Rate For Term Life Insurance

When considering term life insurance, understanding the associated rates is crucial for making informed decisions about coverage. Term life insurance offers a cost-effective way to protect your loved ones during a specified term, typically ranging from 10 to 30 years. The rates for term life insurance are determined by various factors, including age, health status, lifestyle choices, and the amount of coverage desired. Let's delve into the intricacies of term life insurance rates and explore how they can impact your financial planning.

Understanding Term Life Insurance Rates

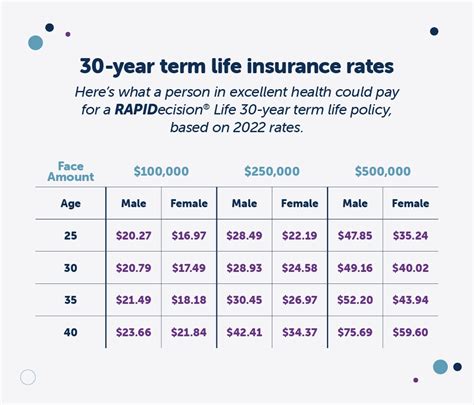

Term life insurance rates are the premiums you pay to secure coverage for a defined period. These rates are typically calculated based on the insurer’s assessment of the risk associated with insuring you. The younger and healthier you are, the lower the rates tend to be, as the insurer assumes a lower likelihood of paying out a claim during the term.

The rates for term life insurance can vary significantly between different insurance providers. It's essential to shop around and compare quotes to find the most competitive rates for your specific circumstances. Factors such as the insurer's financial strength, underwriting practices, and the type of policy you choose can influence the rates you're offered.

Key Factors Affecting Term Life Insurance Rates

- Age: One of the most significant factors in determining term life insurance rates is your age. Generally, younger individuals are offered lower rates as they are less likely to require a payout during the term. As you age, the rates tend to increase, reflecting the higher risk associated with insuring older individuals.

- Health Status: Your overall health plays a crucial role in setting the rates for term life insurance. Insurers will typically require a medical exam or review your medical records to assess your health. Factors like pre-existing conditions, family medical history, and lifestyle habits (such as smoking or excessive alcohol consumption) can impact the rates you’re offered.

- Lifestyle and Occupation: Certain lifestyle choices and occupations can influence term life insurance rates. High-risk activities like skydiving or dangerous occupations like firefighting may result in higher rates. Insurers consider these factors to assess the likelihood of a potential claim.

- Coverage Amount: The amount of coverage you desire is directly linked to the rates you’ll pay. Higher coverage amounts generally result in higher premiums. It’s essential to strike a balance between the coverage you need and the rates you’re comfortable paying.

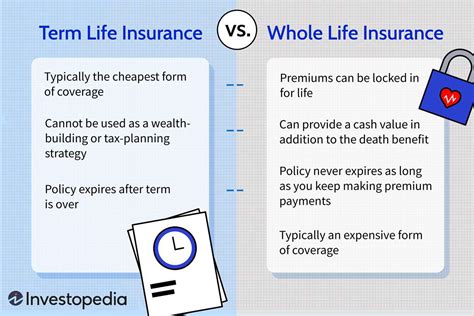

- Policy Type: Different types of term life insurance policies have varying rates. Level term policies, where the premium remains constant throughout the term, are a popular choice. However, other types like decreasing term policies (where the coverage amount decreases over time) or renewable term policies (where you can renew the policy at the end of the term) may have different rate structures.

| Factor | Impact on Rates |

|---|---|

| Age | Younger individuals enjoy lower rates; rates increase with age. |

| Health Status | Good health leads to lower rates; pre-existing conditions or unhealthy habits may result in higher rates. |

| Lifestyle and Occupation | High-risk activities or occupations can increase rates. |

| Coverage Amount | Higher coverage amounts typically result in higher premiums. |

| Policy Type | Different policy types have varying rate structures. |

💡 It's important to note that while term life insurance rates are influenced by these factors, individual circumstances can lead to variations in the rates offered. Shopping around and obtaining multiple quotes can help you find the best rates tailored to your specific needs.

Analyzing Term Life Insurance Rates: A Case Study

To illustrate the impact of these factors on term life insurance rates, let’s consider a hypothetical case study involving two individuals: John and Sarah.

