Affordable Prescription Drug Insurance

In today's healthcare landscape, the cost of prescription medications can be a significant burden for many individuals. With rising healthcare expenses, finding affordable prescription drug insurance has become a priority for those seeking to manage their healthcare costs effectively. This article aims to delve into the intricacies of prescription drug insurance, exploring the options available, the factors influencing affordability, and strategies to make essential medications more accessible.

Understanding Prescription Drug Insurance

Prescription drug insurance, often referred to as pharmacy benefits or medication coverage, is a vital component of healthcare plans. It provides financial protection against the high costs of prescription medications, ensuring individuals can access the treatments they need without breaking the bank. These insurance plans typically cover a wide range of drugs, from common over-the-counter medications to specialized and life-saving treatments.

The affordability of prescription drug insurance is a complex issue influenced by various factors, including the individual's health status, the type of plan chosen, and the specific medications required. Navigating these factors is crucial to securing the most cost-effective coverage.

Key Factors Affecting Affordability

Several key factors play a significant role in determining the affordability of prescription drug insurance:

- Health Status: Pre-existing medical conditions and chronic illnesses can impact the cost of insurance. Individuals with complex health needs may require specialized medications, which can be more expensive to cover.

- Plan Type: Different insurance plans offer varying levels of coverage. Some plans have higher premiums but provide more comprehensive coverage, while others may have lower premiums but come with higher out-of-pocket costs.

- Formulary Lists: Insurance providers maintain formulary lists, which outline the medications they cover. These lists can vary, and medications not included may incur higher costs or require special approval.

- Pharmacy Networks: Insurance plans often have preferred pharmacy networks. Using these networks can lead to lower costs, as they negotiate discounts with pharmacies. Out-of-network pharmacies may charge higher prices.

