Trip Insurance Comparison

Traveling is an exciting adventure, but unforeseen circumstances can quickly turn a dream vacation into a stressful ordeal. This is where trip insurance steps in, offering a safety net for travelers to protect their investments and provide peace of mind. With a vast array of options available, choosing the right trip insurance can be a daunting task. In this comprehensive guide, we will delve into the world of trip insurance, comparing key aspects, benefits, and features to help you make an informed decision.

Understanding Trip Insurance

Trip insurance, also known as travel insurance, is a form of coverage designed to protect travelers against various risks and unforeseen events that may occur before or during their journey. These policies offer financial protection and assistance for expenses such as trip cancellations, medical emergencies, lost luggage, and more. By purchasing trip insurance, travelers can mitigate the financial losses associated with unexpected disruptions, ensuring a more secure and stress-free travel experience.

Key Considerations for Trip Insurance

When comparing trip insurance options, several crucial factors come into play. Understanding these considerations will help you tailor your search and find the most suitable policy for your needs.

Coverage Types

Trip insurance policies offer a range of coverage types, each addressing different aspects of travel. Common coverage options include:

- Trip Cancellation/Interruption: This coverage reimburses you for non-refundable expenses if your trip is canceled or interrupted due to covered reasons such as illness, injury, natural disasters, or travel advisories.

- Medical and Dental Coverage: Essential for international travelers, this coverage provides assistance and reimbursement for medical emergencies, including doctor visits, hospital stays, and even dental procedures.

- Emergency Evacuation and Repatriation: In case of severe illness or injury, this coverage ensures your safe transportation to a medical facility and, if necessary, your return home.

- Baggage and Personal Effects: Protects against lost, stolen, or damaged luggage and personal items during your trip.

- Travel Delay: Offers reimbursement for additional expenses incurred due to delayed travel, such as hotel stays and meals.

- Adventure Sports and Activities: If you plan to engage in high-risk activities like skiing, bungee jumping, or scuba diving, this coverage ensures you’re protected.

Policy Limits and Deductibles

Policy limits refer to the maximum amount an insurance company will pay for a specific coverage type. It’s crucial to ensure these limits align with your potential needs. For instance, medical coverage limits should be sufficient to cover the cost of medical treatment in your destination country. Deductibles, on the other hand, are the amount you must pay out of pocket before the insurance coverage kicks in. Opt for a policy with a deductible that suits your budget and risk tolerance.

Pre-Existing Conditions

If you have any pre-existing medical conditions, it’s vital to choose a policy that explicitly covers them. Some policies may exclude certain conditions or require additional premiums for coverage. Review the fine print to ensure your specific health concerns are addressed.

Travel Destinations

Consider your travel destinations and the associated risks. Some countries may have higher medical costs or be prone to natural disasters, influencing your insurance needs. Additionally, certain destinations may require specialized coverage, such as war risk or terrorism coverage.

Travel Companions and Family

If you’re traveling with family or friends, ensure the policy covers all individuals adequately. Some policies may offer discounts for group travel or family plans, making it more cost-effective.

Trip Duration and Frequency

The length of your trip and how often you travel will impact your insurance needs. Single-trip policies are suitable for one-off vacations, while annual plans can be more cost-effective for frequent travelers.

Provider Reputation and Financial Strength

Choose a reputable insurance provider with a strong financial background. This ensures they can fulfill their obligations and provide reliable assistance when needed. Check customer reviews and financial ratings to make an informed decision.

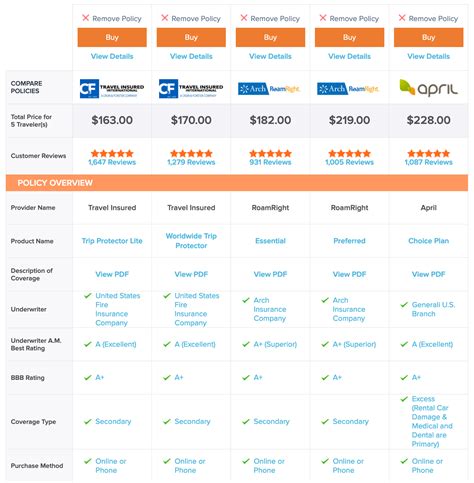

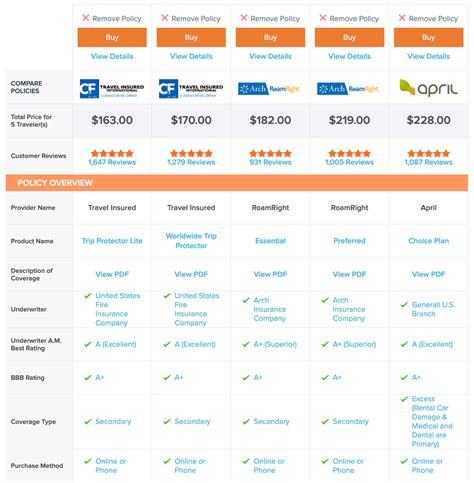

Comparing Trip Insurance Providers

Now that we’ve covered the key considerations, let’s explore some of the top trip insurance providers and compare their offerings.

Provider A: [Provider Name]

Provider A offers a comprehensive range of trip insurance plans, catering to various traveler needs. Their policies include:

- Standard Plan: A basic coverage option suitable for domestic and international travel, offering trip cancellation, medical, and baggage coverage.

