Hartford Insurance Aarp

Welcome to an in-depth exploration of the partnership between Hartford Insurance and AARP. This article will delve into the intricacies of their relationship, the benefits it offers to members, and the impact it has on the insurance industry as a whole. With a focus on expertise and industry insights, we will uncover the unique value proposition that this collaboration brings to the table.

The Hartford Insurance and AARP Partnership: A Comprehensive Overview

The collaboration between The Hartford Insurance Group and AARP (formerly known as the American Association of Retired Persons) is a strategic alliance that has revolutionized the insurance landscape for individuals aged 50 and above. This partnership, rooted in a shared vision of empowering older adults and providing them with comprehensive protection, has flourished over the years, offering a wide array of benefits to AARP members.

At its core, this alliance combines the financial strength and expertise of The Hartford, a leading insurance provider with a rich history spanning over 200 years, with the vast reach and advocacy of AARP, a nonprofit organization dedicated to enhancing the quality of life for its members. Together, they have crafted a range of insurance products tailored to meet the unique needs of the 50+ demographic, offering peace of mind and financial security.

A Brief History of the Partnership

The partnership between Hartford Insurance and AARP began in the early 2000s, with the launch of exclusive insurance products for AARP members. Over the years, this collaboration has expanded and evolved, reflecting the changing needs and preferences of older adults. Today, it stands as a testament to the success of strategic alliances in the insurance industry, showcasing how partnerships can drive innovation and deliver unparalleled value to customers.

Benefits for AARP Members

AARP members enjoy a multitude of advantages through this partnership. Here are some key benefits:

- Discounted Rates: AARP members are eligible for exclusive discounts on a variety of insurance products, including auto, home, life, and long-term care insurance. These discounts can significantly reduce the financial burden of insurance coverage, making it more accessible and affordable.

- Comprehensive Coverage: Hartford Insurance offers a range of customizable insurance plans that cater to the diverse needs of AARP members. From comprehensive auto insurance to specialized home protection, members can choose coverage options that align with their unique lifestyles and circumstances.

- Financial Security: The partnership provides AARP members with access to life insurance and long-term care insurance products. These products offer financial protection and peace of mind, ensuring that members can maintain their standard of living and receive the necessary care in their golden years.

- Educational Resources: Hartford Insurance and AARP collaborate to provide educational materials and resources to members. These resources cover a wide range of topics, from understanding insurance policies to managing financial risks, empowering members to make informed decisions about their insurance needs.

By leveraging the strengths of both organizations, this partnership has become a cornerstone of financial protection and security for AARP members, ensuring they can navigate their later years with confidence and peace of mind.

Insurance Products Offered Through the Partnership

The Hartford Insurance and AARP partnership offers a comprehensive suite of insurance products designed specifically for AARP members. These products are tailored to address the unique needs and concerns of individuals aged 50 and above, providing them with the protection and peace of mind they deserve.

Auto Insurance

Hartford's auto insurance for AARP members offers a range of benefits, including:

- Discounted Rates: AARP members enjoy exclusive rate discounts on auto insurance, making it more affordable to protect their vehicles.

- Accident Forgiveness: This feature ensures that members' rates remain stable even after their first at-fault accident, providing financial relief in challenging times.

- Roadside Assistance: Members have access to 24/7 roadside assistance, including towing, battery jump-starts, and more, ensuring they're never stranded.

- Usage-Based Insurance: Hartford's program, called "Drive Safe & Save," allows members to save on their premiums by driving safely. The program uses telematics to track driving behavior, rewarding safe drivers with discounts.

Hartford's auto insurance for AARP members is designed to provide comprehensive coverage at competitive rates, ensuring that members can drive with confidence and financial security.

Home Insurance

The partnership also offers specialized home insurance for AARP members, which includes:

- Discounts for Multiple Policies: Members who bundle their auto and home insurance policies with Hartford can save even more on their premiums.

