Private Medical Insurance Cost

Private medical insurance (PMI) is a popular healthcare option that provides individuals and families with access to specialized medical care and services outside of the public healthcare system. While public healthcare is widely available, many people opt for private insurance to gain faster access to treatments, choose their preferred healthcare providers, and receive more personalized care. However, the cost of private medical insurance is a significant consideration for those exploring this option.

Understanding Private Medical Insurance Costs

The cost of private medical insurance varies greatly depending on several factors, including the individual’s age, health status, location, and the level of coverage desired. It’s essential to understand these factors to make an informed decision about PMI and to find the most suitable and cost-effective plan.

Factors Influencing PMI Costs

Age and Health: One of the primary determinants of PMI costs is the age and health of the policyholder. Younger individuals generally pay lower premiums, as they are less likely to require extensive medical treatment. Conversely, older individuals and those with pre-existing medical conditions may face higher premiums due to the increased risk of requiring medical care.

Location: The cost of PMI can also vary significantly based on geographical location. Healthcare costs can differ across regions, with urban areas often associated with higher medical expenses. Therefore, the location where the policyholder resides can impact the overall cost of their insurance.

Coverage Level: The level of coverage chosen is another critical factor in determining PMI costs. Basic plans typically offer a narrower range of services and may have higher out-of-pocket expenses, while comprehensive plans provide broader coverage but may come with higher premiums. The policyholder's specific needs and preferences will dictate the appropriate level of coverage.

| Coverage Level | Description | Average Monthly Premium |

|---|---|---|

| Basic | Limited coverage, often excluding certain specialties | $300 - $500 |

| Standard | Moderate coverage, includes most common medical needs | $500 - $800 |

| Comprehensive | Extensive coverage, including specialty care and additional benefits | $800 - $1,200 |

Average Costs and Trends

According to recent industry reports, the average cost of private medical insurance in 2023 varies between 300 and 1,200 per month, depending on the factors mentioned above. This range reflects the diverse needs and preferences of policyholders and the wide range of coverage options available.

