Property Insurance Insurance

Unveiling the Comprehensive Guide to Property Insurance: Protecting Your Assets

In the intricate world of insurance, property insurance stands as a cornerstone, offering crucial protection for one of life's most significant investments - your property. Whether it's your cherished home, commercial real estate, or valuable assets, understanding the nuances of property insurance is essential. This comprehensive guide delves deep into the realm of property insurance, shedding light on its intricacies and empowering you to make informed decisions about safeguarding your assets.

The Essence of Property Insurance: More Than Just a Policy

At its core, property insurance is a contract between an individual or business and an insurance provider. This contract promises financial reimbursement should your property suffer damage or loss due to unforeseen events. However, the beauty of property insurance lies in its versatility and the level of customization it offers. It's not a one-size-fits-all solution; rather, it's tailored to meet the unique needs of each policyholder.

Property insurance isn't merely about protecting your physical assets; it's about safeguarding your financial well-being. Imagine a scenario where your home, a sanctuary of memories and investments, faces unforeseen challenges like a fire, a storm, or even a burst pipe. Without adequate property insurance, the financial burden of repairing or rebuilding can be overwhelming. This is where property insurance steps in, providing a safety net to help you get back on your feet.

The Scope of Property Insurance: Beyond the Obvious

While the term "property insurance" often evokes images of homes and buildings, its scope is far more expansive. Property insurance encompasses a diverse range of assets, including:

- Residential Properties: From single-family homes to condominiums and apartments, property insurance provides a safety net against various risks.

- Commercial Real Estate: Businesses, too, require protection. Property insurance for commercial spaces covers a wide array of risks, from office buildings to retail stores.

- Landlord Insurance: For property owners renting out their spaces, landlord insurance offers coverage for rental properties, including tenant-related risks.

- Mobile Homes and Manufactured Housing: These unique living spaces require specialized insurance coverage to address their specific needs and vulnerabilities.

- Specialized Property: From barns and farms to vacation homes and rental properties, specialized property insurance caters to unique asset types.

Each of these property types has its own set of risks and challenges, and property insurance is designed to address these specific needs. Whether it's protecting your primary residence or a commercial venture, understanding the unique coverage requirements is key to effective risk management.

Understanding Coverage: A Comprehensive Approach

Property insurance coverage is not a one-size-fits-all proposition. It's tailored to meet the specific needs of the policyholder, taking into account factors like the type of property, its location, and the potential risks it faces. Let's delve into the key components of property insurance coverage:

Property Damage and Loss

This is the cornerstone of property insurance. It provides financial protection against damage or loss to your property caused by a range of perils, including:

- Fire

- Storms and Natural Disasters

- Theft and Burglary

- Vandalism

- Water Damage (including burst pipes and flooding)

The level of coverage varies based on the policy and the specific perils included. Some policies offer all-risk coverage, which protects against all perils except those specifically excluded, while others provide named-peril coverage, covering only the perils explicitly mentioned in the policy.

Liability Protection

Property insurance often includes liability coverage, which is crucial for protecting policyholders from financial liability in the event someone is injured on their property or their actions result in property damage. This coverage can include:

- Medical Payments: Covers the medical expenses of injured individuals, regardless of fault.

- Personal Liability: Provides financial protection if you're found legally responsible for someone else's injuries or property damage.

Additional Living Expenses

In the event your home becomes uninhabitable due to an insured peril, this coverage steps in. It reimburses you for the additional expenses incurred while you temporarily relocate, such as hotel stays, restaurant meals, and other necessary living costs.

Personal Property Coverage

Property insurance policies often include coverage for personal belongings within the insured property. This can include furniture, electronics, clothing, and other personal items. However, it's important to note that high-value items like jewelry, artwork, or collectibles may require additional coverage or endorsements.

Customizable Endorsements and Riders

To meet unique needs, property insurance policies often offer a range of endorsements or riders. These are additions or amendments to the policy that provide extra coverage for specific risks or assets. For instance, you might add an endorsement for flood insurance if your property is in a high-risk area.

