Phone Insurance Claim

In today's world, smartphones have become an indispensable part of our daily lives, serving as our primary means of communication, entertainment, and access to information. With the high cost of smartphones and the potential for damage or loss, it's no wonder that phone insurance has become a popular option for many consumers. However, when it comes to filing a claim, the process can often be confusing and frustrating. In this comprehensive guide, we will delve into the intricacies of phone insurance claims, providing you with the knowledge and insights to navigate the process successfully and ensure a smooth resolution.

Understanding Phone Insurance Claims

Phone insurance claims involve a set of procedures and guidelines that govern the process of seeking compensation or repairs for your smartphone when it suffers damage, theft, or loss. These claims are typically made through insurance policies specifically designed to cover smartphones, and they aim to provide financial protection and peace of mind to policyholders.

The process of filing a phone insurance claim can vary depending on the insurance provider and the specific policy you have. However, there are several common steps and considerations that are generally involved. Understanding these steps is crucial to ensuring a successful and efficient claims process.

Assessing the Damage or Loss

The first step in any phone insurance claim is to thoroughly assess the damage or loss to your device. This assessment is crucial as it determines whether your claim is valid and covered by your insurance policy. Take note of the specific issues with your phone, such as cracked screens, water damage, or signs of physical impact. Document the damage with photographs, as these can be valuable evidence during the claims process.

In the case of theft or loss, report the incident to the local authorities immediately. Obtain a police report or a unique reference number, as this documentation will be essential for your insurance claim. Keep in mind that some insurance policies may require you to provide this evidence as a condition for processing your claim.

Reviewing Your Insurance Policy

Before filing a claim, it is imperative to carefully review your insurance policy. Understand the terms and conditions, including the types of coverage provided, any exclusions or limitations, and the process for making a claim. Familiarize yourself with the policy’s excess or deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in.

Pay close attention to the policy's coverage limits and any specific requirements or restrictions. For instance, some policies may have limits on the number of claims you can make within a certain period or may require you to use authorized repair centers for specific types of damage. Understanding these details will help you manage your expectations and ensure a smoother claims process.

| Policy Feature | Description |

|---|---|

| Coverage Types | Accidental damage, theft, and loss are typically covered. |

| Exclusions | Check for exclusions like water damage or mechanical failure. |

| Claim Process | Understand the steps and timelines for filing a claim. |

| Excess or Deductible | Be aware of the amount you need to pay before insurance coverage. |

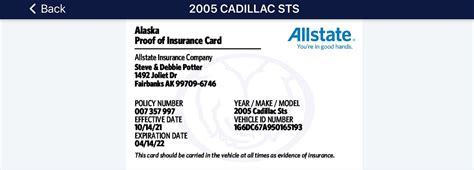

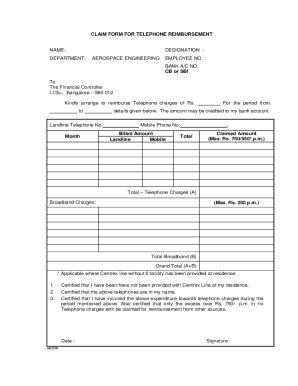

Gathering Necessary Documentation

To support your phone insurance claim, you will need to gather a range of documents and evidence. This documentation provides proof of your ownership, the value of your phone, and the circumstances of the damage or loss. Here are some essential documents you may need:

- Proof of Purchase: This could be a receipt, invoice, or online purchase confirmation.

- Policy Documents: Keep a copy of your insurance policy and any amendments or endorsements.

- Photographic Evidence: Take clear and detailed photos of the damaged phone.

- Police Report: If your phone was stolen or lost, obtain a police report.

- Repair Estimates: If applicable, gather estimates from authorized repair centers.

- Warranty Information: Check if your phone is still under manufacturer's warranty.

Initiating the Claims Process

Once you have gathered the necessary documentation and assessed the damage or loss, it’s time to initiate the claims process. Contact your insurance provider and inform them of your intention to file a claim. They will guide you through the specific steps and requirements for your policy.

During this process, be prepared to provide detailed information about the incident, including the date, location, and circumstances of the damage or loss. Be honest and accurate in your description, as any misrepresentations can lead to claim denials or other complications.

Your insurance provider may request additional documentation or evidence to support your claim. Cooperate fully and provide any requested information promptly to avoid delays in the claims process.

Navigating the Claims Process

Now that we’ve covered the initial steps, let’s delve into the specifics of navigating the phone insurance claims process. This section will provide you with practical insights and strategies to ensure a smooth and successful journey.

Communication with Your Insurer

Effective communication with your insurance provider is key to a positive claims experience. When initiating your claim, choose a communication channel that suits your preference and the insurer’s guidelines. This could be through a dedicated claims hotline, an online portal, or email.

Provide clear and concise information about your claim, including the nature of the damage or loss, the date it occurred, and any relevant details. Be prepared to answer questions and provide additional information as requested. Maintain a polite and professional tone throughout your interactions, as this can help build a positive relationship with your insurer.

Keep records of all your communications with the insurer, including dates, times, and the names of the representatives you speak with. This documentation can be valuable if any disputes or misunderstandings arise during the claims process.

Claim Assessment and Approval

Once you have submitted your claim and provided the necessary documentation, the insurance company will assess your claim. This assessment involves a thorough review of your policy, the evidence you have presented, and the specifics of your case.

