Liability Automobile Insurance

Liability automobile insurance is a crucial aspect of vehicle ownership, providing essential financial protection in the event of accidents or mishaps. This type of insurance covers the policyholder's legal liability for bodily injury or property damage caused to others while operating a vehicle. With the increasing number of vehicles on the road and the potential for accidents, having adequate liability coverage is vital to protect both personal finances and the well-being of others.

Understanding Liability Automobile Insurance

Liability insurance is a fundamental component of any comprehensive insurance policy, designed to safeguard individuals and businesses from financial ruin due to unforeseen accidents or damages. In the context of automobile insurance, liability coverage is a mandatory requirement in most jurisdictions, ensuring that drivers can provide compensation for any harm caused to others during vehicular incidents.

This type of insurance offers protection in two main areas: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the policyholder. Property damage liability, on the other hand, covers the cost of repairing or replacing property, such as vehicles, fences, or buildings, damaged in an accident for which the policyholder is at fault.

Key Components of Liability Automobile Insurance

- Bodily Injury Liability: This covers the cost of medical treatment, rehabilitation, and other expenses for individuals injured in an accident caused by the insured driver. It also provides compensation for pain and suffering and lost wages.

- Property Damage Liability: This component covers the cost of repairing or replacing damaged property, including other vehicles, buildings, fences, and personal belongings, as a result of an accident caused by the insured driver.

- Defense Costs: Liability insurance often includes legal defense costs in the event the insured is sued as a result of an accident. This ensures that the policyholder has access to legal representation and protection against potential financial losses.

- Uninsured/Underinsured Motorist Coverage: This optional coverage provides protection in the event the at-fault driver in an accident has insufficient or no insurance to cover the damages. It ensures the insured can receive compensation for their injuries and property damage.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for injured individuals. |

| Property Damage Liability | Repairs or replaces damaged property caused by the insured driver. |

| Uninsured/Underinsured Motorist Coverage | Provides compensation if the at-fault driver lacks sufficient insurance. |

The Importance of Adequate Coverage

While liability automobile insurance is a legal requirement in most regions, it’s crucial to ensure that the coverage limits are sufficient to protect your financial interests. The standard liability coverage amounts vary by state and country, but often, the minimum required limits may not be enough to cover potential damages in a serious accident.

In the United States, for instance, many states require a minimum of $25,000 in bodily injury liability coverage per person, $50,000 per accident, and $25,000 in property damage liability coverage. However, the cost of medical treatment and vehicle repairs can quickly exceed these limits, leaving the policyholder responsible for the remaining expenses.

Factors Influencing Coverage Limits

- State Requirements: Each state has its own minimum liability coverage requirements, which act as a baseline for policyholders. However, these minimums may not provide sufficient protection, especially in cases of severe accidents.

- Asset Protection: One of the primary reasons for adequate liability coverage is asset protection. If an insured individual is found at fault in an accident and the damages exceed their policy limits, their personal assets could be at risk. Increasing coverage limits can provide an additional layer of protection.

- Legal Costs: In the event of a lawsuit, legal defense costs can be significant. Having higher liability limits can ensure that these costs are covered, preventing the policyholder from incurring substantial out-of-pocket expenses.

| State | Minimum Bodily Injury Liability | Minimum Property Damage Liability |

|---|---|---|

| California | $15,000 per person / $30,000 per accident | $5,000 |

| Texas | $30,000 per person / $60,000 per accident | $25,000 |

| New York | $25,000 per person / $50,000 per accident | $10,000 |

Common Misconceptions and Challenges

While liability automobile insurance is a widely understood concept, there are still several misconceptions and challenges associated with it. Understanding these can help policyholders make more informed decisions and better protect themselves.

Misconceptions about Liability Insurance

- Limited Coverage: Some individuals believe that liability insurance only covers the other party’s damages and not their own. In reality, liability insurance covers the policyholder’s legal liability for bodily injury and property damage to others, but it does not provide coverage for the policyholder’s own vehicle or injuries.

