Prescription Eyeglasses Insurance

Prescription eyeglasses insurance is a valuable asset for individuals who rely on corrective lenses to enhance their vision and overall quality of life. In today's fast-paced world, where visual acuity is crucial for various aspects of daily life, having insurance coverage for eyeglasses can provide peace of mind and significant cost savings. This comprehensive guide aims to explore the world of prescription eyeglasses insurance, shedding light on its benefits, coverage options, and the impact it can have on your vision care journey.

Understanding the Value of Prescription Eyeglasses Insurance

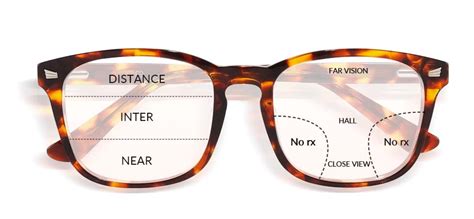

Prescription eyeglasses, often considered a necessity rather than a luxury, play a vital role in correcting refractive errors and ensuring clear vision. Whether you’re nearsighted, farsighted, or require multifocal lenses to address presbyopia, the right prescription lenses can make a world of difference. However, the cost of prescription eyeglasses can be substantial, especially when considering the latest lens technologies, designer frames, and regular updates due to prescription changes.

This is where prescription eyeglasses insurance steps in as a crucial component of your vision care plan. By offering financial protection and a range of benefits, insurance policies for eyeglasses can alleviate the financial burden associated with purchasing and maintaining your eyewear. In this article, we will delve into the intricacies of prescription eyeglasses insurance, exploring the various coverage options, the enrollment process, and the long-term advantages it provides.

Types of Prescription Eyeglasses Insurance Coverage

Prescription eyeglasses insurance policies come in various forms, each offering a unique set of benefits tailored to meet different needs. Understanding the different types of coverage available is essential to make an informed decision when choosing an insurance plan.

Basic Eyeglass Insurance Plans

Basic eyeglass insurance plans provide fundamental coverage for the cost of prescription eyeglasses. These plans typically offer a fixed reimbursement amount or a percentage of the total cost of the eyeglasses, helping individuals offset the expense of purchasing new lenses and frames. Basic plans are ideal for those seeking affordable coverage without a plethora of additional benefits.

| Plan Type | Reimbursement |

|---|---|

| Basic | Fixed amount or percentage of total cost |

For instance, consider the Standard Vision Plan, which offers a straightforward approach to eyeglass insurance. With this plan, policyholders receive a reimbursement of up to $150 per year for the cost of their prescription eyeglasses. While it may not cover the entire expense, it significantly reduces the financial burden, making it an attractive option for those on a budget.

Comprehensive Vision Insurance Plans

Comprehensive vision insurance plans take a more holistic approach to covering eyeglass expenses. In addition to providing reimbursement for the cost of prescription lenses and frames, these plans often include additional benefits such as discounts on contact lenses, laser eye surgery, and even vision exams. Comprehensive plans are designed to offer a wider range of vision care options, ensuring policyholders have access to a variety of services and products.

| Plan Type | Coverage Highlights |

|---|---|

| Comprehensive | Reimbursement for lenses and frames, discounts on contacts and laser eye surgery, vision exams |

Take the example of the VisionCare Premium Plan, a comprehensive insurance option that offers policyholders a reimbursement of up to $300 per year for prescription eyeglasses. Additionally, this plan provides a 20% discount on contact lenses and a 15% discount on laser eye surgery procedures. With its comprehensive benefits, the VisionCare Premium Plan ensures policyholders have access to a wide range of vision care solutions.

Customizable Vision Insurance Plans

Customizable vision insurance plans allow individuals to tailor their coverage to their specific needs. These plans offer a flexible approach, enabling policyholders to select the benefits that best suit their lifestyle and vision care requirements. From choosing the level of reimbursement for eyeglasses to adding optional benefits like discounts on sunglasses or sports eyewear, customizable plans provide a personalized insurance experience.

| Plan Type | Customizable Options |

|---|---|

| Customizable | Reimbursement level, optional benefits (e.g., sunglasses, sports eyewear) |

The VisionFlex Plan is a prime example of a customizable vision insurance option. Policyholders can choose their desired level of reimbursement, ranging from $100 to $500 per year, for prescription eyeglasses. Additionally, the VisionFlex Plan offers a unique feature: policyholders can opt for a 10% discount on premium designer frames, allowing them to enhance their style while still benefiting from insurance coverage.

