Texas Vehicle Insurance

In the vast and diverse state of Texas, vehicle insurance is a crucial aspect of responsible driving and financial protection. With its expansive roads, vibrant cities, and varying weather conditions, Texas residents must navigate a unique set of considerations when it comes to auto insurance. This article aims to provide an in-depth exploration of Texas vehicle insurance, covering everything from the essential coverages and legal requirements to the nuances of pricing and policy options. By understanding the intricacies of this essential topic, Texas drivers can make informed decisions to safeguard their vehicles, themselves, and others on the road.

Understanding Texas Vehicle Insurance Requirements and Coverages

Texas is known for its unique approach to vehicle insurance, with a system that prioritizes personal responsibility and flexibility. Unlike many other states, Texas does not mandate comprehensive or collision coverage, allowing drivers to tailor their policies to their specific needs and budgets. However, certain minimum requirements must be met to drive legally in the state.

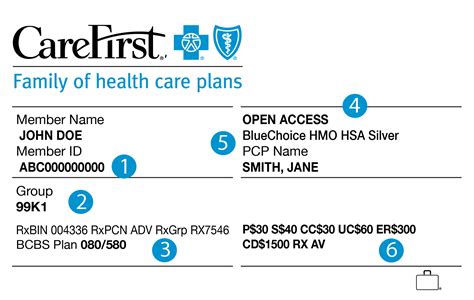

Liability Insurance: The Texas Minimum

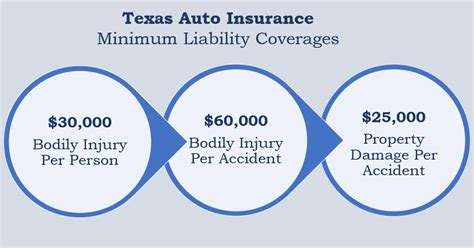

Liability insurance is the cornerstone of Texas vehicle insurance. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an at-fault accident. Texas requires drivers to carry at least:

- Bodily Injury Liability: 30,000 per person / 60,000 per accident

- Property Damage Liability: $25,000 per accident

These minimums provide a basic level of protection, but many experts recommend increasing coverage limits to better safeguard against financial risks. The cost of medical care and property repair can quickly exceed these amounts, leaving the driver personally liable for the remainder.

Optional Coverages: Tailoring Your Policy

While liability insurance is mandatory, Texas drivers have the freedom to choose additional coverages to enhance their protection. Here are some common optional coverages:

- Collision Coverage: Pays for damage to your vehicle in an accident, regardless of fault. This coverage is especially beneficial for newer or financed vehicles.

- Comprehensive Coverage: Covers damage to your vehicle from non-collision events like theft, vandalism, natural disasters, or collisions with animals. It provides peace of mind for those living in areas prone to severe weather or high crime rates.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages. This coverage is vital in Texas, where the insurance rate is lower than the national average.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault. It can help ensure you receive prompt medical attention without worrying about upfront costs.

Pricing and Factors Affecting Texas Vehicle Insurance

The cost of vehicle insurance in Texas varies significantly based on numerous factors. Understanding these factors can help drivers make informed decisions to secure the best coverage at the most competitive rates.

Personal Characteristics and Driving History

Insurance companies assess various personal characteristics and driving histories to determine policy premiums. Factors that can impact rates include:

- Age: Young drivers (under 25) and older drivers (over 65) often face higher premiums due to increased accident risks.

- Gender: While gender is becoming less of a consideration, some insurers still use it as a factor, with young male drivers often facing higher rates.

- Marital Status: Married individuals may receive lower rates, as they are often seen as more stable and responsible drivers.

- Driving Record: A clean driving record can lead to significant savings. Tickets, accidents, and DUIs can significantly increase premiums.

Vehicle Characteristics and Usage

The type of vehicle you drive and how you use it can also impact your insurance rates. Here are some key considerations:

- Vehicle Make and Model: Some vehicles, particularly high-performance or luxury cars, can be more expensive to insure due to their repair costs and theft risks.

- Vehicle Age: Older vehicles are generally cheaper to insure, as they have lower repair and replacement costs.

- Annual Mileage: Drivers who use their vehicles for long commutes or business purposes may pay higher premiums, as their risk of accidents is perceived to be higher.

- Safety Features : Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems may qualify for discounts.

Location and Coverage Preferences

Where you live and the coverage options you choose can significantly impact your insurance costs. Consider the following:

- Geographic Location: Urban areas often have higher insurance rates due to increased traffic and crime rates. Rural areas may have lower rates but can see higher premiums for comprehensive coverage due to wildlife collisions.

