Who Needs Life Insurance

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their loved ones. While it is often associated with providing a financial safety net upon the policyholder's death, the benefits of life insurance extend beyond this single event. In this article, we will delve into the various scenarios and life stages where life insurance plays a crucial role, highlighting why it is an indispensable asset for a wide range of individuals.

Protecting Your Loved Ones

One of the primary purposes of life insurance is to ensure the financial well-being of your family or dependents in the event of your untimely passing. Here are some specific situations where life insurance becomes invaluable:

Young Families Starting Out

For young couples with children or those planning to start a family, life insurance is a fundamental component of their financial plan. It provides a safety net to cover the cost of raising children, paying off mortgages, and maintaining their standard of living. With life insurance, parents can rest assured that their family’s future is secure, even in the unfortunate event of their passing.

Single Parents

Single parents bear the sole responsibility of raising their children, often facing unique financial challenges. Life insurance is especially crucial for them, as it ensures that their children’s financial needs will be met, including education expenses, housing costs, and daily living expenses. It provides a safety net to safeguard their children’s future.

| Policy Type | Benefits |

|---|---|

| Term Life Insurance | Affordable coverage for a specific term, ideal for covering temporary needs. |

| Whole Life Insurance | Lifetime coverage with cash value accumulation, suitable for long-term financial planning. |

Stay-at-Home Parents

Stay-at-home parents contribute immensely to their families, often handling childcare, household management, and other essential tasks. While their work may not generate a traditional income, their contributions are invaluable. Life insurance ensures that their efforts are recognized and protected, providing financial support to the family should the unexpected occur.

Securing Your Financial Future

Beyond protecting loved ones, life insurance serves as a vital tool for securing your own financial future and achieving various life goals.

Paying Off Debts and Loans

Many individuals have outstanding debts, such as mortgages, student loans, or credit card balances. Life insurance can be a strategic tool to pay off these debts, ensuring that your loved ones are not burdened with financial obligations after your passing. It provides a sense of financial freedom and peace of mind.

Funding Retirement and Savings Goals

Life insurance policies, particularly whole life or permanent life insurance, offer a unique opportunity to build cash value over time. This accumulated cash value can be used to fund retirement, supplement income, or achieve other long-term financial goals. It provides a reliable source of funds for your future aspirations.

Business Owners and Entrepreneurs

Business owners and entrepreneurs face unique financial challenges and opportunities. Life insurance can be an essential tool for business continuity, ensuring that the business can continue operating smoothly in the event of the owner’s death. It provides stability and helps protect the business’s future.

| Business Insurance | Benefits |

|---|---|

| Key Person Insurance | Protects the business from financial loss due to the death or disability of a key employee or owner. |

| Buy-Sell Agreements | Ensures a smooth transition of ownership in the event of a partner's death, preventing potential disputes. |

Life Transitions and Specific Needs

Life insurance is versatile and can be tailored to meet the unique needs of individuals at different stages of life.

Empty Nesters and Retirees

As children grow up and leave the nest, life insurance remains relevant for empty nesters and retirees. It can provide a financial buffer to cover end-of-life expenses, medical costs, and ensure a dignified legacy for their loved ones. Life insurance policies can also be converted into retirement income streams, offering a reliable source of funds during retirement.

Individuals with Specific Needs

Life insurance can be customized to address specific needs and concerns. For example, individuals with disabilities or chronic illnesses can benefit from life insurance to cover the cost of ongoing medical care, assistive devices, and specialized treatments. It provides financial support to manage these unique challenges.

Estate Planning and Legacy Building

Life insurance is a powerful tool for estate planning and leaving a lasting legacy. It can be used to pay estate taxes, settle debts, and ensure the smooth transfer of assets to beneficiaries. By incorporating life insurance into your estate plan, you can have greater control over the distribution of your wealth and provide for your loved ones’ future.

Conclusion

Life insurance is not a one-size-fits-all solution; it is a personalized financial tool that adapts to the unique needs of individuals and their families. Whether you are starting a family, running a business, or planning for retirement, life insurance offers security, peace of mind, and the opportunity to protect your loved ones and achieve your financial goals. By understanding the diverse benefits of life insurance, you can make informed decisions to safeguard your future and the future of those you care about.

How much life insurance do I need?

+

The amount of life insurance you need depends on your personal circumstances, including your financial obligations, income, and desired level of protection. A common rule of thumb is to have coverage that is 10-15 times your annual income. However, it’s best to consult with a financial advisor or insurance professional to determine the precise amount that suits your needs.

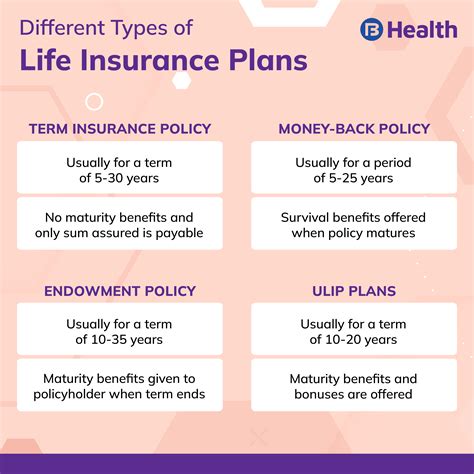

What are the different types of life insurance policies available?

+

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically 10-30 years, and is more affordable. Permanent life insurance, such as whole life or universal life, offers lifetime coverage and accumulates cash value over time. The choice depends on your financial goals and needs.

Can life insurance be used for retirement planning?

+

Yes, certain types of life insurance, like whole life or universal life policies, can be used as a vehicle for retirement planning. These policies accumulate cash value, which can be borrowed against or withdrawn to supplement retirement income. However, it’s essential to consult with a financial advisor to understand the potential tax implications and ensure it aligns with your retirement goals.