John’s Scenario

Age: John is a 35-year-old non-smoker with no significant health issues.

Health Status: He maintains a healthy lifestyle, exercises regularly, and has a clean medical history.

Lifestyle and Occupation: John works as an accountant and does not engage in any high-risk activities.

Coverage Amount: He seeks $500,000 in coverage to provide financial security for his family.

Policy Type: John opts for a level term policy with a 20-year term.

Based on these factors, John can expect to receive competitive term life insurance rates due to his healthy lifestyle, young age, and absence of high-risk factors.

Sarah’s Scenario

Age: Sarah is a 45-year-old smoker with a history of high blood pressure.

Health Status: She has managed her blood pressure with medication, but smoking remains a concern.

Lifestyle and Occupation: Sarah works as a chef and occasionally engages in cooking competitions, which involve some physical risks.

Coverage Amount: She aims to secure $300,000 in coverage to protect her family’s financial well-being.

Policy Type: Sarah chooses a renewable term policy with a 10-year term.

Given Sarah’s age, smoking habit, and health concerns, her term life insurance rates are likely to be higher compared to John’s. However, the renewable policy type allows her to renew the coverage at the end of the term, providing flexibility and continued protection.

Maximizing Value: Strategies for Affordable Term Life Insurance

While term life insurance rates are influenced by various factors beyond your control, there are strategies you can employ to potentially reduce the cost of your coverage.

Tips for Lowering Term Life Insurance Rates

- Improve Your Health: Maintaining a healthy lifestyle and managing any existing health conditions can positively impact your rates. Regular exercise, a balanced diet, and quitting smoking can lead to lower premiums.

- Compare Multiple Quotes: Shopping around and comparing quotes from different insurers is essential. Each insurer has its own underwriting criteria, and you may find more favorable rates by exploring various options.

- Choose the Right Coverage Amount: Assess your financial needs and determine the appropriate coverage amount. Overestimating your needs can result in higher premiums, so strike a balance that provides adequate protection without excessive costs.

- Consider Group Policies: Some employers offer group life insurance policies, which can provide coverage at a discounted rate. Exploring these options can be a cost-effective way to secure term life insurance.

- Bundle with Other Insurance Policies: Insurers often offer discounts when you bundle multiple insurance policies, such as auto and home insurance with your term life insurance. Bundling can lead to savings on your overall insurance costs.

The Future of Term Life Insurance Rates

The landscape of term life insurance rates is constantly evolving. As technology advances and insurers gain access to more data, they can refine their underwriting processes and risk assessment models. This may lead to more accurate and personalized rates, taking into account a broader range of factors.

Additionally, the rise of insurtech startups and digital insurance platforms is transforming the industry. These innovative companies are leveraging technology to streamline the insurance process, reduce administrative costs, and offer more competitive rates. As the industry adapts to these changes, consumers can expect greater accessibility and affordability in term life insurance coverage.

Conclusion

Understanding the factors that influence term life insurance rates is crucial for making informed decisions about your financial protection. By considering your age, health status, lifestyle choices, and coverage needs, you can navigate the term life insurance market effectively and secure the coverage you require at a competitive rate. Remember to shop around, compare quotes, and explore the various strategies available to maximize the value of your term life insurance policy.

Frequently Asked Questions

How often do term life insurance rates change?

+Term life insurance rates are typically locked in for the duration of the policy term. However, if you choose a renewable or convertible policy, the rates may adjust when you renew or convert the policy.

Can I negotiate term life insurance rates with insurers?

+While negotiating rates directly with insurers is uncommon, you can leverage the power of competition by obtaining multiple quotes. This allows you to compare rates and potentially find better deals.

Are term life insurance rates affected by gender or marital status?

+In many jurisdictions, insurers are prohibited from using gender or marital status as a factor in determining term life insurance rates. However, it’s always advisable to check the specific regulations in your region.

What happens if my health status changes during the term of my policy?

+If your health status significantly deteriorates during the term, you may need to reassess your coverage needs and consider updating your policy. However, it’s important to note that any changes in health status may impact future rates or eligibility for coverage.

Can I switch term life insurance policies if I find better rates elsewhere?

+Yes, you have the freedom to switch term life insurance policies if you find more favorable rates or terms elsewhere. However, ensure you carefully review the new policy’s terms and conditions to avoid any unexpected surprises.