United Healtcare Insurance

United Healthcare Insurance: Unraveling the Comprehensive Coverage Options

Welcome to an in-depth exploration of United Healthcare Insurance, a renowned name in the health insurance industry. This article aims to delve into the intricacies of their coverage, providing a comprehensive guide for those seeking to understand and navigate their insurance options effectively. United Healthcare is known for its extensive range of plans, catering to diverse healthcare needs, and this article will shed light on the key features, benefits, and considerations associated with their insurance offerings.

Understanding United Healthcare’s Vision and Mission

United Healthcare, a subsidiary of UnitedHealth Group, is a leading provider of healthcare services and insurance solutions in the United States. With a strong commitment to improving access to quality healthcare, they strive to make healthcare more affordable, efficient, and personalized for individuals and communities alike.

Their mission is centered around empowering individuals to take control of their health by offering a wide array of insurance plans and services. By partnering with a vast network of healthcare providers and leveraging advanced technologies, United Healthcare aims to simplify the healthcare experience, ensuring that individuals can access the care they need when they need it.

The Breadth of United Healthcare’s Insurance Coverage

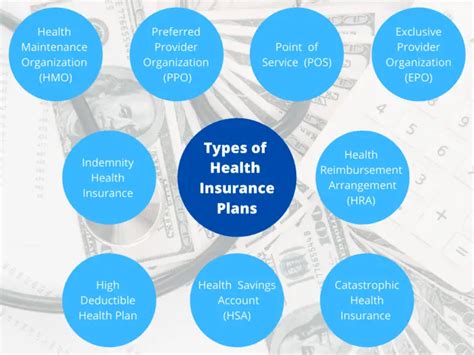

United Healthcare offers an extensive portfolio of insurance plans, catering to various demographics and healthcare requirements. Their coverage options can be broadly categorized into the following segments:

Individual and Family Plans

These plans are tailored for individuals and families seeking comprehensive healthcare coverage. United Healthcare provides a range of options, including:

- PPO (Preferred Provider Organization) Plans: Offering flexibility and choice, PPO plans allow policyholders to visit healthcare providers within the United Healthcare network without referrals. Out-of-network coverage is also available, although at a higher cost.

- HMO (Health Maintenance Organization) Plans: HMO plans provide cost-effective coverage by requiring policyholders to choose a primary care physician and obtain referrals for specialty care. This model promotes coordinated care and can lead to significant savings.

- POS (Point of Service) Plans: POS plans combine elements of PPO and HMO plans, providing flexibility and cost savings. Policyholders can choose between in-network and out-of-network providers, with different cost structures for each option.

- Catastrophic Plans: Designed for younger adults or those who prefer minimal coverage, catastrophic plans offer basic protection with low premiums. These plans typically have high deductibles and are suitable for those who rarely need medical care.

Senior Plans (Medicare)

United Healthcare plays a significant role in the Medicare market, offering a variety of plans tailored for seniors and individuals with disabilities. Their Medicare offerings include:

- Medicare Advantage Plans: These plans, also known as Part C, offer an alternative to original Medicare (Parts A and B). They provide comprehensive coverage, often including additional benefits like dental, vision, and prescription drug coverage.

- Medicare Supplement Plans: Also referred to as Medigap plans, these policies fill the gaps in original Medicare coverage. United Healthcare offers a range of Medigap plans to cover copayments, deductibles, and other out-of-pocket expenses.

- Part D Prescription Drug Plans: United Healthcare’s Part D plans provide coverage for prescription medications, helping seniors manage the cost of their medications and maintain their health.

Group and Employer Plans

United Healthcare works closely with employers to provide group health insurance plans for their employees. These plans are designed to meet the specific needs of the workforce, offering a range of benefits and options to attract and retain talent. Some key features of group plans include:

- Customizable Coverage: Employers can choose from a variety of plan designs, allowing them to tailor the coverage to their budget and the needs of their workforce.

- Wellness Programs: Many United Healthcare group plans include wellness initiatives aimed at promoting healthy lifestyles and preventing costly chronic conditions.

- Telehealth Services: With the increasing importance of virtual healthcare, United Healthcare’s group plans often include telehealth options, providing convenient access to medical advice and consultations.

- Employee Assistance Programs (EAPs): These programs offer additional support for employees, covering mental health services, substance abuse treatment, and work-life balance resources.

Specialty and Supplemental Plans

In addition to their core insurance offerings, United Healthcare provides a range of specialty and supplemental plans to address specific healthcare needs. These plans include:

- Dental and Vision Plans: United Healthcare offers standalone dental and vision plans, ensuring that individuals can access comprehensive eye and oral care.

- Critical Illness Plans: These plans provide financial protection in the event of a critical illness, such as cancer, heart attack, or stroke, by covering expenses not typically covered by traditional health insurance.

- Accident and Disability Plans: Accident plans provide coverage for unexpected injuries, while disability plans offer income protection in the event of a long-term disability.

