Geico Rental Insurance Car

In the world of travel and insurance, one common question that arises is whether a trusted auto insurance provider like GEICO can also offer reliable rental car insurance. This comprehensive guide aims to delve into the intricacies of GEICO's rental car insurance options, shedding light on the coverage, benefits, and potential pitfalls. By understanding the ins and outs of this coverage, travelers can make informed decisions to protect themselves financially while enjoying their adventures.

Understanding GEICO’s Rental Car Insurance

GEICO, known for its catchy marketing campaigns and competitive rates, has expanded its services to include rental car insurance. This specialized coverage is designed to protect renters from potential financial liabilities that may arise during their rental period. While it is an additional expense, it provides peace of mind for those who want comprehensive protection.

Coverage Options

GEICO’s rental car insurance offers a range of coverage options, tailored to meet the diverse needs of travelers. The primary coverage types include:

- Liability Coverage: This option provides protection against bodily injury and property damage claims made against the renter. It covers the renter’s legal responsibility for accidents that occur during the rental period.

- Collision Damage Waiver (CDW): CDW is a comprehensive coverage that waives the renter’s responsibility for any damage to the rental vehicle, including collisions, theft, or vandalism. It provides financial protection for the renter, ensuring they are not liable for expensive repairs.

- Personal Effects Coverage: This coverage extends to personal belongings left inside the rental car. It offers protection against theft or damage to valuables, providing an extra layer of security for travelers.

- Medical Payments Coverage: In the event of an accident, this coverage pays for the medical expenses of the renter and their passengers, regardless of fault. It ensures that medical bills are covered, reducing the financial burden on the traveler.

Each coverage option comes with its own set of terms and conditions, and it is essential for renters to carefully review these details to ensure they understand the extent of their protection.

Benefits and Advantages

Opting for GEICO’s rental car insurance offers several advantages. Firstly, it provides a sense of security, knowing that financial liabilities are covered in the event of an accident or damage to the rental vehicle. This peace of mind allows travelers to focus on enjoying their trip without the stress of potential financial burdens.

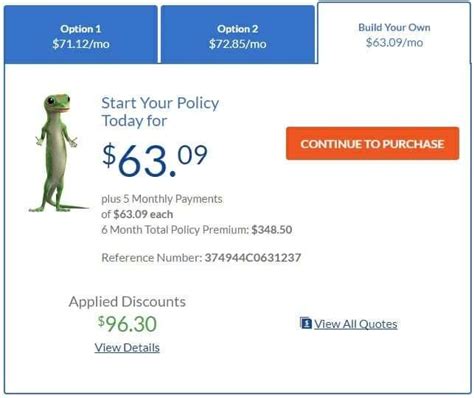

Additionally, GEICO's rental car insurance can be more cost-effective than purchasing coverage directly from the rental car company. Rental car agencies often offer insurance packages at a premium, whereas GEICO's rates may be more competitive, especially for those who already have an auto insurance policy with the company.

Another benefit is the convenience of having all insurance needs met by a single provider. GEICO customers can easily add rental car insurance to their existing policy, streamlining the process and providing a seamless experience.

Considerations and Potential Pitfalls

While GEICO’s rental car insurance offers many advantages, there are certain considerations and potential pitfalls to be aware of. Understanding these aspects is crucial to making an informed decision.

Policy Exclusions

Like any insurance policy, GEICO’s rental car insurance comes with exclusions. It is essential to review the policy carefully to understand what is not covered. Some common exclusions may include damage to certain parts of the vehicle, such as tires or windshields, or damage incurred during off-road driving.

It is also important to note that GEICO's rental car insurance may not cover all rental vehicles. Certain high-end or exotic cars may be excluded from coverage, so it is advisable to check with GEICO or the rental car company to ensure the desired vehicle is covered.

Deductibles and Out-of-Pocket Expenses

Rental car insurance policies typically come with deductibles, which are the amounts renters must pay out of pocket before the insurance coverage kicks in. These deductibles can vary depending on the coverage selected and the rental car company’s policies. It is crucial to understand the deductible amount and factor it into the overall cost of the rental.

Additionally, there may be other out-of-pocket expenses associated with rental car insurance, such as administrative fees or surcharges. These fees can add up, so it is essential to review the policy and calculate the total cost to ensure it aligns with the traveler's budget.

Alternative Coverage Options

Before opting for GEICO’s rental car insurance, it is worthwhile to explore alternative coverage options. Many credit card companies offer rental car insurance benefits as part of their rewards programs. These benefits can provide similar coverage to GEICO’s policy, often at no additional cost. It is advisable to check with the credit card issuer to understand the extent of the coverage and any conditions that may apply.

Additionally, some auto insurance policies may extend coverage to rental cars. Travelers should review their existing auto insurance policies to see if they already have rental car coverage included. This can provide an additional layer of protection without the need for a separate policy.

Real-Life Scenarios and Case Studies

To better understand the impact of GEICO’s rental car insurance, let’s explore some real-life scenarios and case studies.

Scenario 1: Accident Coverage

Imagine a traveler named Sarah who rents a car for a road trip across the country. Unfortunately, an accident occurs, resulting in damage to the rental vehicle. Sarah, who has GEICO’s rental car insurance with a comprehensive collision damage waiver, can breathe easy knowing that the insurance will cover the repairs. With no deductible to pay, Sarah can focus on her recovery and continue her journey without financial strain.

