Full.coverage Insurance

Full coverage insurance is a comprehensive insurance policy that provides a wide range of protections for vehicles and their owners. It is designed to offer financial security and peace of mind by covering a variety of potential risks and damages that drivers may face on the road. This type of insurance is especially beneficial for those who want maximum protection for their vehicles and themselves. In this article, we will delve into the world of full coverage insurance, exploring its components, benefits, and how it can safeguard policyholders against various unforeseen events.

Understanding Full Coverage Insurance

Full coverage insurance is an all-encompassing term used to describe a combination of different insurance coverages. It typically includes liability insurance, collision coverage, and comprehensive coverage. Each of these components plays a vital role in providing comprehensive protection for vehicle owners.

Liability Insurance

Liability insurance is a fundamental aspect of full coverage. It protects the policyholder in the event they are found legally responsible for causing damage or injury to others in an accident. This coverage ensures that the policyholder’s financial obligations are met, including medical expenses, property damage, and legal fees, up to the limits specified in the policy.

For instance, if you accidentally collide with another vehicle and cause significant damage, liability insurance will step in to cover the costs of repairing the other party's vehicle and any medical bills incurred as a result of the accident. This coverage is essential for protecting your financial well-being and ensuring you can fulfill your legal responsibilities.

Collision Coverage

Collision coverage is a critical component of full coverage insurance. It provides protection for the policyholder’s own vehicle in the event of an accident, regardless of who is at fault. This coverage pays for the repair or replacement of the insured vehicle if it sustains damage in a collision with another vehicle, an object, or if it rolls over.

Imagine driving on a rainy night and losing control of your vehicle, resulting in a collision with a guardrail. Collision coverage would come into play, covering the costs of repairing your vehicle, ensuring you don't bear the financial burden alone.

Comprehensive Coverage

Comprehensive coverage is another vital aspect of full coverage insurance. It provides protection against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, or even damage caused by animals. This coverage offers a safety net for policyholders, ensuring they are not left financially devastated in the face of unexpected events.

For example, if your vehicle is vandalized or damaged by a fallen tree during a storm, comprehensive coverage would be there to help cover the costs of repairing or replacing the damaged parts, providing you with the necessary financial support to get your vehicle back on the road.

Benefits of Full Coverage Insurance

Full coverage insurance offers a multitude of benefits that make it an attractive option for vehicle owners. Here are some key advantages:

- Comprehensive Protection: Full coverage insurance provides a comprehensive safety net, covering a wide range of potential risks and damages. From accidents to natural disasters, policyholders can rest assured knowing they are protected against various unforeseen events.

- Peace of Mind: With full coverage insurance, drivers can enjoy peace of mind, knowing they are financially protected in the event of an accident or other covered incidents. This peace of mind allows them to focus on their daily lives without the constant worry of unforeseen expenses.

- Asset Protection: Full coverage insurance helps protect the policyholder's valuable asset - their vehicle. It ensures that the vehicle is adequately covered and can be repaired or replaced if damaged, preserving its value and functionality.

- Legal Compliance: In many regions, liability insurance is a legal requirement for vehicle owners. By opting for full coverage, policyholders not only meet their legal obligations but also gain additional protections for their vehicles and themselves.

- Financial Security: Full coverage insurance provides financial security by covering a wide range of costs associated with accidents, damages, and legal liabilities. This can be especially crucial for individuals who may not have the means to cover such expenses out of pocket.

Components of a Full Coverage Policy

A full coverage insurance policy typically consists of several key components, each designed to address specific risks and provide tailored protection. These components can vary depending on the insurer and the policyholder’s needs, but here are some common elements:

| Component | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage claims made against the policyholder when they are at fault in an accident. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after a collision, regardless of fault. |

| Comprehensive Coverage | Protects against damages caused by non-collision events, such as theft, vandalism, fire, and natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Provides protection if the at-fault driver in an accident is uninsured or underinsured, ensuring the policyholder's damages are covered. |

| Medical Payments Coverage | Covers medical expenses for the policyholder and their passengers, regardless of fault, after an accident. |

| Rental Car Reimbursement | Provides reimbursement for rental car expenses while the insured vehicle is being repaired or replaced. |

| Towing and Labor Coverage | Covers the cost of towing and labor services in the event of a breakdown or accident. |

| Gap Coverage | Protects policyholders in the event their vehicle is totaled and the insurance payout is less than the remaining loan balance. |

It's important to note that the specific components and coverage limits can vary between insurance providers and policies. Policyholders should carefully review their policy documents and consult with their insurance agent to ensure they have the appropriate coverage for their needs.

Frequently Asked Questions

Is full coverage insurance mandatory?

+Full coverage insurance is not mandatory in all states, but it is highly recommended. While liability insurance is often a legal requirement, full coverage provides additional protections for your vehicle and can be beneficial in the event of an accident or other unforeseen circumstances.

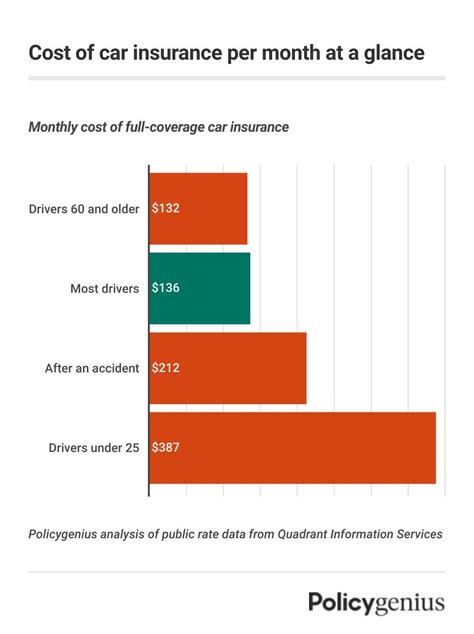

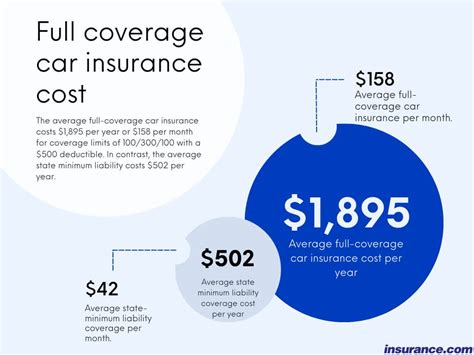

How much does full coverage insurance cost?

+The cost of full coverage insurance can vary depending on factors such as the make and model of your vehicle, your driving record, and the specific coverage limits you choose. It’s best to obtain quotes from multiple insurance providers to find the most competitive rates.

What is the difference between full coverage and liability-only insurance?

+Full coverage insurance includes liability coverage, collision coverage, and comprehensive coverage, providing protection for both the policyholder and their vehicle. Liability-only insurance, on the other hand, only covers the policyholder’s legal obligations for bodily injury and property damage to others. It does not provide protection for the insured vehicle.

Can I customize my full coverage policy?

+Yes, full coverage policies can often be customized to meet your specific needs. You can choose different coverage limits, add optional coverages like rental car reimbursement or gap coverage, and even select deductible amounts that suit your budget and preferences.

What should I consider when choosing a full coverage insurance provider?

+When selecting a full coverage insurance provider, consider factors such as their reputation, financial stability, customer service, and the range of coverage options they offer. It’s also beneficial to read reviews and compare quotes from multiple providers to find the best value and coverage for your needs.