- Deluxe Plan: An enhanced version of the Standard Plan, providing higher policy limits and additional coverage for adventure sports and travel delays.

- Comprehensive Plan: Their flagship plan, offering the highest limits and most extensive coverage, including emergency evacuation and specialized coverage for high-risk activities.

Provider A is known for its excellent customer service, with a 24⁄7 assistance hotline and a dedicated team of travel experts. They also offer flexible payment options and allow policy changes up to 24 hours before your trip.

Provider B: [Provider Name]

Provider B specializes in customizable trip insurance plans, allowing travelers to build their own coverage. Their key features include:

- Build-Your-Own Plan: Travelers can select the coverage types and limits they need, creating a personalized plan. This flexibility is ideal for those with specific travel requirements.

- Medical-Only Plan: A cost-effective option for travelers primarily concerned about medical emergencies, offering comprehensive medical coverage without the need for other benefits.

- Group Discounts: Provider B offers significant discounts for group travel, making it an attractive option for families or friends traveling together.

Provider B is renowned for its user-friendly online platform, allowing customers to compare plans and receive instant quotes. Their policies also include access to a global network of medical providers, ensuring quick and efficient assistance.

Provider C: [Provider Name]

Provider C focuses on providing extensive coverage for international travelers, especially those visiting high-risk destinations. Their plans include:

- International Traveler Plan: Tailored for international travel, this plan offers high policy limits and specialized coverage for medical emergencies, evacuation, and political risks.

- Student Travel Plan: Designed for students studying abroad, this plan provides extended medical coverage, trip interruption benefits, and coverage for personal effects.

- Business Traveler Plan: Aimed at frequent business travelers, it offers coverage for trip cancellations, medical emergencies, and lost business equipment.

Provider C stands out for its global assistance network, with a team of multilingual experts available 24⁄7. They also offer trip cancellation coverage for any reason, providing added peace of mind.

Real-World Examples and Case Studies

To illustrate the importance of trip insurance, let’s explore some real-life scenarios and how having the right coverage can make a significant difference.

Case Study 1: Medical Emergency

Imagine you’re on a hiking trip in the Swiss Alps when you slip and sustain a severe ankle injury. Without trip insurance, you’d be responsible for the entire cost of emergency medical treatment, which can easily exceed $10,000. However, with a comprehensive trip insurance policy covering medical emergencies, you can rest assured that your expenses will be covered, allowing you to focus on your recovery.

Case Study 2: Trip Cancellation

You’ve planned a dream vacation to New Zealand, but a week before your departure, a family emergency arises, forcing you to cancel your trip. Without trip cancellation insurance, you’d likely lose all the money you’ve invested in non-refundable flights and accommodations. With the right policy, however, you can file a claim and receive reimbursement for these expenses, minimizing your financial loss.

Case Study 3: Lost Luggage

As you arrive at your destination, you discover that your luggage has been lost or delayed. Without baggage coverage, you’d be left scrambling to purchase essential items like clothing and toiletries, potentially incurring significant costs. With trip insurance, you can file a claim and receive reimbursement for these expenses, making the situation less stressful.

Tips for Choosing the Right Trip Insurance

To ensure you select the most suitable trip insurance policy, consider these additional tips:

- Compare multiple providers and plans to find the best fit for your needs and budget.

- Read the policy documents carefully, paying attention to exclusions and limitations.

- Choose a provider with a solid reputation and a track record of prompt claim processing.

- Consider purchasing insurance early to ensure coverage for pre-existing conditions.

- Opt for a policy with 24⁄7 emergency assistance and multilingual support.

Conclusion

Trip insurance is an essential tool for any traveler, providing protection and peace of mind during your journeys. By understanding your specific needs and comparing various providers and plans, you can make an informed decision and enjoy your travels with confidence. Remember, the right trip insurance policy can make all the difference when unforeseen circumstances arise.

How much does trip insurance typically cost?

+The cost of trip insurance can vary significantly depending on several factors, including the duration of your trip, your destination, the age of travelers, and the level of coverage you choose. On average, you can expect to pay between 4% and 10% of your total trip cost for a comprehensive policy. However, it’s essential to shop around and compare prices to find the best value for your needs.

Can I purchase trip insurance after I’ve already booked my trip?

+Yes, you can purchase trip insurance even after booking your trip, but it’s generally recommended to buy it as soon as possible to ensure coverage for pre-existing conditions. Some policies may have a time limit for purchasing coverage, so it’s best to check the provider’s guidelines.

What happens if I need to make a claim on my trip insurance policy?

+If you need to make a claim, you’ll typically need to provide documentation supporting your claim, such as medical reports, receipts for expenses incurred, and proof of trip cancellation or delay. It’s important to follow the provider’s claim process and submit all required documentation to ensure a smooth and timely reimbursement.

Are there any activities or situations not covered by trip insurance?

+Yes, trip insurance policies typically have exclusions and limitations. Common exclusions include war or civil unrest, participating in extreme sports without proper supervision, and engaging in illegal activities. It’s crucial to review the policy document thoroughly to understand what is and isn’t covered.

Can I cancel my trip insurance policy if I change my mind?

+Most trip insurance policies allow for cancellations within a certain time frame, usually within 10 to 15 days of purchase. However, there may be cancellation fees involved, and you may not receive a full refund. It’s important to review the policy’s cancellation terms and conditions before purchasing.