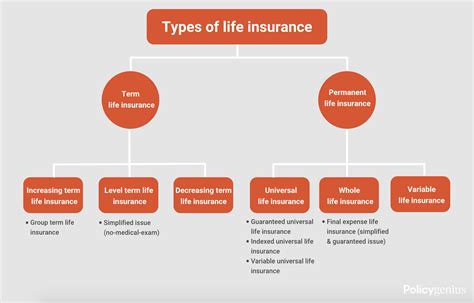

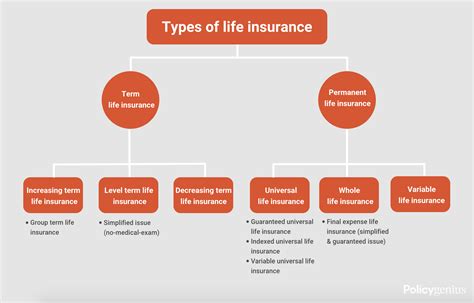

Type Of Life Insurance

In the world of financial planning and security, life insurance stands as a cornerstone, offering peace of mind and a safety net for individuals and their loved ones. With a myriad of options available, choosing the right type of life insurance can be a daunting task. This comprehensive guide aims to demystify the different types of life insurance policies, providing an in-depth analysis to help you make an informed decision tailored to your unique circumstances.

Understanding the Landscape of Life Insurance

Life insurance is a contract between an individual and an insurance company, where the insurer promises to pay a sum of money, known as the death benefit, to the policyholder’s beneficiaries upon the insured’s death. This financial safeguard ensures that the insured’s family or chosen beneficiaries receive a lump-sum payment to cover various expenses, from funeral costs to long-term financial stability.

The world of life insurance is diverse, offering a range of policies designed to cater to different needs and life stages. The key types include term life insurance, whole life insurance, universal life insurance, and variable life insurance, each with its own set of features, benefits, and considerations.

Term Life Insurance: A Temporary Solution with Long-Term Impact

Term life insurance is a popular choice for individuals seeking coverage for a specific period of time, often ranging from 10 to 30 years. It provides a fixed death benefit for a predetermined term, making it an attractive option for those who require coverage during their working years or while their children are dependent.

Key Features and Benefits

- Affordability: Term life insurance is known for its cost-effectiveness, making it an accessible option for many. The premiums are generally lower compared to other types of life insurance, as the coverage is limited to a specific term.

- Flexibility: Policyholders can choose the term length based on their needs. Whether it’s covering mortgage payments, providing for children’s education, or ensuring financial stability during high-earning years, term life insurance can be tailored to individual circumstances.

- Renewability: While the initial term may expire, many term life policies offer the option to renew, allowing individuals to extend their coverage as needed. However, it’s important to note that premiums may increase with age and health status.

Real-World Example

John, a 35-year-old with two young children, opts for a 20-year term life insurance policy with a $500,000 death benefit. With affordable monthly premiums, this policy ensures that his family will be financially secure in the event of his untimely passing, covering mortgage payments and providing for his children’s education.

Technical Specifications

| Term Length | Death Benefit | Premium Structure |

|---|---|---|

| 10-30 years | Fixed amount | Level premiums during the term |

Whole Life Insurance: Permanent Protection with Cash Value

Whole life insurance, also known as permanent life insurance, provides lifelong coverage, ensuring that the death benefit will be paid to the beneficiaries upon the insured’s passing, regardless of when that occurs.

Key Features and Benefits

- Lifetime Coverage: Whole life insurance offers the reassurance of permanent protection, ensuring that your loved ones are financially secure throughout your entire life.

- Cash Value Accumulation: Unlike term life insurance, whole life policies build cash value over time. This cash value can be borrowed against or withdrawn, providing a source of funds for emergencies or financial goals.

- Guaranteed Premiums: The premiums for whole life insurance remain the same throughout the policy’s lifetime, providing stability and predictability in financial planning.

Performance Analysis

While whole life insurance offers long-term security, it’s important to note that the cash value accumulation may be slower compared to other investment options. The trade-off is the guaranteed death benefit and the flexibility of accessing funds during the policyholder’s lifetime.

Real-World Example

Sarah, a 40-year-old business owner, opts for a whole life insurance policy with a $1 million death benefit. With consistent premium payments, she ensures that her business will have the necessary funds to continue operating in the event of her untimely passing, while also building a substantial cash value over time.

Technical Specifications

| Coverage | Death Benefit | Premium Structure |

|---|---|---|

| Lifetime | Fixed amount | Level premiums throughout the policy |

Universal Life Insurance: Flexibility and Customization

Universal life insurance offers a balance between term life and whole life policies, providing permanent coverage with added flexibility in premium payments and death benefit adjustments.

