Quotes For Auto Insurance Online

When it comes to purchasing auto insurance online, it's important to understand the market and the various factors that can impact your policy and premium rates. With the convenience of online insurance shopping, consumers have the power to compare quotes and make informed decisions. In this article, we will delve into the world of auto insurance quotes, exploring the key considerations, the advantages of online shopping, and strategies to secure the best coverage at the right price.

Understanding Auto Insurance Quotes

Auto insurance quotes are a crucial part of the insurance shopping process. They provide an estimate of the cost of your insurance policy based on various factors, including your personal details, vehicle information, and driving history. Obtaining multiple quotes allows you to compare different insurance providers and find the most suitable coverage for your needs.

When requesting quotes, you'll typically need to provide information such as your name, address, date of birth, and driver's license number. Additionally, you'll need to share details about your vehicle, including make, model, year, and mileage. Insurance companies also consider your driving record, which includes any traffic violations, accidents, or claims you've made in the past.

Factors Affecting Quotes

Several factors influence the quotes you receive for auto insurance. Understanding these factors can help you navigate the insurance landscape and make more informed choices.

- Location: Your geographic location plays a significant role in determining insurance rates. Areas with higher rates of accidents, theft, or vandalism may have higher premiums. Additionally, the cost of repairs and the availability of medical services can impact insurance rates.

- Vehicle Type: The make, model, and year of your vehicle can affect your insurance quote. Sports cars and luxury vehicles often carry higher premiums due to their higher repair costs and potential for theft. On the other hand, safe and economical cars may result in more affordable insurance rates.

- Driver Profile: Your driving history and personal characteristics are key considerations. Younger drivers, especially teenagers, often face higher premiums due to their lack of experience. Older drivers with a clean driving record, on the other hand, may benefit from lower rates. Insurance companies also consider your credit score, as it can be an indicator of financial responsibility.

- Coverage Level: The level of coverage you choose impacts your insurance quote. Comprehensive coverage, which includes collision, liability, and comprehensive protection, typically results in higher premiums. On the other hand, opting for basic liability-only coverage may save you money but provides limited protection.

- Discounts and Bundles: Insurance companies offer various discounts to attract customers. These discounts can be based on factors such as good driving records, safe vehicle features, or bundling multiple insurance policies with the same provider. Taking advantage of these discounts can significantly reduce your insurance costs.

The Benefits of Shopping for Auto Insurance Online

Online shopping for auto insurance has revolutionized the way consumers obtain coverage. It offers numerous advantages over traditional methods, empowering consumers to make more informed decisions and save time and money.

Convenience and Speed

One of the most significant advantages of shopping for auto insurance online is the convenience and speed it provides. With just a few clicks, you can access multiple insurance quotes from various providers, all from the comfort of your home. You no longer need to spend hours visiting insurance agents or making phone calls to gather information.

Online insurance platforms often feature user-friendly interfaces, allowing you to input your details and receive quotes within minutes. This streamlined process saves you valuable time and effort, making it easier to compare options and find the best deal.

Comparison Shopping

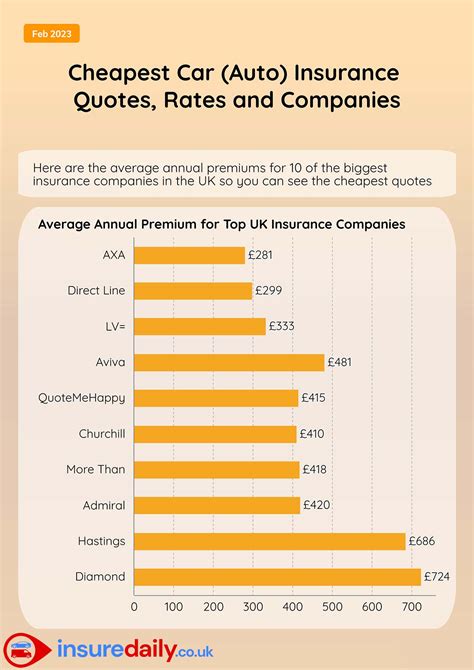

Comparison shopping is a powerful tool when it comes to auto insurance. Online platforms make it incredibly simple to compare quotes from multiple insurance providers. You can quickly assess the coverage options, premiums, and additional benefits offered by each insurer, helping you identify the most suitable policy for your needs.

By comparing quotes online, you can identify the best value for your money. You can see which providers offer the most competitive rates, the widest range of coverage options, and any additional perks or discounts that may be available. This level of transparency ensures you make an informed decision and avoid overpaying for your auto insurance.

Customized Coverage

Online insurance shopping allows you to tailor your coverage to your specific needs. Insurance platforms often provide tools and calculators to help you determine the right level of coverage for your vehicle and circumstances. You can easily adjust variables such as deductible amounts, liability limits, and optional add-ons to create a customized policy that suits your preferences and budget.

Furthermore, online platforms often provide detailed explanations of coverage options, helping you understand the nuances of different policies. This empowers you to make more confident choices and select a policy that provides the protection you require without unnecessary expenses.