The Enrollment Process: How to Get Prescription Eyeglasses Insurance

Enrolling in prescription eyeglasses insurance is a straightforward process, but it’s essential to understand the steps involved to ensure a seamless experience.

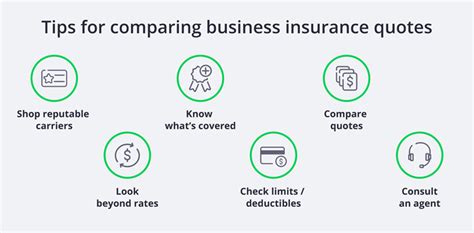

Step 1: Research and Compare Insurance Providers

The first step in obtaining prescription eyeglasses insurance is to research and compare various insurance providers. Different companies offer a range of plans with varying benefits and coverage levels. Consider factors such as the provider’s reputation, the scope of coverage, and any additional perks or discounts they offer. Online resources and reviews can provide valuable insights into the reliability and customer satisfaction of different insurance providers.

Step 2: Choose the Right Plan for Your Needs

Once you’ve researched and identified potential insurance providers, it’s time to select the plan that best aligns with your vision care requirements. Consider your prescription needs, budget, and any additional vision care services you may require. Assess the coverage limits, reimbursement amounts, and any potential exclusions or limitations to ensure the plan meets your expectations.

Step 3: Gather Necessary Documents and Information

To enroll in prescription eyeglasses insurance, you’ll need to gather certain documents and information. This typically includes personal details such as your name, date of birth, and contact information. Additionally, you may need to provide proof of identity, residency, and any relevant medical records or prescription information. Ensure you have all the necessary documents readily available to streamline the enrollment process.

Step 4: Complete the Enrollment Application

With your research complete and the necessary documents gathered, you can proceed to fill out the enrollment application. This application will guide you through the process, allowing you to input your personal details, select your desired plan, and provide any additional information required by the insurance provider. Take your time to ensure accuracy and completeness in the application to avoid delays or complications.

Step 5: Pay the Premium and Receive Your Insurance Card

After submitting your enrollment application, the final step is to pay the premium for your chosen plan. The premium amount will vary depending on the insurance provider and the specific plan you’ve selected. Once the payment is processed, you will receive your insurance card, which serves as proof of your coverage. Keep this card handy, as you’ll need to present it when claiming benefits or purchasing prescription eyeglasses.

Maximizing Your Prescription Eyeglasses Insurance Benefits

Prescription eyeglasses insurance offers a range of benefits beyond financial protection. By understanding how to maximize these benefits, you can make the most of your insurance coverage and enhance your overall vision care experience.

Regular Vision Exams and Updates

One of the key advantages of prescription eyeglasses insurance is the coverage it provides for regular vision exams. Vision exams are crucial for monitoring your eye health and ensuring your prescription remains up-to-date. Many insurance plans include an annual eye exam benefit, allowing you to maintain optimal vision clarity and detect any potential eye conditions early on. By taking advantage of this benefit, you can stay on top of your eye health and ensure your prescription eyeglasses remain effective.

Discounts on Premium Frames and Lens Technologies

Prescription eyeglasses insurance often includes discounts on premium frames and advanced lens technologies. These discounts can significantly reduce the cost of investing in high-quality, designer frames or cutting-edge lens options. Whether you prefer sleek, minimalist frames or bold, statement-making designs, insurance-provided discounts can help you upgrade your eyewear style while staying within your budget.

Coverage for Lens Upgrades and Add-Ons

Insurance plans for prescription eyeglasses typically offer coverage for lens upgrades and add-ons. This means you can enhance the functionality and comfort of your eyeglasses by opting for advanced lens coatings, such as anti-reflective or blue light-blocking coatings, without incurring additional costs. Additionally, some plans provide coverage for lens options like photochromic lenses, which automatically adapt to changing light conditions, ensuring clear vision in various environments.

Access to a Network of Vision Care Providers

Prescription eyeglasses insurance often comes with access to a network of trusted vision care providers. This network includes optometrists, ophthalmologists, and optical shops that accept your insurance coverage. By utilizing this network, you can ensure you receive high-quality vision care from reputable professionals. Moreover, insurance providers may offer exclusive discounts or promotions when using in-network providers, further maximizing your insurance benefits.

