Real Cheap Car Insurance

Finding affordable car insurance can be a challenging task, especially with the numerous factors that influence premiums. However, with the right knowledge and strategies, it is possible to secure real cheap car insurance without compromising on coverage. In this comprehensive guide, we will explore the various aspects of car insurance, uncover hidden costs, and provide expert tips to help you obtain the best rates available.

Understanding Car Insurance Costs

Car insurance is an essential financial protection for vehicle owners, covering a range of potential risks and liabilities. The cost of car insurance varies significantly based on several factors, including the type of coverage, the insured’s driving history, the make and model of the vehicle, and even the location. Understanding these factors is crucial in navigating the insurance market and finding the most affordable options.

Types of Car Insurance Coverage

There are primarily three types of car insurance coverage: liability, collision, and comprehensive. Liability insurance covers the costs associated with bodily injury and property damage caused to others in an accident for which you are at fault. Collision insurance covers the repair or replacement of your vehicle after an accident, regardless of fault. Comprehensive insurance provides coverage for non-collision incidents such as theft, vandalism, and natural disasters.

The type of coverage you choose will impact your premium. For instance, opting for higher liability limits or adding comprehensive and collision coverage can increase your costs. However, these additional coverages provide valuable protection against unexpected events.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage to others |

| Collision | Covers damage to your vehicle in an accident |

| Comprehensive | Covers non-collision incidents like theft or natural disasters |

Factors Influencing Insurance Rates

Insurance companies consider a multitude of factors when determining your premium. Here are some key elements that can impact your car insurance costs:

- Driving History: A clean driving record with no accidents or traffic violations can lead to lower insurance rates. Conversely, a history of accidents or moving violations may result in higher premiums.

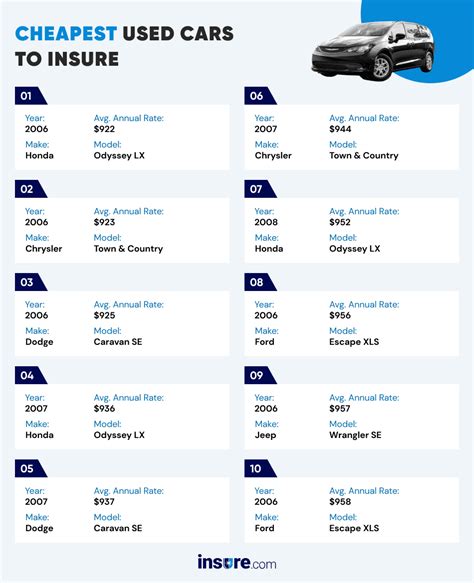

- Vehicle Type and Age: The make, model, and age of your vehicle play a significant role. Newer, more expensive cars often carry higher insurance costs due to their replacement value. Additionally, certain vehicle types, like sports cars or SUVs, may be considered higher risk and thus cost more to insure.

- Location: Your geographical location is a critical factor. Areas with higher crime rates, dense traffic, or a history of natural disasters may have higher insurance premiums.

- Credit Score: Surprisingly, your credit score can impact your insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a particular individual. A higher credit score may lead to lower premiums.

- Discounts and Bundles: Insurers often offer discounts for various reasons, such as safe driving, having multiple policies with the same company, or being a loyal customer. Bundling your car insurance with other policies like homeowners or renters insurance can also result in significant savings.

Strategies to Get Real Cheap Car Insurance

Now that we have a solid understanding of the factors influencing car insurance costs, let’s explore some effective strategies to secure real cheap car insurance without sacrificing coverage.

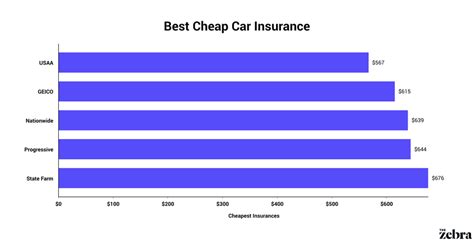

Shop Around and Compare

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple insurers. Each insurance company uses its own formula to calculate premiums, so rates can vary significantly. Use online quote comparison tools or directly contact insurers to get multiple quotes.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional benefits or discounts offered. Ensure that you are comparing similar coverage options to make an accurate assessment of the best value.

Improve Your Driving Record

Your driving history is a critical factor in determining your insurance rates. A clean driving record can lead to significant savings. If you have a history of accidents or violations, consider taking a defensive driving course or enrolling in a safe driving program. Many insurers offer discounts for completing such courses, and it can also help improve your driving skills and reduce the likelihood of future accidents.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you are essentially agreeing to bear more of the financial responsibility in the event of an accident. While this strategy can lead to lower premiums, ensure that you can afford the higher deductible in the event of a claim.

Explore Discounts and Bundles

Insurance companies offer a variety of discounts to attract and retain customers. Some common discounts include safe driver discounts, multi-policy discounts (for bundling car insurance with other policies), good student discounts (for young drivers with good grades), and loyalty discounts (for long-term customers). Ask your insurer about the discounts they offer and see if you qualify for any of them.

