Health Insurance Open Enrollment 2024

The annual Health Insurance Open Enrollment period is a crucial event for individuals and families across the United States. It serves as a reminder to review and update their health insurance coverage, ensuring they have the right plans to meet their healthcare needs for the upcoming year. This period is an opportunity to make informed decisions, explore different options, and secure the most suitable health insurance plans.

As we approach the 2024 Open Enrollment, it's essential to understand the process, timelines, and key considerations to make the most of this annual opportunity. This comprehensive guide aims to provide an in-depth analysis of the 2024 Health Insurance Open Enrollment, covering everything from understanding the basics to advanced strategies for optimizing your healthcare coverage.

Understanding Health Insurance Open Enrollment

The Health Insurance Open Enrollment period is a designated time frame each year when individuals can enroll in, switch, or make changes to their health insurance plans. This annual event is regulated by the Affordable Care Act (ACA) and is a critical opportunity for millions of Americans to access affordable healthcare coverage.

During this period, individuals can:

- Select a new health insurance plan if they are not currently insured.

- Switch to a different plan if their current plan no longer meets their needs.

- Make adjustments to their existing plan, such as adding or removing family members or updating personal information.

- Explore new options, compare costs, and understand the benefits offered by various insurance providers.

The Open Enrollment period typically lasts for a few months, allowing individuals ample time to research and make informed decisions. However, it's crucial to note that missing the enrollment deadline can result in being uninsured for the entire year, unless you qualify for a Special Enrollment Period due to specific life events.

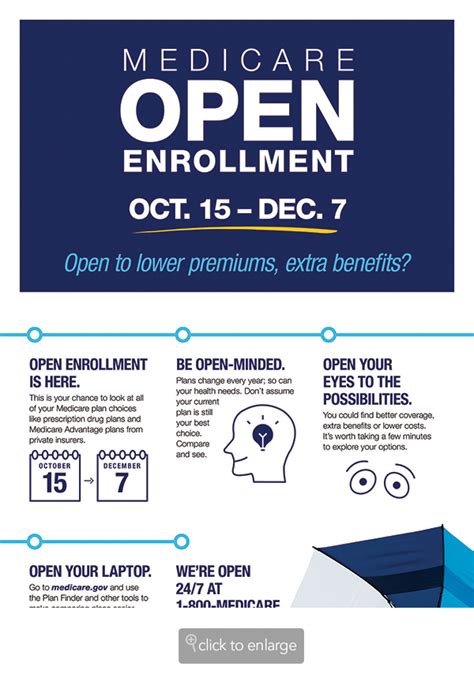

Key Dates for 2024 Open Enrollment

The dates for the 2024 Health Insurance Open Enrollment period are as follows:

| Event | Date |

|---|---|

| Open Enrollment Begins | November 1, 2023 |

| Open Enrollment Ends | January 15, 2024 |

| Coverage Begins | January 1, 2024 |

It's essential to mark these dates on your calendar and start preparing for Open Enrollment well in advance. This gives you ample time to gather the necessary documents, understand your healthcare needs, and compare different insurance plans.

Preparing for Open Enrollment

Effective preparation is key to a successful Open Enrollment experience. Here are some essential steps to take before the enrollment period begins:

Gather Important Documents

Collect all relevant documents, including your:

- Social Security Number

- Date of Birth

- Income and Tax Information (e.g., W-2 forms, 1099s)

- Policy Numbers for any current health insurance plans

- Employer-provided health insurance details (if applicable)

Having these documents readily available will streamline the enrollment process and ensure accuracy in your application.

Assess Your Healthcare Needs

Take the time to evaluate your healthcare requirements. Consider factors such as:

- Your current and potential future health conditions

- The need for prescription medications

- The requirement for specialist care or ongoing treatments

- Dental and vision care needs

- The cost of healthcare services in your area

Understanding your healthcare needs will help you choose a plan that provides adequate coverage without unnecessary expenses.

Explore Insurance Options

Research and compare different health insurance plans available in your area. Consider factors like:

- Monthly premiums

- Deductibles and out-of-pocket maximums

- Co-pays and co-insurance rates

- Network of providers (in-network vs. out-of-network)

- Covered services and benefits

- Customer reviews and insurer reputation

Utilize online tools, broker services, or healthcare navigators to assist you in finding the best plan for your needs.

Making Informed Choices

During Open Enrollment, you’ll have the opportunity to make important decisions regarding your health insurance coverage. Here’s a guide to help you navigate this process effectively:

Understand Plan Types

Health insurance plans come in various types, each with its own set of features and benefits. Common plan types include:

- Health Maintenance Organization (HMO): Typically offers lower premiums but may require you to choose a primary care physician and obtain referrals for specialist visits.

