State Farm Insurance Rates

When it comes to insurance, one of the most crucial decisions is choosing the right provider. With countless options available, consumers often seek reliable and affordable coverage. State Farm, a well-established insurance company, has gained a reputation for its comprehensive policies and competitive rates. In this comprehensive analysis, we will delve into the world of State Farm insurance rates, exploring the factors that influence them, the range of coverage options, and the overall value they offer to policyholders.

Understanding State Farm Insurance Rates

State Farm is a leading provider of insurance services in the United States, offering a wide range of policies to meet various needs. Their rates are determined by a complex interplay of factors, each playing a significant role in shaping the overall cost of insurance coverage.

Factors Influencing State Farm Insurance Rates

Several key factors influence State Farm’s insurance rates, ensuring a fair and personalized assessment of each policyholder’s risk profile. Here’s an in-depth look at these factors:

- Risk Assessment: State Farm evaluates various risk factors to determine the likelihood of claims. This includes considerations such as age, gender, driving record, and the type of vehicle insured. Younger drivers, for instance, may face higher premiums due to their relative inexperience on the road.

- Coverage Type: The type of insurance coverage chosen plays a vital role in determining rates. Auto insurance, homeowners' insurance, and life insurance policies each have their own unique rate structures, reflecting the specific risks and benefits associated with each coverage type.

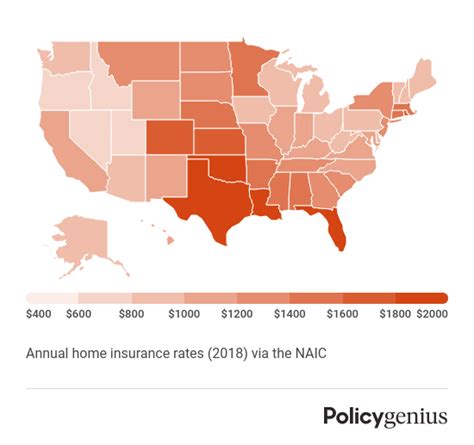

- Location: Geographical factors significantly impact insurance rates. Areas with higher crime rates, frequent natural disasters, or dense traffic may result in increased premiums. State Farm takes into account the unique characteristics of each location to assess the associated risks accurately.

- Claims History: An individual's or household's claims history is a critical factor in rate determination. Prior claims can indicate a higher likelihood of future incidents, leading to increased premiums. Conversely, a clean claims record may result in more favorable rates.

- Discounts and Bundling: State Farm offers a range of discounts to policyholders, encouraging safe practices and loyalty. These discounts can significantly reduce overall rates. Additionally, bundling multiple insurance policies with State Farm can result in substantial savings, making it an attractive option for those seeking comprehensive coverage.

State Farm’s Coverage Options and Rates

State Farm provides a diverse range of insurance coverage options, catering to the unique needs of its policyholders. Here’s an overview of some of their key coverage types and the associated rates:

Auto Insurance

State Farm’s auto insurance policies are comprehensive, offering protection against a wide range of incidents. Rates for auto insurance vary based on factors such as the make and model of the vehicle, the driver’s age and driving history, and the level of coverage chosen. State Farm provides customizable options, allowing policyholders to select the coverage that best suits their needs and budget.

| Coverage Type | Average Rate |

|---|---|

| Liability Coverage | $250 - $500 per month |

| Collision and Comprehensive Coverage | $300 - $600 per month |

| Personal Injury Protection (PIP) | $150 - $300 per month |

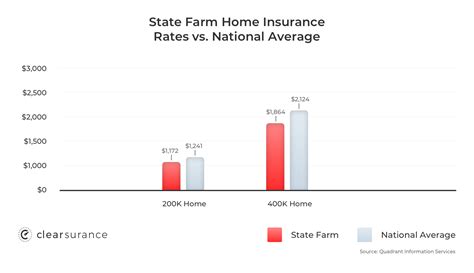

Homeowners’ Insurance

State Farm’s homeowners’ insurance policies provide financial protection for policyholders’ homes and personal belongings. Rates for homeowners’ insurance depend on factors such as the location, size, and construction of the home, as well as the chosen coverage limits and deductibles. State Farm offers customizable options, ensuring policyholders can tailor their coverage to their specific needs.

| Coverage Type | Average Rate |

|---|---|

| Dwelling Coverage | $500 - $1,000 per year |

| Personal Property Coverage | $200 - $500 per year |

| Liability Coverage | $150 - $300 per year |

Life Insurance

State Farm offers both term life and permanent life insurance policies. Rates for life insurance depend on factors such as the policyholder’s age, health status, and the chosen coverage amount. Term life insurance policies typically offer lower premiums, while permanent life insurance provides lifelong coverage with more comprehensive benefits.

| Coverage Type | Average Rate |

|---|---|

| Term Life Insurance | $50 - $200 per month |

| Permanent Life Insurance | $100 - $500 per month |

The Value Proposition of State Farm Insurance Rates

State Farm’s insurance rates are designed to offer a balanced approach, providing policyholders with comprehensive coverage at competitive prices. Here’s a closer look at the value proposition:

Competitive Pricing

State Farm’s rates are generally competitive within the insurance industry. They strive to offer affordable coverage without compromising on the quality and breadth of their policies. By carefully assessing risk factors and providing personalized quotes, State Farm ensures that policyholders receive fair and reasonable rates.

Comprehensive Coverage Options

State Farm understands that every policyholder has unique needs. Their range of coverage options allows individuals and families to customize their insurance plans, ensuring they receive the protection they require. Whether it’s auto, homeowners’, or life insurance, State Farm provides comprehensive coverage to address a wide array of risks.

Discounts and Bundling Benefits

State Farm’s commitment to rewarding safe practices and loyalty is evident in their generous discount offerings. Policyholders can take advantage of discounts for safe driving, multiple policies, and various other qualifications. Additionally, bundling multiple insurance policies with State Farm can result in significant savings, making it a cost-effective choice for those seeking comprehensive coverage.

Claims Handling and Customer Service

In the event of a claim, State Farm’s efficient and responsive claims handling process is a key differentiator. Their dedicated claims teams work tirelessly to ensure policyholders receive fair and prompt settlements. Furthermore, State Farm’s commitment to customer service excellence is evident in their highly trained and accessible agents, providing guidance and support throughout the insurance journey.

Conclusion

State Farm insurance rates reflect a thoughtful balance between risk assessment and providing policyholders with affordable, comprehensive coverage. By considering a range of factors and offering customizable options, State Farm ensures that individuals and families can secure the protection they need without breaking the bank. With competitive pricing, comprehensive coverage options, and a focus on customer satisfaction, State Farm remains a trusted choice for millions of policyholders across the United States.

How do State Farm’s insurance rates compare to other providers?

+State Farm’s insurance rates are generally competitive within the industry. While rates can vary based on individual circumstances, State Farm’s personalized quotes ensure fair pricing. It’s recommended to compare quotes from multiple providers to find the best fit for your needs.

What factors can policyholders control to potentially lower their insurance rates?

+Policyholders can take several steps to potentially lower their insurance rates. These include maintaining a clean driving record, installing safety features in their vehicles, and bundling multiple insurance policies with the same provider. Additionally, regularly reviewing and adjusting coverage limits and deductibles can also impact rates.

Are there any discounts available for State Farm insurance policies?

+Yes, State Farm offers a range of discounts to policyholders. These include discounts for safe driving, multiple policies, and various other qualifications. It’s worth discussing these discounts with your State Farm agent to determine which ones you may be eligible for.