Term Life Insurance Terms

Understanding the intricacies of term life insurance is crucial for anyone seeking financial protection for their loved ones. This comprehensive guide aims to shed light on the essential terms and concepts associated with term life insurance, empowering you to make informed decisions about your coverage.

Unraveling the Basics: Term Life Insurance Fundamentals

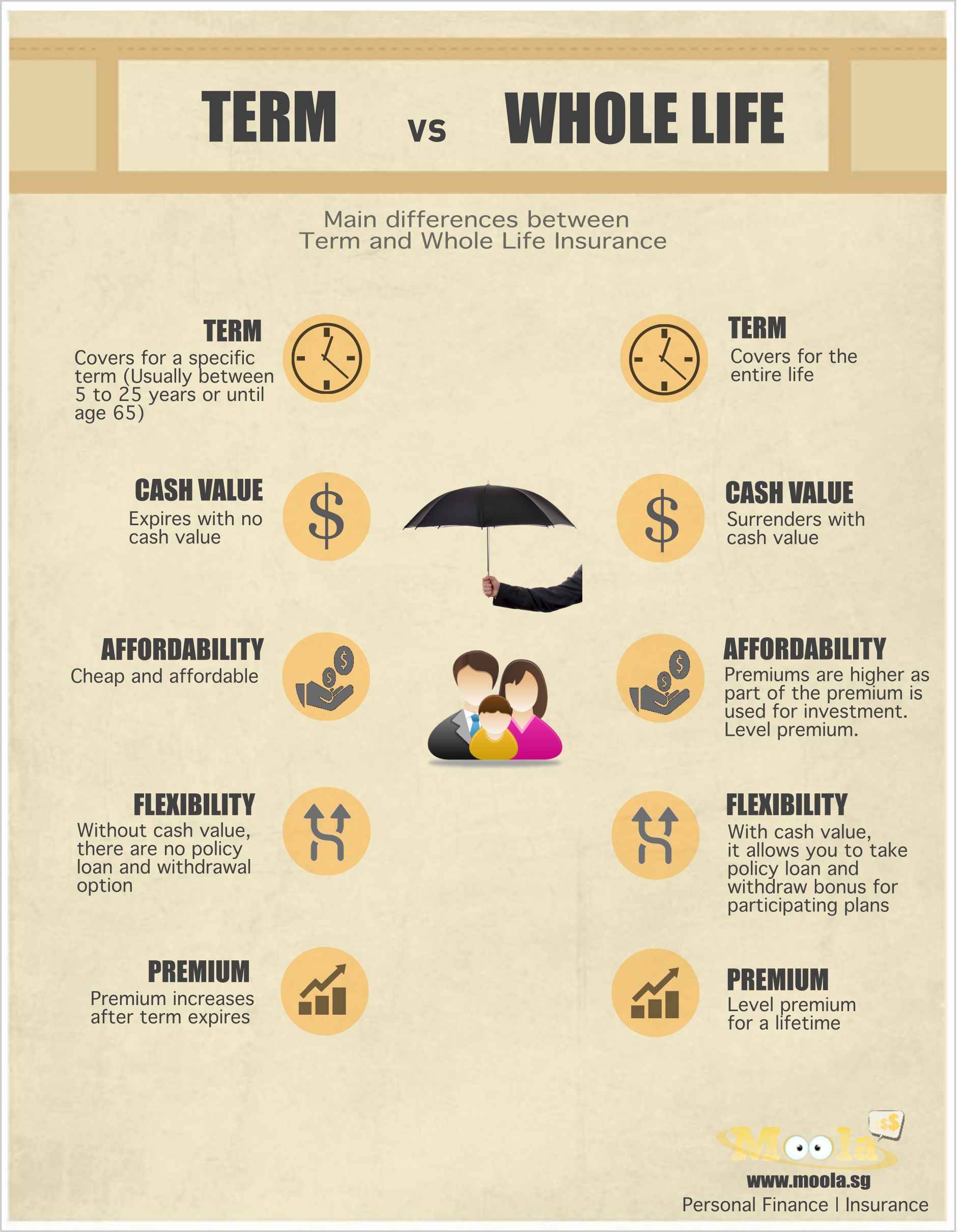

Term life insurance is a type of policy that provides coverage for a specified period, known as the term. Unlike permanent life insurance, which offers lifelong coverage, term life insurance is designed to meet short-term financial needs. It’s an affordable and flexible option, making it an attractive choice for many individuals and families.

The key characteristic of term life insurance is its temporal nature. The term can range from 10 to 30 years, during which the insured pays a fixed premium for a specified death benefit. If the insured passes away during the term, the beneficiaries receive the full death benefit. However, if the term expires without a claim, the policy ends, and no benefits are paid out.

Key Considerations for Term Life Insurance

- Death Benefit: This is the amount of money paid to the beneficiaries upon the insured’s death. It can be used to cover a range of expenses, including funeral costs, outstanding debts, and everyday living expenses for dependents.