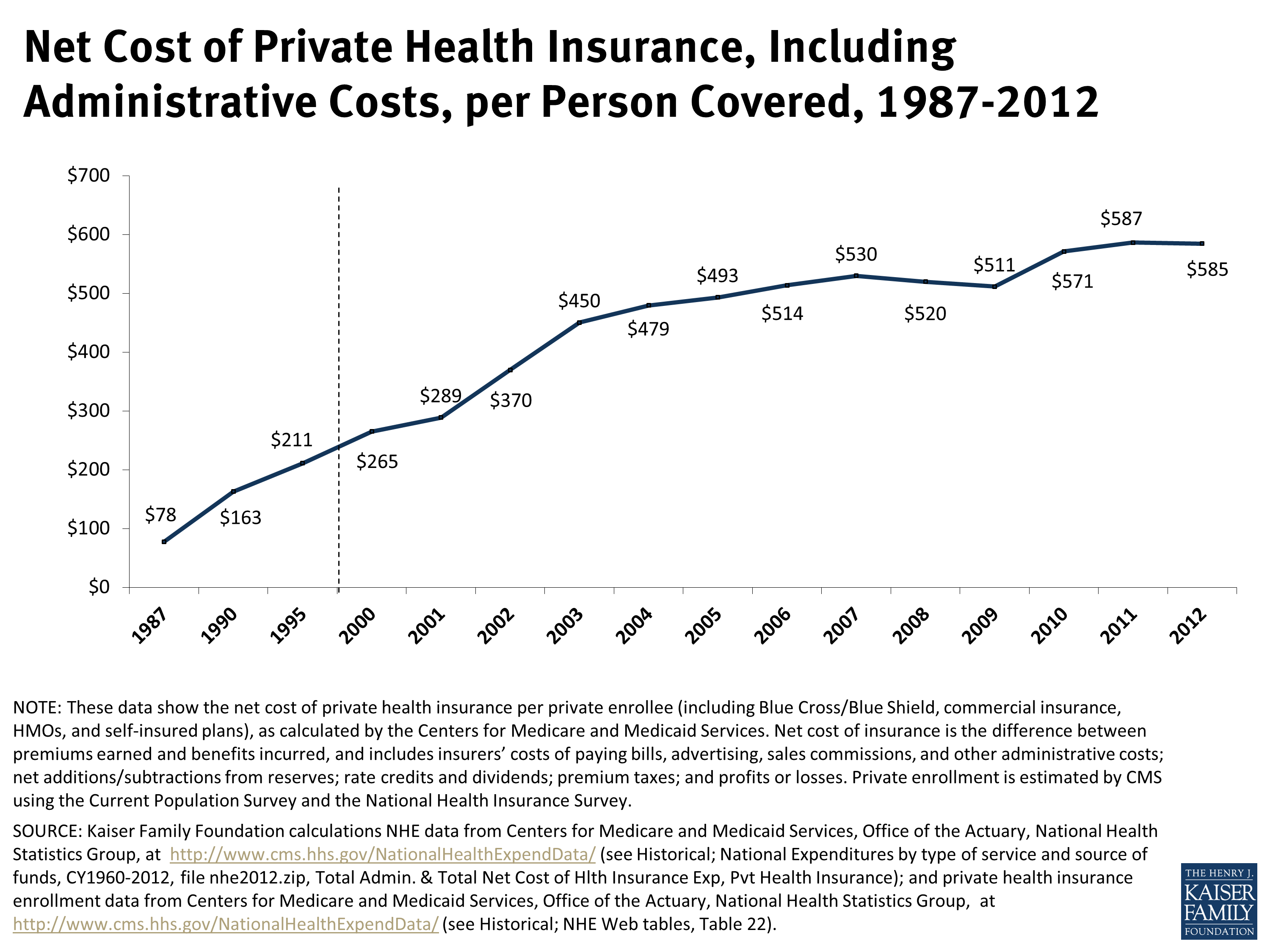

It's important to note that PMI costs have been steadily increasing over the past decade, primarily due to rising healthcare expenses and the growing demand for specialized medical treatments. As a result, individuals and families considering PMI should be prepared for potential premium increases over time.

Strategies to Reduce PMI Costs

While the cost of private medical insurance can be substantial, there are strategies that individuals can employ to reduce their premiums and make PMI more affordable. Here are some effective approaches to consider:

Choose the Right Coverage Level

Assessing one’s specific healthcare needs is crucial when selecting a PMI plan. Opting for a basic or standard coverage level, rather than a comprehensive plan, can lead to significant cost savings. This approach is particularly suitable for healthy individuals who primarily require coverage for routine medical check-ups and occasional illnesses.

Consider Group Plans

Many employers offer group private medical insurance plans as an employee benefit. These group plans often come with discounted premiums, as the risk is spread across a larger pool of individuals. By joining a group plan, employees can access more affordable PMI options while enjoying the convenience of payroll deductions.

Review and Shop Around

Regularly reviewing and comparing PMI plans is essential to ensure one is getting the best value for their money. Insurance providers may offer different rates and benefits, so it’s worth exploring multiple options. Online comparison tools and insurance brokers can be valuable resources for finding the most cost-effective plan that aligns with individual needs.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle can have a positive impact on PMI costs. Insurance providers often offer discounts or reduced premiums to individuals who demonstrate a commitment to healthy habits. This may include regular exercise, a balanced diet, and the absence of risky behaviors such as smoking. By adopting a healthier lifestyle, individuals can not only improve their overall well-being but also potentially reduce their PMI costs.

The Future of Private Medical Insurance Costs

Looking ahead, the future of PMI costs is influenced by several key factors. The continued rise in healthcare expenses, advancements in medical technology, and changes in demographic trends are likely to shape the cost landscape for private medical insurance.

Technological Advancements

The integration of technology in healthcare, such as telemedicine and digital health platforms, has the potential to reduce the cost of medical services. By facilitating remote consultations and streamlining administrative processes, these innovations could lead to more efficient healthcare delivery, ultimately lowering the overall cost of PMI.

Demographic Shifts

The aging population and changing demographics present both challenges and opportunities for the PMI industry. As the population ages, the demand for specialized medical care is expected to rise, potentially driving up costs. However, an increased focus on preventative care and wellness initiatives among older adults could also lead to more cost-effective healthcare solutions, benefiting both individuals and insurance providers.

Policy and Regulatory Changes

Government policies and regulatory frameworks play a significant role in shaping the PMI market. Changes in healthcare legislation, tax incentives for PMI, and the implementation of healthcare reforms can all impact the cost and accessibility of private medical insurance. Staying informed about these policy shifts is essential for individuals and families to navigate the evolving PMI landscape.

Conclusion: Navigating the PMI Cost Landscape

Private medical insurance offers individuals and families a valuable option for accessing specialized healthcare services. While the cost of PMI can be a significant consideration, understanding the factors that influence premiums and implementing cost-saving strategies can make this healthcare option more accessible and affordable.

By carefully assessing individual needs, shopping around for the best plan, and maintaining a healthy lifestyle, individuals can make informed decisions about PMI and take control of their healthcare expenses. As the PMI market continues to evolve, staying informed about industry trends and policy changes will be crucial for navigating the cost landscape and making the most suitable healthcare choices.

Can I negotiate PMI premiums with insurance providers?

+While insurance providers typically set their premium rates based on standardized risk assessments, it’s worth inquiring about potential discounts or promotions. Some providers may offer discounts for long-term customers or those who meet certain health criteria. Negotiating directly with providers may not always be successful, but it’s worth exploring all available options to find the most cost-effective plan.

Are there any tax benefits associated with PMI?

+In many countries, private medical insurance premiums are eligible for tax relief or deductions. These tax benefits can help offset the cost of PMI, making it more affordable for individuals and families. It’s important to consult with a tax professional or refer to local tax regulations to understand the specific tax advantages available in your region.

How do I choose the right PMI plan for my family’s needs?

+Selecting the right PMI plan involves a careful assessment of your family’s specific healthcare needs. Consider factors such as the age and health status of each family member, the types of medical services they frequently require, and any pre-existing conditions. Consulting with an insurance broker or financial advisor can provide valuable guidance in choosing a plan that offers adequate coverage at a reasonable cost.