Navigating Policy Options: A Personalized Approach

With a myriad of policy options available, choosing the right property insurance can be daunting. It's crucial to assess your specific needs and the unique risks your property faces. Here's a breakdown of some common policy types and considerations:

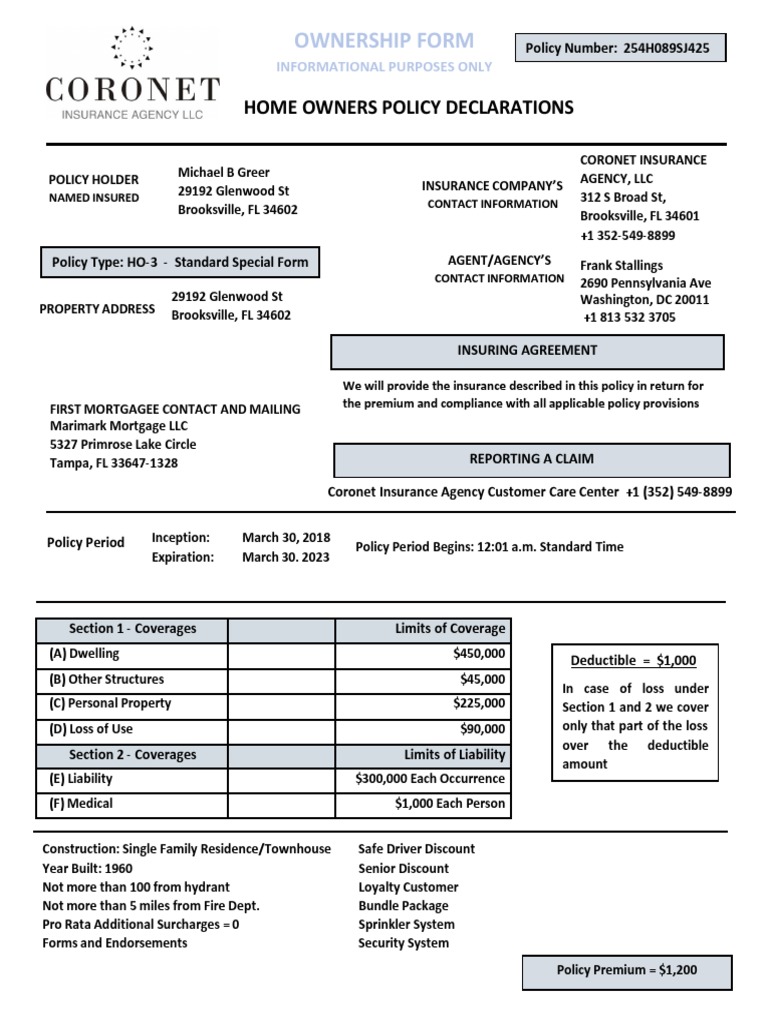

Homeowner's Insurance

Designed for residential properties, homeowner's insurance offers a comprehensive package covering the structure of your home, personal belongings, and liability. It's tailored to meet the needs of homeowners, providing peace of mind against a range of perils.

Condominium and Co-op Insurance

For those living in condominiums or co-ops, specific insurance policies are available. These policies consider the unique ownership structures and coverages, ensuring protection for both the unit and personal belongings.

Renter's Insurance

Renter's insurance is a vital consideration for individuals leasing their living spaces. It provides coverage for personal belongings and liability, offering protection against risks that standard lease agreements might not cover.

Landlord Insurance

Landlords face unique risks, and landlord insurance is tailored to meet these needs. It provides coverage for the building structure, liability, and loss of rental income in case tenants can't occupy the property due to an insured peril.

Mobile Home Insurance

Mobile homes and manufactured housing require specialized insurance. These policies address the unique risks and challenges associated with these types of properties, ensuring comprehensive protection.

Commercial Property Insurance

For businesses, commercial property insurance is essential. It covers a wide range of commercial properties, from offices and retail spaces to warehouses and factories. The coverage is tailored to meet the specific needs of the business, ensuring protection against various risks.

