials may have higher premiums.

- Age of the Home: Older homes may have higher insurance rates due to potential issues with aging infrastructure and increased risk of certain types of damage.

- Deductibles: Choosing a higher deductible can lead to lower premiums, as it means the homeowner assumes a larger portion of the risk.

- Claims History: A history of filing insurance claims can result in higher premiums or even policy cancellation in some cases.

Benefits and Peace of Mind

Both vehicle and home insurance offer numerous benefits, providing financial security and peace of mind to policyholders. In the event of an accident, theft, or natural disaster, these insurance policies can help cover the costs of repairs, replacements, and potential legal liabilities.

Additionally, insurance companies often provide a range of services beyond simple financial coverage. These can include assistance with filing claims, guidance on safety measures to reduce risks, and access to a network of trusted repair and restoration professionals.

| Insurance Type | Key Benefits |

|---|---|

| Vehicle Insurance | Protects against financial losses due to accidents, theft, and other events; offers assistance with legal liabilities and medical expenses. |

| Home Insurance | Covers the cost of repairing or rebuilding a home after damage; protects personal belongings; provides liability protection; covers additional living expenses in case of a covered loss. |

What should I consider when choosing vehicle insurance coverage?

+When selecting vehicle insurance, consider your specific needs and the potential risks you face. For example, if you live in an area with a high risk of theft or vandalism, comprehensive coverage is essential. Additionally, consider your personal financial situation and choose a deductible and coverage limits that align with your ability to pay out-of-pocket expenses.

How can I reduce my home insurance premiums?

+There are several strategies to reduce home insurance premiums. These include increasing your deductible, maintaining a good credit score, and installing security systems or fire prevention measures. Additionally, regular maintenance and upgrades to your home can reduce the risk of damage and lead to lower premiums.

What are some common exclusions in vehicle and home insurance policies?

+Common exclusions in vehicle insurance policies include intentional damage, normal wear and tear, and mechanical breakdowns. In home insurance, exclusions often include damage caused by pests, poor maintenance, and flooding (unless a separate flood insurance policy is purchased). It’s crucial to review your policy documents carefully to understand what is and isn’t covered.