The Impact of Prescription Eyeglasses Insurance on Vision Care

Prescription eyeglasses insurance has a significant impact on the accessibility and affordability of vision care. By providing financial protection and a range of benefits, insurance plans empower individuals to prioritize their vision health and seek the necessary corrective measures without financial strain.

Improved Accessibility to Vision Care Services

Prescription eyeglasses insurance removes financial barriers to accessing vision care services. With insurance coverage, individuals can afford regular eye exams, ensuring they receive the necessary care to maintain good eye health. Additionally, insurance plans often cover the cost of prescription eyeglasses, making it more feasible for individuals to obtain the corrective lenses they need to enhance their vision.

Cost Savings and Financial Peace of Mind

The financial protection offered by prescription eyeglasses insurance is a significant advantage. By covering a portion or the entirety of the cost of prescription eyeglasses, insurance plans alleviate the financial burden associated with purchasing new lenses and frames. This cost savings extends beyond the initial purchase, as insurance often provides coverage for updates and replacements, ensuring policyholders can maintain their vision care needs without significant financial strain.

Encouraging Regular Eye Exams and Early Detection

Prescription eyeglasses insurance promotes regular eye exams, which are essential for early detection of eye conditions and refractive errors. By including coverage for annual eye exams, insurance plans encourage individuals to prioritize their eye health. Early detection of eye issues can lead to timely treatment, preventing potential vision loss and ensuring optimal eye health over the long term.

Promoting Vision Health and Quality of Life

Ultimately, prescription eyeglasses insurance plays a crucial role in promoting vision health and enhancing the overall quality of life for individuals. With insurance coverage, individuals can access the corrective lenses they need to see clearly, perform daily tasks, and engage in various activities without vision-related limitations. Clear vision contributes to improved productivity, safety, and overall well-being, making prescription eyeglasses insurance an invaluable asset for maintaining a high quality of life.

Conclusion: The Benefits of Prescription Eyeglasses Insurance

Prescription eyeglasses insurance offers a comprehensive solution to the financial challenges associated with vision care. By providing coverage for prescription eyeglasses, regular vision exams, and a range of additional benefits, insurance plans empower individuals to prioritize their eye health and maintain clear vision. With the right insurance coverage, individuals can access the latest lens technologies, premium frames, and necessary vision care services without breaking the bank.

Whether you're a student, professional, or retiree, prescription eyeglasses insurance is a valuable investment in your vision health and overall well-being. By understanding the different coverage options, enrollment process, and ways to maximize benefits, you can make informed decisions to ensure your vision care needs are met. So, embrace the clarity and confidence that prescription eyeglasses insurance brings, and take control of your vision health journey today.

Can prescription eyeglasses insurance cover the cost of my contact lenses as well?

+

Yes, some comprehensive vision insurance plans offer coverage for contact lenses in addition to prescription eyeglasses. These plans typically provide a reimbursement or discount on the cost of contact lenses, making it more affordable to switch between eyeglasses and contacts as needed.

Are there any age restrictions for enrolling in prescription eyeglasses insurance?

+

Age restrictions for prescription eyeglasses insurance vary depending on the insurance provider and the specific plan. Some plans are designed for all ages, while others may have age limits or specific eligibility criteria. It’s essential to review the plan details and eligibility requirements before enrolling.

Can I use my prescription eyeglasses insurance coverage to purchase sunglasses or sports eyewear?

+

Some customizable vision insurance plans offer the option to include coverage for sunglasses or sports eyewear. These plans allow policyholders to select additional benefits, such as discounts or reimbursement for specific types of eyewear, ensuring they can protect their eyes in various situations.

How often can I claim reimbursement for prescription eyeglasses under my insurance plan?

+

The frequency of reimbursement for prescription eyeglasses varies among insurance plans. Some plans offer annual reimbursement, allowing policyholders to claim benefits once per year. Others may provide more flexible options, allowing multiple claims within a specified timeframe, such as every two or three years.

Are there any exclusions or limitations to consider when choosing a prescription eyeglasses insurance plan?

+

Yes, it’s crucial to review the exclusions and limitations of any prescription eyeglasses insurance plan before enrolling. These may include specific conditions or circumstances where coverage is not provided, such as pre-existing eye conditions or certain types of lens technologies. Understanding these exclusions ensures you choose a plan that aligns with your vision care needs.