Additionally, consider bundling your car insurance with other policies, such as homeowners or renters insurance. Many insurers offer substantial discounts for bundling multiple policies, making it a cost-effective way to secure insurance coverage.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. A good credit score demonstrates financial responsibility and can lead to lower premiums. Work on improving your credit score by paying your bills on time, reducing debt, and maintaining a healthy credit history. A higher credit score not only benefits your insurance rates but also opens up opportunities for better financial products and services.

Review and Adjust Your Coverage

Regularly review your car insurance policy to ensure it aligns with your current needs and circumstances. Over time, your life and financial situation may change, and your insurance coverage should reflect these changes. For instance, if you have paid off your car loan, you may no longer need collision or comprehensive coverage, as these coverages primarily protect the lender’s interest.

Additionally, consider adjusting your coverage limits. If you have been accident-free for several years, you may be able to lower your liability limits and save on premiums. However, ensure that you maintain adequate coverage to protect your assets in the event of a significant accident.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is a relatively new concept that uses telematics to track your driving behavior and reward safe driving habits. Insurers offer these programs to encourage safer driving and provide customized insurance rates based on your actual driving habits.

With usage-based insurance, your premium is calculated based on factors like the number of miles driven, the time of day you drive, and your driving behavior (such as sudden braking or rapid acceleration). If you are a safe and cautious driver, this type of insurance can result in significant savings.

Real-World Examples of Affordable Car Insurance

To further illustrate the strategies for obtaining real cheap car insurance, let’s explore some real-world examples of affordable insurance policies and the factors that influenced their cost.

Example 1: John’s Affordable Policy

John, a 30-year-old professional, recently purchased a new car and was looking for affordable insurance. He started by comparing quotes from multiple insurers and found that rates varied significantly. He then focused on improving his driving record by taking a defensive driving course, which led to a substantial discount on his insurance premium.

Additionally, John opted for a higher deductible to lower his premiums further. He also bundled his car insurance with his homeowners insurance, resulting in an additional discount. By implementing these strategies, John was able to secure a comprehensive insurance policy with liability limits of $100,000/$300,000/$50,000 and a $1,000 deductible for an annual premium of $850.

Example 2: Sarah’s Savings with Usage-Based Insurance

Sarah, a 25-year-old student, wanted to save on her car insurance while maintaining adequate coverage. She enrolled in a usage-based insurance program offered by her insurer. By driving cautiously and avoiding high-risk behaviors, Sarah qualified for significant savings. Her premium was based on her actual driving habits, and she received a 20% discount on her insurance, resulting in an annual premium of 600 for liability coverage of 50,000/100,000/25,000 and a $500 deductible.

The Future of Affordable Car Insurance

As the insurance industry continues to evolve, new technologies and innovative strategies are shaping the future of affordable car insurance. Here are some trends and developments to watch out for:

Telematics and Usage-Based Insurance

Usage-based insurance is gaining popularity, and its impact on affordable insurance is significant. With the increasing adoption of telematics and advanced driving behavior tracking technologies, insurers can offer more precise and personalized insurance rates. This trend is likely to continue, providing opportunities for safe drivers to save on their insurance premiums.

AI and Data Analytics

Artificial intelligence (AI) and data analytics are transforming the insurance industry. Insurers are using advanced analytics to better understand risk factors and price insurance policies more accurately. By leveraging AI and data, insurers can offer more competitive rates and provide personalized coverage options to meet individual needs.

Digital Transformation

The digital transformation of the insurance industry is making it easier and more convenient for consumers to compare and purchase insurance policies online. Insurers are investing in digital platforms and mobile apps to streamline the insurance shopping and purchasing process. This increased accessibility and competition can drive down insurance costs and provide consumers with more affordable options.

Pay-Per-Mile Insurance

Pay-per-mile insurance is an emerging concept where drivers pay insurance premiums based on the actual miles driven. This model can be particularly beneficial for low-mileage drivers, as they only pay for the coverage they need. As this concept gains traction, it has the potential to provide affordable insurance options for those who drive infrequently.

Conclusion

Securing real cheap car insurance is within reach with the right knowledge and strategies. By understanding the factors that influence insurance rates and implementing the expert tips outlined in this guide, you can find affordable insurance coverage without compromising on quality. Remember to shop around, compare quotes, and explore the various discounts and coverage options available. Stay informed about the latest trends and developments in the insurance industry to take advantage of emerging opportunities for affordable car insurance.

How often should I review my car insurance policy?

+It is recommended to review your car insurance policy annually or whenever your circumstances change significantly. Regular reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage.

Can I negotiate my car insurance premium?

+While car insurance premiums are typically set based on a formula, you can negotiate with your insurer to some extent. Highlight your safe driving record, loyalty to the company, or any other factors that may qualify you for a discount. Negotiating can be especially effective when shopping for a new insurance policy.

What is the difference between liability and comprehensive coverage?

+Liability coverage protects you against claims for bodily injury and property damage to others if you are at fault in an accident. Comprehensive coverage, on the other hand, provides protection for your vehicle in non-collision incidents such as theft, vandalism, or natural disasters. It covers the cost of repairing or replacing your vehicle in these scenarios.