- Replacement Cost Coverage: This option ensures that members receive the full cost of replacing their home and personal belongings in the event of a covered loss, providing added financial protection.

- Enhanced Personal Property Coverage: Hartford's home insurance offers broader coverage for personal property, including valuables like jewelry and fine art, ensuring that members' cherished possessions are adequately protected.

- Identity Theft Protection: In today's digital age, identity theft is a growing concern. Hartford's home insurance includes identity theft protection services, helping members recover and restore their identities if they fall victim to this crime.

With these specialized home insurance offerings, AARP members can safeguard their homes and belongings, knowing they have the financial protection they need to recover from unforeseen events.

Life Insurance

Hartford's life insurance products for AARP members are designed to provide financial security and peace of mind. Here's an overview:

- Whole Life Insurance: This type of policy provides lifetime coverage, with level premiums and a cash value component that grows over time. It offers a guaranteed death benefit, ensuring financial protection for loved ones.

- Term Life Insurance: Hartford offers term life insurance policies with flexible terms, ranging from 10 to 30 years. These policies provide affordable coverage for a specified period, catering to members' short-term financial needs.

- Guaranteed Issue Life Insurance: For members who may have health concerns or pre-existing conditions, Hartford provides guaranteed issue life insurance. This policy is available to all AARP members without a medical exam, ensuring that everyone has access to life insurance coverage.

- Accidental Death Benefit: As an added layer of protection, Hartford's life insurance policies often include an accidental death benefit rider. This rider provides an additional death benefit if the insured person passes away due to an accident, offering enhanced financial security.

By offering a variety of life insurance options, Hartford and AARP ensure that members can choose the coverage that best aligns with their financial goals and the needs of their loved ones.

Long-Term Care Insurance

Long-term care insurance is a critical component of financial planning for older adults, and the Hartford and AARP partnership recognizes this. Here's what members can expect from their long-term care insurance offerings:

- Comprehensive Coverage: Hartford's long-term care insurance policies cover a range of services, including home health care, assisted living, and nursing home care. This ensures that members can receive the care they need, where and how they prefer.

- Inflation Protection: Policies often include inflation protection, which helps ensure that the benefit amount keeps pace with rising costs of care over time.

- Flexible Benefit Options: Members can choose from a variety of benefit options, including daily benefit amounts and benefit periods, allowing them to tailor their coverage to their specific needs and budget.

- Tax Advantages: Long-term care insurance premiums may be tax-deductible, providing additional financial benefits to policyholders.

With Hartford's long-term care insurance, AARP members can plan for their future with confidence, knowing they have the financial resources to access the care they may need as they age.

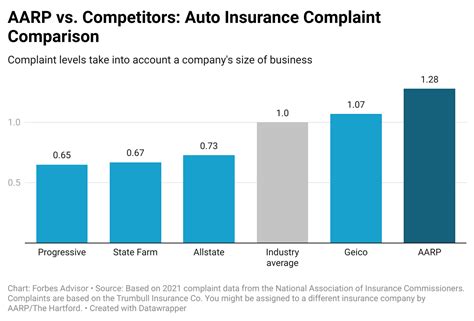

The Impact on the Insurance Industry

The partnership between Hartford Insurance and AARP has had a profound impact on the insurance industry, shaping the way insurance products are designed and marketed to older adults. Here's a deeper look at its influence:

Innovative Product Design

Hartford and AARP's collaboration has led to the development of insurance products specifically tailored to the needs of the 50+ demographic. This innovative approach has set a new standard for the industry, encouraging other insurers to follow suit and create products that better serve this often-overlooked market segment.

Enhanced Customer Experience

The partnership has prioritized delivering an exceptional customer experience. By combining Hartford's insurance expertise with AARP's member-centric approach, they've created a seamless and personalized insurance journey for older adults. This focus on customer satisfaction has raised the bar for the entire industry, emphasizing the importance of tailored, accessible services.

