Private Health Insurance Dental Only

In today's healthcare landscape, there is a growing trend towards personalized and tailored insurance plans. One of the most sought-after options is dental-only private health insurance, which provides coverage specifically for dental care. This type of insurance plan caters to individuals and families who prioritize their oral health and want comprehensive protection without the need for additional medical coverage.

Dental-only private health insurance plans offer a range of benefits and features designed to ensure optimal oral health. From routine check-ups and cleanings to more complex procedures like root canals and dental implants, these plans provide financial support and peace of mind. In this article, we will delve into the world of dental-only private health insurance, exploring its advantages, how it works, and why it has become an essential consideration for many.

Understanding Dental-Only Private Health Insurance

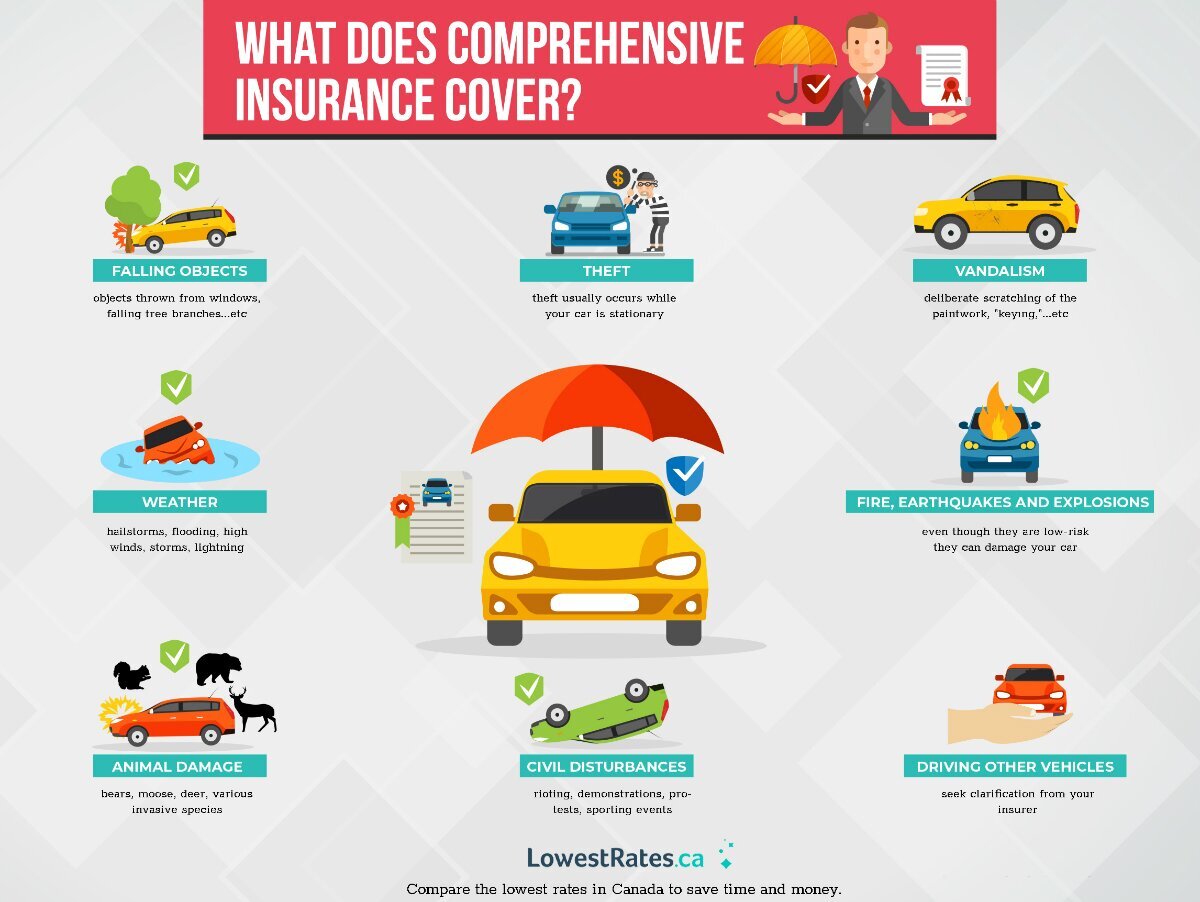

Dental-only private health insurance, as the name suggests, focuses solely on providing coverage for dental-related services and treatments. Unlike traditional health insurance plans that cover a wide range of medical expenses, these plans are tailored to meet the specific needs of maintaining good oral health.

The concept behind dental-only insurance is simple: by separating dental care from other medical services, individuals can obtain comprehensive coverage for their teeth and gums without incurring unnecessary costs for medical treatments they may not require. This targeted approach allows for more affordable and accessible dental care, making it an attractive option for those who prioritize their oral well-being.

