Define Universal Life Insurance

Universal life insurance is a flexible and versatile form of permanent life insurance that offers policyholders a range of benefits and options to tailor coverage to their specific needs. Unlike term life insurance, which provides coverage for a set period, universal life insurance offers lifelong protection with the potential for cash value growth.

Understanding Universal Life Insurance

Universal life insurance policies are designed to provide long-term financial protection while also offering flexibility in terms of premiums, death benefits, and cash value accumulation. This type of insurance is particularly appealing to individuals seeking a balance between the affordability of term life insurance and the longevity and investment potential of whole life insurance.

The key feature of universal life insurance is its ability to adapt to changing circumstances. Policyholders can adjust their premium payments and death benefits within certain limits, making it possible to increase or decrease coverage as their financial situation or family needs evolve. Additionally, universal life insurance policies typically offer a savings or investment component, allowing policyholders to build cash value over time.

How Universal Life Insurance Works

When a policyholder purchases a universal life insurance policy, they agree to pay a set premium, which is typically flexible and can be adjusted within certain guidelines. A portion of this premium is used to cover the cost of insurance (COI), which is the amount necessary to maintain the death benefit. The remaining portion is allocated to the policy’s cash value account, which earns interest and can grow over time.

The cash value account operates similarly to a savings or investment account. Policyholders can choose how their cash value is invested, typically from a range of investment options offered by the insurance company. These options may include fixed interest accounts, mutual funds, or other investment vehicles. The growth of the cash value is tax-deferred, meaning it accumulates without being taxed until it is withdrawn or used.

| Universal Life Insurance Features | Description |

|---|---|

| Flexible Premiums | Policyholders can adjust premium payments within certain limits, providing flexibility in managing their finances. |

| Adjustable Death Benefit | The death benefit can be increased or decreased, allowing policyholders to adapt coverage to their changing needs. |

| Cash Value Accumulation | A portion of premiums is allocated to a cash value account, which earns interest and can be used for various purposes. |

| Investment Options | Policyholders can choose how their cash value is invested, offering the potential for growth. |

| Tax-Deferred Growth | The cash value grows tax-deferred, providing tax advantages for long-term savings. |

Benefits and Considerations

One of the primary benefits of universal life insurance is its flexibility. Policyholders can adjust their coverage to reflect significant life events, such as the birth of a child, purchasing a home, or retirement planning. This adaptability makes universal life insurance a versatile tool for managing long-term financial goals.

Additionally, the cash value component of universal life insurance can be utilized in various ways. Policyholders can borrow against the cash value for major purchases or use it to supplement retirement income. The tax-deferred growth of the cash value makes it an attractive option for long-term savings and investment.

Key Considerations

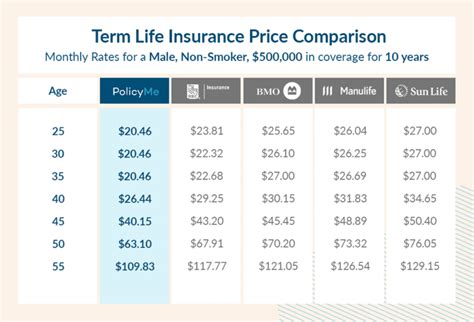

While universal life insurance offers numerous advantages, it’s essential to consider certain factors before purchasing a policy. Firstly, the cost of universal life insurance can be higher than term life insurance due to its permanent nature and cash value accumulation. Policyholders should carefully assess their financial situation and long-term goals to determine if the added cost is justifiable.

Secondly, the performance of the cash value account is not guaranteed. While insurance companies offer a range of investment options, the returns can vary, and there is a risk of underperformance or loss. Policyholders should understand the potential risks and rewards associated with their chosen investment strategy.

Lastly, universal life insurance policies often require careful management to ensure they remain in force. Policyholders must ensure that premiums are paid and that the cash value account is adequately funded to cover the cost of insurance. Failure to do so could result in the policy lapsing, leading to a loss of coverage and any accumulated cash value.

Conclusion

Universal life insurance is a powerful tool for individuals seeking lifelong financial protection and the potential for cash value growth. Its flexibility and adaptability make it a popular choice for those with evolving financial needs. However, policyholders must carefully consider the costs, investment risks, and management requirements to ensure they maximize the benefits of this type of insurance.

Can I access the cash value of my universal life insurance policy?

+Yes, you can access the cash value of your universal life insurance policy through policy loans or withdrawals. Policy loans allow you to borrow against the cash value, while withdrawals let you take out a portion of the cash value. However, it’s important to note that policy loans and withdrawals may have tax implications and can impact the death benefit and cash value growth of your policy.

How do I choose the right investment options for my universal life insurance policy’s cash value account?

+When choosing investment options for your cash value account, consider your risk tolerance, financial goals, and time horizon. Insurance companies typically offer a range of options, including fixed interest accounts, mutual funds, and indexed investments. It’s advisable to consult with a financial advisor to determine the most suitable investment strategy for your needs.

What happens if I fail to pay my universal life insurance premiums?

+If you fail to pay your universal life insurance premiums, your policy may enter a grace period, typically 30-60 days. During this time, the policy remains in force, and you have the opportunity to make the missed payment. If the grace period expires without payment, the policy may lapse, resulting in the loss of coverage and any accumulated cash value.