- Preferred Provider Organization (PPO): Provides more flexibility in choosing healthcare providers but often comes with higher premiums.

- Exclusive Provider Organization (EPO): Similar to PPOs but usually does not cover out-of-network care except in emergencies.

- Point-of-Service (POS) Plans: Combine features of HMOs and PPOs, allowing you to choose between in-network and out-of-network care.

- High-Deductible Health Plans (HDHPs): These plans have lower premiums but higher deductibles, and they are often paired with Health Savings Accounts (HSAs) for tax-advantaged savings.

Understanding the differences between these plan types will help you choose the one that aligns best with your healthcare needs and budget.

Compare Costs and Benefits

When comparing health insurance plans, consider the following cost factors:

- Premiums: The amount you pay monthly for your insurance coverage.

- Deductibles: The amount you must pay out of pocket before your insurance coverage kicks in.

- Co-pays: Fixed amounts you pay for specific services, like doctor visits or prescription drugs.

- Co-insurance: The percentage of costs you share with your insurance provider for covered services.

- Out-of-pocket maximum: The maximum amount you'll pay out of pocket in a year for covered services.

Evaluate these costs in relation to the benefits offered by each plan, including covered services, prescription drug coverage, and specialist care options. Consider your expected healthcare needs for the upcoming year to choose a plan that provides the best value for your money.

Assess Your Eligibility for Subsidies

If you meet certain income requirements, you may be eligible for subsidies to help lower your health insurance costs. These subsidies, known as Premium Tax Credits, can significantly reduce your monthly premiums. To determine your eligibility, you’ll need to estimate your household income for the upcoming year. You can use the Health Insurance Marketplace’s income calculator or consult a tax professional for guidance.

Enroll in a Plan

Once you’ve evaluated your options and selected the plan that best suits your needs, it’s time to enroll. You can do this through the Health Insurance Marketplace, your state’s insurance website, or directly through an insurance provider. Ensure that you have all the necessary documents and information ready to complete the enrollment process accurately.

Navigating Special Enrollment Periods

In certain circumstances, you may qualify for a Special Enrollment Period (SEP) outside of the regular Open Enrollment period. An SEP allows you to enroll in or change your health insurance plan due to specific life events, such as:

- Marriage or divorce

- Birth or adoption of a child

- Loss of job-based or other qualifying health coverage

- Moving to a new area

- Changes in income that affect eligibility for subsidies

If you experience any of these life events, you should take action promptly to ensure you don't miss out on the opportunity to enroll in or change your health insurance plan.

How to Apply for an SEP

To apply for a Special Enrollment Period, you’ll need to gather the necessary documentation to support your qualifying life event. This may include marriage certificates, birth or adoption records, termination letters from previous employers, or proof of income changes. Submit your application through the Health Insurance Marketplace or your state’s insurance website, and be prepared to provide additional details if requested.

Conclusion: Your Path to Better Healthcare Coverage

The 2024 Health Insurance Open Enrollment period presents a valuable opportunity to secure the right health insurance coverage for you and your family. By understanding the process, preparing effectively, and making informed choices, you can navigate this annual event with confidence. Remember to mark the key dates on your calendar, gather the required documents, assess your healthcare needs, and compare insurance plans to find the best fit for your situation.

Stay informed, ask questions, and seek guidance when needed. With the right preparation and strategy, you can make the most of Open Enrollment and ensure you have the healthcare coverage you need to protect your well-being and financial security.

What happens if I miss the Open Enrollment deadline?

+If you miss the Open Enrollment deadline, you generally cannot enroll in a new health insurance plan until the next Open Enrollment period, unless you qualify for a Special Enrollment Period due to a qualifying life event. This means you may go uninsured for the entire year, so it’s crucial to stay aware of the enrollment dates and plan accordingly.

Can I enroll outside of the Open Enrollment period if I lose my job-based coverage?

+Yes, if you lose your job-based health insurance coverage, you may qualify for a Special Enrollment Period to enroll in a new plan. This is considered a qualifying life event, and you have a limited time window to enroll in a new plan. It’s important to act promptly to ensure you don’t go without coverage.

How can I determine if I’m eligible for Premium Tax Credits (subsidies)?

+To determine your eligibility for Premium Tax Credits, you’ll need to estimate your household income for the upcoming year. You can use the Health Insurance Marketplace’s income calculator or consult a tax professional for guidance. If your estimated income falls within the specified range, you may qualify for subsidies to lower your insurance costs.