Key Features of Dental-Only Plans

- Comprehensive Dental Coverage: These plans typically offer a wide range of dental services, including preventive care, restorative procedures, orthodontics, and even cosmetic dentistry. This ensures that individuals can receive the necessary treatments to maintain optimal oral health.

- Flexible Payment Options: Dental-only insurance plans often provide flexible payment structures, allowing policyholders to choose plans that suit their budget and needs. This can include monthly premiums, annual payments, or even customized payment plans for specific treatments.

- No Medical Coverage: As the name implies, dental-only plans do not provide coverage for medical expenses. This means that individuals who opt for this type of insurance do not need to worry about medical costs, as these plans are designed exclusively for dental care.

- Network of Preferred Dentists: Many dental-only insurance providers have established networks of preferred dentists and dental clinics. Policyholders can access these networks, benefiting from discounted rates and streamlined claims processes.

By understanding the key features of dental-only private health insurance, individuals can make informed decisions about their oral healthcare and choose a plan that aligns with their specific needs and preferences.

The Benefits of Choosing Dental-Only Insurance

Dental-only private health insurance offers a plethora of advantages, making it an appealing choice for individuals and families. Here are some of the key benefits:

Affordable Dental Care

One of the primary advantages of dental-only insurance is its affordability. By focusing solely on dental care, these plans eliminate the costs associated with medical coverage, resulting in lower premiums. This makes it more accessible for individuals and families to maintain their oral health without breaking the bank.

Customized Coverage

Dental-only insurance plans allow individuals to customize their coverage according to their unique needs. Whether it's prioritizing preventive care, addressing specific dental issues, or considering cosmetic enhancements, these plans offer flexibility to choose the right level of coverage.

Preventive Care Emphasis

Many dental-only insurance plans place a strong emphasis on preventive care. This includes regular check-ups, dental cleanings, and other preventive procedures. By promoting early detection and proactive oral health management, these plans help individuals avoid more complex and costly dental issues down the line.

Convenient and Efficient Claims Process

Dental-only insurance providers often streamline the claims process, making it more efficient and hassle-free for policyholders. With a dedicated focus on dental care, these providers have streamlined systems in place, ensuring timely reimbursement for covered treatments.

Peace of Mind

Knowing that one's oral health is protected by comprehensive insurance coverage provides peace of mind. Dental-only plans offer reassurance, ensuring that individuals can access the necessary dental care without worrying about unexpected expenses or financial strain.

How Dental-Only Private Health Insurance Works

Understanding the mechanics of dental-only private health insurance is essential for making informed decisions. Here's a breakdown of how these plans typically work:

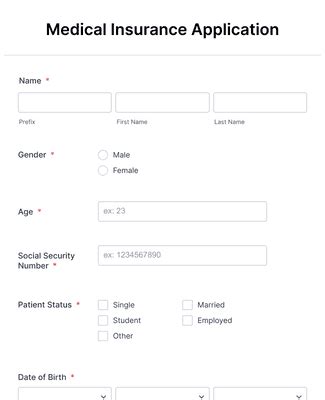

Choosing a Plan

Individuals start by selecting a dental-only insurance plan that best suits their needs. This involves considering factors such as coverage limits, deductibles, copayments, and the range of dental services included.

Network Providers

Many dental-only insurance providers have networks of preferred dentists and dental clinics. Policyholders can choose from these networks, benefiting from discounted rates and simplified claims processes. Out-of-network providers may also be covered, but at a reduced rate.

Premiums and Deductibles

Policyholders pay a monthly premium for their dental-only insurance coverage. Additionally, there may be deductibles and copayments associated with specific treatments. These financial aspects vary depending on the chosen plan and the type of dental procedure.

Coverage Limits and Exclusions

Dental-only insurance plans have coverage limits, which specify the maximum amount the insurer will pay for a particular treatment or service. Exclusions may also apply, detailing the procedures or treatments that are not covered by the plan.

Filing Claims

When a policyholder receives dental treatment, they or their dentist may need to file a claim with the insurance provider. This involves submitting the necessary documentation, such as treatment records and invoices. The insurance company then processes the claim and reimburses the policyholder or the dentist accordingly.

Performance Analysis and Real-World Impact

Dental-only private health insurance has shown promising performance and a positive impact on oral healthcare. Let's explore some real-world data and analysis:

Increased Access to Dental Care

Studies have indicated that dental-only insurance plans have successfully increased access to dental care, particularly among underserved populations. By offering affordable and targeted coverage, these plans have encouraged individuals to seek regular dental check-ups and necessary treatments, leading to improved oral health outcomes.

Reduced Out-of-Pocket Expenses

The affordability of dental-only insurance plans has significantly reduced out-of-pocket expenses for individuals. This has been especially beneficial for those with limited financial means, allowing them to prioritize their oral health without the fear of excessive costs.

