Online Store Insurance

In today's digital landscape, online businesses have become an integral part of our economy, offering convenience and accessibility to customers worldwide. As the e-commerce sector continues to thrive, it is essential for online store owners to recognize the importance of insurance coverage. Just as physical retail stores require protection, online ventures need to safeguard their operations, assets, and reputation. This comprehensive guide aims to delve into the world of Online Store Insurance, exploring the various aspects, benefits, and considerations to ensure your online business remains secure and resilient.

Understanding Online Store Insurance

Online Store Insurance, often referred to as e-commerce insurance, is a specialized form of coverage designed to address the unique risks and challenges faced by online businesses. It provides a safety net for retailers operating in the digital realm, offering protection against a wide range of potential liabilities and losses.

In the fast-paced world of e-commerce, where transactions are conducted remotely and customer interactions are often limited to digital interfaces, the need for robust insurance coverage is paramount. Online Store Insurance aims to mitigate the financial impact of unforeseen events, ensuring business continuity and peace of mind for store owners.

Key Components of Online Store Insurance

Online Store Insurance policies typically encompass a comprehensive range of coverages tailored to the specific needs of e-commerce operations. Here are some of the essential components:

- Cyber Liability Insurance: This coverage is vital for online stores, as it protects against data breaches, cyber attacks, and identity theft. With increasing cyber threats, safeguarding customer information and maintaining data security is crucial.

- Product Liability Insurance: E-commerce businesses are responsible for the products they sell. Product liability insurance provides protection in case of defective products, injuries, or property damage caused by their merchandise.

- Business Interruption Insurance: Online stores can suffer disruptions due to various reasons, such as website crashes, cyber attacks, or natural disasters. Business interruption insurance ensures financial support during these periods, covering lost income and expenses.

- Professional Liability Insurance (E&O): Also known as Errors and Omissions insurance, this coverage safeguards online businesses against claims of negligence, mistakes, or failures to perform contractual duties.

- Property Insurance: While online stores primarily operate digitally, they often have physical assets like inventory, equipment, and office spaces. Property insurance protects these assets from damage, theft, or loss.

- Workers' Compensation Insurance: If an online store has employees, workers' compensation insurance is essential to cover medical expenses and lost wages for work-related injuries or illnesses.

Each of these components plays a critical role in ensuring the overall protection and stability of an online business. The specific needs of an e-commerce venture will dictate the combination and extent of coverage required.

Benefits of Online Store Insurance

Implementing comprehensive Online Store Insurance offers a multitude of advantages to business owners. Let’s explore some of the key benefits:

Financial Protection

One of the primary advantages of insurance is the financial security it provides. Online businesses can face significant financial losses due to various incidents, from data breaches to product defects. Insurance coverage ensures that the financial impact of such events is mitigated, allowing businesses to recover more quickly and efficiently.

Risk Management

Online Store Insurance goes beyond financial protection; it also aids in effective risk management. By identifying potential risks and implementing coverage strategies, businesses can proactively address vulnerabilities. This not only protects their assets but also enhances their reputation and customer trust.

Peace of Mind

Running an online store can be fraught with uncertainties. With insurance coverage in place, business owners can operate with a sense of confidence and security. Knowing that their operations are protected allows them to focus on growth, innovation, and delivering exceptional customer experiences.

Legal Compliance

In many jurisdictions, certain types of insurance are mandatory for businesses. Online Store Insurance ensures that e-commerce ventures meet legal requirements, avoiding potential fines and penalties. It also provides a layer of protection against lawsuits and legal disputes.

Business Continuity

Disruptions are an inevitable part of business, but with insurance, the impact can be significantly reduced. Business interruption insurance, for instance, ensures that online stores can continue operating and serving customers even during unforeseen circumstances.

Real-World Applications and Case Studies

To illustrate the significance of Online Store Insurance, let’s examine a few real-world scenarios:

Cyber Attack on an E-commerce Giant

In 2020, a major online retailer fell victim to a sophisticated cyber attack, resulting in a massive data breach. The incident exposed customer information, including credit card details, leading to widespread panic and legal repercussions. However, the company’s robust cyber liability insurance coverage helped mitigate the financial impact, allowing them to swiftly address the issue and regain customer trust.

Product Recall and Liability

A popular online store specializing in electronic gadgets discovered a manufacturing defect in one of its bestselling products. The defect posed a safety hazard, prompting a voluntary recall. Product liability insurance stepped in, covering the costs associated with the recall, including legal fees, replacement parts, and customer compensation.

Natural Disaster and Business Interruption

During a severe storm, an online clothing store experienced a prolonged power outage, disrupting its operations and website functionality. Business interruption insurance provided financial support during this period, covering lost revenue and additional expenses incurred to restore operations.

| Scenario | Coverage Type | Outcome |

|---|---|---|

| Cyber Attack | Cyber Liability Insurance | Mitigated financial losses, regained customer trust |

| Product Recall | Product Liability Insurance | Covered recall costs, protected brand reputation |

| Natural Disaster | Business Interruption Insurance | Provided financial support during operational disruption |

These case studies highlight the tangible benefits of Online Store Insurance, demonstrating how it can safeguard businesses against various risks and challenges.