The insurer may request additional information or clarifications to ensure a fair and accurate assessment. Cooperate fully with their requests and provide any missing details promptly. This cooperation demonstrates your commitment to a transparent claims process and can help expedite the approval process.

During the assessment, the insurer will determine whether your claim is valid and covered by your policy. They will also assess the extent of the damage or loss and the appropriate compensation or repair options. This process may involve further discussions and negotiations to reach a mutually agreeable resolution.

Repair or Replacement Options

Depending on the nature of your phone insurance claim, you may have options for repair or replacement. These options are typically outlined in your insurance policy, and the insurer will guide you through the available choices.

Repair options may include sending your phone to an authorized repair center or having an approved technician come to your location. The insurer will cover the cost of repairs up to the policy's limits, ensuring your phone is restored to its pre-damage condition. Keep in mind that some policies may require you to pay a small excess or deductible for repairs.

If the damage is severe or the phone is beyond repair, the insurer may offer a replacement option. This could involve providing you with a similar model or a phone of equivalent value. The insurer will typically guide you through the process of selecting a suitable replacement and arranging its delivery.

Handling Claim Denials

In some cases, your phone insurance claim may be denied by the insurer. This can happen for various reasons, such as policy exclusions, misrepresentation of facts, or failure to provide sufficient evidence. If your claim is denied, it’s important to understand the reasons for the denial and explore your options for appeal.

Carefully review the denial letter or communication from the insurer. It should outline the specific reasons for the denial and any steps you can take to appeal the decision. Gather any additional evidence or information that may support your case and present it to the insurer. Be prepared to provide further clarification or documentation to strengthen your appeal.

If you feel that the denial was unfair or based on incorrect information, consider seeking legal advice or consulting with a consumer protection organization. They can provide guidance on your rights and options for disputing the denial.

Maximizing Your Phone Insurance Benefits

Phone insurance policies offer valuable protection, but it’s essential to make the most of your coverage to ensure you receive the full benefits. This section will provide you with tips and strategies to maximize your phone insurance benefits and get the most out of your policy.

Regularly Review Your Policy

Phone insurance policies can evolve and change over time. To stay informed and ensure you are getting the best coverage, regularly review your policy. Look for any updates, amendments, or changes in coverage limits or exclusions. Understand any new features or benefits that may be available to you.

If you have recently upgraded your phone or made significant changes to your policy, ensure that your documentation is up-to-date. Keep a record of any changes, and if necessary, update your proof of purchase or other relevant documents.

Take Preventive Measures

While phone insurance provides financial protection, it’s always better to prevent damage or loss from occurring in the first place. Take proactive measures to protect your phone and minimize the risk of claims.

Invest in a high-quality case and screen protector to safeguard your phone against accidental drops and scratches. Be cautious with your phone's exposure to water, especially if it is not water-resistant. Avoid leaving your phone unattended in public places, and consider using a tracking app or service to locate your phone if it is lost or stolen.

Utilize Additional Policy Benefits

Phone insurance policies often come with additional benefits beyond coverage for damage or loss. Take advantage of these benefits to get the most value from your policy.

Some policies offer extended warranties, which can provide coverage for mechanical or electrical failures beyond the manufacturer's warranty period. Others may include accidental damage coverage for items other than your phone, such as accessories or other devices. Explore these additional benefits and understand how they can enhance your overall protection.

Choose the Right Policy

When selecting a phone insurance policy, it’s crucial to choose one that aligns with your needs and provides adequate coverage. Consider factors such as the cost of the policy, the level of coverage, and any exclusions or limitations.

Compare different policies and insurers to find the best fit for your situation. Look for policies that offer comprehensive coverage, including protection against theft, loss, and accidental damage. Consider the excess or deductible amounts and choose a policy with an amount that you are comfortable paying.

Read reviews and seek recommendations from trusted sources to ensure you are choosing a reputable insurer with a good track record of claims handling.

Conclusion: Navigating the Future of Phone Insurance

Phone insurance claims can be a complex and sometimes daunting process, but with the right knowledge and approach, you can successfully navigate the journey and receive the compensation or repairs you deserve. By understanding the process, communicating effectively with your insurer, and maximizing your policy benefits, you can make the most of your phone insurance coverage.

As technology advances and smartphones become even more integral to our lives, the landscape of phone insurance is evolving. Insurers are adapting to meet the changing needs of consumers, offering innovative solutions and enhanced coverage options. Stay informed about these developments and choose policies that align with your lifestyle and the latest technological advancements.

Remember, phone insurance is not just about financial protection; it's about peace of mind. By being proactive and well-informed, you can ensure that your valuable smartphone is protected, and you are prepared for any unexpected situations that may arise.

What should I do if my phone is lost or stolen?

+If your phone is lost or stolen, report the incident to the local authorities immediately. Obtain a police report or a unique reference number, as this documentation is crucial for your insurance claim. Additionally, notify your insurance provider as soon as possible to initiate the claims process.

How long does it typically take to process a phone insurance claim?

+The processing time for phone insurance claims can vary depending on the insurer and the complexity of the case. Typically, it can take anywhere from a few days to several weeks. Factors such as the completeness of your documentation, the severity of the damage, and the insurer’s workload can influence the processing time.

Can I file a claim if my phone is damaged due to my own negligence?

+Phone insurance policies often have exclusions for damage caused by negligence or misuse. However, it’s important to review your specific policy to understand its terms and conditions. Some policies may cover accidental damage, even if it was caused by your own actions, while others may have limitations or require additional coverage.