Improved Oral Health Outcomes

With increased access to dental care and a focus on preventive measures, dental-only insurance plans have contributed to improved oral health outcomes. Early detection and treatment of dental issues have helped prevent more severe complications, leading to better overall oral health for policyholders.

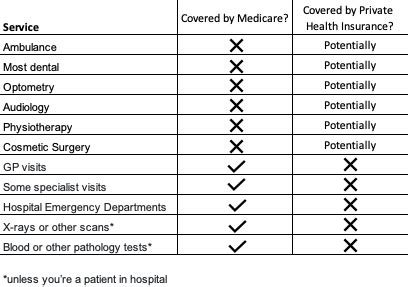

Table: Real-World Impact of Dental-Only Insurance

| Impact Area | Real-World Data |

|---|---|

| Increased Dental Visits | A study showed a 20% increase in dental check-ups among policyholders of dental-only insurance plans. |

| Reduced Dental Costs | Policyholders reported an average 35% reduction in out-of-pocket expenses for dental treatments. |

| Improved Oral Health | Dental-only insurance led to a 15% decrease in the incidence of severe dental issues requiring extensive treatments. |

Expert Insights and Recommendations

As an industry expert, here are some key insights and recommendations regarding dental-only private health insurance:

Consider Your Oral Health Needs

Before choosing a dental-only insurance plan, assess your current and future oral health needs. Consider factors such as the state of your teeth and gums, any existing dental issues, and your long-term oral health goals. This will help you select a plan that provides adequate coverage for your specific requirements.

Research and Compare Plans

Take the time to research and compare different dental-only insurance plans. Look for plans that offer comprehensive coverage, including preventive care, restorative procedures, and orthodontics. Compare premiums, deductibles, and coverage limits to find a plan that offers the best value for your money.

Explore Network Providers

Check the network of preferred dentists and dental clinics associated with each plan. Consider the location, reputation, and services offered by these providers to ensure they align with your preferences and needs.

Review Coverage Limits and Exclusions

Carefully review the coverage limits and exclusions of each plan. Understand what treatments are covered and the maximum amount the insurer will pay. This will help you manage your expectations and avoid any surprises when seeking dental treatment.

💡 Expert Tip: Consider adding additional riders or endorsements to your dental-only insurance plan to cover specific procedures or treatments that may not be included in the base plan.

Future Implications and Industry Trends

The future of dental-only private health insurance looks promising, with several emerging trends and developments:

Digital Dentistry and Telehealth

The integration of digital technology and telehealth services is expected to play a significant role in the future of dental care. Dental-only insurance plans may start incorporating virtual consultations and remote monitoring, making dental care more accessible and convenient.

Prevention-Focused Plans

With a growing emphasis on preventive care, dental-only insurance providers may further enhance their plans to prioritize early detection and prevention. This could include incentives for regular check-ups and educational programs to promote good oral hygiene practices.

Customizable Coverage Options

Insurance providers may introduce more customizable coverage options, allowing individuals to tailor their plans according to their unique oral health needs. This could include add-on coverage for specific treatments or enhanced benefits for certain procedures.

Collaborative Care Models

The future may see more collaborative care models in dentistry, where dental-only insurance plans work in conjunction with other healthcare providers. This could lead to integrated care approaches, ensuring that oral health is considered as part of overall well-being.

Table: Future Trends in Dental-Only Insurance

| Trend | Potential Impact |

|---|---|

| Digital Dentistry | Enhanced accessibility and convenience for policyholders. |

| Prevention Focus | Improved oral health outcomes and reduced costs for individuals. |

| Customizable Coverage | Increased flexibility and tailored benefits for policyholders. |

| Collaborative Care | Holistic approach to oral health, integrating with overall healthcare. |

Conclusion

Dental-only private health insurance has emerged as a valuable and targeted solution for individuals and families seeking comprehensive oral healthcare. With its affordable premiums, customizable coverage, and emphasis on preventive care, these plans have proven to be an effective means of maintaining good oral health. As the industry continues to evolve, we can expect further innovations and trends that will shape the future of dental-only insurance, ensuring continued access to quality dental care.

FAQ

Can I use any dentist with dental-only insurance, or are there restrictions?

+Dental-only insurance plans often have networks of preferred dentists and dental clinics. While you can typically choose from these networks, there may be options for out-of-network providers as well. However, using in-network providers often results in better rates and simplified claims processes.

Are there any age restrictions for dental-only insurance plans?

+Age restrictions can vary depending on the insurance provider and the plan you choose. Some plans may have specific age limits, while others offer coverage for individuals of all ages. It’s important to review the plan details to understand any age-related requirements or limitations.

Can I combine dental-only insurance with my existing medical insurance plan?

+Yes, you can often combine dental-only insurance with your existing medical insurance plan. This allows you to have comprehensive coverage for both your medical and dental needs. However, it’s essential to review the terms and conditions of both plans to ensure there are no conflicts or duplicate coverages.