How Much Is Term Life Insurance

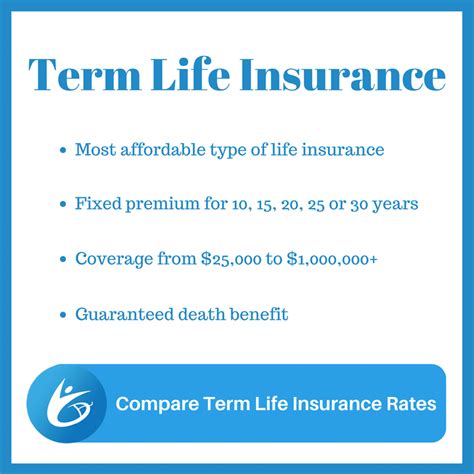

Term life insurance is a popular and affordable option for individuals seeking financial protection for their loved ones during a specified period. This type of insurance policy offers coverage for a set term, typically ranging from 10 to 30 years, and provides a death benefit to the beneficiaries in the event of the policyholder's untimely demise during the policy period. The cost of term life insurance can vary significantly based on several factors, including the policyholder's age, health, lifestyle, and the coverage amount chosen. In this comprehensive article, we will delve into the factors influencing the cost of term life insurance, explore average costs, and provide insights into how you can secure the best rates for your specific needs.

Understanding the Factors that Impact Term Life Insurance Costs

The cost of term life insurance is determined by a variety of factors, each playing a crucial role in the overall premium. By understanding these factors, you can make informed decisions to secure the most cost-effective coverage for your circumstances.

Age and Health

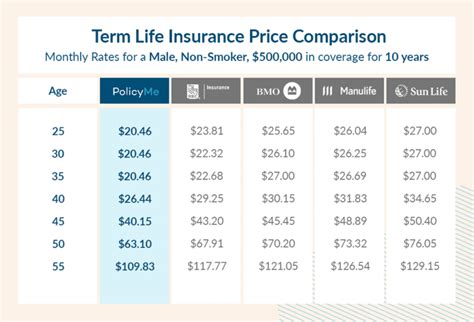

One of the primary factors influencing term life insurance costs is the age and health of the policyholder. Insurance companies assess an individual’s age and health to determine their risk profile. Younger individuals, typically aged between 20 and 40, are considered lower-risk candidates and often enjoy lower premiums. As individuals age, their risk of developing health conditions increases, leading to higher premiums. Additionally, pre-existing health conditions or high-risk lifestyles, such as smoking or engaging in hazardous activities, can significantly impact the cost of term life insurance.

| Age Group | Average Annual Premium (for $500,000 coverage) |

|---|---|

| 20-29 | $200 - $300 |

| 30-39 | $250 - $400 |

| 40-49 | $350 - $600 |

| 50-59 | $600 - $1,000 |

The table above provides a general overview of the average annual premiums for a $500,000 term life insurance policy based on different age groups. It's important to note that these are approximate figures and can vary based on individual health and lifestyle factors.

Coverage Amount and Term Length

The amount of coverage you choose for your term life insurance policy is another significant factor in determining the cost. Higher coverage amounts provide more financial protection for your beneficiaries but also result in higher premiums. Similarly, the length of the term, whether it’s 10, 20, or 30 years, affects the overall cost. Longer term lengths often lead to slightly higher premiums, as the insurance company bears the risk for a more extended period.

| Coverage Amount | Average Annual Premium (for 20-year term) |

|---|---|

| $250,000 | $150 - $250 |

| $500,000 | $200 - $350 |

| $1,000,000 | $400 - $800 |

| $2,000,000 | $800 - $1,600 |

The table above illustrates the average annual premiums for different coverage amounts, assuming a 20-year term. Again, these are general estimates, and actual costs may vary based on individual circumstances.

Tobacco Use and Lifestyle Factors

Insurance companies also consider lifestyle factors when assessing term life insurance premiums. Individuals who use tobacco products, such as cigarettes or chewing tobacco, often face higher premiums due to the increased health risks associated with tobacco use. Additionally, individuals with high-risk hobbies or occupations, such as extreme sports enthusiasts or those working in hazardous industries, may also experience higher costs.

Gender and Family History

Gender can also play a role in determining term life insurance costs. Historically, men have been charged higher premiums than women due to their generally shorter life expectancies and higher mortality rates. However, this gap has been narrowing in recent years as life expectancy rates have improved and insurance companies have updated their underwriting practices.

Family history is another factor that insurance companies take into account. If you have a family history of certain medical conditions or diseases, such as heart disease or cancer, your premiums may be higher. Insurance companies assess the likelihood of inheriting these conditions and adjust their rates accordingly.

Tips for Securing the Best Term Life Insurance Rates

Now that we’ve explored the factors influencing term life insurance costs, let’s discuss some strategies to help you secure the most cost-effective coverage for your needs.