Key Features and Benefits

- Flexibility: Policyholders can adjust their premium payments and death benefit amounts to align with their changing financial circumstances. This flexibility is particularly beneficial for those with fluctuating income or financial goals.

- Cash Value Accumulation: Similar to whole life insurance, universal life policies build cash value over time. This cash value can be used to pay premiums, providing a self-funding mechanism for the policy.

- Variable Premiums: Unlike whole life insurance, universal life policies allow for variable premiums. This means that policyholders can pay more or less, depending on their financial situation, while still maintaining coverage.

Performance Analysis

Universal life insurance provides a middle ground between the affordability of term life and the security of whole life. The flexibility in premium payments and death benefit adjustments makes it an attractive option for those seeking customization and the ability to adapt to life’s changes.

Real-World Example

Michael, a 30-year-old with a growing family, chooses a universal life insurance policy with a $750,000 death benefit. As his financial situation evolves, he can adjust his premium payments and death benefit to ensure that his family’s needs are always covered, whether it’s for educational expenses or long-term financial planning.

Technical Specifications

| Coverage | Death Benefit | Premium Structure |

|---|---|---|

| Lifetime | Adjustable | Variable premiums, based on policyholder’s choices |

Variable Life Insurance: Investing with a Death Benefit

Variable life insurance is a unique type of policy that combines life insurance with investment opportunities. It allows policyholders to allocate a portion of their premiums to various investment options, offering the potential for higher returns but also carrying more risk.

Key Features and Benefits

- Investment Opportunities: Policyholders can choose from a range of investment options, such as stocks, bonds, and mutual funds, to grow their cash value. This provides the potential for higher returns compared to traditional life insurance policies.

- Death Benefit Flexibility: Similar to universal life insurance, variable life policies allow for adjustments in the death benefit amount based on the performance of the chosen investments.

- Premiums and Coverage: The premiums and coverage amount can be tailored to the policyholder’s needs, providing a customizable solution.

Performance Analysis

Variable life insurance offers the potential for significant growth in cash value, but it also comes with the risk of investment losses. Policyholders must carefully consider their risk tolerance and financial goals before opting for this type of policy.

Real-World Example

Emily, a 28-year-old with a strong investment mindset, chooses a variable life insurance policy with a $400,000 death benefit. She allocates a portion of her premiums to a diversified portfolio of stocks and bonds, aiming to grow her cash value while still maintaining a substantial death benefit for her family.

Technical Specifications

| Coverage | Death Benefit | Premium Structure |

|---|---|---|

| Lifetime | Adjustable, based on investment performance | Variable premiums, tailored to investment choices |