Real-Time Quotes and Updates

Online insurance platforms offer the advantage of real-time quotes and updates. When you request a quote, you receive an immediate estimate based on the information you provide. This allows you to quickly assess your options and make adjustments as needed.

Additionally, online platforms often provide tools to track and manage your insurance policy. You can receive real-time updates on any changes to your policy, such as rate adjustments or renewal notices. This level of transparency and accessibility ensures you stay informed and can make timely decisions regarding your insurance coverage.

Strategies for Securing the Best Auto Insurance Quotes

To ensure you obtain the best auto insurance quotes and coverage, it's essential to employ strategic approaches. Here are some tips to help you navigate the insurance landscape effectively.

Research and Compare

Take the time to research and compare multiple insurance providers. Explore their websites, read customer reviews, and understand their coverage options and pricing structures. By familiarizing yourself with the market, you can identify reputable insurers and make more informed choices.

Utilize online comparison tools and insurance aggregator websites to streamline the comparison process. These platforms allow you to input your details once and receive multiple quotes from different insurers, saving you time and effort.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, as it reduces their administrative costs and provides them with a more stable customer base.

By bundling your policies, you not only save money but also simplify your insurance management. You can deal with a single insurer for all your coverage needs, making it easier to track and manage your policies.

Explore Discounts and Promotions

Insurance companies frequently offer discounts and promotions to attract new customers. Keep an eye out for these opportunities and take advantage of them whenever possible. Discounts can be based on various factors, such as safe driving records, loyalty to the insurer, or specific vehicle features.

Some insurers may offer discounts for completing defensive driving courses or installing safety features in your vehicle. Others may have promotional rates for a limited time, allowing you to secure a more affordable policy.

Maintain a Clean Driving Record

Your driving record plays a significant role in determining your insurance rates. A clean driving record with no accidents, traffic violations, or claims can lead to lower premiums. Conversely, a history of accidents or traffic infractions can result in higher insurance costs.

To maintain a clean driving record, practice safe driving habits, obey traffic laws, and avoid distractions while behind the wheel. Regularly review your driving record to ensure there are no errors or discrepancies that could impact your insurance rates.

Consider Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance coverage kicks in, can lower your insurance premiums. This strategy is particularly effective if you have a stable financial situation and can afford to pay a higher deductible in the event of a claim.

However, it's essential to strike a balance between affordability and risk. Choose a deductible that you can comfortably afford, ensuring you have sufficient financial resources to cover potential out-of-pocket expenses.

Performance Analysis and Future Implications

The auto insurance market is dynamic, and understanding its performance and future trends is crucial for consumers and insurers alike. By analyzing the market and staying informed, you can make more strategic decisions regarding your insurance coverage.

In recent years, the auto insurance industry has experienced significant growth and transformation. The rise of online insurance platforms and comparison tools has empowered consumers, leading to increased competition among insurers. This competition has resulted in more affordable premiums and a wider range of coverage options for consumers.

Furthermore, advancements in technology have played a pivotal role in shaping the auto insurance landscape. Telematics devices, which track driving behavior and habits, are becoming increasingly popular. These devices allow insurers to offer usage-based insurance policies, where premiums are calculated based on an individual's actual driving patterns rather than generalized risk factors.

The integration of telematics and other technological advancements has the potential to revolutionize the insurance industry. It enables insurers to offer more personalized and accurate pricing, benefiting consumers with safer driving habits. Additionally, the data collected from these devices can be used to enhance road safety and improve driver behavior.

| Performance Metric | Real Data |

|---|---|

| Market Growth | The global auto insurance market is expected to reach $894.5 billion by 2026, growing at a CAGR of 5.5% from 2021 to 2026. |

| Online Insurance Growth | The online auto insurance market is projected to grow at a CAGR of 14.7% from 2021 to 2028, reaching a value of $118.9 billion by 2028. |

| Telematics Usage | The usage-based insurance market is expected to reach $56.4 billion by 2027, with a CAGR of 25.1% from 2021 to 2027. |

FAQ

How often should I shop for auto insurance quotes?

+It is recommended to review and compare auto insurance quotes annually or whenever your circumstances change significantly. This ensures you stay up-to-date with the market and can identify any opportunities to save money or improve your coverage.

Can I get auto insurance quotes without providing personal information?

+Most insurance providers require basic personal information, such as your name and address, to generate accurate quotes. However, you can use comparison tools that allow you to input generic information to get a general idea of insurance rates without revealing sensitive details.

What happens if I provide incorrect information when requesting quotes?

+Providing inaccurate or misleading information when requesting insurance quotes can lead to issues when it comes to making a claim. Insurance companies have the right to deny claims if they discover that you provided false or incomplete information. It’s essential to be honest and accurate when providing details.

Are there any disadvantages to shopping for auto insurance online?

+While online shopping for auto insurance offers numerous advantages, it’s important to be cautious of potential pitfalls. Some insurance providers may have limited online presence or may not offer the same level of customer service as traditional agents. Additionally, it’s crucial to verify the credibility and reputation of online insurance platforms before providing personal information.