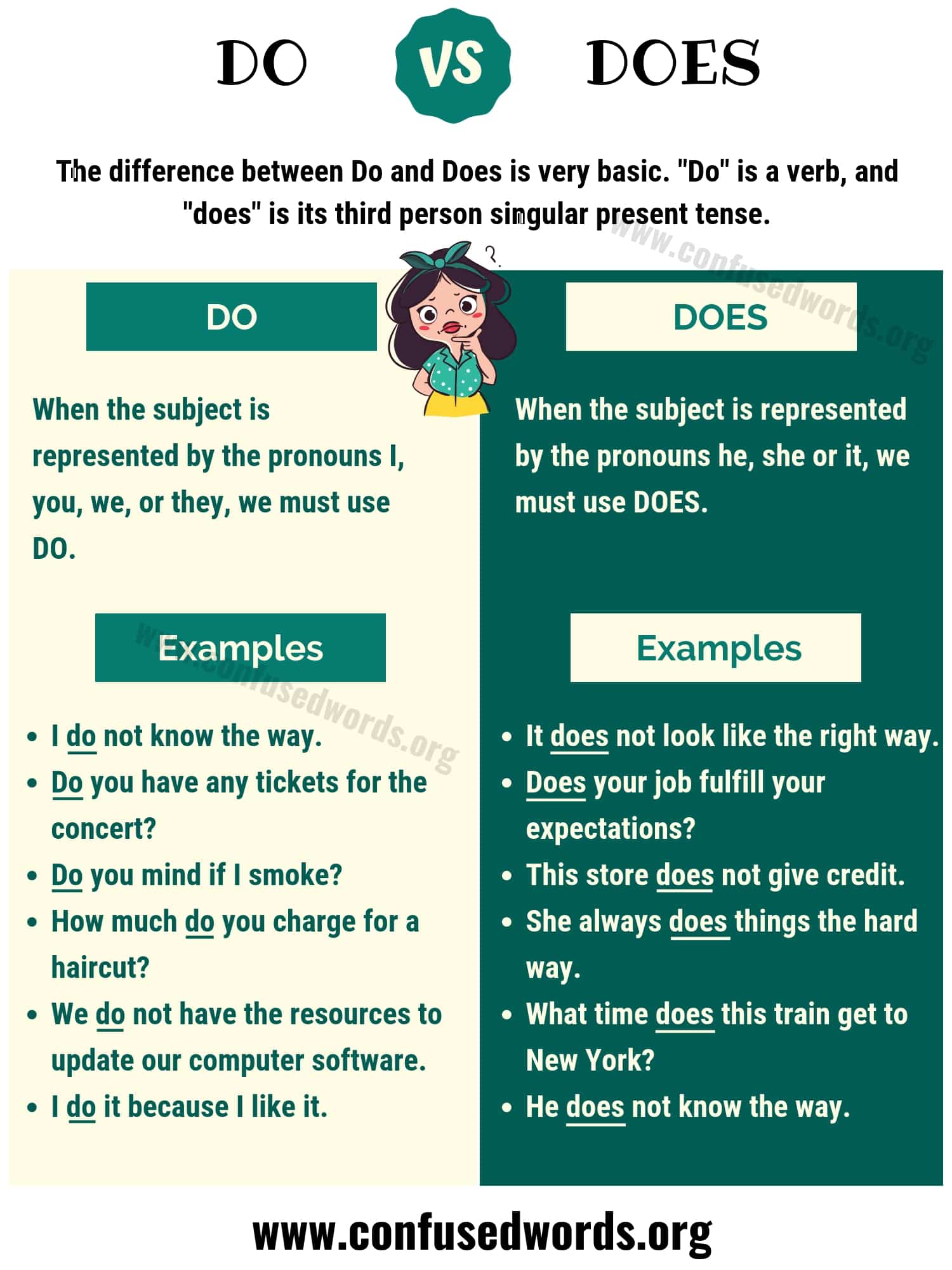

- Copayments and Coinsurance: These are the out-of-pocket costs individuals pay for medications. Copayments are fixed amounts, while coinsurance is a percentage of the medication’s cost. Higher copays and coinsurance can impact affordability.

Exploring Affordable Options

Securing affordable prescription drug insurance involves a careful consideration of various options and a strategic approach to healthcare planning. Here’s a comprehensive guide to help individuals navigate the complexities of medication coverage.

Employer-Sponsored Plans

For many individuals, the most common source of prescription drug insurance is through employer-sponsored health plans. These plans are often more affordable due to the negotiating power of large groups. Employers typically offer a range of options, allowing employees to choose a plan that aligns with their healthcare needs and budget.

When evaluating employer-sponsored plans, it's essential to consider the following:

- Plan Deductibles: Understand the annual deductible for prescription medications. Higher deductibles mean you'll need to pay more out-of-pocket before the insurance kicks in.

- Formulary Inclusion: Check if your essential medications are covered under the plan's formulary. If not, explore the process for obtaining special approval or considering alternative medications.

- Generic Options: Generic medications are often more affordable than brand-name drugs. Ensure the plan encourages the use of generics by offering lower copays or coinsurance for these options.

- Mail-Order Pharmacies: Some plans offer discounts or incentives for using mail-order pharmacies, which can be more cost-effective for long-term medications.

Government-Sponsored Programs

Government-sponsored programs, such as Medicare and Medicaid, provide essential coverage for individuals who qualify based on age, disability, or income. These programs often include prescription drug coverage, making them a crucial option for affordable medication access.

Medicare, in particular, offers Part D coverage specifically for prescription drugs. Here's what you need to know:

- Medicare Part D: This optional plan covers both brand-name and generic drugs. It typically involves a monthly premium, deductibles, and copays or coinsurance. The costs can vary based on the chosen plan.

- Medicare Advantage Plans: Some Medicare Advantage plans (Part C) include prescription drug coverage. These plans often provide more comprehensive coverage but may have limited provider networks.

- Medicaid: Medicaid is a state-based program, and its coverage varies. Many states offer comprehensive prescription drug coverage, making it an affordable option for low-income individuals.

Private Insurance Plans

Private insurance plans, including individual and family plans, offer flexibility in coverage options. While they may have higher premiums, they provide an opportunity to tailor coverage to specific medication needs.

When considering private plans, keep the following in mind:

- Compare Plans: Research and compare different private insurance plans. Look for those that offer generous prescription drug coverage, especially for medications you regularly use.

- Pharmacy Networks: Ensure the plan's pharmacy network includes your preferred pharmacies. If not, consider the convenience and potential savings of switching to an in-network option.

- Discount Programs: Some private insurers offer discount programs or partnerships with pharmacies, providing additional savings on medications.

Strategies for Affordability

Securing affordable prescription drug insurance involves a combination of informed decision-making and strategic planning. Here are some practical strategies to help individuals make the most of their medication coverage:

Generic Medications

Generic medications are an excellent way to save on prescription costs. They offer the same therapeutic benefits as brand-name drugs but at a significantly lower price. When discussing medication options with healthcare providers, inquire about generic alternatives.

Here's how generics can help:

- Cost Savings: Generic medications can be up to 80% cheaper than their brand-name counterparts, resulting in substantial savings over time.

- Formulary Inclusion: Most insurance plans encourage the use of generics by offering lower copays or coinsurance. This makes them an affordable choice within the plan's formulary.

Pharmacy Discount Programs

Many pharmacies offer discount programs or loyalty schemes that can provide significant savings on medications. These programs often provide discounts on generic and brand-name drugs, making them an attractive option for individuals without comprehensive insurance coverage.

Consider the following when exploring pharmacy discount programs:

- Eligibility: Check the eligibility criteria and any requirements for enrollment. Some programs may be open to all, while others may have specific income or health status requirements.

- Savings: Research the potential savings offered by different programs. Compare the discounts on your essential medications to find the most cost-effective option.

- Coverage: Ensure the program covers a wide range of medications, including those you regularly use. Some programs may have limitations on the types of drugs they discount.

Manufacturer Discounts and Coupons

Pharmaceutical manufacturers often provide discounts and coupons to make their medications more accessible. These offers can significantly reduce the out-of-pocket costs for brand-name drugs.

When considering manufacturer discounts, keep the following in mind:

- Availability: Check the manufacturer's website or speak with your pharmacist to determine if discounts or coupons are available for your specific medication.