Choosing the Right Insurance Provider

Selecting the appropriate insurance provider is a critical step in ensuring your online store receives the coverage it needs. Here are some factors to consider when choosing an insurer:

- Industry Expertise: Opt for an insurance provider with a strong understanding of the e-commerce industry. They should be well-versed in the unique risks and challenges faced by online businesses.

- Tailored Coverage: Look for insurers who offer customizable policies that can be tailored to your specific business needs. Every online store is unique, and coverage should reflect that.

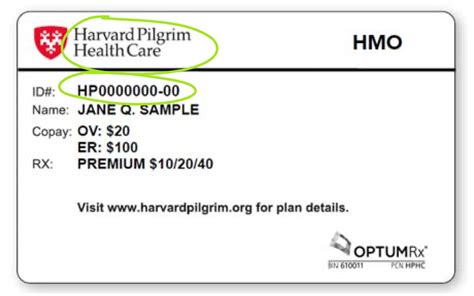

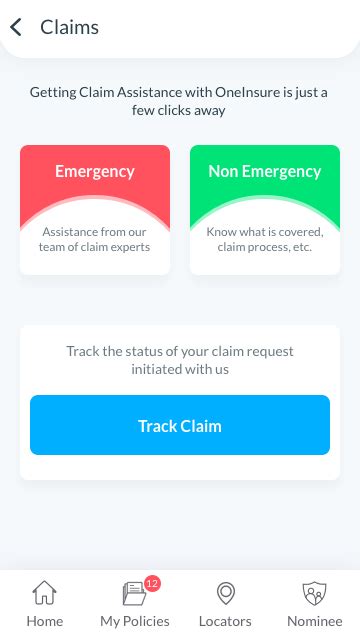

- Claims Process: Inquire about the insurer's claims process, including response times and customer support. A streamlined and efficient claims process is essential during times of crisis.

- Financial Stability: Ensure the insurance provider is financially stable and has a strong reputation. You want to partner with a company that will be there to support you in the long term.

- Customer Reviews: Read reviews and seek recommendations from other online business owners. Their experiences can provide valuable insights into the insurer's reliability and service quality.

Additional Considerations

When evaluating insurance options, it’s essential to consider the following:

- Policy Exclusions: Understand what is not covered by the policy to avoid any surprises during a claim.

- Deductibles and Limits: Be aware of the deductibles (the amount you pay before insurance kicks in) and coverage limits to ensure they align with your business needs.

- Renewal Process: Inquire about the renewal process and any potential changes to coverage or premiums.

Future Implications and Industry Trends

As the e-commerce landscape continues to evolve, so too will the insurance industry’s response to emerging risks. Here are some key trends and considerations for the future:

Increased Cyber Threats

With the rise of remote work and digital transactions, cyber threats are expected to grow in sophistication and frequency. Online businesses must stay vigilant and ensure their cyber liability insurance coverage is up-to-date and comprehensive.

E-commerce Expansion

The e-commerce sector is projected to continue its rapid growth, with more businesses embracing online sales. This expansion will bring new opportunities but also increased competition and potential risks. Insurance providers will need to adapt their offerings to accommodate the evolving needs of online stores.

Emerging Technologies

The integration of technologies like artificial intelligence, blockchain, and the Internet of Things (IoT) will present both opportunities and challenges for e-commerce. Insurance providers will need to develop coverage for these emerging technologies to protect online businesses effectively.

Regulatory Changes

Stay informed about any changes in regulations and compliance requirements. Insurance policies should be reviewed and updated to ensure they align with evolving legal standards.

Frequently Asked Questions (FAQ)

How much does Online Store Insurance typically cost?

+

The cost of Online Store Insurance can vary widely depending on several factors, including the size and nature of your business, the type and value of your inventory, and the level of coverage you require. It’s best to obtain quotes from multiple insurers to compare prices and coverage options.

What happens if I don’t have enough insurance coverage and a claim exceeds my policy limits?

+

If a claim exceeds your policy limits, you may be responsible for covering the excess amount out of pocket. It’s essential to review your coverage regularly and ensure it aligns with your business’s evolving needs to avoid such situations.

Can I bundle my Online Store Insurance with other types of coverage, such as commercial auto insurance or general liability insurance?

+

Yes, many insurers offer the option to bundle different types of coverage, including Online Store Insurance, commercial auto insurance, and general liability insurance. Bundling policies can often result in cost savings and streamlined management.

How often should I review and update my Online Store Insurance coverage?

+

It’s recommended to review your insurance coverage annually or whenever significant changes occur in your business, such as expanding your product range, hiring additional employees, or moving to a new location. Regular reviews ensure your coverage remains adequate and up-to-date.

Are there any discounts available for Online Store Insurance?

+

Yes, many insurers offer discounts for Online Store Insurance. These discounts may be based on factors such as the number of years in business, safety measures implemented, and the purchase of multiple policies from the same insurer. It’s worth inquiring about available discounts to potentially reduce your insurance costs.

Online Store Insurance is an essential component of a well-rounded risk management strategy for e-commerce businesses. By understanding the various coverage options, benefits, and industry trends, online store owners can make informed decisions to protect their operations and ensure long-term success. Stay proactive, stay protected, and continue thriving in the exciting world of e-commerce.