- Life Insurance: United Healthcare also offers life insurance policies, ensuring that policyholders can provide financial security for their loved ones in the event of their passing.

The Benefits of United Healthcare Insurance

Choosing United Healthcare insurance comes with a range of advantages. Here are some key benefits that policyholders can expect:

Comprehensive Coverage

United Healthcare’s plans are designed to provide comprehensive coverage, ensuring that policyholders have access to a wide range of healthcare services. From routine check-ups to specialized treatments, their plans aim to cover all aspects of healthcare.

Nationwide Network of Providers

United Healthcare maintains an extensive network of healthcare providers, ensuring that policyholders have access to quality care regardless of their location. This network includes hospitals, clinics, specialists, and pharmacies, making it convenient for individuals to receive the care they need.

Advanced Technology and Tools

United Healthcare leverages technology to enhance the insurance experience. Their online portals and mobile apps provide policyholders with easy access to their policy information, claims status, and other important details. Additionally, they offer tools for finding in-network providers, estimating costs, and managing healthcare expenses.

Customer-Centric Approach

United Healthcare is known for its commitment to customer service. Their customer support teams are readily available to assist policyholders with any questions or concerns they may have. Whether it’s understanding coverage details, filing claims, or exploring plan options, United Healthcare strives to provide a seamless and supportive experience.

Performance Analysis and Reputation

United Healthcare’s performance and reputation in the insurance industry are backed by a range of accolades and positive feedback. Here’s a closer look at their performance and the factors contributing to their success:

Financial Strength and Stability

United Healthcare is consistently rated highly by leading insurance rating agencies, such as A.M. Best and Standard & Poor’s. Their financial strength and stability are evidenced by their strong credit ratings, indicating that they have the resources to meet their financial obligations and provide long-term security for policyholders.

Customer Satisfaction

United Healthcare prioritizes customer satisfaction, and this commitment is reflected in various surveys and customer reviews. They have consistently received high ratings for their customer service, with policyholders praising their easy-to-use platforms, responsive support teams, and efficient claims processing.

Innovative Solutions and Partnerships

United Healthcare is known for its innovative approach to healthcare insurance. They continuously strive to develop new solutions and partnerships to enhance the healthcare experience. This includes collaborations with technology companies to improve telehealth services, partnerships with fitness and wellness brands to promote healthy lifestyles, and initiatives to address social determinants of health.

Industry Recognition and Awards

United Healthcare’s dedication to excellence has been recognized through numerous industry awards. They have been honored for their innovative use of technology, their commitment to diversity and inclusion, and their leadership in the healthcare industry. These awards highlight their position as a trusted and respected insurer.

Future Implications and Developments

As the healthcare landscape continues to evolve, United Healthcare remains at the forefront, anticipating and adapting to emerging trends and challenges. Here are some key developments and future implications to consider:

Focus on Preventive Care

United Healthcare recognizes the importance of preventive care in maintaining good health and reducing healthcare costs. They are investing in initiatives that promote wellness and early detection of health issues. This includes expanding their telehealth services, offering incentives for preventive screenings, and providing resources for healthy lifestyle choices.

Digital Transformation and AI Integration

United Healthcare is embracing digital transformation to enhance the efficiency and accessibility of their services. They are leveraging artificial intelligence and machine learning to streamline claims processing, improve fraud detection, and personalize healthcare recommendations. This digital evolution aims to make insurance more convenient and tailored to individual needs.

Addressing Social Determinants of Health

United Healthcare understands that social factors, such as income, education, and housing, can significantly impact an individual’s health. They are actively working to address these social determinants by partnering with community organizations and developing initiatives to improve access to healthy foods, promote mental health awareness, and support underserved populations.

Expanding Global Presence

While United Healthcare is primarily focused on the U.S. market, they are exploring opportunities for expansion into other countries. By leveraging their expertise and resources, they aim to bring their comprehensive insurance solutions to international markets, addressing the diverse healthcare needs of individuals worldwide.

FAQ

How do I choose the right United Healthcare insurance plan for my needs?

+

Selecting the right United Healthcare plan depends on various factors, including your healthcare needs, budget, and preferences. Consider your regular healthcare expenses, any pre-existing conditions, and the level of coverage you require. United Healthcare offers a range of plans, from PPOs to HMOs, and their customer service team can guide you through the process to find the best fit.

What is the difference between Medicare Advantage and Medicare Supplement plans offered by United Healthcare?

+

Medicare Advantage (Part C) plans are an alternative to original Medicare (Parts A and B), providing comprehensive coverage that may include additional benefits like dental, vision, and prescription drug coverage. Medicare Supplement (Medigap) plans, on the other hand, fill the gaps in original Medicare coverage, covering copayments, deductibles, and other out-of-pocket expenses.

How can I access telehealth services through my United Healthcare plan?

+

United Healthcare offers telehealth services as part of many of their plans. To access these services, you can typically log in to your online account or mobile app and locate the telehealth option. From there, you can schedule virtual appointments with healthcare providers and receive the care you need from the comfort of your home.