Landlord Tenant Insurance

In the complex world of property management, understanding the intricacies of insurance is crucial. One often-overlooked aspect is the role of landlord tenant insurance, a vital safeguard for both property owners and tenants. This comprehensive guide will delve into the depths of this insurance type, exploring its benefits, coverage, and implications.

Understanding Landlord Tenant Insurance

Landlord tenant insurance, also known as rental property insurance, is a specialized form of coverage designed to protect property owners who rent out their properties. It provides financial protection in the event of various risks associated with tenancy, offering a safety net for both the landlord and the tenant.

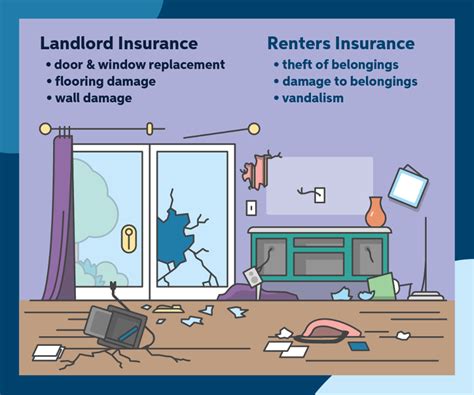

This insurance type differs from traditional homeowner's insurance or renter's insurance, as it specifically addresses the unique challenges and liabilities that come with being a landlord. It covers a range of scenarios, from property damage to liability claims, ensuring a secure and stable rental environment.

Key Benefits of Landlord Tenant Insurance

- Property Protection: Landlord tenant insurance safeguards the rental property against damage caused by tenants, natural disasters, or other unforeseen events. This coverage ensures the landlord can repair or rebuild the property without incurring significant financial strain.

- Liability Coverage: It provides liability protection for the landlord, covering legal fees and potential compensation in the event of tenant injuries or property damage claims. This is particularly crucial in high-risk rental situations.

- Loss of Rental Income: In the event the property becomes uninhabitable due to covered perils, this insurance often includes a provision for loss of rental income, ensuring the landlord can continue to receive income while repairs are made.

- Legal Expenses: Landlord tenant insurance can cover legal costs associated with tenant disputes, eviction processes, or other legal matters related to the rental property.

- Additional Living Expenses: If a tenant’s residence becomes unlivable due to a covered event, this insurance may cover the tenant’s temporary living expenses, such as hotel stays or rental of alternative accommodation.

Coverage and Policy Details

Landlord tenant insurance policies can vary widely, offering different levels of coverage and exclusions. It’s essential for landlords to carefully review and understand the specific terms of their policy to ensure adequate protection.

Typical Coverage Components

- Dwelling Coverage: This is the primary coverage, protecting the rental property’s structure and attached fixtures against damage or destruction due to covered perils.

- Personal Property Coverage: While this typically refers to the tenant’s personal belongings, some policies may also cover the landlord’s personal property kept on the premises.

- Liability Protection: Landlord tenant insurance provides coverage for bodily injury or property damage claims made against the landlord by tenants, guests, or third parties.

- Loss of Use: As mentioned earlier, this coverage reimburses the landlord for lost rental income when the property is uninhabitable due to a covered loss.

- Additional Coverages: Depending on the policy, additional coverages may include ordinance or law coverage, which pays for upgrades to meet current building codes, or coverage for service line breaks.

It's important to note that standard landlord tenant insurance policies often exclude certain types of risks, such as:

- Flood damage

- Earthquake damage

- Intentional acts of the landlord or tenant

- War or nuclear incidents

- Normal wear and tear

Policy Exclusions and Limitations

Landlord tenant insurance policies typically exclude coverage for:

- Intentional Acts: Damage or injuries caused intentionally by the landlord or tenant are not covered.

- Natural Disasters: Certain natural disasters like floods, earthquakes, or hurricanes may require additional coverage.

- War and Nuclear Incidents: These policies generally do not cover damage or losses resulting from war, including nuclear incidents.

- Ordinary Wear and Tear: Normal deterioration of the property over time is not covered.

- Tenant's Personal Property: While some policies may provide limited coverage, tenants should consider purchasing their own renter's insurance for comprehensive protection.

Real-World Scenarios and Claims

To illustrate the importance and benefits of landlord tenant insurance, let's explore a few hypothetical scenarios and how this insurance type could provide protection:

Scenario 1: Natural Disaster

Imagine a rental property located in an area prone to hurricanes. A severe storm hits, causing extensive damage to the property. With a comprehensive landlord tenant insurance policy, the landlord can claim for repairs, ensuring the property is restored and tenants can return to their homes safely.

Scenario 2: Liability Claim

A tenant slips and falls on a poorly maintained walkway outside the rental property, resulting in serious injuries. The tenant files a liability claim against the landlord. Landlord tenant insurance would cover the legal fees and potential compensation, providing financial relief to the landlord.

Scenario 3: Loss of Rental Income

Due to a fire caused by faulty electrical wiring, a rental property becomes uninhabitable. The landlord’s insurance policy includes loss of rental income coverage, compensating the landlord for the period the property is under repair, ensuring a steady income stream.

Choosing the Right Policy

Selecting the appropriate landlord tenant insurance policy is crucial. Here are some key considerations:

Assessing Risks

Evaluate the specific risks associated with your rental property, including location-specific hazards, tenant demographics, and the overall condition of the property. This assessment will help you determine the level of coverage required.

Policy Limits and Deductibles

Understand the policy limits and deductibles. Ensure the limits are sufficient to cover potential losses, and consider the impact of higher deductibles on your premium costs.

Reviewing Policy Exclusions

Carefully review the policy exclusions to ensure you’re aware of any gaps in coverage. Consider adding additional coverage for high-risk areas, such as flood or earthquake insurance.

Comparing Providers

Shop around and compare policies from different insurance providers. Look for reputable companies with a track record of prompt claims processing and fair settlement practices.

Future Implications and Industry Trends

The role of landlord tenant insurance is evolving, driven by changing market dynamics and an increasing focus on risk management. Here are some key trends and implications:

Growing Importance of Rental Properties

With the rising demand for rental properties, especially in urban areas, landlord tenant insurance is becoming increasingly crucial. It ensures property owners can manage their rental assets effectively and protect their investments.

Advancements in Technology

The insurance industry is embracing technology, with online platforms and digital tools making it easier for landlords to compare policies, obtain quotes, and manage their insurance needs efficiently.

Risk Assessment and Data Analytics

Insurance providers are leveraging data analytics to assess risks more accurately. This allows for more tailored insurance solutions, considering factors like tenant demographics, property condition, and location-specific hazards.

FAQs

Does landlord tenant insurance cover tenant’s personal belongings?

+While some policies may provide limited coverage, it’s recommended that tenants obtain their own renter’s insurance for comprehensive protection of their personal property.

Can I get landlord tenant insurance for short-term rentals like Airbnb or VRBO?

+Yes, specialized insurance policies are available for short-term rentals, providing coverage for a range of risks specific to this type of rental arrangement.

What happens if my rental property is damaged and I don’t have landlord tenant insurance?

+Without insurance, you would be financially responsible for all repairs and potential liability claims. This could result in significant out-of-pocket expenses and legal liabilities.