State Farm Homeowners Insurance Quote

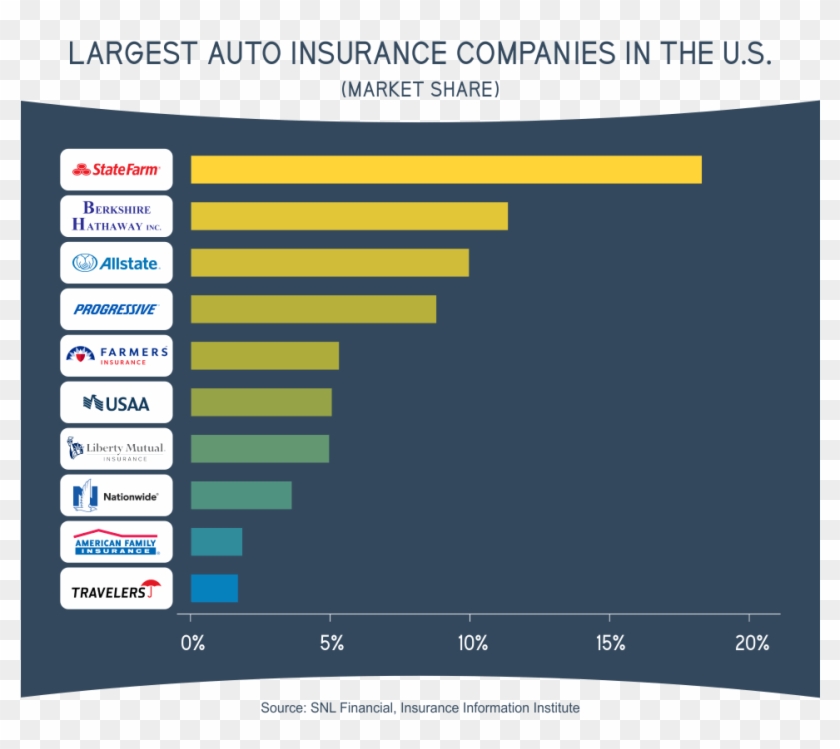

As one of the largest property and casualty insurance providers in the United States, State Farm is a well-known name in the insurance industry. Its comprehensive range of insurance products, including homeowners insurance, offers policyholders peace of mind and financial protection for their homes and possessions. Obtaining a State Farm homeowners insurance quote is a straightforward process, and understanding the factors that influence your quote can help you make informed decisions about your coverage.

Understanding State Farm’s Homeowners Insurance

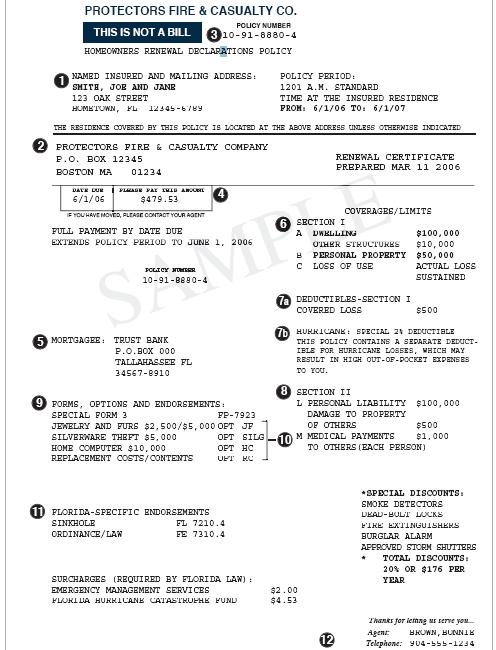

State Farm’s homeowners insurance policies are designed to provide comprehensive coverage for your home and its contents. These policies typically include coverage for the structure of your home, personal belongings, liability protection, and additional living expenses in the event of a covered loss. State Farm offers several policy options, allowing homeowners to customize their coverage based on their specific needs and budget.

Key Features of State Farm’s Homeowners Insurance

State Farm’s homeowners insurance policies come with a range of standard features, including:

- Dwelling Coverage: Protects the physical structure of your home against damages caused by perils such as fire, windstorms, and vandalism.

- Personal Property Coverage: Covers the replacement or repair of your personal belongings, including furniture, electronics, and clothing.

- Liability Protection: Provides financial coverage in case you’re found legally responsible for another person’s injury or property damage that occurs on your property.

- Additional Living Expenses: Covers the cost of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered loss.

- Medical Payments Coverage: Pays for medical expenses for injuries sustained by guests on your property, regardless of liability.

Customizable Options

State Farm offers several endorsements and optional coverages to tailor your homeowners insurance policy to your specific needs. Some of these options include:

- Identity Restoration Coverage: Assists policyholders with the costs and time involved in restoring their identity if it’s stolen.

- Scheduled Personal Property Coverage: Provides additional protection for high-value items like jewelry, fine art, or collectibles.

- Home Business Protection: Covers business-related equipment and inventory kept at home.

- Water Backup Coverage: Offers protection against water damage caused by the backup of sewers or drains.

Factors Influencing Your State Farm Homeowners Insurance Quote

When requesting a quote for homeowners insurance from State Farm, several factors come into play that can impact the cost of your policy. Understanding these factors can help you make informed decisions about your coverage and potentially lower your insurance premiums.

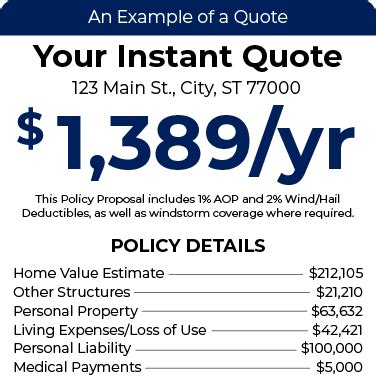

Home Value and Location

The value of your home and its location are primary factors in determining your insurance quote. State Farm assesses the replacement cost of your home, taking into account factors like its size, construction materials, and any recent renovations or additions. Homes in areas prone to natural disasters or high crime rates may also see higher insurance premiums.

