Insurance Quote California

When it comes to insurance, obtaining accurate and reliable quotes is a crucial step in ensuring you have the right coverage for your needs. In the state of California, known for its diverse landscape and vibrant communities, understanding the insurance landscape is essential. This article aims to provide an in-depth analysis of the insurance quote process in California, offering valuable insights and expert guidance.

Understanding Insurance Quotes in California

Insurance quotes in California are tailored to meet the unique needs and requirements of residents and businesses. Whether you’re seeking auto, home, health, or business insurance, the process of obtaining a quote involves a comprehensive assessment of various factors. From driver profiles and property locations to healthcare needs and business risks, each quote is designed to provide an accurate representation of the coverage and costs involved.

Factors Influencing Insurance Quotes

Several key factors influence the insurance quote process in California. These include:

- Location: The specific area or region within California where you reside or operate your business plays a significant role. Different locations may have varying levels of risk, such as natural disasters, crime rates, or traffic congestion, which can impact insurance premiums.

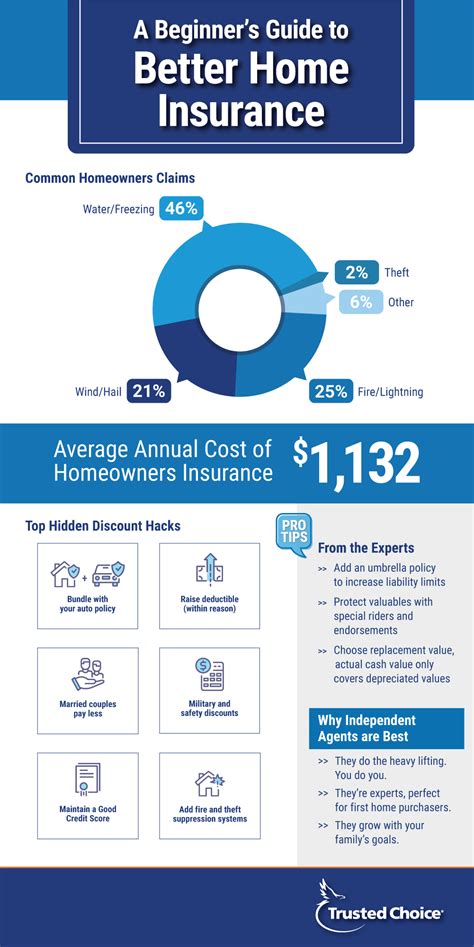

- Coverage Requirements: The type and extent of coverage you require will impact your insurance quote. For instance, auto insurance quotes will consider factors like the make and model of your vehicle, your driving record, and the coverage limits you choose. Similarly, home insurance quotes will assess the value of your property, its location, and any additional coverage options you select.

- Personal or Business Profile: Your individual or business profile is a critical factor. This includes your age, gender, marital status, and credit history for personal insurance quotes. For business insurance, factors such as industry, size, and revenue can influence the quote.

- Claim History: A clean claim history can work in your favor when obtaining insurance quotes. Insurers often reward customers with a good claim record by offering more favorable rates, as it indicates a lower risk profile.

- Discounts and Bundling: Taking advantage of discounts and bundling options can significantly impact your insurance costs. Many insurers offer discounts for multiple policies, safe driving or business practices, or even for belonging to certain organizations or associations.

The Insurance Quote Process: A Step-by-Step Guide

Obtaining an insurance quote in California typically involves the following steps:

- Assess Your Needs: Begin by evaluating your specific insurance needs. Are you seeking auto, home, health, or business insurance? Consider the level of coverage you require and any additional options you may need.

- Gather Relevant Information: Collect all necessary information, such as your driver’s license number, vehicle registration, home value estimates, business revenue data, or health insurance details. Having this information readily available will streamline the quote process.

- Choose Reputable Insurers: Select a few reputable insurance companies or brokers in California. Research their reputation, customer reviews, and the range of coverage options they offer. Consider factors like financial stability and customer service ratings.

- Request Quotes: Contact the chosen insurers or brokers and request quotes. Provide them with the relevant information and specify the coverage limits and options you desire. Be prepared to answer questions and provide additional details to ensure an accurate quote.

- Compare Quotes: Once you have received quotes from multiple sources, take the time to compare them. Look at the coverage details, premiums, deductibles, and any additional benefits or exclusions. Ensure you are comparing similar coverage options to make an informed decision.

- Negotiate and Finalize: If you find a quote that aligns with your needs and budget, consider negotiating with the insurer. Discuss any discounts or bundling options they may offer. Once you are satisfied with the terms, finalize the quote and proceed with the application process.