Scenario 2: Personal Belongings Protection

John, a frequent traveler, opts for GEICO’s rental car insurance with personal effects coverage. During one of his trips, his laptop is stolen from the rental car. With this coverage, John can file a claim and receive compensation for the loss of his valuable item. This coverage provides an added layer of security for his personal belongings, ensuring he is not left financially burdened.

Scenario 3: Credit Card Benefits

Emily, a savvy traveler, decides to explore alternative coverage options before purchasing GEICO’s rental car insurance. She discovers that her premium credit card offers rental car insurance benefits. By utilizing this benefit, Emily enjoys the same level of coverage as GEICO’s policy, but without the additional cost. This scenario highlights the importance of exploring all available options before making a decision.

Performance Analysis and Customer Satisfaction

To assess the effectiveness and customer satisfaction of GEICO’s rental car insurance, let’s delve into some performance metrics and customer feedback.

Claim Settlement Process

A crucial aspect of any insurance policy is the claim settlement process. GEICO strives to provide a seamless and efficient experience for its customers. The company has implemented a streamlined process, allowing renters to file claims online or through their mobile app. This digital approach ensures a quick and convenient experience, reducing the stress associated with the claims process.

GEICO's claim adjusters are known for their expertise and fairness. They work diligently to assess claims promptly and provide fair settlements. The company's commitment to customer satisfaction is evident in its claim settlement process, ensuring renters receive the compensation they deserve without unnecessary delays.

Customer Feedback and Reviews

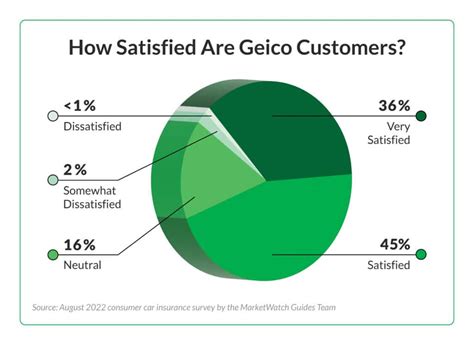

GEICO’s rental car insurance has received generally positive feedback from customers. Many travelers appreciate the comprehensive coverage and the peace of mind it provides. The convenience of adding rental car insurance to an existing GEICO policy is highly regarded, as it simplifies the insurance process.

However, some customers have expressed concerns about certain exclusions and the need for a thorough understanding of the policy's terms and conditions. It is essential for renters to carefully review the policy and ask any questions they may have to ensure they are fully aware of the coverage they are purchasing.

Future Implications and Industry Trends

As the travel industry continues to evolve, rental car insurance remains a crucial aspect of travelers’ financial planning. GEICO, being a prominent player in the insurance market, is well-positioned to adapt to changing trends and consumer needs.

Emerging Technologies and Digital Solutions

GEICO recognizes the importance of staying ahead of the curve in an increasingly digital world. The company has invested in emerging technologies to enhance its rental car insurance offerings. This includes the development of mobile apps that provide real-time updates and streamlined claim processes, ensuring a seamless experience for renters.

Additionally, GEICO is exploring partnerships with rental car companies to integrate their insurance services directly into the rental process. This integration would provide renters with a seamless and convenient experience, allowing them to purchase insurance alongside their rental reservation.

Industry Collaboration and Standardization

The rental car insurance industry is constantly evolving, with various providers offering different coverage options and terms. GEICO, along with other industry leaders, is actively working towards standardization and collaboration. This effort aims to simplify the rental car insurance landscape, making it easier for travelers to understand and compare coverage options.

Through industry collaboration, GEICO strives to establish clear and consistent guidelines for rental car insurance, ensuring that renters receive fair and transparent information. This initiative benefits both renters and providers, promoting trust and confidence in the insurance process.

Expansion of Coverage Options

Looking ahead, GEICO plans to expand its rental car insurance offerings to cater to a wider range of travelers. This includes exploring specialized coverage for unique rental scenarios, such as extended rentals or rentals for business purposes. By offering tailored coverage, GEICO aims to meet the diverse needs of its customers, providing comprehensive protection for all types of travel.

Conclusion

GEICO’s rental car insurance offers a comprehensive solution for travelers seeking financial protection during their rental periods. With a range of coverage options, benefits, and advantages, renters can enjoy their adventures with peace of mind. However, it is crucial to carefully review the policy’s terms and conditions, consider alternative coverage options, and understand the potential pitfalls to make an informed decision.

As the travel industry continues to evolve, GEICO's dedication to innovation and customer satisfaction ensures that its rental car insurance offerings remain at the forefront, providing travelers with the protection and convenience they deserve.

Can GEICO’s rental car insurance cover damage to the rental vehicle caused by natural disasters?

+Yes, GEICO’s rental car insurance typically covers damage caused by natural disasters, such as hurricanes, floods, or earthquakes. However, it is important to review the policy’s terms and conditions to understand any specific exclusions or limitations that may apply.

Does GEICO offer rental car insurance for international trips?

+Yes, GEICO’s rental car insurance can be extended to cover international trips. Renters should contact GEICO or review their policy documents to understand the specific coverage options and any additional requirements for international rentals.

What happens if I have an accident while renting a car and don’t have rental car insurance?

+If you are involved in an accident while renting a car without rental car insurance, you may be financially responsible for any damages to the rental vehicle, as well as any third-party claims. It is always advisable to have rental car insurance to protect yourself from such liabilities.