I Need Cheap Car Insurance

Finding affordable car insurance is a common goal for many vehicle owners. The cost of car insurance can vary significantly depending on various factors, and it's essential to explore options that provide adequate coverage without breaking the bank. This comprehensive guide aims to help you navigate the process of obtaining cheap car insurance while ensuring you get the protection you need.

Understanding the Factors That Impact Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, and understanding these elements can help you make informed decisions when seeking cheaper coverage. Here’s a breakdown of the key factors that insurance providers consider when determining your premium:

1. Driver Profile

Your driving record plays a significant role in insurance pricing. Insurers evaluate your history to assess your risk level. If you have a clean driving record with no accidents or traffic violations, you’re likely to qualify for lower rates. On the other hand, a history of accidents, speeding tickets, or DUI convictions can result in higher premiums.

2. Vehicle Type and Usage

The type of vehicle you drive and how you use it also impact your insurance costs. Sports cars and luxury vehicles generally have higher insurance rates due to their higher repair costs and increased risk of theft. Additionally, the primary purpose of your vehicle usage matters. If you use your car for personal pleasure or commuting, your rates might be lower compared to those who use their vehicles for business purposes or long-distance travel.

3. Location and Address

Where you live and work can significantly influence your insurance rates. Insurance providers consider the crime rate, traffic density, and accident statistics of your area. If you reside in a high-crime or high-traffic area, your insurance costs are likely to be higher. Additionally, your address determines which insurance company is best suited to provide coverage for your needs.

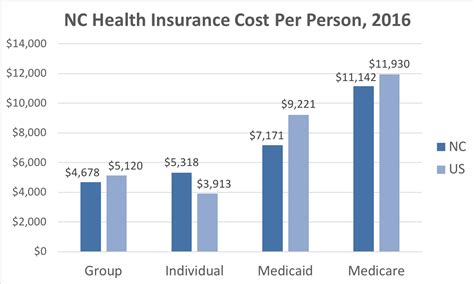

4. Age and Gender

Insurance rates often vary based on age and gender. Young drivers, especially males under 25, are typically considered high-risk due to their lack of driving experience and higher propensity for accidents. As a result, they often pay higher premiums. However, as drivers gain experience and reach their mid-20s, insurance rates generally decrease. Similarly, gender can impact rates, with some insurers charging higher premiums for male drivers due to historical data showing higher accident rates among this demographic.

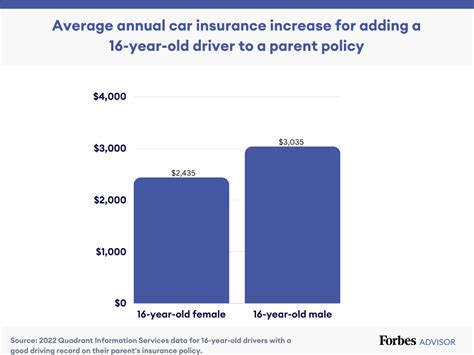

5. Coverage Options and Deductibles

The type of coverage you choose and the associated deductibles can significantly affect your insurance costs. Comprehensive and collision coverage, which provide protection for damage to your vehicle, can be costly. On the other hand, liability-only coverage, which covers damage to other vehicles or property, is typically more affordable. Adjusting your deductibles, the amount you pay out of pocket before your insurance coverage kicks in, can also impact your premium. Higher deductibles generally result in lower premiums, while lower deductibles increase your costs.

Strategies for Securing Cheap Car Insurance

Now that we’ve explored the factors that influence car insurance rates, let’s delve into strategies to help you find affordable coverage:

1. Shop Around and Compare Quotes

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from multiple insurers. Online comparison tools can be particularly useful for this task. By gathering quotes from various providers, you can identify the most competitive rates for your specific needs. Additionally, don’t hesitate to negotiate with insurers. They may be willing to offer a better rate to secure your business.

2. Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. By combining your insurance needs with one provider, you can often save money. However, it’s essential to compare the bundled rates with those of separate policies to ensure you’re getting the best deal.

3. Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a relatively new concept that rewards safe driving. With this type of insurance, your premium is determined by your actual driving behavior, such as the number of miles driven and your driving habits. If you drive sparingly and safely, you could potentially save a significant amount on your insurance costs.

4. Improve Your Credit Score

Insurance providers often consider your credit score when determining your premium. A higher credit score can lead to lower insurance rates. Therefore, it’s essential to maintain a good credit score by paying your bills on time and managing your credit responsibly. If your credit score is low, focus on improving it to potentially lower your insurance costs.