Expert Tips and Insights for Optimizing Your Insurance Quote

Here are some valuable tips and insights from industry experts to help you navigate the insurance quote process in California:

Utilize Online Tools and Resources

Many insurance companies in California offer online quote tools and resources. These tools allow you to input your information and instantly receive personalized quotes. While online quotes provide a convenient starting point, it’s essential to follow up with a licensed insurance professional to ensure you receive the most accurate and comprehensive assessment of your needs.

Understand Your Coverage Options

Take the time to understand the various coverage options available to you. Whether it’s auto, home, health, or business insurance, each type of coverage comes with specific benefits and limitations. Educate yourself about the different policy types, deductibles, and coverage limits to make informed decisions during the quote process.

Consider Bundle Discounts

Bundling your insurance policies can lead to significant savings. Many insurers in California offer discounts when you combine multiple policies, such as auto and home insurance or business property and liability coverage. By bundling, you not only save money but also streamline your insurance management.

Maintain a Clean Claim History

A clean claim history is an asset when it comes to insurance quotes. Insurers view customers with a history of responsible claims management as lower risk, which can result in more favorable rates. Strive to maintain a positive claim record by practicing safe driving, maintaining your property, and implementing risk-mitigation measures in your business operations.

Seek Professional Advice

Consulting with a licensed insurance broker or agent can provide valuable insights and guidance. These professionals have extensive knowledge of the California insurance market and can offer personalized advice based on your specific needs. They can help you navigate complex coverage options, identify potential risks, and negotiate the best terms for your insurance policies.

Regularly Review and Update Your Policies

Insurance needs can evolve over time. Regularly review your policies to ensure they align with your current circumstances and requirements. Life changes such as marriage, the birth of a child, purchasing a new home, or expanding your business can impact your insurance needs. Stay proactive and update your policies accordingly to maintain adequate coverage.

The Future of Insurance Quotes in California

The insurance landscape in California is continuously evolving, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of insurance quotes in the Golden State:

Digital Transformation

The insurance industry in California is embracing digital transformation. Insurers are investing in innovative technologies, such as artificial intelligence and machine learning, to enhance the quote process. Expect to see more streamlined online platforms, personalized recommendations, and real-time quote adjustments based on your unique circumstances.

Telematics and Usage-Based Insurance

Telematics, the use of technology to monitor vehicle usage and driving behavior, is gaining traction in the auto insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer personalized premiums based on actual driving habits. This technology provides an accurate assessment of risk and can lead to more affordable insurance options for safe drivers.

Data Analytics and Risk Assessment

Advanced data analytics and risk assessment tools are transforming the way insurers evaluate quotes. By analyzing vast amounts of data, insurers can more accurately predict risks and tailor coverage options to individual needs. This shift towards data-driven decision-making ensures that insurance quotes are fair and reflective of the actual risks faced by policyholders.

Personalized Insurance Solutions

The future of insurance quotes in California lies in personalized solutions. Insurers are recognizing the value of offering tailored coverage options to meet the unique needs of individuals and businesses. Whether it’s customized auto insurance packages for specific professions or tailored health insurance plans for different lifestyles, the focus is on providing coverage that aligns with each customer’s circumstances.

Collaborative Insurance Models

Collaborative insurance models, where insurers work closely with customers to identify and mitigate risks, are gaining popularity. By actively involving policyholders in the risk assessment process, insurers can offer more accurate quotes and provide valuable insights for risk reduction. This collaborative approach fosters a stronger relationship between insurers and their customers.

Conclusion

Obtaining an insurance quote in California is a critical step towards securing the right coverage for your needs. By understanding the factors that influence quotes, following a structured process, and seeking expert advice, you can navigate the insurance landscape with confidence. As the insurance industry continues to evolve, embracing digital transformation and personalized solutions, the future of insurance quotes in California promises enhanced accuracy, affordability, and customer-centricity.

How often should I review and update my insurance policies in California?

+It is recommended to review your insurance policies annually or whenever significant life changes occur. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

Can I negotiate insurance quotes in California?

+Absolutely! Negotiating insurance quotes is a common practice. By discussing your specific needs and circumstances with insurers, you can often secure more favorable terms and discounts.

What are some common discounts available for insurance in California?

+Common discounts in California include multi-policy discounts (bundling), safe driver or good student discounts, loyalty discounts, and discounts for belonging to certain organizations or associations. It’s worth exploring these options with your insurer.

How do I find reputable insurance companies in California?

+You can research reputable insurance companies by checking their financial stability ratings, reading customer reviews, and seeking recommendations from trusted sources. Additionally, the California Department of Insurance provides valuable resources and guidance.