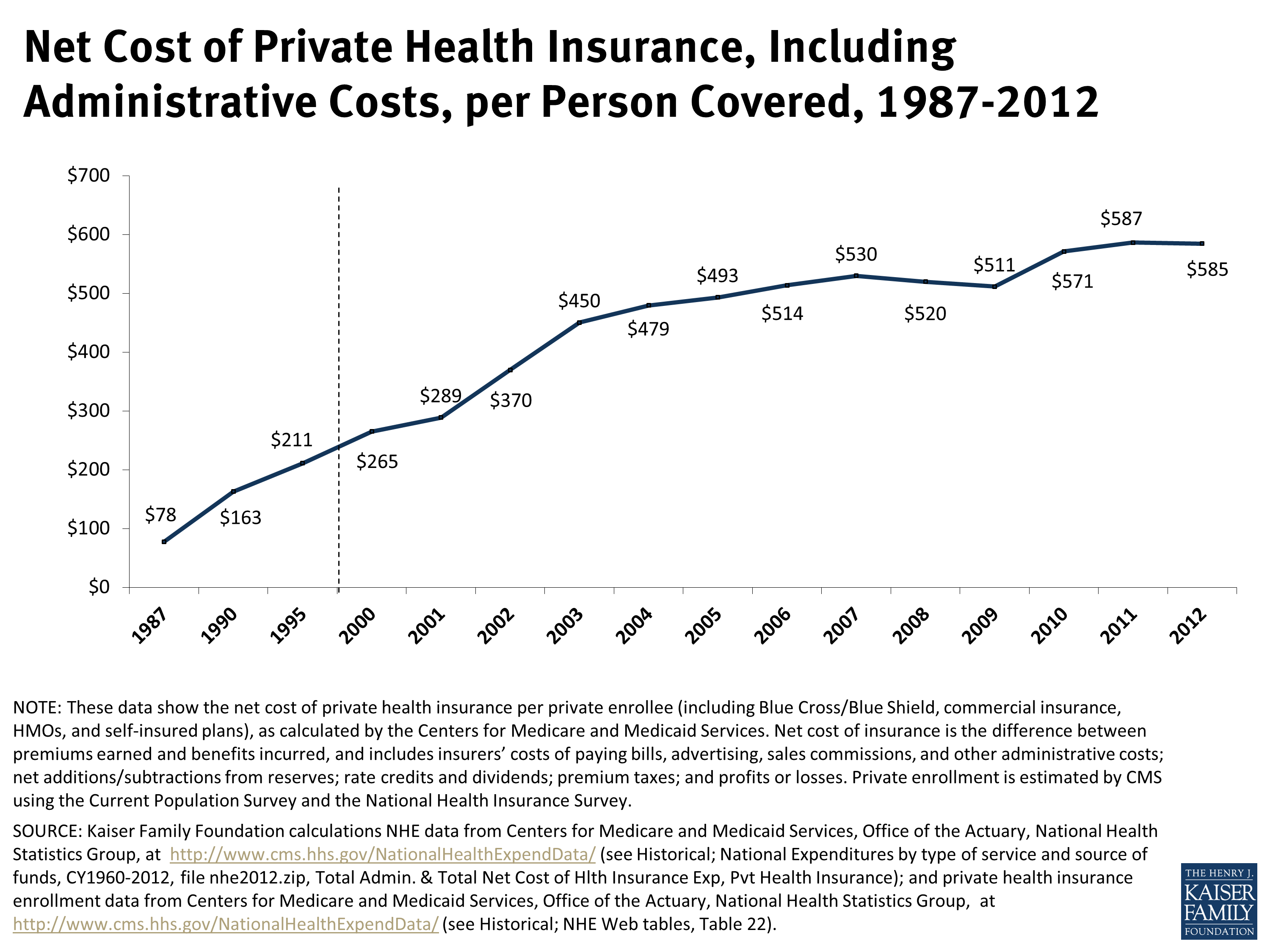

Comparative Analysis: Weighing the Options

When choosing the right type of life insurance, it’s essential to consider your financial goals, risk tolerance, and the stage of life you’re in. Term life insurance offers affordability and flexibility, making it a popular choice for those with temporary coverage needs. Whole life insurance provides long-term security and the added benefit of cash value accumulation. Universal life insurance strikes a balance, offering customization and flexibility, while variable life insurance appeals to those seeking investment opportunities alongside a death benefit.

Key Considerations

- Financial Goals: Assess your financial objectives and the stage of life you’re in. Are you looking for temporary coverage during your working years, or do you need permanent protection for your loved ones?

- Risk Tolerance: Consider your comfort level with risk. Term life insurance is straightforward and carries less risk, while variable life insurance offers potential investment returns but also carries more uncertainty.

- Premium Affordability: Evaluate your budget and choose a policy that aligns with your financial capabilities. Term life insurance is generally more affordable, while whole life and universal life policies may offer premium flexibility.

Future Implications and Expert Insights

The landscape of life insurance is constantly evolving, with new innovations and products entering the market. As technology advances, we can expect to see more personalized and data-driven life insurance solutions. Additionally, the rise of digital platforms and online applications is making it easier for individuals to access and compare different policies, empowering them to make informed choices.

It's important to note that life insurance is not a one-size-fits-all solution. Consulting with a financial advisor or insurance professional can provide valuable insights tailored to your unique circumstances. They can help you navigate the complexities of different policies, ensuring that you make a decision that aligns with your financial goals and provides the necessary protection for your loved ones.

Final Thoughts

Choosing the right type of life insurance is a critical decision that can provide financial security and peace of mind for you and your family. By understanding the different types of policies, their features, and benefits, you can make an informed choice that aligns with your financial goals and life stage. Remember, life insurance is a long-term commitment, and it’s essential to carefully consider your options to ensure a secure future for your loved ones.

What is the difference between term life and whole life insurance?

+Term life insurance provides coverage for a specific term, typically 10-30 years, with affordable premiums. It is ideal for temporary coverage needs. Whole life insurance, on the other hand, offers permanent coverage with the added benefit of cash value accumulation. It provides lifelong protection and stability.

Can I switch from term life to whole life insurance later in life?

+Yes, it is possible to switch from term life to whole life insurance, but it may be subject to additional underwriting and potentially higher premiums due to age and health factors. Consulting with an insurance professional can guide you through the process.

Is variable life insurance suitable for everyone?

+Variable life insurance carries investment risk, making it more suitable for individuals with a higher risk tolerance and a strong understanding of investment strategies. It’s important to carefully consider your financial goals and consult with a professional before opting for this type of policy.