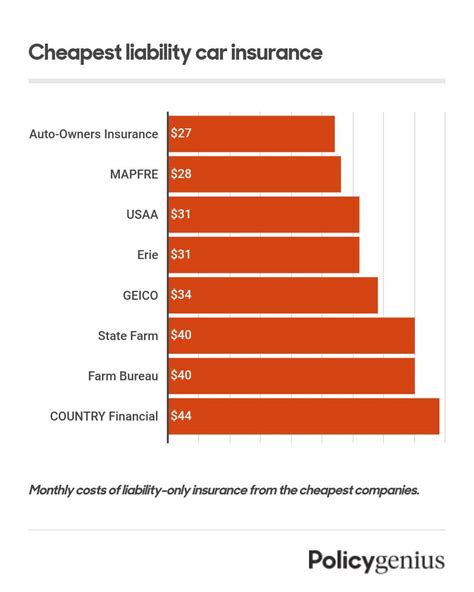

- Cost vs. Benefit: There’s often a misconception that liability insurance is an unnecessary expense. However, the potential financial risks and legal implications of inadequate coverage far outweigh the cost of premiums. It’s a necessary investment to protect personal finances and legal standing.

Challenges in Obtaining Adequate Coverage

- Cost: Higher liability coverage limits often come with increased premiums. For individuals on a tight budget, this can be a significant challenge. However, there are ways to manage costs, such as comparing quotes from multiple insurers, opting for higher deductibles, or bundling policies.

- Understanding Policy Terms: Liability insurance policies can be complex, with various terms and conditions that may be difficult to understand. It’s crucial to thoroughly review the policy documents and seek clarification on any unclear aspects to ensure you have the coverage you need.

Future Trends and Innovations

The automobile insurance industry is evolving, driven by technological advancements and changing consumer expectations. Here are some key trends and innovations that are shaping the future of liability automobile insurance.

Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes driving data in real-time, is gaining traction in the insurance industry. Usage-based insurance (UBI) programs use telematics to monitor driving behavior and offer personalized insurance rates based on actual driving habits. This trend is expected to continue, providing more accurate risk assessments and potentially reducing costs for safe drivers.

Connected Vehicles and Data Sharing

With the increasing connectivity of vehicles, insurance companies are leveraging vehicle data to enhance their risk assessment capabilities. Connected vehicles can provide real-time information on driving patterns, vehicle performance, and accident data, enabling insurers to offer more precise coverage and potentially reduce claims fraud.

Artificial Intelligence and Machine Learning

AI and machine learning technologies are being utilized to improve various aspects of the insurance process, from risk assessment and pricing to claims handling. These technologies can analyze vast amounts of data, identify patterns, and make predictions, leading to more efficient and accurate insurance offerings.

Conclusion

Liability automobile insurance is a critical component of responsible vehicle ownership, providing financial protection and peace of mind. While the concept is well-established, it’s essential to stay informed about the latest trends and innovations in the industry to ensure you have the most appropriate coverage for your needs. By understanding the key components, importance of adequate coverage, and future trends, policyholders can make more informed decisions and navigate the ever-evolving insurance landscape with confidence.

What is the difference between liability and comprehensive automobile insurance?

+Liability insurance covers the policyholder’s legal liability for bodily injury and property damage caused to others, while comprehensive insurance provides coverage for damages to the policyholder’s own vehicle due to non-collision incidents such as theft, vandalism, or natural disasters.

How do I know if my liability coverage is sufficient?

+Evaluating the sufficiency of your liability coverage involves considering your personal assets and the potential risks you face. It’s recommended to consult with an insurance professional who can help you assess your specific needs and recommend appropriate coverage limits.

Can liability insurance cover legal defense costs?

+Yes, many liability insurance policies include legal defense costs as part of their coverage. This means that if you’re sued as a result of an accident, your insurance provider will cover the cost of your legal representation, up to the policy limits.