- Coverage Limits: Choosing higher coverage limits can provide better protection but will also increase your premiums.

- Deductibles: Opting for higher deductibles can lower your premiums, but it means you’ll pay more out of pocket if you need to make a claim.

Texas Vehicle Insurance: Navigating the Process

Obtaining vehicle insurance in Texas involves a series of steps to ensure you get the right coverage at the best price. Here’s a guide to help you navigate the process:

Assessing Your Needs

Before shopping for insurance, assess your needs and preferences. Consider factors like your driving record, the value of your vehicle, and your financial ability to absorb losses. Determine the coverages you want and the limits that provide adequate protection.

Researching Insurers

Texas is home to numerous insurance providers, each with its own unique offerings and pricing structures. Researching and comparing insurers is crucial to finding the best fit for your needs. Consider factors like:

- Financial stability and reputation

- Customer service and claims handling

- Discounts and policy options

- Ease of doing business, including online and mobile capabilities

Obtaining Quotes

Once you’ve identified potential insurers, obtain quotes to compare rates and coverage. Be sure to provide accurate and detailed information to ensure you’re getting an apples-to-apples comparison. Consider using an insurance broker or comparison website to streamline the process.

Understanding Policy Details

When reviewing insurance policies, pay close attention to the fine print. Ensure you understand the coverages, limits, deductibles, and any exclusions or limitations. Look for any additional benefits or perks, such as rental car coverage or roadside assistance.

Making the Purchase

Once you’ve found the right policy at the right price, it’s time to make the purchase. Many insurers offer online or over-the-phone purchasing options, but it’s essential to review the policy documents carefully before finalizing the transaction. Ensure all your personal and vehicle information is accurate and that the coverage meets your needs.

Texas Vehicle Insurance: Expert Insights and Tips

Navigating the world of vehicle insurance can be complex, but with the right knowledge and approach, Texas drivers can secure comprehensive coverage at competitive rates. Here are some expert insights and tips to help you make the most of your insurance journey:

Discounts and Savings

Insurance companies offer a wide range of discounts to attract and retain customers. Some common discounts include:

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period can qualify you for discounts.

- Good Student Discounts: Students with a certain GPA or academic standing may be eligible for discounts, encouraging academic excellence.

- Loyalty Discounts: Staying with the same insurer for an extended period can result in loyalty rewards and discounts.

Understanding Coverage Gaps

While Texas vehicle insurance provides a solid foundation, there may be gaps in coverage that could leave you vulnerable. Here are some common coverage gaps to watch out for:

- Gap Insurance: If you’re leasing or financing your vehicle, consider gap insurance to cover the difference between your vehicle’s actual cash value and the remaining loan balance in case of a total loss.

- Rental Car Coverage: Some policies may not include rental car coverage, leaving you responsible for rental expenses after an accident.

- Personal Injury Protection (PIP): Texas does not require PIP coverage, but it can provide valuable benefits like medical and disability coverage, income replacement, and funeral expenses.

Staying Informed and Prepared

The world of vehicle insurance is constantly evolving, with new laws, regulations, and coverage options emerging regularly. Stay informed about changes that could impact your coverage or premiums. Additionally, prepare for the unexpected by keeping your policy documents, proof of insurance, and emergency contact information readily accessible.

| Insurance Type | Coverage Details |

|---|---|

| Liability Insurance | Bodily Injury: $30,000 / $60,000; Property Damage: $25,000 |

| Collision Coverage | Covers vehicle damage in accidents, regardless of fault |

| Comprehensive Coverage | Covers non-collision events like theft, vandalism, and natural disasters |

| Uninsured/Underinsured Motorist Coverage | Protects against accidents with drivers lacking sufficient insurance |

| Medical Payments Coverage | Covers medical expenses for you and your passengers |

What happens if I drive without insurance in Texas?

+Driving without insurance in Texas is illegal and can result in serious consequences. If caught, you may face fines, license suspension, and even vehicle impoundment. Additionally, you’ll be personally liable for any damages or injuries caused in an accident.

Can I get SR-22 insurance in Texas?

+Yes, Texas requires an SR-22 form for drivers who have had their license suspended due to certain violations, such as driving under the influence (DUI) or failure to maintain insurance. SR-22 insurance provides proof of financial responsibility and is often required for a set period, typically three years.

How often should I review my vehicle insurance policy in Texas?

+It’s recommended to review your insurance policy annually or whenever your circumstances change. This ensures your coverage remains adequate and you’re not overpaying for unnecessary coverage. Reviewing your policy regularly also allows you to take advantage of new discounts or coverage options.