When Should You Get Life Insurance

Life insurance is a vital financial tool that provides a safety net for your loved ones and ensures their financial stability in the event of your untimely passing. It's a thoughtful and responsible decision to consider purchasing life insurance, but the question remains: when is the right time to get it? This comprehensive guide will delve into the factors that influence the timing of your life insurance purchase, providing you with the knowledge to make an informed decision tailored to your unique circumstances.

Understanding Life Insurance and Its Benefits

Life insurance is a contract between you and an insurance company, where you pay a premium in exchange for a financial benefit to be paid out to your beneficiaries upon your death. This benefit, often referred to as the death benefit, can provide significant financial relief to your family, helping them cover expenses such as funeral costs, outstanding debts, and daily living expenses.

Additionally, life insurance can be a powerful tool for wealth transfer and estate planning. It can fund buy-sell agreements in a business, provide liquidity for estate taxes, and even be used to leave a legacy for charitable causes. The benefits of life insurance extend beyond the immediate financial needs of your loved ones, offering long-term financial security and peace of mind.

Key Factors to Consider When Choosing the Right Time

Determining the optimal time to purchase life insurance involves considering several critical factors. Here’s a breakdown of these factors and how they influence your decision:

Your Age and Health

Your age and current health status play a significant role in the life insurance landscape. Generally, younger individuals in good health can secure more affordable life insurance policies with lower premiums. This is because insurance companies assess risk based on age and health, and younger individuals are considered less risky.

For instance, let's consider the case of John, a 30-year-old non-smoker with no pre-existing health conditions. John could potentially secure a 20-year term life insurance policy with a $1 million death benefit for a monthly premium of approximately $30. However, if John were to wait until he's 40, the same policy might cost him $50 per month, reflecting the increased risk associated with age.

| Age | Health Status | Premium |

|---|---|---|

| 30 | Excellent | $30/month |

| 40 | Excellent | $50/month |

| 50 | Good | $80/month |

It's important to note that health considerations extend beyond your current state. Pre-existing conditions, family medical history, and even certain hobbies or occupations can impact your life insurance eligibility and premiums. For example, individuals with a history of heart disease or those who engage in high-risk activities like skydiving may face higher premiums or policy exclusions.

Financial Responsibilities and Goals

Your financial situation and future goals are crucial in determining the need for life insurance. If you have financial dependents, such as a spouse, children, or aging parents, life insurance becomes even more essential. It provides a financial cushion to ensure their continued well-being and helps cover essential expenses like mortgage payments, education costs, and daily living expenses.

Additionally, life insurance can be a strategic tool for achieving long-term financial goals. For instance, if you're planning for your children's education, a life insurance policy can provide a substantial sum to cover tuition fees and other related expenses. Similarly, if you own a business, life insurance can protect your business partners and ensure the continuity of your enterprise.

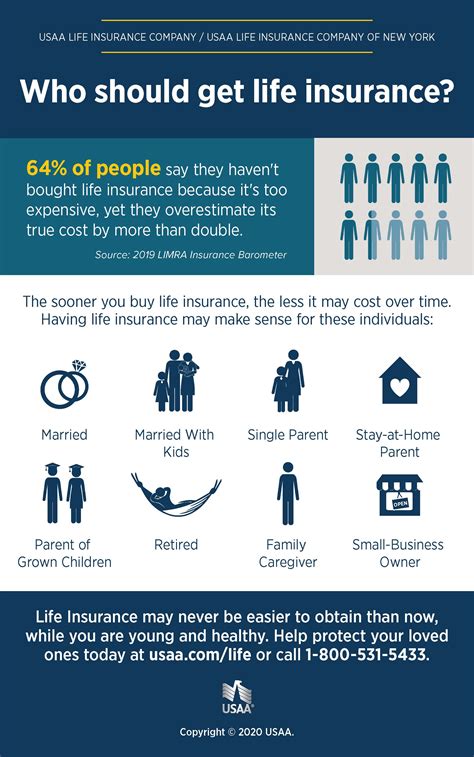

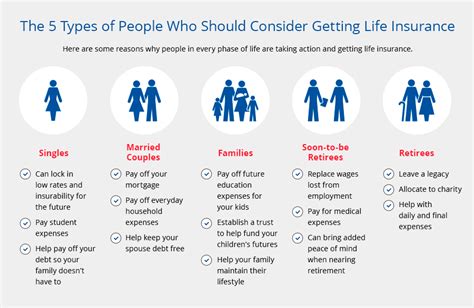

Stage of Life and Major Life Events

Life insurance needs often evolve as you progress through different stages of life. Major life events, such as marriage, the birth of a child, or purchasing a home, can significantly impact your financial responsibilities and, consequently, your life insurance requirements.

- Marriage: When you get married, your financial responsibilities often expand. Life insurance can provide financial protection for your spouse and ensure their financial security in the event of your untimely demise.

- Having Children: The arrival of children brings new financial obligations. Life insurance can help cover the costs of raising a family, including education, healthcare, and other expenses.

- Homeownership: Buying a home is a significant milestone. Life insurance can provide a financial safety net to protect your investment and ensure your loved ones can keep the family home.

As you navigate these life stages, it's essential to periodically review your life insurance coverage to ensure it aligns with your changing needs. For instance, you may need to increase your coverage amount or adjust the term of your policy to accommodate your growing family and financial responsibilities.