- Premium: The premium is the cost of the insurance policy, paid by the insured. It remains constant throughout the term and is determined by various factors, including age, health, and the amount of coverage chosen.

- Term Length: The duration of the policy is a critical consideration. It should align with the insured’s financial goals and the period for which coverage is needed. For instance, a 30-year term might be suitable for covering young children until they become financially independent.

- Renewability: Many term life insurance policies offer the option to renew at the end of the term. However, the premium may increase with age, and the insured may need to undergo a new medical examination to assess their health status.

One of the advantages of term life insurance is its flexibility. It allows individuals to tailor their coverage to their specific needs and budget. For instance, if financial circumstances change, the insured can opt for a convertible term policy, which allows them to convert their term policy into a permanent life insurance policy without a medical exam.

| Term Length | Benefits |

|---|---|

| 10-Year Term | Ideal for covering short-term needs like paying off a mortgage or supporting children through college. |

| 20-Year Term | Suitable for providing long-term financial security, ensuring dependents are cared for until they reach adulthood. |

| 30-Year Term | Offers the most extended coverage, ideal for those with long-term financial obligations or specific goals. |

Exploring the Features: Understanding Term Life Insurance Options

Term life insurance policies come with various features and options that can be tailored to individual needs. Understanding these features is crucial for making an informed decision.

Guaranteed Renewable Term

A guaranteed renewable term policy ensures that the policy can be renewed at the end of the term, regardless of any changes in health status. This feature provides peace of mind, knowing that coverage can continue even if health issues arise.

Convertible Term

As mentioned earlier, a convertible term policy allows the insured to convert their term life insurance into a permanent life insurance policy without undergoing a new medical exam. This option is beneficial for those who anticipate their financial needs changing over time.

Accelerated Death Benefit

Some term life insurance policies offer an accelerated death benefit, also known as a living benefit. This feature allows the insured to access a portion of the death benefit while they are still alive if they are diagnosed with a terminal illness. It provides financial support during a challenging time.

Rider Options

Riders are add-ons to the base policy that can enhance coverage. Common rider options for term life insurance include:

- Waiver of Premium: This rider waives the premium payments if the insured becomes disabled and unable to work.

- Term Conversion: As mentioned, this rider allows for the conversion of a term policy to a permanent one.

- Accidental Death Benefit: This rider provides an additional death benefit if the insured’s death is due to an accident.

When selecting a term life insurance policy, it's crucial to consider these features and tailor them to your specific needs. Consulting with a financial advisor or insurance agent can help you navigate these options and choose the best policy for your circumstances.

Performance Analysis: Term Life Insurance in Action

To illustrate the effectiveness of term life insurance, let’s examine a hypothetical case study. Imagine a couple, John and Sarah, who recently welcomed their first child. They want to ensure their child’s financial security in the event of an unforeseen tragedy.

John, aged 35, opts for a 20-year term life insurance policy with a $500,000 death benefit. The premium for this policy is $50 per month, which is affordable for their budget. The policy includes a waiver of premium rider, ensuring that if John becomes disabled, the policy will continue without additional costs.

During the term, John's health remains stable, and the policy performs as expected. However, sadly, an accident occurs when John is 45, and he passes away. The death benefit of $500,000 is paid out to Sarah, providing her with the financial stability needed to care for their child and maintain their lifestyle.

This case study demonstrates how term life insurance can offer peace of mind and financial protection during a challenging time. It ensures that loved ones are taken care of, even in the face of tragedy.

Future Implications: Navigating the Evolving Landscape of Term Life Insurance

The world of insurance is constantly evolving, and term life insurance is no exception. As technology advances and demographics shift, the industry adapts to meet new demands and challenges.

One notable trend is the increasing availability of digital term life insurance policies. These policies can be purchased entirely online, often without the need for a medical exam. This convenience and accessibility make term life insurance more appealing to a broader range of individuals.

Additionally, the rise of parametric insurance is changing the game. Parametric insurance uses parameters like weather data or satellite imagery to trigger payouts, bypassing the need for traditional claim assessments. This innovative approach could revolutionize the term life insurance industry, offering faster payouts and enhanced protection.

As we look to the future, it's clear that term life insurance will continue to evolve to meet the changing needs of individuals and families. Staying informed about these developments can help you make the most advantageous decisions for your financial security.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specified period, while permanent life insurance offers lifelong coverage. Term life insurance is more affordable and flexible, making it ideal for short-term financial needs, whereas permanent life insurance builds cash value over time and provides long-term financial protection.

How do I determine the right term length for my policy?

+The term length should align with your financial goals and the period for which you need coverage. Consider factors like the age of your dependents, outstanding debts, and any specific financial milestones you want to reach. Consult with a financial advisor to determine the optimal term length for your situation.

Can I renew my term life insurance policy if I develop a health condition?

+Renewability depends on the specific policy and the insurer’s guidelines. Some policies offer guaranteed renewable terms, ensuring coverage regardless of health status. Others may require a new medical examination and potentially higher premiums. It’s essential to review your policy’s terms and conditions regarding renewability.