Increased Awareness and Education

Through their joint efforts, Hartford and AARP have elevated public awareness about the importance of insurance coverage for older adults. Their educational initiatives have empowered individuals to make informed decisions about their financial protection, leading to a more knowledgeable and proactive customer base.

Industry Collaboration

The success of this partnership has inspired other insurance companies to seek similar alliances with advocacy groups and organizations representing specific demographics. This trend has fostered a more collaborative and customer-centric approach within the industry, benefiting consumers with a wider range of tailored insurance options.

Future Implications and Industry Insights

As the landscape of the insurance industry continues to evolve, the Hartford and AARP partnership is poised to remain a driving force in shaping the future of insurance for older adults. Here are some insights into what we can expect:

Technological Advancements

With the rapid advancement of technology, we can anticipate that the partnership will leverage digital tools and platforms to enhance the insurance experience for AARP members. This could include streamlined online applications, mobile app integrations, and even the use of artificial intelligence for more efficient claims processing.

Expanded Product Offerings

As the needs of older adults evolve, the partnership is likely to expand its product portfolio. This may include introducing new types of insurance, such as pet insurance or travel insurance, to cater to the diverse interests and lifestyles of AARP members.

Focus on Preventive Care

In alignment with the growing trend of preventive healthcare, the partnership may increasingly emphasize the role of insurance in promoting wellness and preventing long-term health issues. This could involve offering incentives for members to engage in healthy behaviors or providing access to wellness programs and resources.

Enhanced Customer Engagement

To maintain its competitive edge, the partnership will likely continue to prioritize customer engagement and satisfaction. This could involve personalized insurance plans, exclusive member events, and enhanced customer support channels to ensure AARP members feel valued and well-served.

Regulatory Compliance and Innovation

With the insurance industry subject to ongoing regulatory changes, the partnership will need to adapt and innovate to remain compliant. This may involve developing new products or services that align with evolving regulations while maintaining the high standards of quality and customer service that the partnership is known for.

Conclusion

The partnership between Hartford Insurance and AARP has revolutionized the insurance landscape for older adults, offering a comprehensive suite of products and services tailored to their unique needs. Through this collaboration, AARP members can access affordable, comprehensive insurance coverage, enjoy exclusive discounts, and benefit from educational resources. As the insurance industry continues to evolve, this partnership will undoubtedly remain a leader, shaping the future of insurance for the 50+ demographic and beyond.

How can I enroll in Hartford Insurance’s AARP-exclusive plans?

+To enroll in Hartford Insurance’s AARP-exclusive plans, you must be an AARP member. You can join AARP online or through their official website. Once you become a member, you’ll have access to a range of insurance products offered by Hartford, tailored to meet your needs as an older adult.

What are the key benefits of Hartford’s auto insurance for AARP members?

+Hartford’s auto insurance for AARP members offers exclusive rate discounts, accident forgiveness, 24⁄7 roadside assistance, and usage-based insurance. These features provide financial relief, peace of mind, and tailored coverage, ensuring members can drive with confidence.

How does Hartford’s home insurance for AARP members provide enhanced protection?

+Hartford’s home insurance for AARP members offers multiple policy discounts, replacement cost coverage, enhanced personal property protection, and identity theft protection services. These features ensure members receive comprehensive coverage and financial security for their homes and belongings.

What life insurance options are available through the Hartford and AARP partnership?

+Through the partnership, AARP members can choose from whole life, term life, and guaranteed issue life insurance policies. These options provide financial security and peace of mind, ensuring members can protect their loved ones and plan for their future.

How does long-term care insurance from Hartford and AARP benefit older adults?

+Long-term care insurance provides financial resources to access necessary care as individuals age. Hartford and AARP’s policies offer comprehensive coverage, inflation protection, flexible benefit options, and potential tax advantages, ensuring older adults can plan for their future with confidence.