5. Choose a Higher Deductible

As mentioned earlier, your deductible is the amount you pay out of pocket before your insurance coverage takes effect. By opting for a higher deductible, you can often reduce your premium. However, it’s crucial to ensure that you can afford the higher deductible in the event of an accident or claim. Carefully consider your financial situation before making this decision.

6. Explore Discounts and Savings

Insurance companies offer various discounts and savings opportunities to attract customers. Common discounts include safe driver discounts, multi-policy discounts, good student discounts, and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for completing defensive driving courses or installing anti-theft devices in your vehicle. Be sure to inquire about all available discounts when obtaining quotes.

Tips for Maintaining Affordable Car Insurance

Once you’ve secured cheap car insurance, it’s essential to maintain those low rates. Here are some tips to help you keep your insurance costs affordable over time:

1. Maintain a Clean Driving Record

A clean driving record is crucial for keeping your insurance rates low. Avoid traffic violations and accidents to prevent increases in your premium. If you have a clean driving history, your insurance provider may offer you a safe driver discount, further reducing your costs.

2. Regularly Review and Update Your Policy

Insurance needs can change over time, so it’s important to regularly review your policy to ensure it aligns with your current situation. Factors such as a change in marital status, the addition of a new driver to your household, or the purchase of a new vehicle may impact your insurance requirements. Stay informed and update your policy accordingly to avoid overpaying for unnecessary coverage.

3. Consider Alternative Transportation Options

If you’re a frequent driver, reducing your mileage can lead to lower insurance costs. Consider using public transportation, carpooling, or cycling as alternatives to driving your vehicle. By driving less, you can potentially qualify for low-mileage discounts or reduce your insurance costs based on your reduced risk profile.

4. Avoid Unnecessary Claims

While it’s important to make an insurance claim when necessary, avoid making claims for minor incidents. Each claim you make can potentially increase your insurance rates or result in non-renewal of your policy. Assess the situation and determine if the cost of repairs is significantly lower than the potential increase in your premium. If so, consider paying for the repairs out of pocket to maintain your affordable insurance rates.

5. Stay Informed About Market Changes

The insurance market is dynamic, and rates can fluctuate over time. Stay informed about market changes and new insurance options that may become available. Regularly compare your current insurance rates with those of other providers to ensure you’re not overpaying. If you find a better deal elsewhere, don’t hesitate to switch providers to take advantage of the lower rates.

Conclusion: Finding the Right Balance

Securing cheap car insurance requires a balanced approach. While it’s important to find affordable coverage, you should also ensure that your policy provides adequate protection for your vehicle and your financial well-being. By understanding the factors that influence insurance rates and implementing the strategies outlined above, you can strike the right balance between affordability and coverage.

Remember, shopping around, comparing quotes, and exploring discounts are essential steps in the process. Additionally, maintaining a safe driving record, regularly reviewing your policy, and staying informed about market changes can help you maintain affordable car insurance over the long term. With the right approach, you can drive confidently, knowing you have the protection you need at a price that fits your budget.

How can I find the best car insurance rates for my specific needs?

+To find the best car insurance rates for your needs, it’s crucial to shop around and compare quotes from multiple insurers. Utilize online comparison tools to quickly gather quotes and assess your options. Additionally, consider the factors that influence insurance rates, such as your driving record, vehicle type, and coverage preferences. By understanding your specific needs and comparing rates, you can identify the insurer that offers the most competitive rates for your situation.

Are there any hidden costs associated with cheap car insurance policies?

+While cheap car insurance policies can be an attractive option, it’s important to be aware of potential hidden costs. Some insurers may offer low premiums but have higher deductibles or limited coverage. Carefully review the policy details, including the terms and conditions, to understand any potential additional costs or limitations. It’s essential to ensure that the cheap insurance policy provides the coverage you need without compromising your financial security.

Can I negotiate my car insurance rates with insurers?

+Absolutely! Negotiating your car insurance rates is a common practice. Insurance providers often have some flexibility in their pricing, especially when it comes to attracting new customers. When obtaining quotes, don’t hesitate to ask for a better rate or inquire about any available discounts. Many insurers are willing to negotiate, especially if you’ve been a loyal customer for an extended period.

What are some common discounts available for car insurance policies?

+Car insurance providers offer a variety of discounts to attract and retain customers. Some common discounts include safe driver discounts for maintaining a clean driving record, multi-policy discounts when you bundle your car insurance with other policies, good student discounts for young drivers with good grades, and loyalty discounts for long-term customers. Additionally, insurers may provide discounts for completing defensive driving courses or installing anti-theft devices in your vehicle. It’s worth inquiring about these discounts when shopping for car insurance.