How Much Is Health Insurance In California

Health insurance is a crucial aspect of healthcare coverage in the United States, and understanding the cost and coverage options is essential for individuals and families. In California, the health insurance landscape offers a range of plans and pricing structures, catering to the diverse needs of its residents. Let's delve into the specifics of health insurance costs in the Golden State, exploring the factors that influence premiums and the resources available to navigate this complex system.

The Cost of Health Insurance in California: Unraveling the Variables

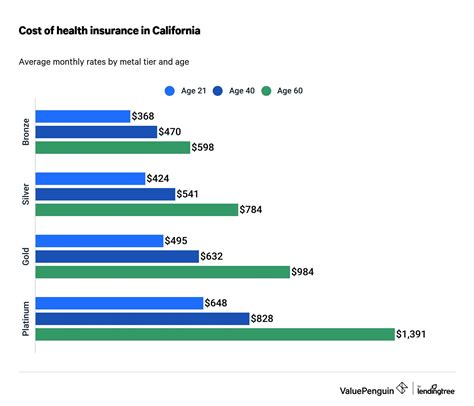

The price of health insurance in California is influenced by several key factors, each playing a significant role in determining the final premium. These factors include age, location, plan type, and the level of coverage desired. Additionally, the health status of the insured individual or family can impact the cost, with pre-existing conditions often requiring specialized plans or additional coverage.

Age and Premium Rates

Age is a critical factor in health insurance pricing, as it reflects the potential health risks associated with different life stages. In California, young adults aged 18 to 25 may find more affordable rates due to their generally lower health risks. However, as individuals age, premiums tend to increase, reflecting the higher likelihood of health issues and medical needs.

| Age Group | Average Premium Range (Monthly) |

|---|---|

| 18-25 | $250 - $400 |

| 26-35 | $300 - $500 |

| 36-50 | $400 - $700 |

| 51+ (Senior) | $600 - $1,000 |

It's important to note that these are approximate ranges, and actual premiums can vary significantly based on individual circumstances and the chosen plan.

Geographic Location: A Determining Factor

California’s diverse geography and urban-rural divide also play a role in health insurance costs. Urban areas like Los Angeles and San Francisco often have higher premiums due to the concentration of healthcare providers and facilities, leading to increased demand for services. In contrast, rural areas may offer more affordable options due to lower healthcare costs and a different provider network.

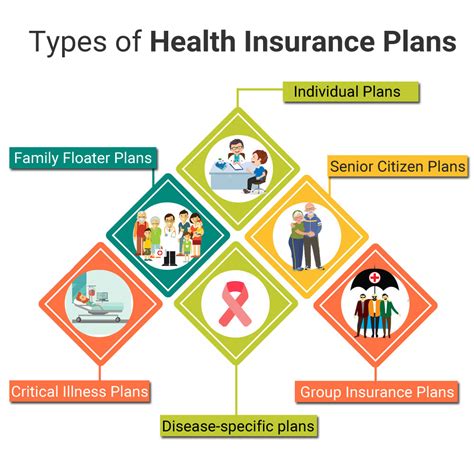

Plan Types and Coverage Options

The type of health insurance plan chosen significantly impacts the cost. California residents have various plan options, including:

- HMO (Health Maintenance Organization): Typically more affordable, HMOs provide coverage through a network of healthcare providers. Premiums are often lower, but out-of-network care may not be covered.

- PPO (Preferred Provider Organization): Offering more flexibility, PPO plans allow for out-of-network care, although at a higher cost. Premiums are generally higher than HMOs.

- EPO (Exclusive Provider Organization): Similar to PPOs, EPOs provide coverage for a specific network of providers, but without the out-of-network option. Premiums can be more affordable than PPOs.

- POS (Point of Service): POS plans combine elements of HMOs and PPOs, offering flexibility with a primary care provider network and out-of-network options. Premiums vary based on the plan’s structure.

Individual vs. Family Plans

Health insurance costs also differ based on whether the plan covers an individual or a family. Family plans typically have higher premiums to account for the increased coverage needs of multiple individuals. However, family plans can provide significant cost savings compared to individual plans when multiple family members require coverage.

| Plan Type | Average Premium (Monthly) |

|---|---|

| Individual | $350 - $600 |

| Family | $700 - $1,200 |

The Impact of Pre-existing Conditions

California’s health insurance market, like many other states, operates under the Affordable Care Act (ACA), which prohibits insurance companies from denying coverage or charging higher premiums based solely on pre-existing conditions. However, the management of these conditions can significantly influence the overall cost of healthcare.

For individuals with pre-existing conditions, such as diabetes, heart disease, or mental health disorders, specialized plans or additional coverage may be necessary. These plans often come with higher premiums to cover the increased healthcare needs associated with managing chronic conditions. It's essential for individuals with pre-existing conditions to carefully evaluate their options and choose a plan that provides comprehensive coverage without undue financial burden.

Navigating the California Health Insurance Market

With a myriad of plan options and pricing structures, navigating the health insurance market in California can be daunting. Fortunately, resources are available to assist residents in making informed decisions.

The Covered California website is a valuable resource, offering a comprehensive marketplace for individuals and families to compare and enroll in health insurance plans. The site provides detailed information on plan options, premiums, and coverage, making it easier to find a plan that fits both healthcare needs and budget.

Additionally, health insurance brokers and agents can provide personalized guidance, helping individuals understand their options and choose the most suitable plan. These professionals can offer insights into the nuances of different plans, ensuring that Californians receive the coverage they need without unnecessary expenses.

The Future of Health Insurance in California

The landscape of health insurance in California is continually evolving, with ongoing efforts to improve accessibility and affordability. Recent initiatives, such as the expansion of Medicaid and the implementation of the Affordable Care Act, have made significant strides in providing coverage to more residents. However, challenges remain, particularly in addressing the rising costs of healthcare and ensuring equitable access for all.

As the state continues to innovate and adapt its healthcare system, the focus remains on providing quality, affordable healthcare to its diverse population. This includes exploring new models of healthcare delivery, such as telemedicine and value-based care, which have the potential to lower costs and improve outcomes. Additionally, ongoing advocacy and policy changes are necessary to address systemic issues and ensure that health insurance remains a viable option for all Californians.

Conclusion

Understanding the cost of health insurance in California is a complex yet crucial task for residents. By unraveling the various factors that influence premiums, individuals can make more informed decisions about their healthcare coverage. With a range of plan options and resources available, Californians can navigate the health insurance market with confidence, ensuring they receive the coverage they need at a price they can afford.

Frequently Asked Questions

How can I find the most affordable health insurance plan in California?

+Finding the most affordable plan involves a thorough comparison of different options. Utilize resources like Covered California to compare premiums, coverage, and plan types. Additionally, consider your specific healthcare needs and choose a plan that provides adequate coverage without unnecessary costs.

Are there any discounts or subsidies available for health insurance in California?

+Yes, California offers various discounts and subsidies to make health insurance more affordable. These include tax credits for individuals and families with lower incomes, as well as reduced cost-sharing options for those with specific health needs. Visit Covered California for more information on these programs.

What happens if I can’t afford health insurance in California?

+If you cannot afford health insurance, you may be eligible for Medicaid, California’s public health insurance program for low-income individuals and families. Additionally, Covered California offers financial assistance to help make insurance more affordable. It’s important to explore all available options to ensure you have adequate coverage.

Can I switch health insurance plans during the year in California?

+In general, health insurance plans have specific enrollment periods. However, certain life events, such as losing your job or getting married, may qualify you for a Special Enrollment Period, allowing you to switch plans outside of the regular enrollment window. Check with Covered California or your insurance provider for more information.