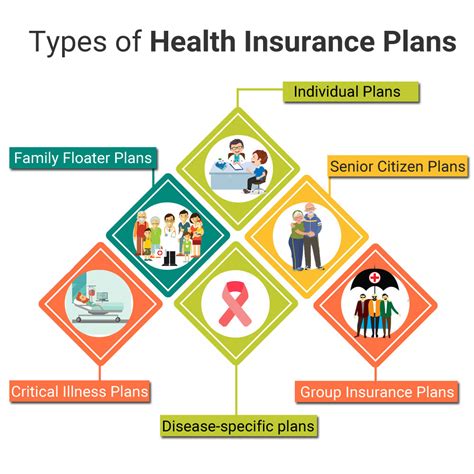

Policy Types and Their Suitability

Life insurance policies come in various types, each designed to cater to different needs and financial goals. Understanding the different policy types is crucial in making an informed decision about when to purchase life insurance.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It offers pure protection, meaning the policy pays out a death benefit only if the insured person dies during the term of the policy. Term life insurance is often more affordable than permanent life insurance, making it an attractive option for individuals with temporary financial responsibilities.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides lifelong coverage. It includes whole life, universal life, and variable life policies. These policies offer a death benefit, as well as a cash value component that accumulates over time and can be accessed through loans or withdrawals. Permanent life insurance is generally more expensive than term life insurance but offers the advantage of long-term financial protection and potential tax benefits.

Financial Planning and Budgeting

Life insurance is an essential component of your overall financial plan. It’s crucial to assess your financial situation, including your income, savings, and existing debts, to determine how life insurance fits into your budget. While life insurance is a vital investment in your family’s future, it’s important to balance it with other financial priorities, such as retirement savings and emergency funds.

When budgeting for life insurance, consider your monthly income and expenses. Aim to allocate a reasonable portion of your income towards life insurance premiums, ensuring it doesn't strain your financial resources. It's advisable to consult with a financial advisor or insurance professional to create a comprehensive financial plan that incorporates life insurance.

Real-Life Examples and Testimonials

To illustrate the impact of timely life insurance decisions, let’s explore a few real-life scenarios:

The Smith Family’s Story

The Smith family, consisting of Mr. and Mrs. Smith and their two young children, decided to purchase life insurance when they welcomed their first child. Mr. Smith, the primary breadwinner, recognized the importance of protecting his family’s financial future. They opted for a 20-year term life insurance policy with a $500,000 death benefit, ensuring that if anything were to happen to Mr. Smith, his family would have the financial resources to maintain their standard of living.

Their timely decision proved to be a wise one. Just a few years later, Mrs. Smith was diagnosed with a serious illness. The family faced significant medical expenses, but the life insurance policy provided them with the financial stability to focus on Mrs. Smith's treatment without worrying about their financial obligations.

Sarah’s Journey to Financial Security

Sarah, a single woman in her late 20s, understood the importance of financial independence. She decided to purchase a permanent life insurance policy with a small death benefit and a focus on building cash value. Sarah’s policy allowed her to accumulate savings within the policy, providing her with a financial cushion for unexpected expenses and a potential source of retirement income.

As Sarah progressed in her career and her financial responsibilities grew, she increased her life insurance coverage to protect her growing assets and ensure her financial stability. Sarah's early decision to invest in life insurance not only provided her with peace of mind but also contributed to her long-term financial goals.

Future Implications and Planning

The decision to purchase life insurance is not just about the present; it’s about securing your loved ones’ future. By obtaining life insurance, you’re not only protecting your family’s financial well-being but also planning for potential challenges and ensuring a legacy.

Legacy and Estate Planning

Life insurance can be a powerful tool in estate planning, allowing you to leave a lasting legacy for your loved ones. It can provide the funds necessary to cover estate taxes, ensuring your assets are distributed according to your wishes. Additionally, life insurance can fund charitable causes, allowing you to support causes close to your heart even after your passing.

Retirement Planning

Life insurance can also play a role in your retirement planning. Permanent life insurance policies, with their cash value component, can serve as a tax-efficient savings vehicle. Over time, the cash value within the policy can grow, providing a source of retirement income or a financial cushion for unexpected expenses.

Financial Protection for Your Business

If you own a business, life insurance can be a crucial component of your business continuity plan. It can protect your business from financial loss in the event of your death, ensuring your business partners or beneficiaries can continue operations or sell the business without financial strain.

Frequently Asked Questions

What is the average cost of life insurance per month?

+The cost of life insurance varies depending on factors such as age, health, and the type of policy. On average, a 30-year-old non-smoker can expect to pay around 20-30 per month for a term life insurance policy with a 500,000 death benefit. However, premiums can range from as low as 10 per month for a basic policy to several hundred dollars for more comprehensive coverage.

Is life insurance necessary if I don’t have any financial dependents?

+While financial dependents are a significant factor in determining life insurance needs, it’s not the only consideration. Even if you don’t have immediate dependents, life insurance can still be beneficial. It can provide a financial safety net for your loved ones, cover final expenses, and leave a legacy for charitable causes or future generations.

Can I purchase life insurance if I have a pre-existing health condition?

+Yes, individuals with pre-existing health conditions can still obtain life insurance. However, the cost and availability of coverage may be impacted. Insurance companies assess risk based on health conditions, and individuals with certain pre-existing conditions may face higher premiums or policy exclusions. It’s advisable to consult with an insurance professional to explore your options.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy periodically, ideally every 3-5 years or whenever there’s a significant life event. These events may include marriage, the birth of a child, purchasing a home, or changes in your financial situation. Regular reviews ensure your coverage remains adequate and aligned with your changing needs.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage will expire, and you’ll no longer have protection. However, you may have the option to renew the policy or convert it to a permanent life insurance policy, which provides lifelong coverage. It’s important to carefully consider your options and consult with an insurance professional to make an informed decision.

In conclusion, the decision to purchase life insurance is a critical step towards ensuring the financial security and well-being of your loved ones. By understanding the factors that influence this decision and tailoring your life insurance plan to your unique circumstances, you can provide a lasting legacy of financial protection and peace of mind.