Policy Coverage and Deductibles

The level of coverage you choose and your selected deductibles significantly impact your insurance quote. Higher coverage limits and lower deductibles typically result in higher premiums, while lower coverage limits and higher deductibles can reduce your costs. It’s essential to find a balance that provides adequate protection while remaining affordable.

| Coverage Type | Coverage Amount | Monthly Premium |

|---|---|---|

| Dwelling | $300,000 | $120 |

| Personal Property | $150,000 | $85 |

| Liability | $300,000 | $40 |

| Medical Payments | $10,000 | $25 |

Your Claims History

State Farm considers your claims history when determining your insurance quote. A history of frequent claims or large losses may lead to higher premiums or even difficulty in obtaining coverage. Maintaining a clean claims history can help keep your insurance costs down.

Credit Score and Financial Stability

Your credit score is another factor that can influence your insurance quote. Insurance companies, including State Farm, often use credit-based insurance scores to assess the risk associated with insuring a particular individual. A higher credit score may result in lower insurance premiums, as it indicates a lower risk of financial loss for the insurer.

Discounts and Bundling

State Farm offers various discounts that can help lower your insurance premiums. These discounts may be available for:

- Bundling multiple insurance policies (e.g., auto and home insurance) with State Farm.

- Having safety features like smoke detectors, fire extinguishers, and burglar alarms installed in your home.

- Being a loyal State Farm customer for multiple years.

- Being a member of certain organizations or associations.

- Having a home built with fire-resistant materials or located in a community with fire protection services.

The State Farm Quote Process

Obtaining a homeowners insurance quote from State Farm is a straightforward process. You can choose to request a quote online, over the phone, or by visiting a local State Farm agent. During the quote process, you’ll be asked to provide information about your home, its location, your desired coverage limits, and any applicable discounts.

Online Quote

State Farm’s online quote tool is user-friendly and provides a convenient way to obtain a preliminary quote. You’ll be guided through a series of questions about your home and coverage preferences. Once you’ve completed the online form, you’ll receive an estimated quote that you can review and customize further if needed.

Phone Quote

If you prefer a more personalized approach, you can call State Farm’s customer service hotline and speak with a representative. They will ask you a series of questions to gather the necessary information for your quote and can provide guidance on choosing the right coverage limits and policy options.

In-Person Quote

Meeting with a local State Farm agent allows for a face-to-face discussion of your insurance needs. The agent can provide expert advice based on your specific circumstances and help you understand the various coverage options and potential discounts available. They can also assist with any questions or concerns you may have about the quote process or your insurance coverage.

Comparing Quotes and Making a Decision

Once you’ve obtained quotes from State Farm and potentially other insurance providers, it’s essential to compare them carefully. Consider not only the cost of the premiums but also the coverage limits, deductibles, and any additional benefits or perks offered by each policy. Ensure that you’re comparing apples to apples by evaluating policies with similar coverage levels.

Working with an Independent Insurance Agent

If you’re unsure about which insurance provider to choose or need assistance understanding the nuances of different policies, working with an independent insurance agent can be beneficial. These agents work with multiple insurance companies, including State Farm, and can provide unbiased advice and help you find the best policy to meet your needs at a competitive price.

Reviewing Your Policy Annually

It’s a good practice to review your homeowners insurance policy annually to ensure it continues to meet your needs. Your circumstances may change over time, and your policy should reflect those changes. Regular policy reviews can help you identify potential gaps in coverage or opportunities to save money on your premiums.

Conclusion

Obtaining a State Farm homeowners insurance quote is a critical step in ensuring the financial protection of your home and belongings. By understanding the factors that influence your insurance quote and taking advantage of available discounts, you can find a policy that provides the coverage you need at a competitive price. Whether you choose to work with a State Farm agent or an independent insurance professional, taking the time to review and compare your options can lead to significant savings and peace of mind.

How long does it take to get a State Farm homeowners insurance quote?

+The time it takes to receive a State Farm homeowners insurance quote can vary depending on the method you choose. Online quotes are typically available within minutes, while phone quotes may take slightly longer due to the personalized nature of the conversation. In-person quotes with a State Farm agent can take a bit more time, but they offer the benefit of immediate discussion and clarification.

Can I customize my State Farm homeowners insurance policy after receiving a quote?

+Absolutely! State Farm’s quote process is designed to provide a preliminary estimate based on your initial inputs. After receiving your quote, you can customize your policy further by adjusting coverage limits, deductibles, and optional endorsements. This allows you to tailor your policy to your specific needs and budget.

What factors determine if I’m eligible for State Farm’s homeowners insurance discounts?

+State Farm offers a variety of discounts based on factors such as your home’s safety features, loyalty to State Farm, and membership in certain organizations. To determine your eligibility for these discounts, you’ll need to provide specific details about your home and personal circumstances during the quote process. A State Farm agent can guide you through the various discount options and help you maximize your savings.

How can I get the most accurate State Farm homeowners insurance quote?

+To ensure the accuracy of your State Farm homeowners insurance quote, provide as much detailed information as possible about your home and its location, including its size, construction materials, and any recent renovations. Be transparent about your claims history and credit score, as these factors can significantly impact your quote. Additionally, consider discussing your specific needs and concerns with a State Farm agent, who can help you fine-tune your coverage and ensure you receive an accurate quote.