Texas State Health Insurance

The topic of health insurance is of utmost importance, especially when considering the well-being and financial security of individuals and families. In the vast state of Texas, understanding the health insurance landscape is crucial for making informed decisions about healthcare coverage. This comprehensive guide aims to delve into the specifics of Texas State Health Insurance, shedding light on its intricacies, benefits, and how it impacts the lives of Texans.

Navigating Texas State Health Insurance: A Comprehensive Overview

Texas, being the second-most populous state in the United States, boasts a diverse healthcare system with a range of insurance options. The state’s approach to health insurance is influenced by its unique demographic and geographic characteristics, leading to a complex yet essential network of coverage plans. This section provides an in-depth analysis of the key aspects of Texas State Health Insurance.

Understanding the Healthcare Landscape in Texas

Texas is known for its vast rural areas and diverse urban centers, each presenting unique healthcare challenges. The state’s healthcare system is a blend of public and private entities, with a strong presence of private insurance providers. The Texas Department of Insurance plays a vital role in regulating and overseeing the state’s health insurance market, ensuring compliance with state and federal laws.

The state's Medicaid program, known as Texas Medicaid, provides healthcare coverage to low-income individuals and families. Additionally, the Children's Health Insurance Program (CHIP) offers coverage to children whose families may not qualify for Medicaid but still face financial challenges. These public programs are crucial safety nets for many Texans, ensuring access to essential healthcare services.

| Health Insurance Type | Description |

|---|---|

| Employer-Sponsored Plans | Many Texans receive health insurance through their employers, with coverage varying based on the plan offered. |

| Individual and Family Plans | These plans are purchased directly by individuals or families and are tailored to their specific needs and preferences. |

| Short-Term Plans | Designed for temporary coverage, these plans offer flexibility but may have limited benefits and coverage. |

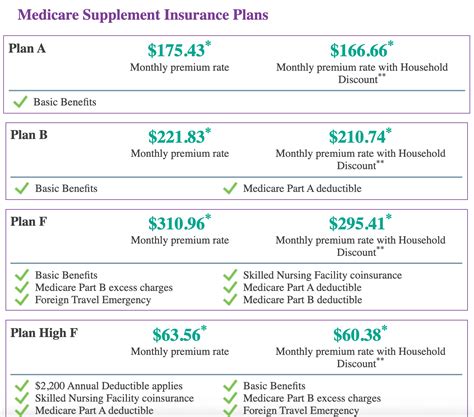

| Medicare Advantage Plans | For Texans aged 65 and older, Medicare Advantage plans provide an alternative to original Medicare, offering additional benefits and often including prescription drug coverage. |

Key Features of Texas State Health Insurance

Texas State Health Insurance offers a range of features designed to meet the diverse needs of its residents. Here’s an overview of some key aspects:

- Essential Health Benefits: All health insurance plans in Texas, both private and public, must cover a set of essential health benefits. These include ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care.

- Network Providers: Most insurance plans in Texas have a network of healthcare providers, including doctors, hospitals, and specialists. Choosing an in-network provider often results in lower out-of-pocket costs. It's important for individuals to review the network list to ensure their preferred providers are included.

- Out-of-Pocket Costs: These include deductibles, copayments, and coinsurance. Deductibles are the amount an individual must pay out of pocket before insurance coverage kicks in. Copayments are fixed amounts paid for specific services, while coinsurance is a percentage of the cost of a covered service that the individual pays.

- Prescription Drug Coverage: Many health insurance plans in Texas include prescription drug coverage, which can vary based on the plan and the specific drugs covered. It's crucial to review the formulary, a list of prescription drugs covered by the plan, to ensure necessary medications are included.

Texas State Health Insurance: A Case Study

To illustrate the impact of Texas State Health Insurance, let’s consider the case of the Smith family. The Smiths, a family of four living in a suburban area of Texas, recently experienced a medical emergency. Mr. Smith, the primary breadwinner, was involved in a car accident, resulting in significant injuries and requiring extensive medical treatment.

Thanks to their comprehensive health insurance plan, the Smiths were able to navigate this challenging situation with financial stability. The plan's coverage included emergency services, hospitalization, and rehabilitative care, ensuring Mr. Smith received the necessary treatment. Additionally, the plan's prescription drug coverage ensured that Mr. Smith had access to the medications required for his recovery.