Compare Multiple Quotes

One of the most effective ways to find the best term life insurance rates is to compare quotes from multiple insurance companies. Each insurer has its own underwriting guidelines and rate structures, so obtaining quotes from several providers can help you identify the most competitive rates for your specific circumstances.

Consider a Longer Term Length

While longer term lengths may result in slightly higher premiums, they can provide significant savings in the long run. If you opt for a 30-year term instead of a 20-year term, for example, you may lock in a lower premium rate for a more extended period, which can be especially beneficial if you anticipate needing coverage for a longer duration.

Improve Your Health and Lifestyle

Improving your health and adopting a healthier lifestyle can have a positive impact on your term life insurance costs. If you’re a smoker, quitting smoking can significantly reduce your premiums. Additionally, maintaining a healthy weight, exercising regularly, and managing any pre-existing health conditions can enhance your overall health profile, making you a lower-risk candidate for insurance companies.

Bundle Policies for Discounts

If you’re already insured with a particular company for auto or home insurance, consider bundling your term life insurance policy with your existing policies. Many insurance companies offer discounts when you purchase multiple policies from them, which can lead to substantial savings on your term life insurance premiums.

Seek Professional Guidance

Navigating the term life insurance market and understanding the nuances of different policies can be challenging. Seeking guidance from a qualified insurance professional or financial advisor can be invaluable. They can assess your specific needs, provide personalized recommendations, and help you secure the most suitable and cost-effective coverage.

The Future of Term Life Insurance Costs

The term life insurance industry is continuously evolving, and advancements in technology and data analytics are shaping the future of insurance costs. Here’s a glimpse into some of the potential developments that may impact term life insurance costs in the coming years.

Advanced Underwriting Techniques

Insurance companies are increasingly utilizing advanced underwriting techniques, such as biometric screenings and genetic testing, to assess an individual’s health and risk profile more accurately. These techniques can provide a more precise understanding of an individual’s health, potentially leading to more tailored and precise premium calculations.

Personalized Pricing

With the advent of big data and machine learning, insurance companies are exploring ways to offer personalized pricing based on an individual’s unique risk profile. By analyzing vast amounts of data, insurers can identify specific factors that contribute to an individual’s risk and adjust premiums accordingly. This approach could lead to more accurate and fair pricing for policyholders.

Digital Health Monitoring

The integration of digital health monitoring technologies, such as wearable fitness trackers and health apps, is gaining traction in the insurance industry. These technologies provide real-time health data, allowing insurance companies to offer incentives and discounts to policyholders who maintain healthy lifestyles and actively manage their health. As these technologies become more prevalent, they could influence term life insurance costs by rewarding healthier individuals with lower premiums.

Increased Competition

The term life insurance market is becoming increasingly competitive, with more insurers entering the market and offering innovative products and pricing structures. This competition can drive down costs and provide more options for consumers. As the market becomes more competitive, policyholders can expect to see a wider range of coverage options and potentially more affordable premiums.

Frequently Asked Questions

What is the average cost of term life insurance for a 30-year-old non-smoker?

+For a 30-year-old non-smoker, the average cost of term life insurance can range from 150 to 300 per year for a $500,000 policy. However, individual rates may vary based on health and lifestyle factors.

Can I get term life insurance if I have a pre-existing medical condition?

+Yes, you can still obtain term life insurance with a pre-existing medical condition. However, your premiums may be higher, and you may need to undergo additional medical examinations or provide detailed health information during the underwriting process.

Are there any term life insurance policies with no medical exam required?

+Yes, there are term life insurance policies available that do not require a medical exam. These policies are often referred to as “simplified issue” or “guaranteed issue” policies. However, these policies typically have higher premiums and may have certain coverage limitations.

How often should I review and update my term life insurance policy?

+It’s recommended to review your term life insurance policy every few years or whenever your life circumstances change significantly. This ensures that your coverage remains adequate and aligned with your current needs and financial situation.

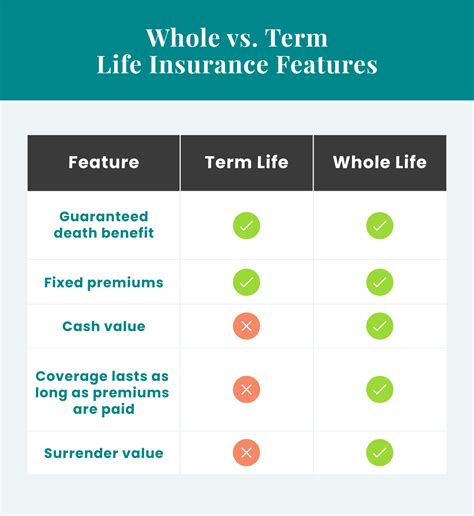

Can I convert my term life insurance policy into a permanent life insurance policy later on?

+Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy into a permanent life insurance policy, such as whole life or universal life insurance. This can be a beneficial option if your financial situation or needs change over time.