- Eligibility: Understand the eligibility criteria for these discounts. Some may be income-based, while others may require enrollment in a specific program.

- Duration: Manufacturer discounts often have an expiration date. Plan your medication purchases accordingly to maximize savings.

Prescription Assistance Programs

For individuals facing financial challenges, prescription assistance programs can be a lifeline. These programs, often sponsored by pharmaceutical companies or nonprofit organizations, provide free or low-cost medications to eligible individuals.

Here's what you need to know about prescription assistance programs:

- Eligibility: These programs typically have income and health status requirements. Some may also consider other factors like family size or employment status.

- Application Process: The application process can be complex and may require documentation of financial need and medical condition. Seek assistance from social workers or patient advocacy groups to navigate this process.

- Medications Covered: Each program has a list of medications it covers. Ensure that your essential medications are included before applying.

Future Implications and Innovations

The landscape of prescription drug insurance is evolving, driven by technological advancements, policy changes, and a growing focus on patient-centric care. Here's a glimpse into the future of affordable medication coverage.

Telehealth and Digital Health Solutions

The integration of telehealth and digital health solutions is revolutionizing the healthcare industry. These technologies offer new avenues for affordable and accessible medication management.

Consider the following advancements:

- Remote Prescribing: Telehealth platforms allow healthcare providers to prescribe medications remotely, eliminating the need for in-person visits. This can reduce the time and cost associated with prescription refills.

- Digital Health Apps: Mobile apps and digital platforms provide convenient medication management tools. These apps can remind patients to take their medications, track adherence, and even offer discounts or coupons for prescriptions.

- Online Pharmacies: The rise of online pharmacies offers convenience and potential cost savings. These platforms often have competitive pricing and may provide free shipping, making them an attractive option for individuals seeking affordable medications.

Policy Reforms and Advocacy

Policy reforms and advocacy efforts play a crucial role in shaping the future of prescription drug insurance. Advocacy groups and policymakers are working to address the high cost of medications and improve access to affordable coverage.

Here are some key initiatives and potential outcomes:

- Price Transparency: Advocacy efforts are pushing for greater transparency in medication pricing. This could lead to more competitive pricing and better-informed consumers.

- Medicare Negotiation: There is growing support for allowing Medicare to negotiate drug prices directly with pharmaceutical companies. This could result in lower costs for Medicare beneficiaries and potentially drive down prices across the healthcare system.

- Expanded Coverage: Policy reforms may aim to expand prescription drug coverage, especially for underserved populations. This could include initiatives to improve Medicaid coverage or provide financial assistance for individuals with high medication costs.

Personalized Medicine and Precision Therapeutics

The future of healthcare lies in personalized medicine, where treatments are tailored to an individual's unique genetic makeup and health needs. This precision approach has the potential to revolutionize medication coverage.

Consider the implications of personalized medicine:

- Targeted Therapies: Personalized medicine focuses on developing therapies that target specific genetic markers or biological pathways. This precision can lead to more effective treatments with fewer side effects, potentially reducing the need for multiple medications and associated costs.

- Genetic Testing: Genetic testing plays a crucial role in personalized medicine. As the cost of genetic testing decreases, it may become more accessible, allowing individuals to better understand their health risks and make informed decisions about medication use.

- Data-Driven Decisions: The integration of data analytics and artificial intelligence can enhance medication coverage. By analyzing large datasets, insurers and healthcare providers can make more accurate predictions about an individual's medication needs, leading to more efficient and cost-effective coverage.

Conclusion

Affordable prescription drug insurance is a complex yet crucial aspect of healthcare planning. By understanding the factors that influence affordability and exploring the various options available, individuals can make informed decisions to secure the coverage they need. From employer-sponsored plans to government programs and private insurance, the key lies in tailoring coverage to individual needs and taking advantage of strategic savings opportunities.

As the healthcare landscape continues to evolve, embracing technological advancements, policy reforms, and personalized medicine will shape a future where prescription drug coverage is more accessible and affordable for all. Stay informed, advocate for change, and explore the innovative solutions that are transforming the way we manage our healthcare needs.

What is the difference between copayments and coinsurance in prescription drug insurance?

+Copayments are fixed amounts that individuals pay for each prescription fill, regardless of the medication’s cost. On the other hand, coinsurance is a percentage of the medication’s cost that the individual pays. For example, a plan with 20% coinsurance means you pay 20% of the medication’s cost, while the insurance covers the remaining 80%.

How can I find out if my medications are covered by a specific insurance plan?

+Most insurance providers offer online tools or apps where you can search for medications and check their coverage status. You can also contact the insurance provider’s customer service or consult with your healthcare provider or pharmacist, who can guide you through the process.

Are there any tax benefits associated with prescription drug insurance?

+Yes, in some cases, there may be tax benefits associated with prescription drug insurance. For example, if you have high medical expenses, including prescription drug costs, you may be able to deduct these expenses from your taxable income. However, the rules and eligibility criteria vary, so it’s advisable to consult a tax professional for personalized advice.