The out-of-pocket costs associated with Mr. Smith's treatment were manageable due to the plan's reasonable deductibles and copayments. The Smiths were also relieved to find that their preferred hospital and specialists were part of the insurance network, avoiding additional costs associated with out-of-network care.

This case study highlights the importance of having adequate health insurance coverage. In Texas, where medical costs can be high, a robust insurance plan can provide peace of mind and financial security during unforeseen medical emergencies.

The Future of Texas State Health Insurance: Trends and Innovations

The landscape of Texas State Health Insurance is constantly evolving, influenced by advancements in technology, changes in healthcare regulations, and shifts in the state’s demographic profile. Here, we explore some of the trends and innovations shaping the future of health insurance in Texas.

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue in Texas. Telehealth allows individuals to access healthcare services remotely, often through video conferencing or phone calls. This innovation improves access to care, especially for individuals in rural areas or those with limited mobility.

Insurance providers in Texas are increasingly covering telehealth services, recognizing their value in delivering convenient and cost-effective care. As technology advances, we can expect to see further integration of telehealth into the healthcare system, benefiting both patients and providers.

Value-Based Care and Payment Models

Value-based care is an approach that focuses on the quality and outcomes of healthcare, rather than the quantity of services provided. This model aims to improve patient health while reducing costs. In Texas, insurance providers are exploring value-based payment models, such as accountable care organizations (ACOs) and bundled payments.

ACOs bring together healthcare providers, such as doctors, hospitals, and specialists, to coordinate patient care. This collaborative approach aims to improve the quality of care while controlling costs. Bundled payments, on the other hand, involve a single payment for all services related to a specific medical condition or episode of care. This model encourages providers to work together to deliver efficient and effective treatment.

Focus on Preventive Care

Preventive care is a cornerstone of modern healthcare, and Texas insurance providers are placing increased emphasis on it. By investing in preventive services, such as vaccinations, screenings, and wellness programs, insurance companies aim to reduce the burden of chronic diseases and improve overall population health.

Many insurance plans in Texas now offer incentives for individuals to engage in preventive care. This may include reduced copayments for preventive services or rewards programs that encourage healthy behaviors. By promoting preventive care, insurance providers can help individuals stay healthy and avoid costly treatments for preventable conditions.

Conclusion: Empowering Texans through Informed Healthcare Decisions

Understanding the intricacies of Texas State Health Insurance is crucial for individuals and families seeking to make informed decisions about their healthcare coverage. The state’s diverse healthcare landscape, with its range of insurance options and public programs, provides Texans with the opportunity to find a plan that meets their unique needs.

From employer-sponsored plans to individual and family options, Texans have a variety of choices. The key is to carefully review the features, benefits, and out-of-pocket costs of each plan to ensure the best fit. Additionally, staying informed about the latest trends and innovations in health insurance can help Texans stay ahead of the curve and make the most of their coverage.

As we've explored, the future of Texas State Health Insurance is promising, with advancements in telehealth, value-based care, and preventive services. These innovations are not only improving access to care but also enhancing the overall quality of healthcare delivered to Texans.

By staying informed and actively engaged in their healthcare decisions, Texans can navigate the complex world of health insurance with confidence. Remember, the right health insurance plan can provide peace of mind and financial security, ensuring access to the care you need when you need it most.

What is the average cost of health insurance in Texas?

+

The cost of health insurance in Texas can vary significantly based on factors such as age, location, and the specific plan chosen. On average, Texans pay around 400 to 600 per month for individual plans and up to $1,500 for family plans. However, these figures can change based on individual circumstances.

Are there any subsidies or financial assistance available for health insurance in Texas?

+

Yes, Texas offers financial assistance for health insurance through the Health Insurance Marketplace. Eligibility for subsidies is based on income, and individuals may qualify for lower out-of-pocket costs or reduced premiums.

Can I choose my own doctor or healthcare provider under Texas State Health Insurance plans?

+

Yes, most Texas State Health Insurance plans offer a network of healthcare providers. Individuals can choose their preferred doctors and specialists from within this network. However, it’s important to review the network list to ensure the desired providers are included.

What happens if I need medical care while traveling outside of Texas with my insurance plan?

+

Most Texas health insurance plans provide some level of coverage for out-of-network or out-of-state medical care. However, it’s crucial to review the specific details of your plan to understand the extent of this coverage and any potential costs involved.