The Process of Claiming: A Step-by-Step Guide

Should the unfortunate occur and you need to file a claim, understanding the process is crucial. Here's a simplified guide to help you navigate the claim process:

Reporting the Claim

Contact your insurance provider as soon as possible after the incident. Provide detailed information about the claim, including the date, time, and nature of the loss or damage. Be prepared to answer questions and provide any relevant documentation.

Documentation and Evidence

Gather and document evidence of the loss or damage. This can include photographs, videos, repair estimates, and any other relevant documents. Ensure you keep a record of all expenses related to the incident.

Adjusting the Claim

An insurance adjuster will be assigned to assess your claim. They'll review the evidence, inspect the property (if necessary), and determine the extent of the damage. Based on their assessment, they'll calculate the amount of compensation you're entitled to under your policy.

Settlement and Payment

Once the adjuster has determined the value of your claim, they'll work with you to settle it. This may involve a direct payment, repairs or replacements, or a combination of both. Ensure you understand the settlement process and ask questions if needed.

Appealing the Decision

If you disagree with the adjuster's decision, you have the right to appeal. Review your policy and the adjuster's report, and gather any additional evidence to support your case. Contact your insurance provider to discuss your concerns and explore the appeals process.

The Future of Property Insurance: Technological Advancements and Trends

The landscape of property insurance is evolving, driven by technological advancements and changing consumer needs. Here's a glimpse into the future of property insurance:

Digital Transformation

Insurance providers are embracing digital technologies to enhance the customer experience. From online policy management to digital claim submission and real-time policy adjustments, technology is streamlining the insurance process.

Data Analytics and AI

Advanced data analytics and artificial intelligence are transforming risk assessment and underwriting processes. These technologies enable insurers to make more accurate predictions, personalize coverage, and offer competitive pricing.

Telematics and IoT

The Internet of Things (IoT) and telematics are revolutionizing insurance. By connecting devices and collecting real-time data, insurers can offer more precise coverage and even provide usage-based insurance, where premiums are based on actual usage and risk exposure.

Sustainability and Green Initiatives

With growing environmental concerns, property insurance is evolving to support sustainability efforts. Insurers are offering incentives for eco-friendly practices and incorporating green building standards into their policies.

Cyber Risk Coverage

As cyber threats become more prevalent, property insurance is adapting to include cyber risk coverage. This protects policyholders against financial losses resulting from cyber attacks, data breaches, and other digital risks.

Conclusion: Empowering Your Financial Future

Property insurance is more than just a policy; it's a commitment to safeguarding your financial well-being and protecting your most valuable assets. By understanding the intricacies of property insurance, you can make informed decisions, tailor coverage to your unique needs, and navigate the claim process with confidence. In an ever-changing world, property insurance provides the stability and security you need to thrive.

How much does property insurance typically cost?

+

The cost of property insurance varies widely based on factors such as the type of property, its location, the level of coverage, and the insurance provider. On average, homeowner’s insurance policies can range from a few hundred to a few thousand dollars annually. However, it’s important to note that the cost can be significantly influenced by the specific risks and coverage needs of your property.

What should I do if my property sustains damage?

+

In the event of property damage, it’s crucial to act promptly. First, ensure the safety of yourself and others. Then, contact your insurance provider as soon as possible to report the incident. Provide detailed information about the damage and any relevant documentation. Follow their guidance on the claim process, and work with them to assess and address the damage.

Are there any discounts available for property insurance?

+

Yes, many insurance providers offer discounts to encourage safe practices and reduce risks. These can include discounts for multiple policies (e.g., bundling home and auto insurance), security system discounts, loyalty discounts for long-term customers, and discounts for specific occupations or affiliations. It’s always worth inquiring about potential discounts when discussing your policy.

How often should I review my property insurance policy?

+

It’s recommended to review your property insurance policy annually, or whenever there are significant changes to your property or personal circumstances. This ensures your coverage remains adequate and up-to-date. Regular reviews can help you identify gaps in coverage, take advantage of any discounts, and make necessary adjustments to your policy.